What Rating Is 610 Credit Score

adminse

Apr 07, 2025 · 8 min read

Table of Contents

What Rating Is a 610 Credit Score? Understanding Your Creditworthiness

What does a 610 credit score truly mean, and what are its implications?

A 610 credit score signifies a subprime credit rating, presenting challenges but also opportunities for improvement.

Editor’s Note: This article on credit scores, specifically a 610 rating, was published today and provides up-to-date information on understanding and improving your creditworthiness. We’ll explore the meaning of this score, its impact on your financial life, and actionable steps to improve it.

Why Your Credit Score Matters:

Your credit score is a three-digit number that summarizes your creditworthiness. Lenders use it to assess the risk of lending you money. A higher score indicates a lower risk, leading to better loan terms (lower interest rates, higher credit limits) and easier access to credit. Conversely, a lower score, like 610, signals a higher risk, potentially resulting in higher interest rates, loan denials, or less favorable financial options. Understanding your credit score and its implications is crucial for managing your finances effectively. This score impacts various aspects of your life, including:

-

Loan Approval and Interest Rates: A 610 credit score dramatically increases the likelihood of loan applications being denied or receiving loans with significantly higher interest rates. This applies to mortgages, auto loans, personal loans, and even credit cards.

-

Rental Applications: Many landlords now utilize credit checks as part of their tenant screening process. A 610 score may make securing an apartment or rental property more difficult.

-

Insurance Premiums: In some cases, insurance companies consider credit scores when setting premiums. A low score could result in higher premiums for auto, home, or renters insurance.

-

Employment Opportunities: While less common, some employers conduct credit checks, particularly for positions involving financial management or handling sensitive information. A low score could negatively influence their hiring decision.

-

Utility Services: Some utility companies might require a security deposit or deny service based on a poor credit history reflected in a low credit score.

Overview: What This Article Covers:

This article will provide a comprehensive understanding of a 610 credit score. We'll delve into its classification, the factors contributing to such a score, its impact on different financial aspects, and, most importantly, actionable strategies for improvement. We'll also explore the connection between credit report errors and the score, and address frequently asked questions.

The Research and Effort Behind the Insights:

The information presented here is based on extensive research, drawing from reputable sources such as Fair Isaac Corporation (FICO), credit reporting agencies (Equifax, Experian, and TransUnion), and financial experts. The analysis incorporates data-driven insights and real-world examples to provide accurate and practical guidance.

Key Takeaways:

- Understanding Credit Score Ranges: A 610 score falls within the subprime range, indicating a higher risk to lenders.

- Factors Affecting Credit Score: Late payments, high credit utilization, bankruptcies, and collections are major contributors to a low score.

- Improving Your Credit Score: Strategies include paying bills on time, reducing credit utilization, disputing errors, and seeking credit counseling.

- Impact on Financial Decisions: A 610 score can significantly impact loan approvals, interest rates, and access to financial products.

- Long-Term Implications: Improving credit scores takes time and consistent effort, but the long-term benefits are substantial.

Smooth Transition to the Core Discussion:

Now that we understand the significance of a 610 credit score, let's delve deeper into its implications and explore practical steps towards improvement.

Exploring the Key Aspects of a 610 Credit Score:

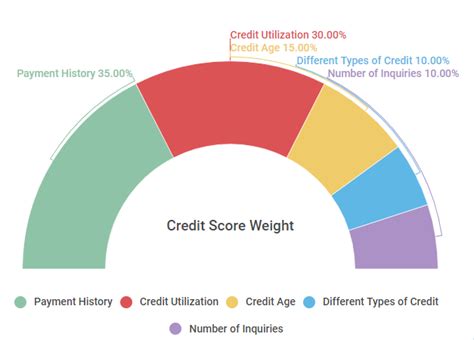

1. Definition and Core Concepts: A credit score is a numerical representation of your creditworthiness, calculated using a complex algorithm based on information from your credit report. A 610 score falls into the subprime category, meaning lenders perceive you as a high-risk borrower. The most widely used scoring models are FICO scores, developed by the Fair Isaac Corporation, and VantageScore, a competing model. While the specific algorithms differ, both generally consider the same key factors.

2. Applications Across Industries: As mentioned earlier, a 610 score impacts various financial decisions. It can significantly hinder your ability to obtain loans at favorable interest rates, secure rental properties, and even obtain certain types of insurance. It may also affect your chances of getting a job in certain industries.

3. Challenges and Solutions: The challenges associated with a 610 score are primarily related to accessing credit and obtaining favorable financial terms. Solutions involve proactively addressing the underlying issues that contributed to the low score and building a stronger credit history. This requires consistent effort and responsible financial management.

