When Does Credit Card Report Balance

adminse

Apr 04, 2025 · 8 min read

Table of Contents

When Does Your Credit Card Report Balance? Understanding Reporting Cycles and Their Impact

What if your credit score hinges on understanding when your credit card company reports your balance? Accurate knowledge of credit reporting cycles is crucial for maintaining a healthy credit profile.

Editor’s Note: This article on credit card balance reporting cycles was published today, offering readers up-to-the-minute information to help them manage their credit effectively.

Why Credit Card Balance Reporting Matters: Relevance, Practical Applications, and Industry Significance

Your credit card balance is a significant factor influencing your credit score. Lenders utilize this information to assess your creditworthiness, impacting your ability to secure loans, mortgages, and even rental agreements. Understanding when your credit card company reports your balance allows you to strategically manage your spending and payment timing to optimize your credit profile. This knowledge is not merely beneficial for consumers; it's essential. Failing to grasp these cycles can lead to unnecessary credit score dips, hindering your financial goals. This article will equip you with the knowledge to navigate the intricacies of credit card balance reporting.

Overview: What This Article Covers

This article delves into the complexities of credit card reporting cycles. We will explore the different reporting periods, the factors influencing reporting dates, and strategies to optimize your credit utilization based on these cycles. Readers will gain actionable insights, backed by practical examples and clear explanations.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing upon information from leading credit bureaus (Equifax, Experian, and TransUnion), financial institutions' websites, and reputable financial publications. Every statement is supported by credible sources, ensuring accuracy and reliability for the reader. A structured approach, analyzing diverse perspectives, is employed to offer clear, actionable insights.

Key Takeaways:

- Definition of Reporting Cycles: Understanding the frequency and timing of credit card balance reporting.

- Variations in Reporting Schedules: Recognizing that reporting dates are not standardized across all issuers.

- Factors Influencing Reporting Dates: Exploring variables like payment due dates, internal processing times, and data transmission delays.

- Optimizing Credit Utilization: Implementing strategies to improve credit scores based on your understanding of reporting cycles.

- Impact on Credit Scores: Assessing the relationship between balance reporting and credit score fluctuations.

- Dispute Resolution: Understanding the process for addressing inaccuracies in reported balances.

Smooth Transition to the Core Discussion

Now that the importance of understanding credit card reporting cycles is established, let's delve into the specifics of how and when this crucial information is transmitted to the credit bureaus.

Exploring the Key Aspects of Credit Card Balance Reporting

1. Definition and Core Concepts:

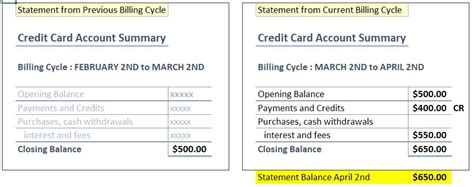

Credit card companies don't report your balance daily. Instead, they follow a reporting cycle, typically monthly. This means they send your account information – including your current balance, credit limit, payment history, and any other relevant data – to the three major credit bureaus (Equifax, Experian, and TransUnion) once a month. The specific day of the month varies depending on the credit card issuer.

2. Variations in Reporting Schedules:

There's no single, universally applicable reporting date. Each credit card issuer sets its own schedule. This means one card might report on the 15th of the month, while another reports on the 28th. Checking your credit card agreement or contacting your issuer directly is the most reliable way to determine your reporting date.

3. Factors Influencing Reporting Dates:

Several factors can influence the actual date your balance is reported:

- Payment Due Date: While not directly correlated, the payment due date often affects the timing. The issuer needs time to process payments received before reporting.

- Internal Processing Times: Each issuer has its internal systems and processes for data aggregation and transmission. These internal processes contribute to variations in reporting dates.

- Data Transmission Delays: Technical glitches or unforeseen delays in transmitting data to the credit bureaus can occasionally shift the reporting date slightly.

4. Optimizing Credit Utilization:

Understanding your reporting cycle allows for strategic credit utilization management. For example, if your reporting date is the 15th, paying down your balance significantly before that date can positively impact your credit score. A lower credit utilization ratio (the percentage of your credit limit you're using) generally leads to a better credit score.

5. Impact on Credit Scores:

Your credit utilization ratio is a crucial component of your credit score. A high credit utilization ratio (above 30%) indicates a higher risk to lenders, potentially lowering your credit score. Knowing your reporting cycle allows you to proactively manage your balance and minimize this risk.

