Why Does Loanable Funds Market Involve Real Interest Rates Rather Than Nominal Interest Rates

adminse

Mar 25, 2025 · 8 min read

Table of Contents

Why the Loanable Funds Market Revolves Around Real, Not Nominal, Interest Rates

What if the effectiveness of monetary policy hinged on understanding the true cost of borrowing? The loanable funds market fundamentally operates on real interest rates, reflecting the true price of credit and driving crucial economic decisions.

Editor’s Note: This article on the loanable funds market and its reliance on real interest rates was published today, offering a timely and relevant analysis of this fundamental economic concept. We aim to provide readers with a clear and comprehensive understanding of this crucial element of macroeconomic theory.

Why Real Interest Rates Matter in the Loanable Funds Market

The loanable funds market is a theoretical construct representing the interaction between borrowers and lenders in an economy. It determines the equilibrium real interest rate, which profoundly impacts investment, savings, and overall economic growth. While nominal interest rates are readily observable, it's the real interest rate – the nominal rate adjusted for inflation – that truly matters for economic decision-making. This is because the real interest rate represents the true return on lending and the true cost of borrowing.

Understanding the difference is crucial. The nominal interest rate is the stated interest rate on a loan, while the real interest rate accounts for the effects of inflation. If the nominal interest rate is 5% and inflation is 3%, the real interest rate is only 2% (approximately; the precise calculation uses the Fisher equation, explained later). This 2% reflects the actual increase in purchasing power the lender receives. Similarly, the borrower is effectively paying only 2% in terms of purchasing power lost.

Ignoring inflation leads to distorted perceptions of borrowing costs and investment returns. A high nominal interest rate during a period of high inflation may not be as burdensome as it appears, and a low nominal interest rate during deflation could actually represent a high real cost. The loanable funds market, therefore, focuses on real interest rates to accurately reflect the true incentives faced by borrowers and lenders.

Overview: What This Article Covers

This article will explore the fundamental reasons why the loanable funds market utilizes real interest rates. We will delve into the definition of real and nominal interest rates, examine the Fisher equation, discuss the role of expectations, analyze how real interest rates influence investment and saving decisions, and finally, illustrate the implications for monetary policy.

The Research and Effort Behind the Insights

This article draws upon established macroeconomic theory, incorporating insights from prominent economists and textbooks. Key concepts are explained clearly, with illustrative examples to solidify understanding. The analysis presented is based on widely accepted principles and aims to provide a robust and accurate explanation of the topic.

Key Takeaways:

- Real vs. Nominal: A clear distinction between real and nominal interest rates and their implications for economic decision-making.

- The Fisher Equation: Understanding the mathematical relationship between nominal, real interest rates, and inflation expectations.

- Investment and Savings: How real interest rates impact investment and savings decisions in the loanable funds market.

- Monetary Policy: The significance of real interest rates for the effectiveness of monetary policy tools.

Smooth Transition to the Core Discussion

Having established the importance of understanding the distinction between real and nominal interest rates, let's now examine the core reasons why the loanable funds market centers on real interest rates.

Exploring the Key Aspects of the Loanable Funds Market and Real Interest Rates

1. Definition and Core Concepts:

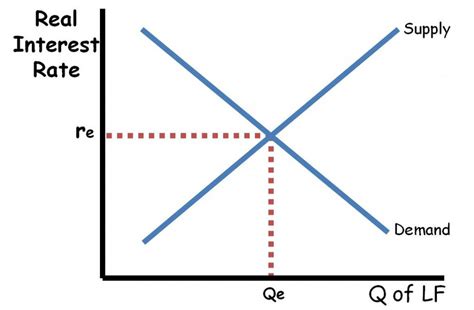

The loanable funds market depicts the supply and demand for loanable funds. The supply comes from saving (households and businesses), while the demand comes from borrowing (firms for investment and individuals for consumption). The interaction of supply and demand determines the equilibrium real interest rate.

2. The Fisher Equation and Inflation Expectations:

The Fisher equation provides a crucial link between nominal and real interest rates:

(1 + nominal interest rate) = (1 + real interest rate) * (1 + expected inflation rate)

This equation highlights that the nominal interest rate is not simply the sum of the real interest rate and the inflation rate. It accounts for the compounding effect of interest and inflation. A simplified approximation is often used:

Nominal interest rate ≈ Real interest rate + Expected inflation rate

The crucial element here is "expected inflation rate". Lenders and borrowers base their decisions not on past inflation but on their expectations of future inflation. If inflation is expected to rise, lenders will demand a higher nominal interest rate to maintain the desired real return. Conversely, if inflation is expected to fall, the nominal interest rate will adjust downwards.

3. Investment and Savings Decisions:

The real interest rate is the critical factor influencing investment decisions. Firms compare the expected real return on investment projects with the real interest rate. If the real return exceeds the real interest rate, the investment is profitable. A higher real interest rate increases the cost of borrowing, making fewer projects viable.

