What Is Total Minimum Payment Due Bank Of America

adminse

Apr 04, 2025 · 9 min read

Table of Contents

Understanding Bank of America's Total Minimum Payment Due: A Comprehensive Guide

What happens if you only pay the minimum on your Bank of America credit card? Could this seemingly small amount actually lead to significant long-term financial consequences?

Understanding Bank of America's total minimum payment due is crucial for responsible credit card management and avoiding costly pitfalls.

Editor’s Note: This article on Bank of America's total minimum payment due was published today and provides up-to-date information on this important aspect of credit card management. It's designed to help you understand your statement, make informed decisions, and avoid debt traps.

Why Understanding Bank of America's Minimum Payment Due Matters

Bank of America, like most major credit card issuers, requires a minimum payment on your outstanding balance each month. While seemingly inconsequential, consistently paying only this minimum can have profound implications for your finances. Understanding what constitutes this minimum payment, and the long-term effects of only paying it, is vital for responsible credit card usage and maintaining good financial health. Failure to understand this can lead to snowballing debt, damaged credit scores, and increased overall interest payments.

Overview: What This Article Covers

This article will dissect Bank of America's minimum payment calculation, explain what factors contribute to it, explore the potential long-term effects of consistently paying only the minimum, and provide strategies for responsible credit card management. We'll also examine the relationship between minimum payments and interest charges, the impact on your credit score, and offer practical tips for budgeting and debt repayment.

The Research and Effort Behind the Insights

The information presented here is based on publicly available information from Bank of America's website, credit card agreements, and general best practices in personal finance. While specific examples are used for illustrative purposes, it’s crucial to consult your individual Bank of America credit card agreement for the most accurate and up-to-date details. This research aims to provide clear, concise, and actionable advice.

Key Takeaways:

- Definition of Minimum Payment: A precise explanation of what Bank of America considers the total minimum payment due.

- Components of the Minimum Payment: A breakdown of the factors included in calculating the minimum.

- Interest Accrual: How interest charges are calculated and how they affect the minimum payment over time.

- Impact on Credit Score: The effect of minimum payments on your credit utilization ratio and overall credit score.

- Strategies for Responsible Credit Card Use: Practical advice for managing credit card debt effectively.

Smooth Transition to the Core Discussion

Now that we've established the importance of understanding Bank of America's minimum payment, let's delve into the specifics of what constitutes this amount and its long-term implications.

Exploring the Key Aspects of Bank of America's Minimum Payment Due

Definition and Core Concepts: The total minimum payment due on your Bank of America credit card is the smallest amount you can pay each month to avoid late fees and potentially negative impacts on your credit score. This amount is clearly stated on your monthly statement. It's crucial to note that this is not necessarily the amount required to reduce your principal balance; often, the minimum payment will only cover a portion of the interest accrued during the billing cycle.

Components of the Minimum Payment: The minimum payment calculation isn't arbitrary. Typically, it includes at least the accrued interest plus a small portion of the outstanding principal balance (the amount you owe). The precise formula used by Bank of America may vary slightly depending on your specific card agreement. However, it always aims to ensure that your debt doesn't balloon uncontrollably. You should always refer to your statement for the precise breakdown.

Interest Accrual and its Effect: Interest is a significant factor. A key concept to grasp is that if you only pay the minimum, a substantial portion of your payment goes towards interest, not reducing the principal. This means that your debt balance remains relatively high, and you'll continue accruing interest on a larger amount, making it more difficult to repay the debt. This cycle can trap you in a continuous loop of debt.

Impact on Credit Score: Consistently paying only the minimum payment has a negative impact on your credit score. Credit scoring models consider your credit utilization ratio—the percentage of your available credit you're using. By carrying a high balance (a result of paying only the minimum), your credit utilization ratio increases, leading to a lower credit score. This can significantly impact your ability to get loans, rent an apartment, or even secure a job in certain fields.

Strategies for Responsible Credit Card Use

- Pay More Than the Minimum: Always aim to pay more than the minimum payment each month, ideally as much as you can comfortably afford. This will reduce your principal balance quicker, minimize interest charges, and improve your credit utilization ratio.

- Budgeting: Create a realistic budget that allows for consistent and larger than minimum payments on your credit card debt. Track your spending meticulously to avoid overspending and accumulating further debt.

- Debt Consolidation: If you're struggling with multiple high-interest debts, consider consolidating them into a lower-interest loan. This can simplify your repayments and potentially save you money on interest.

- Balance Transfers: If you have a high balance on your Bank of America card, a balance transfer to a card with a 0% introductory APR can help you pay off your debt faster and save on interest. Be aware of balance transfer fees and the end date of the introductory period.

- Seek Professional Help: If you're overwhelmed by credit card debt, don't hesitate to seek help from a credit counselor or financial advisor. They can provide personalized guidance and support.