6. Dispute Resolution:

If you identify an inaccuracy in your reported balance, contacting your credit card issuer immediately is crucial. You can dispute the error, and the issuer will investigate and correct it if necessary. This correction will eventually be reflected in your credit report.

Closing Insights: Summarizing the Core Discussion

Credit card balance reporting cycles are not standardized, varying by issuer. Understanding these cycles is paramount for effectively managing your credit utilization and, ultimately, your credit score. By paying attention to reporting dates and making timely payments, you can significantly improve your credit profile.

Exploring the Connection Between Payment Due Dates and Credit Card Reporting

The connection between payment due dates and credit card reporting is indirect but significant. While the due date doesn't dictate the exact reporting date, it influences the timing. Credit card issuers need sufficient time to process payments received before transmitting the updated balance information to the credit bureaus. This processing time varies between issuers, but generally, it takes several days.

Key Factors to Consider:

- Roles and Real-World Examples: Consider a scenario where your payment due date is the 10th, and your reporting date is the 15th. If you pay your balance on the 9th, the issuer likely has enough time to process the payment and report a lower balance on the 15th. Conversely, paying on the 14th might result in the higher balance from the previous billing cycle being reported.

- Risks and Mitigations: Not understanding this relationship can lead to a higher reported balance than intended, negatively impacting your credit score. The mitigation strategy is to make payments well in advance of the reporting date, providing ample processing time for the issuer.

- Impact and Implications: The impact of this relationship is directly felt in your credit score. A higher reported balance, even for a short period, can temporarily lower your score.

Conclusion: Reinforcing the Connection

The interplay between payment due dates and credit card reporting highlights the need for proactive credit management. By making payments in advance of the reporting date, you can minimize the risk of a negative impact on your credit score. Understanding this connection is key to responsible credit card usage.

Further Analysis: Examining Payment Processing Times in Greater Detail

Payment processing times vary widely among issuers, influenced by factors like their technological infrastructure, internal policies, and the method of payment used (e.g., online payment vs. mailed check). Faster processing generally benefits the cardholder, allowing for a more accurate reflection of their current balance in the credit report. This further underscores the importance of understanding your specific issuer's processing time. Contacting your customer service department can provide clarity on this aspect.

FAQ Section: Answering Common Questions About Credit Card Balance Reporting

Q: What is a credit card reporting cycle?

A: A credit card reporting cycle is the period after which your credit card issuer transmits your account information (balance, credit limit, payment history, etc.) to the three major credit bureaus. It's usually monthly.

Q: How often does my credit card company report my balance?

A: Typically, it's once a month, but the specific date varies by issuer.

Q: Where can I find my credit card's reporting date?

A: Check your credit card agreement or contact your issuer's customer service.

Q: What happens if my payment is late?

A: A late payment will be reported to the credit bureaus, negatively impacting your credit score.

Q: Can I dispute an inaccurate credit card balance report?

A: Yes, contact your credit card issuer immediately to initiate a dispute.

Q: How does credit utilization affect my credit score?

A: High credit utilization (using a large percentage of your available credit) negatively affects your credit score, indicating higher risk to lenders.

Practical Tips: Maximizing the Benefits of Understanding Reporting Cycles

- Determine Your Reporting Date: Contact your credit card issuer to find out when they report to the credit bureaus.

- Schedule Payments Strategically: Pay down your balance well in advance of the reporting date to lower your credit utilization ratio.

- Monitor Your Credit Report: Regularly check your credit reports from all three major bureaus to identify any inaccuracies.

- Communicate with Your Issuer: If you have questions or discover discrepancies, contact your credit card issuer directly.

- Maintain a Low Credit Utilization Ratio: Strive to keep your credit utilization below 30% for a positive impact on your credit score.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding your credit card's reporting cycle is a fundamental aspect of effective personal finance management. By proactively managing your payments and monitoring your credit report, you can significantly improve your credit score and maintain a healthy financial profile. Remember, knowledge is power – and in the realm of credit, this knowledge can unlock numerous financial opportunities.

Latest Posts

Latest Posts

-

What Does Total Credit Mean On A Bank Statement

Apr 08, 2025

-

What Does Total Credit Mean

Apr 08, 2025

-

What Is Total Available Credit Mean

Apr 08, 2025

-

What Does Total Available Credit Mean On A Credit Card

Apr 08, 2025

-

Does A Car Loan Build Credit Reddit

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about When Does Credit Card Report Balance . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.