Savings decisions are also affected by the real interest rate. A higher real interest rate incentivizes saving, as it offers a greater return in terms of purchasing power. Conversely, a lower real interest rate reduces the incentive to save.

4. Monetary Policy and Real Interest Rates:

Central banks use monetary policy tools, primarily adjusting the money supply, to influence interest rates. However, the primary target is the real interest rate. While central banks manipulate nominal interest rates, their ultimate goal is to achieve a desired level of real interest rates that supports price stability and economic growth.

If inflation is higher than anticipated, the real interest rate falls even if the central bank maintains or even raises the nominal interest rate. This highlights the limitations of focusing solely on nominal interest rates. Central banks must constantly assess and adjust their policy in light of inflation expectations. This involves complex modeling and forecasting to predict future inflation accurately.

5. Role of Risk and Uncertainty:

The loanable funds market also incorporates risk and uncertainty. Lenders demand a risk premium for lending to borrowers perceived as riskier. This risk premium is added to the real interest rate to determine the nominal interest rate. Higher risk generally leads to higher nominal interest rates, even if the real interest rate remains relatively stable.

Exploring the Connection Between Inflation Expectations and the Loanable Funds Market

The accuracy of inflation expectations is paramount. If individuals and firms consistently underestimate or overestimate inflation, the actual real interest rate will deviate significantly from the intended level. This can lead to misallocation of resources, inefficient investment decisions, and macroeconomic instability.

Key Factors to Consider:

-

Roles and Real-World Examples: Central banks constantly monitor inflation expectations through surveys and market indicators. Policy adjustments are often based on these expectations, aiming to guide the real interest rate towards the desired level. For instance, if inflation is unexpectedly high, the central bank might raise nominal interest rates more aggressively than anticipated to compensate for the fall in the real interest rate.

-

Risks and Mitigations: Inaccurate inflation expectations represent a significant risk. Persistent miscalculations can lead to prolonged periods of either under- or over-investment, impacting economic growth and stability. Central banks strive to improve their forecasting models and communication strategies to manage these risks.

-

Impact and Implications: Consistent biases in inflation expectations can lead to systematic deviations of the real interest rate from its equilibrium level, potentially resulting in financial instability, asset bubbles, or prolonged periods of economic stagnation.

Conclusion: Reinforcing the Connection

The close interplay between inflation expectations and the loanable funds market highlights the crucial role of real interest rates. Ignoring inflation expectations leads to inaccurate assessments of borrowing costs and investment returns, distorting economic decision-making and impacting overall macroeconomic performance.

Further Analysis: Examining Inflation Expectations in Greater Detail

Understanding the formation of inflation expectations is an ongoing area of research in economics. Various theories and models have been developed, but there is no single universally accepted explanation. Factors such as past inflation, current economic conditions, central bank credibility, and global economic trends all influence inflation expectations.

FAQ Section: Answering Common Questions About the Loanable Funds Market and Real Interest Rates

Q: What is the difference between the real and nominal interest rate?

A: The nominal interest rate is the stated interest rate on a loan. The real interest rate adjusts the nominal rate for inflation, reflecting the actual change in purchasing power.

Q: How do real interest rates affect investment decisions?

A: Firms compare the expected real return on investment projects with the real interest rate. Investments are only undertaken if the real return exceeds the real interest rate.

Q: Why is the real interest rate more important than the nominal interest rate for monetary policy?

A: Central banks ultimately aim to influence the real interest rate to achieve price stability and sustainable economic growth. The nominal interest rate is simply a tool to achieve this goal.

Q: What are the risks associated with inaccurate inflation expectations?

A: Inaccurate inflation expectations can lead to misallocation of resources, inefficient investment decisions, and macroeconomic instability.

Practical Tips: Maximizing Understanding of the Loanable Funds Market

-

Master the Fisher Equation: Understand the relationship between nominal, real interest rates, and inflation expectations. Practice calculations to build your intuition.

-

Analyze Economic Data: Examine real and nominal interest rate data alongside inflation figures to observe their relationships over time.

-

Follow Central Bank Communications: Pay attention to central bank statements and press releases, as they often discuss their assessment of inflation expectations and their impact on monetary policy.

-

Consider Risk Premiums: Remember that risk premiums are added to the real interest rate to determine the nominal interest rate, especially when assessing the cost of borrowing for various types of debt.

Final Conclusion: Wrapping Up with Lasting Insights

The loanable funds market is fundamentally driven by real interest rates, reflecting the true cost of borrowing and the true return on saving. Understanding the interplay between nominal interest rates, inflation expectations, and the Fisher equation is crucial for grasping the mechanisms of the loanable funds market and the effectiveness of monetary policy. By comprehending this core relationship, individuals, businesses, and policymakers can make more informed decisions and contribute to a more stable and prosperous economy.

Latest Posts

Related Post

Thank you for visiting our website which covers about Why Does Loanable Funds Market Involve Real Interest Rates Rather Than Nominal Interest Rates . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.