How To Create A Personal Finance App

adminse

Apr 06, 2025 · 8 min read

Table of Contents

Building Your Own Personal Finance App: A Comprehensive Guide

What if achieving financial freedom started with the app you built? This comprehensive guide will equip you with the knowledge and steps needed to create your own personal finance application.

Editor’s Note: This article provides a detailed roadmap for creating a personal finance app, covering everything from initial planning to launch. Whether you're a seasoned developer or just starting out, this guide offers valuable insights and actionable advice.

Why a Personal Finance App Matters:

In today's digital age, personal finance management is increasingly reliant on technology. A well-designed personal finance app can offer users a convenient, secure, and insightful way to track their income, expenses, investments, and debts. The market demand for robust, user-friendly financial apps is high, driven by the need for greater financial literacy and control. This translates to a significant opportunity for developers and entrepreneurs. From budgeting and expense tracking to investment monitoring and debt management, a personal finance app addresses a core need for millions. Its impact extends beyond individuals, influencing financial habits and promoting responsible financial behavior.

Overview: What This Article Covers:

This article will navigate you through the entire process of creating a personal finance app. We'll cover the essential planning stages, including market research, feature selection, and target audience identification. We'll then delve into the technical aspects, outlining the development process, technology stack choices, and design considerations. Finally, we'll discuss crucial aspects like testing, security, and marketing your finished product.

The Research and Effort Behind the Insights:

This guide draws from extensive research on successful personal finance apps, best practices in app development, and insights from industry experts. The information provided is designed to be practical, actionable, and relevant to both novice and experienced developers. We've analyzed existing apps, considered user reviews, and integrated current trends in fintech to create a comprehensive resource.

Key Takeaways:

- Market Analysis & Ideation: Understanding the competitive landscape and identifying your niche.

- Feature Selection & Prioritization: Choosing the right features for your target audience.

- Technology Stack & Development: Selecting the appropriate technologies and development methodologies.

- UI/UX Design: Creating an intuitive and user-friendly interface.

- Security & Compliance: Ensuring the app adheres to security and privacy standards.

- Testing & Deployment: Thoroughly testing and deploying your application.

- Marketing & Monetization: Strategies for marketing your app and generating revenue.

Smooth Transition to the Core Discussion:

Now, let's delve into the specifics of building your personal finance app. We'll begin with the critical planning phase that will lay the foundation for your success.

Exploring the Key Aspects of Creating a Personal Finance App:

1. Market Analysis and Ideation:

Before writing a single line of code, conduct thorough market research. Analyze existing personal finance apps, identifying their strengths and weaknesses. Consider your target audience: Are you building for young adults, families, entrepreneurs, or a specific niche? What are their financial needs and preferences? What unique value proposition will your app offer? This phase involves identifying a gap in the market or improving upon existing solutions. Consider unique features like integration with specific banking APIs, advanced budgeting tools, or personalized financial advice based on user data.

2. Feature Selection and Prioritization:

Prioritize features based on your target audience and value proposition. Core features should include:

- Account Linking: Securely connecting to various bank accounts and credit cards.

- Transaction Tracking: Automatically categorizing transactions and providing visual representations.

- Budgeting Tools: Setting budgets across various categories and tracking progress.

- Expense Analysis: Generating reports and charts to visualize spending patterns.

- Goal Setting: Enabling users to set financial goals (e.g., saving, debt reduction).

- Debt Management: Tracking debt balances, interest rates, and payment schedules.

- Investment Tracking (Optional): Integrating with investment accounts for portfolio monitoring.

- Financial Reports & Analytics: Providing insightful reports to understand financial health.

- Security Features: Implementing robust security measures to protect user data (e.g., encryption, two-factor authentication).

3. Technology Stack and Development:

Choosing the right technology stack is crucial. Consider:

- Frontend: React Native, Flutter, or native iOS/Android development (Swift/Kotlin) offer excellent cross-platform compatibility and performance.

- Backend: Node.js, Python (Django/Flask), or Ruby on Rails are popular choices for building scalable and robust APIs.

- Database: PostgreSQL, MySQL, or MongoDB are suitable for storing user data and financial transactions securely.

- Cloud Platform: AWS, Google Cloud, or Azure provide infrastructure for hosting your app and scaling as needed.

- API Integrations: Integrating with banking APIs (plaid, Yodlee) for account aggregation requires careful consideration of security and compliance.

