What Percentage Should You Keep Your Credit Utilization

adminse

Apr 07, 2025 · 8 min read

Table of Contents

What Percentage Should You Keep Your Credit Utilization? Unlocking the Secrets to a Stellar Credit Score

What if maintaining optimal credit utilization is the key to unlocking a significantly higher credit score and better financial opportunities? Mastering this crucial aspect of credit management can dramatically improve your financial health.

Editor’s Note: This article on credit utilization provides up-to-date insights and strategies for managing your credit effectively. We've consulted leading financial experts and analyzed the latest data to ensure accuracy and relevance.

Why Credit Utilization Matters: Relevance, Practical Applications, and Industry Significance

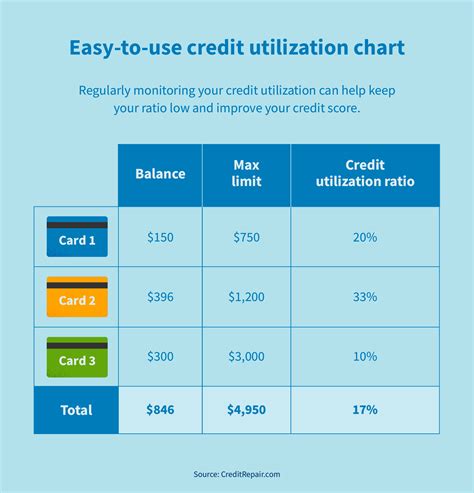

Credit utilization, simply put, is the ratio of your total credit card debt to your total available credit. It's a critical factor influencing your credit score, significantly more so than many realize. Lenders view a high credit utilization ratio as a sign of potential financial instability, increasing your perceived risk. Conversely, a low utilization ratio demonstrates responsible credit management, making you a more attractive borrower. This impacts not only your ability to secure loans at favorable interest rates but also your chances of approval for credit cards, mortgages, and even insurance policies.

Overview: What This Article Covers

This article will delve into the optimal credit utilization percentage, exploring its significance, the various factors influencing its impact, and strategies for maintaining a healthy ratio. We'll examine the differences between various credit scoring models and how they weigh credit utilization. Readers will gain actionable insights, backed by data-driven research and expert analysis, empowering them to proactively manage their credit for a brighter financial future.

The Research and Effort Behind the Insights

This comprehensive article is the result of extensive research, drawing upon data from leading credit bureaus like Experian, Equifax, and TransUnion, alongside analysis from reputable financial institutions and consumer finance experts. We've reviewed numerous studies on credit scoring methodologies and consumer credit behavior to present accurate and trustworthy information.

Key Takeaways:

- Ideal Credit Utilization: Understanding the target percentage and why it's crucial.

- Credit Scoring Models and Utilization: How different scoring models assess credit utilization.

- Factors Influencing Credit Utilization Impact: Exploring variables that affect the weight of utilization.

- Strategies for Managing Credit Utilization: Practical steps to improve and maintain a healthy ratio.

- Addressing High Credit Utilization: Effective methods for lowering your utilization quickly.

- The Importance of Monitoring Your Credit Reports: Regular checks to prevent issues and identify errors.

Smooth Transition to the Core Discussion

Now that we understand the fundamental importance of credit utilization, let’s explore its key aspects in more detail. We’ll examine the recommended percentages, the influence of different credit scoring models, and practical strategies for effective management.

Exploring the Key Aspects of Credit Utilization

1. Defining the Ideal Credit Utilization Percentage:

While the exact ideal percentage varies slightly depending on the credit scoring model, financial experts generally agree that keeping your credit utilization below 30% is crucial for maintaining a healthy credit score. Aiming for even lower – ideally below 10% – is often recommended for optimal results. This demonstrates responsible credit management and significantly reduces your perceived risk to lenders.

2. How Credit Scoring Models Assess Credit Utilization:

The three major credit bureaus (Experian, Equifax, and TransUnion) use different scoring models, each assigning a different weight to credit utilization. However, across all models, high utilization is a significant negative factor. While the specific algorithm remains proprietary, the general principle remains consistent: lower utilization equals a better credit score. Paying attention to your scores from all three bureaus provides a more comprehensive picture of your credit health.

3. Factors Influencing Credit Utilization Impact:

Several factors beyond the simple percentage can influence the impact of credit utilization on your score. These include:

- Payment History: Consistent on-time payments are crucial, regardless of your utilization. A history of late payments will outweigh even a low utilization ratio.

- Credit Mix: Having a variety of credit accounts (credit cards, loans, mortgages) in good standing demonstrates responsible credit management.

- Credit Age: The length of your credit history is another vital factor. Longer history generally leads to a higher score.

- Number of Inquiries: Multiple hard inquiries (when lenders check your credit) within a short period can negatively affect your score.

