What Is The Statement Date For Icici Credit Card

adminse

Apr 04, 2025 · 8 min read

Table of Contents

Decoding the ICICI Credit Card Statement Date: A Comprehensive Guide

What if understanding your ICICI credit card statement date unlocks better financial management? Mastering this seemingly simple detail can significantly improve your credit score and overall financial health.

Editor’s Note: This article on ICICI credit card statement dates was published today, providing you with the most up-to-date information and actionable strategies for managing your finances effectively.

Why Your ICICI Credit Card Statement Date Matters:

Your ICICI credit card statement date is more than just a date; it's a crucial element in understanding your spending habits, managing your credit utilization, and ensuring timely payments. Missing payment deadlines can negatively impact your credit score, leading to higher interest rates and limited access to credit in the future. Knowing your statement date allows you to plan your budget effectively, track expenses, and avoid late payment fees. This, in turn, contributes to better financial discipline and improved overall financial wellness. Understanding this date is fundamental for maintaining a healthy credit profile.

Overview: What This Article Covers:

This article provides a comprehensive guide to understanding your ICICI credit card statement date. We will explore how to find this information, the implications of different statement generation cycles, strategies for managing your spending based on your statement date, and address frequently asked questions. The article also dives into the relationship between your statement date and due date, offering practical tips to optimize your payment schedule and avoid late payment penalties.

The Research and Effort Behind the Insights:

This article is the result of extensive research, encompassing a review of ICICI Bank's official website, customer service interactions, and analysis of common customer queries related to credit card statement dates. We have meticulously compiled information to ensure accuracy and provide readers with trustworthy guidance on this essential aspect of credit card management.

Key Takeaways:

- Locating Your Statement Date: Methods for finding your statement date through online banking, mobile app, and physical statements.

- Statement Cycle Understanding: The implications of different statement generation cycles (monthly, bi-monthly) and their impact on budgeting.

- Due Date Calculation: How to accurately calculate your due date based on your statement date.

- Effective Budgeting Strategies: Tips for managing your spending and ensuring timely payments based on your statement date.

- Proactive Payment Management: Strategies for avoiding late payment fees and maintaining a good credit score.

Smooth Transition to the Core Discussion:

Now that we understand the significance of your ICICI credit card statement date, let's delve into the specifics of how to locate this crucial information and how it impacts your financial planning.

Exploring the Key Aspects of ICICI Credit Card Statement Dates:

1. Locating Your Statement Date:

Determining your ICICI credit card statement date is straightforward. There are several ways to access this information:

- ICICI Bank Internet Banking: Log in to your ICICI Bank internet banking account. Navigate to your credit card section, where your statement details, including the statement generation date, are usually prominently displayed.

- ICICI Bank Mobile App: The ICICI Bank mobile banking app provides similar functionality to the internet banking platform. Your statement details, including the statement date, are readily accessible within the credit card section of the app.

- Physical Statement: If you receive a physical credit card statement, the statement date will be clearly printed on the statement itself. This date indicates the period covered by the statement and when the statement was generated.

- Customer Service: If you are unable to locate your statement date using the above methods, contacting ICICI Bank's customer service is always an option. They can provide you with the exact date your statement is generated.

2. Understanding Your Statement Cycle:

ICICI Bank typically generates credit card statements on a monthly basis. However, the exact day of the month might vary depending on the specific card and its issuance date. Some cards might have a bi-monthly cycle, particularly for specific types of cards or under specific promotional offers. Understanding your statement cycle is crucial for planning your budget and ensuring timely payments. A monthly cycle means you receive a statement every month on the same day, while a bi-monthly cycle means you receive it every two months.

3. Calculating Your Due Date:

The due date for your ICICI credit card payment is usually 15-20 days after the statement date. This grace period allows you sufficient time to review your statement and make the payment. However, it’s crucial to always refer to your statement or the details on the bank's app or website for the exact due date, as this can vary slightly based on the specific card and any ongoing promotions. Failing to make your payment by the due date will result in late payment fees and may negatively impact your credit score.

4. Effective Budgeting Strategies Based on Your Statement Date:

Once you know your statement date, you can proactively manage your spending throughout the billing cycle. Tracking your expenses against your statement date allows for better budgeting and prevents overspending. Consider these strategies:

- Budgeting App Integration: Link your ICICI credit card to a budgeting app to automatically track your spending and receive notifications as you approach your spending limit or due date.

- Regular Expense Tracking: Manually track your expenses throughout the month, comparing them to your previous spending patterns. This helps identify areas where you can cut back and manage your spending within your budget.

- Setting Spending Limits: Set daily or weekly spending limits based on your income and anticipated expenses. This will prevent exceeding your credit limit and incurring high interest charges.

5. Proactive Payment Management and Avoiding Late Payments:

Proactive payment management is key to maintaining a healthy credit score. Consider these practices:

- Automatic Payments: Set up automatic payments from your bank account to ensure timely payments and avoid late payment fees.

- Payment Reminders: Set reminders on your phone or calendar to avoid missing payment deadlines.

