Consumer Reporting Agency Definition Fcra

adminse

Mar 25, 2025 · 9 min read

Table of Contents

Decoding the Consumer Reporting Agency (CRA) Definition Under the Fair Credit Reporting Act (FCRA)

What if your financial future hinges on understanding the intricate workings of Consumer Reporting Agencies (CRAs) under the Fair Credit Reporting Act (FCRA)? These powerful entities shape credit scores, influencing access to loans, insurance, and even employment opportunities – a fact that necessitates a deep understanding of their role and responsibilities.

Editor’s Note: This article on Consumer Reporting Agencies (CRAs) as defined under the Fair Credit Reporting Act (FCRA) was published today, providing readers with up-to-date information and insights into this crucial aspect of consumer protection.

Why Consumer Reporting Agencies (CRAs) Matter:

The Fair Credit Reporting Act (FCRA) of 1970 established a framework for consumer credit reporting, aiming to balance the needs of lenders and businesses with the rights of individuals. Central to this framework are Consumer Reporting Agencies (CRAs). These agencies collect, compile, and disseminate consumer credit information to a wide range of users, including lenders, insurers, employers, and even landlords. Understanding CRAs is vital for consumers to protect their credit reputation and ensure accuracy in the information used to make decisions impacting their lives. The impact of inaccurate or incomplete information reported by CRAs can be substantial, affecting an individual's ability to secure loans, rent an apartment, or even obtain employment. This article will delve into the precise legal definition of a CRA under the FCRA, its functions, and the rights consumers possess when dealing with these powerful entities.

Overview: What This Article Covers:

This comprehensive article will thoroughly explore the FCRA's definition of a CRA, analyzing the criteria that qualify an entity as a CRA, its responsibilities under the act, and the implications for consumers. We will examine the different types of information CRAs collect, the processes involved in reporting and disputing information, and the legal protections afforded to consumers under the FCRA. Further, we'll explore the relationship between CRAs and other key players in the credit reporting system, addressing common misunderstandings and providing actionable insights for consumers to effectively navigate this complex landscape.

The Research and Effort Behind the Insights:

This article is the product of extensive research, drawing upon the text of the FCRA itself, relevant court cases interpreting the act, and guidance from the Consumer Financial Protection Bureau (CFPB), the federal agency responsible for enforcing the FCRA. The analysis presented incorporates insights from legal scholarship, industry reports, and practical experience in consumer credit matters to provide readers with an accurate and comprehensive understanding of CRAs under the FCRA.

Key Takeaways:

- FCRA Definition of a CRA: A precise understanding of what constitutes a CRA under the FCRA.

- CRA Responsibilities: A detailed look at the duties and obligations CRAs have under the law.

- Consumer Rights: A comprehensive overview of the rights consumers have when dealing with CRAs.

- Dispute Resolution: A step-by-step guide on how to dispute inaccurate information on a credit report.

- Practical Applications: Actionable steps consumers can take to protect their credit information.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding CRAs, let's delve into the specifics of their definition and function under the FCRA.

Exploring the Key Aspects of Consumer Reporting Agencies (CRAs) Under the FCRA:

1. Definition and Core Concepts:

The FCRA defines a Consumer Reporting Agency (CRA) as any person which, for monetary fees, dues, or on a cooperative nonprofit basis, regularly engages in whole or in part in the practice of assembling or evaluating consumer credit information or other information on consumers for the purpose of furnishing consumer reports to third parties. This definition is crucial because it establishes the criteria for determining whether an entity falls under the regulatory umbrella of the FCRA. The key components are:

- Regular Engagement: The activity of assembling or evaluating consumer information must be ongoing, not a one-time occurrence.

- Monetary Fees or Cooperative Basis: The agency must operate on a for-profit or cooperative, non-profit basis, signifying a structured operation.

- Furnishing Consumer Reports to Third Parties: The agency must provide consumer reports – not just internal evaluations – to entities outside the agency itself.

- Consumer Credit Information or Other Information on Consumers: This encompasses various types of personal information, including credit history, payment history, public records, and potentially other personal data relevant to creditworthiness.

2. Types of Information Collected by CRAs:

CRAs collect a vast range of data points categorized as:

- Credit History: This comprises information on loans, credit cards, mortgages, and other forms of credit, including payment history, credit limits, and outstanding balances.

- Public Records: This includes bankruptcies, tax liens, judgments, and foreclosures, reflecting legal actions affecting financial standing.

- Inquiries: Records of credit applications, showing who has requested a consumer's credit report.

- Collections: Information about past-due debts that have been sent to collections agencies.

3. The CRA Reporting Process:

Credit information is typically furnished to CRAs by creditors, lenders, and other sources. These sources have a responsibility to provide accurate and up-to-date information. CRAs verify the information provided, although not every item is individually validated. The CRA then compiles this information into a consumer report which is furnished to third parties upon request.

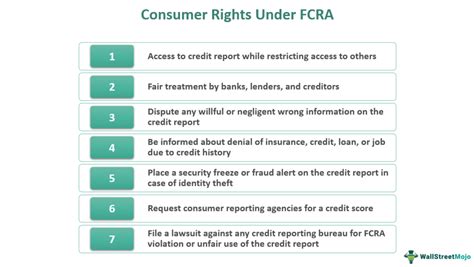

4. Consumer Rights Under the FCRA:

The FCRA grants consumers significant rights concerning their credit reports:

- Right to Access: Consumers have the right to obtain a copy of their credit report from each of the three major CRAs (Equifax, Experian, and TransUnion) once per year, free of charge, through AnnualCreditReport.com.

