If You Have A Credit Score Of 600 What Does That Mean

adminse

Apr 07, 2025 · 8 min read

Table of Contents

A Credit Score of 600: What It Means and How to Improve It

What does a credit score of 600 really mean, and why should you care? A 600 credit score signals a need for immediate attention, impacting your financial future significantly.

Editor’s Note: This article on a 600 credit score was published today, providing up-to-date information and practical advice for individuals seeking to improve their financial standing. Understanding your credit score is crucial for navigating the financial world successfully.

Why a Credit Score of 600 Matters:

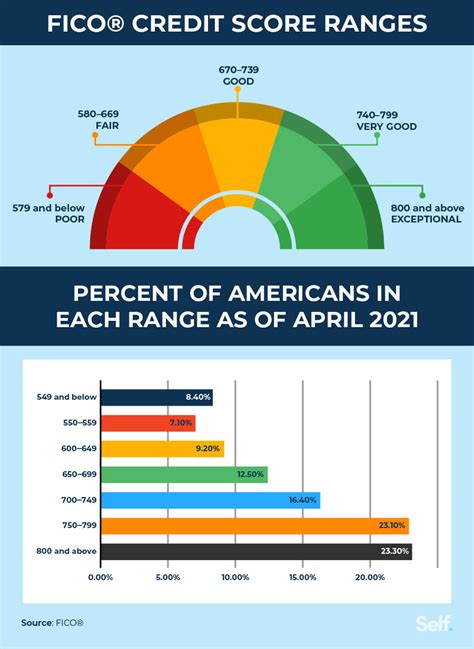

A credit score is a numerical representation of your creditworthiness – how likely you are to repay borrowed money. Lenders use these scores to assess risk. A score of 600 falls squarely into the "subprime" or "fair" range, depending on the specific scoring model used (e.g., FICO, VantageScore). This means lenders perceive you as a higher risk compared to someone with a higher score. This translates into several potential drawbacks:

- Higher interest rates: Lenders compensate for the perceived higher risk by charging significantly higher interest rates on loans, credit cards, and mortgages. This can dramatically increase the total cost of borrowing over the life of the loan.

- Loan application denials: Obtaining approval for loans, particularly larger ones like mortgages or auto loans, can be challenging, even impossible. Many lenders have minimum credit score requirements, and 600 often falls below these thresholds.

- Limited credit card options: Securing a credit card with favorable terms (low interest rates, high credit limits) will be difficult. You might only qualify for cards with high interest rates and low credit limits, potentially hindering your ability to build credit further.

- Higher insurance premiums: In some cases, insurance companies also consider credit scores when determining premiums. A 600 score might result in higher premiums for auto or renter's insurance.

- Rental difficulties: Some landlords use credit checks as part of their tenant screening process. A low score can negatively impact your chances of securing rental housing.

- Employment challenges: Although less common, some employers conduct credit checks, especially for positions involving handling finances. A low score could potentially affect your job prospects.

Overview: What This Article Covers

This article will thoroughly examine the implications of a 600 credit score, exploring its causes, the challenges it presents, and, most importantly, actionable strategies for improvement. We’ll delve into the specifics of credit scoring, explain how to obtain your credit reports, and provide a step-by-step plan for raising your score.

The Research and Effort Behind the Insights:

This article is based on extensive research, drawing upon information from leading credit bureaus (Equifax, Experian, TransUnion), financial experts, and numerous reputable sources. We’ve meticulously analyzed data on credit scoring methodologies and best practices for credit repair to provide readers with accurate and actionable insights.

Key Takeaways:

- Understanding Credit Score Components: Learn the factors that contribute to your credit score and how each impacts your overall rating.

- Accessing Your Credit Reports: Discover how to obtain your free credit reports and identify any inaccuracies or negative information.

- Dispute Errors: Understand the process for disputing errors on your credit reports, a crucial step in improving your score.

- Strategies for Improvement: Explore practical, effective strategies for improving your credit score over time.

- Debt Management Techniques: Learn how to manage existing debt effectively to improve your creditworthiness.

- Building Positive Credit History: Discover ways to establish and maintain a positive credit history through responsible borrowing and repayment.

Smooth Transition to the Core Discussion:

Now that we understand the significant implications of a 600 credit score, let's delve into the specific details, examining the factors that contribute to this score and the practical steps you can take to improve it.

Exploring the Key Aspects of a 600 Credit Score:

1. Definition and Core Concepts: A 600 credit score, as mentioned, sits within the "fair" to "subprime" range. It signifies that your credit history reveals a level of risk to lenders. This risk assessment is based on several key factors, weighted differently depending on the scoring model. These factors generally include:

- Payment History (35%): This is the most significant factor. Late payments, missed payments, and accounts sent to collections severely damage your score. Even one or two late payments can significantly lower your score.

