What Is A Letter Of Experience In Insurance

adminse

Mar 25, 2025 · 8 min read

Table of Contents

Decoding the Letter of Experience in Insurance: A Comprehensive Guide

What if unlocking a successful insurance career hinges on understanding the power of a well-crafted letter of experience? This crucial document can be the key that opens doors to lucrative opportunities and career advancement in the competitive insurance sector.

Editor’s Note: This article on letters of experience in insurance was published today, providing you with the most up-to-date insights and best practices for crafting a compelling and effective document.

Why a Letter of Experience Matters:

In the insurance industry, experience is paramount. A letter of experience, unlike a standard resume, allows candidates to showcase not just what they did in previous roles, but how their skills and experiences translate into tangible value for a prospective employer. It demonstrates a deep understanding of the nuances of the insurance sector, highlighting specific achievements and quantifiable results. This detailed narrative helps differentiate candidates, making them stand out in a competitive job market. It's a crucial element in securing interviews and ultimately landing the desired position. Furthermore, a well-structured letter demonstrates professionalism, attention to detail, and a commitment to the industry, all highly valued attributes in the insurance world.

Overview: What This Article Covers

This article provides a comprehensive guide to understanding and crafting a compelling letter of experience in the insurance field. We will delve into its purpose, key components, writing techniques, and best practices. Readers will gain actionable insights into how to effectively communicate their expertise and secure a competitive edge in their job search.

The Research and Effort Behind the Insights

This article is the result of extensive research, incorporating best practices in resume and cover letter writing, industry-specific knowledge of the insurance sector, and analysis of successful applicant profiles. We’ve consulted recruitment experts and reviewed countless successful letters of experience to provide readers with accurate and impactful guidance.

Key Takeaways:

- Definition and Core Concepts: A clear definition of a letter of experience and its core purpose within the insurance industry.

- Practical Applications: How a letter of experience can be tailored to different insurance roles and company cultures.

- Challenges and Solutions: Common pitfalls in writing a letter of experience and strategies for overcoming them.

- Future Implications: The evolving role of the letter of experience in the increasingly digital landscape of insurance recruitment.

Smooth Transition to the Core Discussion

Now that we understand the importance of a letter of experience, let’s explore its key aspects and delve into the practical steps involved in crafting a compelling document that will significantly enhance your job application.

Exploring the Key Aspects of a Letter of Experience in Insurance

1. Definition and Core Concepts:

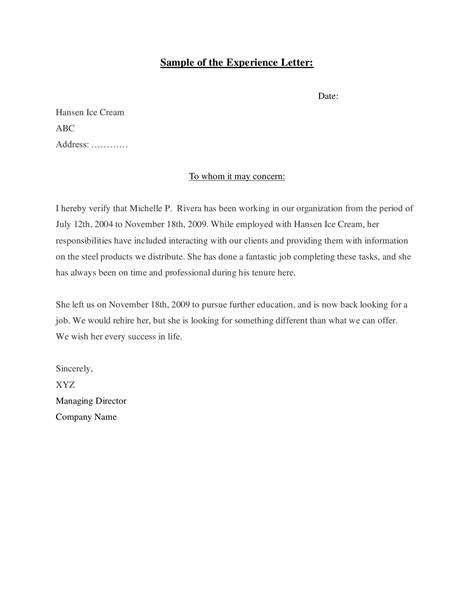

A letter of experience in insurance is a targeted document designed to showcase a candidate's skills, achievements, and expertise relevant to a specific insurance role. Unlike a generic resume, which provides a summarized overview of career history, a letter of experience delves into the specifics, offering concrete examples of how the candidate’s past experiences have prepared them for the target position. It emphasizes quantifiable results and highlights accomplishments that directly address the requirements outlined in the job description.

2. Applications Across Industries:

The letter of experience is applicable across various insurance sub-sectors, including:

- Property & Casualty Insurance: Highlighting experience in risk assessment, claims handling, underwriting, and policy administration.

- Life Insurance: Emphasizing expertise in underwriting, policy sales, client relationship management, and estate planning.

- Health Insurance: Showcasing experience in claims processing, customer service, provider relations, and compliance with regulations.

- Reinsurance: Demonstrating expertise in risk modeling, treaty negotiations, and financial analysis.

- Actuarial Science: Highlighting experience in statistical modeling, risk management, and financial forecasting.

The content and focus of the letter will vary depending on the specific role and the applicant's background.

3. Challenges and Solutions:

One common challenge is conveying significant experience concisely and engagingly. Another is tailoring the letter to each specific application, avoiding a generic approach. Here are some solutions:

- Use a strong opening statement: Immediately grab the reader's attention by highlighting a key achievement or skill directly relevant to the role.