- Right to Dispute: If a consumer discovers inaccurate or incomplete information, they have the right to dispute it with the CRA. The CRA is obligated to investigate the dispute and take appropriate action.

- Right to Correction: If the dispute is validated, the CRA must correct the inaccurate information.

- Right to Place a Fraud Alert or Security Freeze: Consumers can take steps to protect themselves against identity theft by placing a fraud alert or security freeze on their credit reports.

5. Challenges and Solutions:

While the FCRA provides robust protections, challenges remain:

- Data Accuracy: Despite verification efforts, inaccuracies can still occur in credit reports.

- Identity Theft: The potential for identity theft continues to be a significant concern.

- Dispute Resolution: The dispute process can sometimes be lengthy and frustrating.

Consumers can mitigate these challenges by:

- Regularly monitoring their credit reports.

- Promptly disputing any inaccurate information.

- Implementing measures to protect against identity theft.

6. Impact on Innovation:

Technological advancements are changing the way CRAs operate, leading to new methods of data collection and analysis, improved fraud detection, and potentially more accurate credit scoring.

Closing Insights: Summarizing the Core Discussion:

Consumer Reporting Agencies (CRAs) are integral to the credit reporting system, playing a vital role in lending, insurance, and employment decisions. Understanding the FCRA's definition of a CRA, their responsibilities, and consumer rights is crucial for individuals to protect their credit reputation and ensure financial well-being. The systematic application of the FCRA's provisions provides a balanced approach to protect consumers while enabling the legitimate functioning of the credit market.

Exploring the Connection Between Data Security and Consumer Reporting Agencies (CRAs):

The relationship between data security and CRAs is paramount. CRAs hold highly sensitive personal data, making them prime targets for cyberattacks and data breaches. A breach could expose consumers' financial information, potentially leading to identity theft and significant financial losses.

Key Factors to Consider:

- Roles and Real-World Examples: CRAs have a responsibility to implement robust security measures to protect consumer data. Instances of data breaches have highlighted the devastating consequences when these measures fail. The Equifax breach of 2017, for example, exposed the personal information of millions of consumers.

- Risks and Mitigations: The risks associated with data breaches include identity theft, financial fraud, and reputational damage for the CRA. Mitigating these risks requires investing in robust cybersecurity infrastructure, implementing strong data encryption protocols, and conducting regular security audits. Employee training on security best practices is also crucial.

- Impact and Implications: Data breaches can have far-reaching consequences, including significant financial losses for consumers, legal liabilities for CRAs, and erosion of public trust in the credit reporting system.

Conclusion: Reinforcing the Connection:

The connection between data security and CRAs is undeniable. CRAs must prioritize the security of consumer data, implementing stringent measures to protect against breaches and mitigate the associated risks. Stronger regulations and increased transparency are crucial to ensure the responsible handling of sensitive consumer information.

Further Analysis: Examining Data Security Best Practices in Greater Detail:

Strong data security practices should include:

- Multi-factor authentication: Requiring multiple forms of authentication to access sensitive data.

- Data encryption: Encoding data to render it unreadable without the correct decryption key.

- Regular security audits: Conducting periodic assessments to identify vulnerabilities and weaknesses.

- Intrusion detection systems: Monitoring networks for suspicious activity.

- Incident response plans: Developing procedures to address data breaches effectively.

FAQ Section: Answering Common Questions About CRAs and the FCRA:

Q: What is a Consumer Reporting Agency (CRA)?

A: A CRA is an organization that collects, compiles, and disseminates consumer credit information to third parties for a fee or on a cooperative nonprofit basis.

Q: What information do CRAs collect?

A: CRAs collect a wide range of information, including credit history, public records, inquiries, and collections.

Q: How often can I get a free copy of my credit report?

A: You can obtain a free copy of your credit report from each of the three major CRAs (Equifax, Experian, and TransUnion) once per year through AnnualCreditReport.com.

Q: What should I do if I find an error on my credit report?

A: You should immediately contact the CRA and dispute the inaccurate information.

Q: What is a credit freeze?

A: A credit freeze restricts access to your credit report, preventing new creditors from opening accounts in your name.

Q: What is a fraud alert?

A: A fraud alert notifies creditors that you may be a victim of identity theft, prompting them to take extra steps to verify your identity before granting credit.

Practical Tips: Maximizing the Benefits of Understanding the FCRA:

- Regularly check your credit reports: Monitor your credit reports for accuracy and any signs of suspicious activity.

- Understand your rights under the FCRA: Familiarize yourself with your rights to access, dispute, and correct information on your credit report.

- Implement strong data security practices: Protect your personal information to reduce the risk of identity theft.

- Use a credit monitoring service: Consider using a credit monitoring service to receive alerts about changes to your credit report.

- Dispute errors promptly: Don't delay in disputing any inaccuracies you find on your credit reports.

Final Conclusion: Wrapping Up with Lasting Insights:

Consumer Reporting Agencies (CRAs) are powerful entities that significantly impact individuals' financial lives. A thorough understanding of their functions under the Fair Credit Reporting Act (FCRA), along with proactive steps to protect personal information and address inaccuracies, is essential for maintaining good credit health and safeguarding against identity theft. The ongoing evolution of the digital landscape necessitates continued vigilance and informed action on the part of both consumers and CRAs to ensure the integrity and fairness of the credit reporting system.

Latest Posts

Related Post

Thank you for visiting our website which covers about Consumer Reporting Agency Definition Fcra . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.