- Amounts Owed (30%): The amount of debt you owe relative to your available credit (credit utilization ratio) significantly influences your score. High credit utilization (e.g., using 80% or more of your available credit) is a major negative factor.

- Length of Credit History (15%): A longer credit history generally results in a better score, showing lenders a pattern of responsible credit management over time.

- Credit Mix (10%): Having a variety of credit accounts (credit cards, loans, mortgages) can positively impact your score, demonstrating responsible use of different credit products.

- New Credit (10%): Frequently applying for new credit can negatively impact your score. Each application results in a hard inquiry on your credit report, which can signal increased risk to lenders.

2. Applications Across Industries: The impact of a 600 credit score extends to various aspects of your financial life. As previously discussed, it can affect your ability to secure loans, credit cards, insurance, and even rental housing.

3. Challenges and Solutions: The challenges presented by a 600 score are considerable, but not insurmountable. The solution lies in proactively addressing the underlying issues contributing to the low score and implementing strategies for improvement.

4. Impact on Innovation: While not directly related to technological innovation, a low credit score can indirectly impact your ability to participate in the growing fintech and financial technology market. Access to innovative financial products and services often hinges on having a good credit score.

Closing Insights: Summarizing the Core Discussion

A 600 credit score poses significant challenges, limiting access to favorable financial products and services. However, it's not a permanent condition. By understanding the components of credit scoring and actively addressing negative factors, improvement is achievable.

Exploring the Connection Between Debt Management and a 600 Credit Score:

The relationship between effective debt management and improving a 600 credit score is paramount. High levels of debt and high credit utilization are major contributors to low scores.

Key Factors to Consider:

Roles and Real-World Examples: Let's say someone has a 600 credit score primarily due to high credit card debt. They're using 90% of their available credit on multiple cards, resulting in high interest charges and late payments. This directly impacts their score. Conversely, if they implement a debt management plan, paying down balances and lowering credit utilization, their score will gradually improve.

Risks and Mitigations: The risk of inaction is that the debt will continue to grow, interest charges will increase, and further negative marks will appear on their credit report. Mitigation involves creating a budget, prioritizing debt repayment (consider debt consolidation or balance transfers), and avoiding further borrowing.

Impact and Implications: Effective debt management significantly improves the chances of securing better interest rates on future loans, increasing borrowing power and improving overall financial health.

Conclusion: Reinforcing the Connection:

The link between debt management and a 600 credit score is undeniable. By prioritizing debt reduction, individuals can drastically improve their creditworthiness and access more favorable financial opportunities.

Further Analysis: Examining Debt Consolidation in Greater Detail:

Debt consolidation involves combining multiple debts into a single loan or payment, often with a lower interest rate. This can streamline payments, reduce monthly expenses, and ultimately improve credit utilization. Careful consideration of fees and terms is crucial before opting for debt consolidation.

FAQ Section: Answering Common Questions About a 600 Credit Score:

What is a 600 credit score? A 600 credit score is considered fair to subprime, indicating a higher risk to lenders than higher scores.

How can I improve a 600 credit score? Focus on paying down debt, lowering credit utilization, making all payments on time, and avoiding new credit applications.

How long does it take to improve a credit score? The time required varies, depending on the severity of the negative factors and the effectiveness of the improvement strategies. Consistent responsible credit behavior is key.

What are the consequences of a 600 credit score? Higher interest rates, loan denials, limited credit options, and difficulties securing insurance or rental housing are potential consequences.

Can I get a mortgage with a 600 credit score? It's difficult, but not impossible. You might need a larger down payment or find a lender specializing in subprime loans, which usually have higher interest rates.

Practical Tips: Maximizing the Benefits of Credit Score Improvement:

- Obtain your credit reports: Review them for errors and inaccuracies.

- Create a budget: Track your income and expenses to identify areas for savings.

- Pay down debt: Focus on paying down high-interest debt first.

- Lower your credit utilization: Keep your credit utilization ratio below 30%.

- Pay bills on time: Make all payments on time, every time.

- Avoid new credit applications: Limit new credit applications to reduce hard inquiries.

- Monitor your credit score regularly: Track your progress and make adjustments as needed.

Final Conclusion: Wrapping Up with Lasting Insights:

A 600 credit score presents challenges, but it's not a life sentence. Through proactive steps like responsible debt management, consistent on-time payments, and careful credit utilization, improvement is within reach. Building a good credit score is a journey, requiring commitment and consistency. The rewards, however, are substantial—access to better financial opportunities and a brighter financial future.

Latest Posts

Related Post

Thank you for visiting our website which covers about If You Have A Credit Score Of 600 What Does That Mean . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.