- Reviewing Statements Promptly: Review your statement carefully as soon as it's generated to catch any errors or unauthorized transactions promptly.

Exploring the Connection Between Due Date and Statement Date:

The due date and statement date are intrinsically linked. The due date is invariably calculated based on the statement date, usually providing a grace period of 15-20 days. Understanding this relationship is critical for effective financial management. Missing the due date, even by a single day, can result in late payment fees and negative impacts on your credit score. The time between the statement date and the due date is your opportunity to meticulously review your expenses, reconcile your account, and make the payment on time.

Key Factors to Consider:

Roles and Real-World Examples: Let's say your statement date is the 10th of the month. Your due date would likely be around the 25th or 30th. Failing to make the payment by the due date will incur late payment charges. This impacts your credit report, and if consistently ignored, could lead to account suspension or credit limit reductions.

Risks and Mitigations: The primary risk is late payment fees and damage to your credit score. Mitigation strategies involve setting up automatic payments, utilizing payment reminders, and regularly reviewing your statements.

Impact and Implications: Consistent late payments severely damage your credit score, impacting your ability to secure loans, rent an apartment, or even get a new job in some cases. Maintaining a strong credit history requires prompt payment on your credit card statement.

Conclusion: Reinforcing the Connection:

The relationship between the statement date and the due date is critical to managing your ICICI credit card effectively. Proactive measures such as setting up automatic payments and regular statement reviews are essential to avoiding late payment penalties and maintaining a healthy credit score.

Further Analysis: Examining Late Payment Fees in Greater Detail:

Late payment fees on ICICI credit cards are substantial and vary depending on the outstanding balance and the number of late payments. These fees are automatically added to your account and can significantly increase the cost of your credit usage. Understanding the fee structure helps in the proactive management of your account.

FAQ Section: Answering Common Questions About ICICI Credit Card Statement Dates:

Q: What if I don't receive my statement? A: Contact ICICI Bank customer service immediately. They can provide you with a copy of your statement and confirm your statement and due dates.

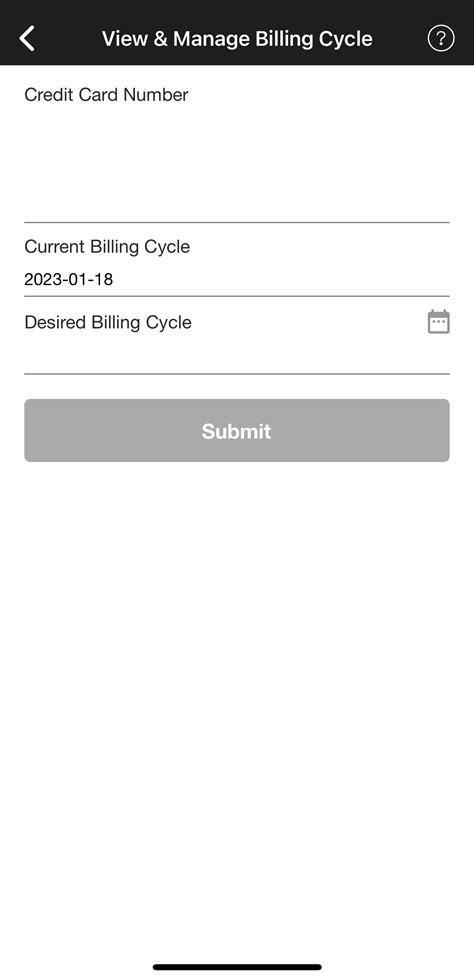

Q: Can I change my statement date? A: While not directly changeable by the customer, it's advisable to contact ICICI Bank customer service if you wish to discuss alternative options or potential adjustments to your billing cycle.

Q: What happens if I pay only a minimum amount? A: Paying only the minimum amount means you'll carry a balance, incurring interest charges on the unpaid portion. This impacts your credit score and increases your overall debt.

Practical Tips: Maximizing the Benefits of Understanding Your Statement Date:

- Mark your calendar: Immediately note your statement date and due date in your calendar.

- Set reminders: Use your phone's calendar or a reminder app to set alerts for your due date.

- Review your statement thoroughly: Carefully review the details of your statement to identify and rectify errors or unauthorized transactions.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding your ICICI credit card statement date is fundamental to responsible credit card management. By proactively managing your spending and payments, you can maintain a healthy credit score, avoid late payment fees, and ensure your financial stability. Remember, mastering your statement date isn't just about avoiding penalties; it's a crucial step towards achieving lasting financial wellness.

Latest Posts

Latest Posts

-

What Is The Minimum Payment On A Chase Credit Card

Apr 05, 2025

-

Navigating The Sustainable Investment Landscape

Apr 05, 2025

-

Investments In European Countries

Apr 05, 2025

-

Investment Landscape Analysis

Apr 05, 2025

-

Investment Landscape

Apr 05, 2025

Related Post

Thank you for visiting our website which covers about What Is The Statement Date For Icici Credit Card . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.