- Quantify your accomplishments: Use numbers and data to demonstrate the impact of your work. For example, instead of saying "Improved customer satisfaction," say "Increased customer satisfaction scores by 15% through the implementation of a new customer service training program."

- Use action verbs: Start sentences with strong action verbs that showcase your proactivity and accomplishments.

- Tailor your letter to each application: Carefully read the job description and tailor your letter to highlight the skills and experiences that are most relevant.

- Proofread meticulously: Ensure your letter is free of grammatical errors and typos.

4. Impact on Career Progression:

A well-crafted letter of experience demonstrates professionalism and can significantly impact career progression within the insurance industry. It enhances the applicant's credibility, making them a stronger candidate for promotions and more senior roles. It showcases a deep understanding of the industry and a commitment to continuous professional development.

Exploring the Connection Between Networking and a Letter of Experience

Networking plays a significant role in securing interviews and securing a job in insurance. Often, professionals learn about opportunities through their network. However, even with a strong network, a compelling letter of experience is still essential. Why? Because a referral, while valuable, doesn’t replace the need to showcase your specific qualifications and achievements. Your letter of experience serves as the concrete evidence backing up the positive recommendation from your contact. It provides the detailed information the hiring manager needs to assess your suitability for the role.

Key Factors to Consider:

- Roles and Real-World Examples: Networking can provide insights into specific company cultures and expectations, allowing you to tailor your letter of experience to demonstrate how your skills align with their values and priorities. Include specific examples from your network’s experiences to illustrate your points.

- Risks and Mitigations: Relying solely on networking without a well-written letter of experience risks overlooking crucial details that could make or break your application. Mitigate this by always preparing a strong letter, regardless of the referral source.

- Impact and Implications: A strong letter of experience, combined with effective networking, exponentially increases your chances of success. It strengthens your candidacy and allows you to present a compelling and comprehensive case for your qualifications.

Conclusion: Reinforcing the Connection

The synergistic relationship between networking and a well-crafted letter of experience is undeniable. Networking provides access to opportunities, while a compelling letter substantiates your qualifications. By leveraging both strategies, insurance professionals significantly improve their prospects of securing desired roles and advancing their careers.

Further Analysis: Examining Networking Strategies in Greater Detail

Effective networking involves more than just collecting business cards. It requires proactive engagement, relationship building, and a genuine interest in the industry. Strategies such as attending industry events, joining professional organizations, and actively participating in online forums provide valuable networking opportunities. These activities can lead to informational interviews, which allow you to learn more about specific companies and roles, enabling you to better tailor your letter of experience.

FAQ Section: Answering Common Questions About Letters of Experience in Insurance

Q: What is the difference between a resume and a letter of experience?

A: A resume provides a concise summary of your work history and skills. A letter of experience is a more detailed and narrative-driven document that showcases your achievements and how they relate to a specific job description.

Q: How long should a letter of experience be?

A: Ideally, a letter of experience should be between one and two pages long. It should be concise yet comprehensive enough to showcase your key qualifications.

Q: Should I include references in my letter of experience?

A: It's generally not necessary to include references in your letter of experience. You can provide them separately if requested.

Q: Can I use a template for my letter of experience?

A: Using a template can be helpful as a starting point, but it's crucial to personalize and tailor it to each specific job application. A generic letter will not be as effective.

Q: How do I quantify my accomplishments?

A: Use numbers and data to demonstrate the impact of your work. For example, instead of saying "Improved customer service," say "Reduced customer complaints by 10% through the implementation of a new training program."

Practical Tips: Maximizing the Benefits of a Letter of Experience

-

Understand the Job Description: Carefully review the job description and identify the key skills and experience required. Tailor your letter to highlight those specific qualifications.

-

Start with a Strong Opening: Begin with a compelling statement that grabs the reader's attention and immediately showcases your relevance to the role.

-

Use Quantifiable Results: Quantify your accomplishments using numbers and data whenever possible.

-

Use Action Verbs: Start your sentences with strong action verbs to convey your proactivity and achievements.

-

Proofread Carefully: Ensure your letter is free of grammatical errors and typos.

Final Conclusion: Wrapping Up with Lasting Insights

A well-crafted letter of experience is a powerful tool for insurance professionals seeking to advance their careers. By understanding its purpose, mastering its key components, and tailoring it to specific job applications, candidates can significantly enhance their chances of securing interviews and landing their desired positions. It’s more than just a document; it's a strategic communication tool that showcases your expertise and positions you as a valuable asset to any insurance organization. Investing time and effort in crafting a compelling letter of experience is an investment in your future success.

Latest Posts

Related Post

Thank you for visiting our website which covers about What Is A Letter Of Experience In Insurance . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.