- Type of Credit: Different types of credit cards (secured, unsecured, store cards) are weighted differently by credit scoring models.

4. Strategies for Managing Credit Utilization:

- Pay Down Existing Debt: Prioritize paying down high-balance credit cards to quickly lower your utilization ratio.

- Increase Your Available Credit: Consider applying for a new credit card with a higher credit limit, but only if you are confident you can manage your spending responsibly.

- Avoid Opening Multiple New Accounts: Opening several new credit cards in a short time can negatively impact your credit score due to increased inquiries.

- Use Credit Cards Strategically: Use credit cards for necessary purchases and pay them off in full each month to avoid accumulating interest.

- Monitor Your Credit Reports Regularly: Regularly check your credit reports from all three bureaus to identify errors or inconsistencies and address them promptly.

Closing Insights: Summarizing the Core Discussion

Maintaining a low credit utilization ratio is paramount for building and maintaining a strong credit score. While the ideal percentage is generally below 30%, aiming for under 10% is even better. However, a holistic approach, incorporating responsible credit management practices alongside a low utilization ratio, is crucial for optimal results.

Exploring the Connection Between Payment History and Credit Utilization

Payment history is arguably the most crucial element influencing your credit score. Even with a low credit utilization, a history of late payments will severely damage your score. This connection is undeniable – responsible spending habits coupled with consistent on-time payments are essential for a stellar credit rating.

Key Factors to Consider:

- Roles and Real-World Examples: A person with a low credit utilization but a history of late payments will experience a much lower credit score than someone with a slightly higher utilization ratio but a consistent history of on-time payments.

- Risks and Mitigations: Ignoring late payments can lead to penalties, higher interest rates, and ultimately, a significantly lower credit score. Setting up automatic payments or reminders can help mitigate this risk.

- Impact and Implications: A poor payment history can severely impact your ability to secure loans, credit cards, and even rental agreements. It also affects your insurance premiums.

Conclusion: Reinforcing the Connection

The interplay between payment history and credit utilization underscores the need for comprehensive credit management. Simply focusing on one aspect is insufficient; both are equally important. By addressing both diligently, individuals can cultivate an excellent credit profile, opening doors to better financial opportunities.

Further Analysis: Examining Payment History in Greater Detail

Consistent on-time payments demonstrate financial responsibility, significantly outweighing even a higher credit utilization ratio in many credit scoring models. The length of your positive payment history also plays a significant role, as longer histories indicate greater reliability. This reinforces the importance of building and maintaining a positive payment track record over time. Missed payments can lead to penalties, higher interest rates, and a negative impact on your credit score that can take years to recover from. This aspect is often more critical than the utilization rate itself in the long run.

FAQ Section: Answering Common Questions About Credit Utilization

Q: What is the single most important factor affecting my credit score?

A: While credit utilization is very significant, payment history is generally considered the most influential factor.

Q: Can I increase my credit limit without affecting my score negatively?

A: Increasing your credit limit can positively affect your credit utilization ratio if your spending habits remain unchanged. However, it's essential to avoid overspending.

Q: How long does it take to repair a damaged credit score?

A: Repairing a damaged credit score takes time and consistent effort. It can take several months or even years depending on the severity of the damage.

Q: What if I have a high utilization ratio?

A: Immediately start reducing your debt. Prioritize paying down high-balance credit cards.

Practical Tips: Maximizing the Benefits of Optimal Credit Utilization

- Track your spending: Use budgeting tools and apps to monitor your spending and ensure you remain within your credit limit.

- Set up automatic payments: Automate your credit card payments to ensure you never miss a due date.

- Check your credit reports regularly: Review your credit reports from all three bureaus at least annually to identify and resolve any errors.

- Pay more than the minimum payment: Always pay more than the minimum payment to reduce your debt faster.

- Create a debt repayment plan: Develop a structured plan to pay down your debt systematically.

Final Conclusion: Wrapping Up with Lasting Insights

Maintaining a healthy credit utilization ratio is a cornerstone of strong personal finance. While aiming for under 30% is a good target, striving for under 10% is even better. Combined with a consistent record of on-time payments, a low credit utilization ratio significantly improves your credit score, opens doors to better financial opportunities, and ultimately contributes to long-term financial well-being. Proactive monitoring, responsible spending, and strategic debt management are essential for maximizing the benefits of optimal credit utilization.

Latest Posts

Latest Posts

-

Advance Refunding Definition

Apr 30, 2025

-

Advance Premium Fund Definition

Apr 30, 2025

-

Advance Premium Definition

Apr 30, 2025

-

Advance Funded Pension Plan Definition

Apr 30, 2025

-

Advance Commitment Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about What Percentage Should You Keep Your Credit Utilization . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.