What Is The Minimum Monthly Payment For Carecredit Reddit

adminse

Apr 06, 2025 · 7 min read

Table of Contents

Decoding CareCredit's Minimum Monthly Payment: A Reddit Deep Dive

What's the real story behind CareCredit's minimum monthly payments, and how can you navigate this financing option effectively?

Understanding the minimum payment can save you money and prevent unexpected financial burdens.

Editor's Note: This article on CareCredit's minimum monthly payments was researched using publicly available information, including Reddit discussions, CareCredit's official website, and financial expert opinions. It aims to provide a comprehensive understanding of this topic, but individual experiences may vary. Always consult CareCredit's official resources for the most accurate and up-to-date information.

Why CareCredit's Minimum Payment Matters:

CareCredit is a popular healthcare financing option, offering interest-free promotional periods for eligible purchases. However, understanding its minimum monthly payment is crucial. Failing to make at least the minimum payment can lead to significant financial consequences, including:

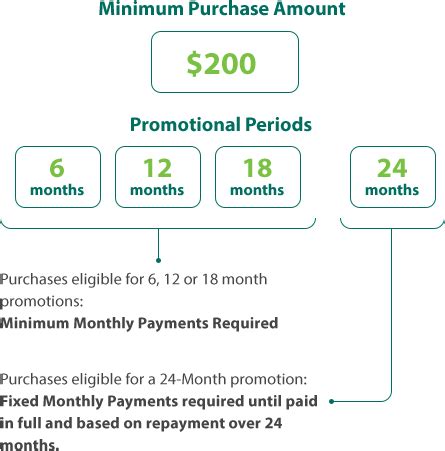

- High Interest Charges: After the promotional period ends (often 6, 12, or 18 months), interest accrues rapidly, potentially turning a manageable debt into a substantial burden. The minimum payment may only cover the interest, leaving the principal balance untouched.

- Late Fees: Missed or late payments result in additional fees, adding to the overall cost.

- Negative Credit Impact: Consistent late payments severely damage your credit score, making it harder to obtain loans and credit in the future.

- Account Suspension: Repeated payment failures can lead to account suspension, preventing further use of CareCredit.

Overview: What This Article Covers:

This in-depth exploration examines CareCredit's minimum monthly payment from various perspectives. We'll analyze Reddit discussions to uncover common user experiences, delve into the factors determining the minimum payment, explore strategies for managing payments effectively, and address frequently asked questions. The goal is to provide you with the knowledge to use CareCredit responsibly and avoid potential pitfalls.

The Research and Effort Behind the Insights:

This article is based on extensive research, combining insights gathered from numerous Reddit threads discussing CareCredit experiences, official CareCredit documentation, and general knowledge of credit card and financing practices. The analysis aims to provide a balanced perspective, reflecting both positive and negative user feedback.

Key Takeaways:

- No Fixed Minimum: CareCredit doesn't have a universally fixed minimum monthly payment. It's calculated based on your total balance and chosen repayment plan.

- Variable Minimums: Your minimum payment will fluctuate monthly based on your remaining balance and interest (if applicable).

- Importance of Full Payment: During the promotional period, paying the full balance before the interest-free period ends is strongly recommended to avoid accruing interest.

- Budgeting is Crucial: Careful budgeting and financial planning are essential before using CareCredit to ensure timely payments.

- Understanding the Terms: Thoroughly reading and understanding the CareCredit agreement before applying is paramount.

Smooth Transition to the Core Discussion:

Now that we understand the significance of understanding CareCredit's minimum payment, let's delve into the specifics gleaned from Reddit discussions and other sources.

Exploring the Key Aspects of CareCredit's Minimum Payment:

1. Reddit Insights: The User Experience:

Numerous Reddit threads reveal diverse experiences with CareCredit's minimum monthly payments. While some users praise its convenience and interest-free periods, others express frustration with unexpected interest charges after promotional periods and the complexities of understanding the minimum payment calculation. Common themes include:

- Unclear Communication: Several users report difficulty understanding the payment calculation and the implications of only making minimum payments.

- Unexpected Interest: Many users express surprise at the rapid accumulation of interest after the promotional period ends, often because they only made the minimum payments.

- Difficulty Paying Off: The minimum payment, especially after the promotional period, sometimes seems insufficient to make significant headway on the principal balance.

2. Factors Determining the Minimum Payment:

The minimum monthly payment isn't arbitrary. It's usually calculated based on several factors:

- Outstanding Balance: The larger the remaining balance, the higher the minimum payment.

- Interest Rate (Post-Promotional Period): Once the promotional period ends, the interest rate significantly impacts the minimum payment calculation. The minimum may barely cover the interest accrued each month.