4. Impact on Innovation: While not directly impacting innovation itself, a low credit score can significantly impact individuals’ and businesses’ ability to participate in the economy and pursue innovative endeavors. Access to capital is essential for growth and development, and a poor credit history can create a significant barrier.

Closing Insights: Summarizing the Core Discussion:

A 610 credit score presents significant challenges, limiting access to favorable financial products and services. However, it's not an insurmountable obstacle. By understanding the factors contributing to the low score and implementing the strategies discussed below, individuals can work towards improving their creditworthiness and achieving better financial outcomes.

Exploring the Connection Between Payment History and a 610 Credit Score:

Payment history is the most critical factor influencing credit scores. A 610 score likely indicates a history of late or missed payments on loans, credit cards, or other forms of credit. Even a few missed payments can significantly impact a score. The severity of the impact depends on factors such as the frequency of late payments, the amount owed, and the length of the delinquency.

Key Factors to Consider:

-

Roles and Real-World Examples: Let's say someone consistently pays their credit card bills 30 days late. This pattern of late payments significantly reduces their credit score. Similarly, a missed mortgage payment has a dramatic impact due to the higher amount involved.

-

Risks and Mitigations: The risk of a low score is primarily the inability to access credit and the higher interest rates charged on any approved credit. Mitigation involves establishing a pattern of on-time payments for all credit accounts.

-

Impact and Implications: The long-term implication of a 610 score is a prolonged struggle to improve financial stability. It can create a vicious cycle of higher interest rates, making it harder to pay off debt and further damaging the credit score.

Conclusion: Reinforcing the Connection:

The connection between payment history and a 610 credit score is undeniable. Consistent on-time payments are crucial for building and maintaining a strong credit profile. Addressing late payment patterns is the first step towards improving a low credit score.

Further Analysis: Examining Debt-to-Credit Ratio in Greater Detail:

Another significant factor affecting a 610 credit score is the debt-to-credit ratio (also known as credit utilization). This ratio compares the amount of credit used to the total amount of available credit. A high ratio, generally above 30%, signals to lenders that you are heavily reliant on credit and may be struggling to manage your finances effectively. A 610 score likely reflects a high credit utilization rate.

FAQ Section: Answering Common Questions About a 610 Credit Score:

Q: What is a 610 credit score?

A: A 610 credit score is considered subprime, meaning it indicates a higher risk to lenders. It suggests a history of credit challenges, such as missed or late payments, high credit utilization, or negative marks like collections or bankruptcies.

Q: How can I improve my 610 credit score?

A: Improving a 610 credit score requires consistent effort. Pay all bills on time, reduce your credit utilization ratio, dispute any errors on your credit reports, and consider seeking credit counseling if needed.

Q: How long does it take to improve my credit score?

A: Improving your credit score takes time. Consistent positive credit behavior should start showing improvements within a few months, but it may take several years to significantly raise your score, especially if you've had severe credit problems.

Q: What are the consequences of a 610 credit score?

A: A 610 credit score can limit your access to credit, result in higher interest rates on loans and credit cards, and may even affect rental applications and insurance premiums.

Practical Tips: Maximizing the Benefits of Credit Score Improvement:

-

Monitor Your Credit Reports Regularly: Check your credit reports from Equifax, Experian, and TransUnion for errors. Dispute any inaccuracies.

-

Pay Bills on Time: This is the single most important factor in improving your credit score. Set up automatic payments to avoid late payments.

-

Reduce Credit Utilization: Keep your credit utilization below 30% of your total available credit.

-

Don't Open Too Many New Accounts: Opening many new accounts in a short period can negatively impact your score.

-

Consider Credit Counseling: If you're struggling to manage your debt, consider seeking help from a reputable credit counseling agency.

Final Conclusion: Wrapping Up with Lasting Insights:

A 610 credit score presents challenges, but it's not a life sentence. By understanding the factors that contribute to a low score, actively addressing those issues, and employing responsible financial habits, it's possible to improve your creditworthiness over time. The journey to a better credit score requires patience and persistence, but the long-term benefits of improved financial health are well worth the effort. Remember, responsible financial management is not just about numbers; it's about building a secure financial future.

Latest Posts

Latest Posts

-

Acquittance Definition

Apr 30, 2025

-

Acquisition Indigestion Definition

Apr 30, 2025

-

Acquisition Financing Definition How It Works Types

Apr 30, 2025

-

Acquisition Accounting Definition How It Works Requirements

Apr 30, 2025

-

Acquiree Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about What Rating Is 610 Credit Score . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.