Exploring the Connection Between Interest Rates and Bank of America's Minimum Payment Due

The interest rate on your Bank of America credit card plays a crucial role in determining the minimum payment amount. A higher interest rate means more interest accrues each month, resulting in a larger minimum payment. This further illustrates the importance of minimizing interest charges by paying off your debt as quickly as possible. The relationship between these two factors is directly proportional; higher interest rates mean higher minimum payments and slower debt reduction.

Key Factors to Consider:

Roles and Real-World Examples: Imagine two individuals, both with a $5,000 balance on their Bank of America credit cards. Individual A has a 15% interest rate, while Individual B has a 25% interest rate. Individual B's minimum payment will be significantly higher due to the increased interest charges. This disparity shows how interest rates significantly impact minimum payments and overall debt repayment timelines.

Risks and Mitigations: The risk associated with only paying the minimum payment is the potential for debt to spiral out of control. The mitigation strategies are to increase payments as much as possible, explore balance transfers or debt consolidation, and improve budgeting habits.

Impact and Implications: The long-term implications of consistently paying only the minimum include a lower credit score, increased interest expenses, and prolonged debt repayment. This can restrict access to credit and financial opportunities in the future.

Conclusion: Reinforcing the Connection

The connection between interest rates and Bank of America's minimum payment due is undeniable. Understanding this connection is critical for managing credit card debt effectively. By actively mitigating the risks and implementing the mitigation strategies discussed, individuals can take control of their finances and avoid the negative consequences of consistently paying only the minimum payment.

Further Analysis: Examining Interest Rate Impacts in Greater Detail

Let's delve deeper into the mechanics of how interest rates affect the minimum payment. The interest is calculated daily on your outstanding balance. This daily interest is then added to your balance, and the next day's interest is calculated on this new, slightly higher balance. This process is known as compound interest, and it can lead to a significant increase in the total amount you owe over time. Therefore, paying more than the minimum reduces the base upon which interest is calculated.

FAQ Section: Answering Common Questions About Bank of America's Minimum Payment Due

What is the minimum payment due on my Bank of America credit card? This is clearly stated on your monthly statement. It’s not a fixed amount and changes based on your balance, interest rate, and payment history.

What happens if I only pay the minimum payment? You will avoid late fees, but your debt will take much longer to repay, and you'll pay significantly more in interest. Your credit score may also be negatively impacted.

Can I negotiate a lower minimum payment? It’s generally not possible to negotiate a lower minimum payment. However, you can negotiate a payment plan with Bank of America if you’re facing financial hardship.

How can I pay off my credit card debt faster? By paying more than the minimum payment each month, creating a budget, exploring balance transfers or debt consolidation, and practicing responsible spending habits.

What is the penalty for not paying the minimum payment? You will be charged a late payment fee, and your credit score could be negatively affected.

Practical Tips: Maximizing the Benefits of Responsible Credit Card Management

- Check your statement carefully: Pay close attention to the total minimum payment due, interest charges, and due date.

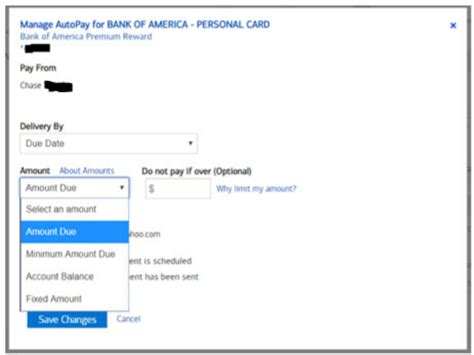

- Set up automatic payments: Schedule automatic payments to ensure you always make at least the minimum payment on time.

- Track your spending: Monitor your spending closely to avoid accumulating unnecessary debt.

- Prioritize debt repayment: Make extra payments whenever possible to reduce your principal balance and interest charges quickly.

- Seek professional advice: If you're struggling with credit card debt, consult a financial advisor or credit counselor.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding Bank of America's total minimum payment due is essential for responsible credit card management. Consistently paying only the minimum can lead to long-term financial problems, including high interest charges, damaged credit scores, and prolonged debt repayment. By actively managing your spending, making larger-than-minimum payments, and considering debt consolidation or balance transfers when necessary, you can take control of your finances and avoid the pitfalls of minimum payment traps. Remember, proactive management is key to maintaining good financial health.

Latest Posts

Latest Posts

-

Why Does My Credit Card Says No Minimum Payment Due

Apr 05, 2025

-

Minimum Payment On Walmart Credit Card

Apr 05, 2025

-

What Is The Minimum Credit Score For A Walmart Credit Card

Apr 05, 2025

-

Minimum Payment Example

Apr 05, 2025

-

Minimum Amount To Pay

Apr 05, 2025

Related Post

Thank you for visiting our website which covers about What Is Total Minimum Payment Due Bank Of America . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.