- Repayment Term: The chosen repayment plan influences the minimum payment. Shorter repayment terms typically mean higher minimum payments.

- CareCredit's Algorithm: CareCredit uses a proprietary algorithm to determine the minimum, aiming to ensure eventual repayment while considering the borrower's capacity.

3. Avoiding the Pitfalls: Strategies for Effective Management:

- Pay in Full (During Promotional Period): The best strategy is to pay off the full balance before the promotional period ends. This avoids interest charges completely.

- Understand Your Minimum Payment: CareCredit provides statements outlining the minimum payment. Review this carefully each month.

- Budgeting and Financial Planning: Create a realistic budget to ensure you can comfortably afford at least the minimum payment each month.

- Explore Alternative Payment Options: Consider if other financing options might be more suitable, especially if you anticipate difficulties making timely payments.

- Contact CareCredit: If facing financial hardship, contact CareCredit directly to discuss potential payment arrangements or hardship programs. Proactive communication is often better than ignoring the issue.

Exploring the Connection Between Interest Rates and Minimum Payments:

The relationship between CareCredit's interest rates and minimum payments is critical. During the promotional period, the interest rate is 0%, and the minimum payment focuses on the principal. However, after this period, a high interest rate is applied. This means the minimum payment may barely cover the monthly accrued interest, leading to slow or no reduction in the principal balance.

Key Factors to Consider:

- Roles and Real-World Examples: Many Reddit users share stories of making only the minimum payment during the promotional period, only to be surprised by a substantial balance and high interest charges after the promotional period's end.

- Risks and Mitigations: The primary risk is accruing significant debt due to high interest charges. Mitigations include paying the balance in full during the promotional period or exploring alternative financing options.

- Impact and Implications: Failing to make timely payments can negatively impact your credit score and financial stability, limiting future borrowing opportunities.

Conclusion: Reinforcing the Connection:

The connection between interest rates and minimum payments highlights the importance of understanding CareCredit's terms and conditions. By carefully planning and prioritizing payments, users can avoid the pitfalls of high-interest debt and maintain their financial health.

Further Analysis: Examining Interest Rates in Greater Detail:

CareCredit's interest rates vary depending on the creditworthiness of the applicant and the chosen repayment plan. These rates are significantly higher than those offered by many other financial institutions. Understanding these rates is crucial in determining whether CareCredit is the most financially responsible option for your needs. Comparison shopping with other financing options is advisable.

FAQ Section: Answering Common Questions About CareCredit Minimum Payments:

- Q: What happens if I miss a CareCredit minimum payment?

- A: You'll likely incur late fees and potentially damage your credit score. Your account may be reported to credit bureaus as delinquent.

- Q: Can I negotiate my minimum payment with CareCredit?

- A: While CareCredit may offer hardship programs, it's less likely to negotiate the minimum payment itself. Focus on communicating your financial situation and exploring alternative payment arrangements.

- Q: How is the minimum payment calculated?

- A: The calculation is proprietary but generally based on your outstanding balance, interest rate (post-promotional period), and repayment term.

- Q: Does the minimum payment ever change?

- A: Yes, the minimum payment will likely change monthly as your balance and interest accrue.

Practical Tips: Maximizing the Benefits of CareCredit:

- Understand the Terms: Before applying, read the terms and conditions carefully.

- Budget Carefully: Create a realistic budget to ensure you can make timely payments.

- Pay in Full (During Promotional Period): The most effective strategy is to pay the balance in full before the interest-free period expires.

- Monitor Your Account Regularly: Stay on top of your payments and review your statements.

- Communicate with CareCredit: If you anticipate difficulties making payments, contact CareCredit proactively to discuss options.

Final Conclusion: Wrapping Up with Lasting Insights:

CareCredit can be a useful financing option, but only when used responsibly. Understanding the nuances of its minimum monthly payment is crucial to avoiding unexpected interest charges and maintaining good financial health. By following the guidelines and strategies outlined in this article, you can navigate CareCredit effectively and avoid potential pitfalls. Remember, proactive planning and careful budgeting are essential for successful utilization of this financing tool.

Latest Posts

Latest Posts

-

Will My Credit Score Go Up When Hard Inquiry Drops Off

Apr 07, 2025

-

Will My Credit Score Go Up When A Hard Inquiry Fall Off

Apr 07, 2025

-

Will My Credit Score Go Up If Inquiries Fall Off

Apr 07, 2025

-

What Store Credit Cards Can You Get With A 600 Credit Score

Apr 07, 2025

-

What Kind Of Credit Card Can You Get With A 600 Credit Score

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about What Is The Minimum Monthly Payment For Carecredit Reddit . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.