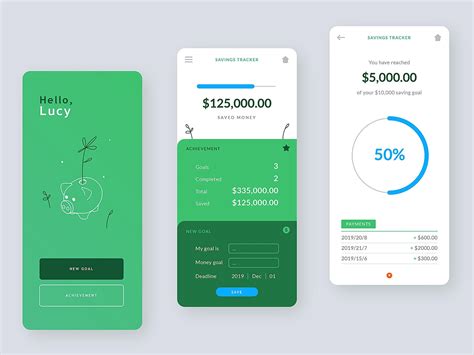

4. UI/UX Design:

User interface (UI) and user experience (UX) design are critical for app success. A clean, intuitive interface is vital for user engagement. Focus on:

- Intuitive Navigation: Make it easy for users to find and use all features.

- Visualizations: Use charts and graphs to represent financial data effectively.

- Personalization: Allow users to customize their dashboards and views.

- Accessibility: Ensure the app is accessible to users with disabilities.

5. Security and Compliance:

Security should be a top priority. Implement robust security measures, including:

- Data Encryption: Encrypt user data both in transit and at rest.

- Two-Factor Authentication: Add an extra layer of security to user accounts.

- Regular Security Audits: Conduct regular security assessments to identify and fix vulnerabilities.

- Compliance: Adhere to relevant regulations like GDPR, CCPA, and PCI DSS.

6. Testing and Deployment:

Thorough testing is essential to ensure app stability and reliability. Conduct:

- Unit Testing: Test individual components of the app.

- Integration Testing: Test the interaction between different parts of the app.

- User Acceptance Testing (UAT): Have users test the app to identify usability issues.

- Deployment: Choose a deployment strategy (e.g., continuous integration/continuous delivery) to streamline the release process.

7. Marketing and Monetization:

Marketing your app effectively is key to attracting users. Strategies include:

- App Store Optimization (ASO): Optimize your app's listing on app stores to improve visibility.

- Social Media Marketing: Promote your app on relevant social media platforms.

- Content Marketing: Create blog posts, articles, and videos to educate users about personal finance.

- Monetization Strategies: Consider freemium models (offering basic features for free and charging for premium features), subscription models, or in-app purchases.

Exploring the Connection Between User Data Privacy and Personal Finance App Development:

User data privacy is paramount in personal finance app development. The relationship between data privacy and app development is inextricably linked. Users entrust sensitive financial information to these apps, demanding robust security and transparent privacy policies.

Key Factors to Consider:

- Roles and Real-World Examples: Companies like Mint and Personal Capital demonstrate the importance of data privacy in attracting and retaining users. Transparency in how user data is collected, used, and protected builds trust.

- Risks and Mitigations: Data breaches can lead to significant financial and reputational damage. Implementing robust security measures, adhering to data protection regulations, and conducting regular security audits are crucial mitigations.

- Impact and Implications: Failure to protect user data can lead to legal penalties, loss of user trust, and damage to the app's reputation. Strong data privacy practices are essential for long-term success.

Conclusion: Reinforcing the Connection:

The interplay between user data privacy and personal finance app development highlights the critical need for responsible data handling. By prioritizing user privacy and implementing robust security measures, developers can build trust, comply with regulations, and create sustainable, successful apps.

Further Analysis: Examining Data Security in Greater Detail:

Data security is a multifaceted issue that requires ongoing attention. This involves not only technical safeguards but also organizational policies and procedures. Security measures must be regularly updated to address evolving threats. Encryption, access controls, and intrusion detection systems are vital components of a robust security architecture. Regular penetration testing and vulnerability assessments help identify and mitigate potential weaknesses before they can be exploited.

FAQ Section: Answering Common Questions About Creating a Personal Finance App:

-

What are the most important features to include in a personal finance app? Prioritize account linking, transaction tracking, budgeting tools, and expense analysis. Additional features can be added based on user needs and market demand.

-

How much does it cost to develop a personal finance app? The cost varies greatly depending on the app's complexity, features, and development team.

-

How can I ensure my app is secure? Implement robust security measures, including data encryption, two-factor authentication, and regular security audits. Adhere to relevant data protection regulations.

-

How can I market my personal finance app? Utilize app store optimization (ASO), social media marketing, content marketing, and potentially influencer marketing.

Practical Tips: Maximizing the Benefits of Your Personal Finance App:

- Start with a Minimum Viable Product (MVP): Focus on core features initially, and add more later based on user feedback.

- Iterate Based on User Feedback: Gather user feedback continuously and use it to improve your app.

- Prioritize User Experience: Make your app easy to use and visually appealing.

- Build a Strong Team: Assemble a team with the necessary skills in development, design, and marketing.

- Plan for Scalability: Design your app to handle increasing numbers of users and transactions.

Final Conclusion: Wrapping Up with Lasting Insights:

Building a successful personal finance app requires careful planning, robust development, and a strong commitment to user experience and security. By following the steps outlined in this guide, developers can create a valuable tool that empowers individuals to take control of their finances and achieve their financial goals. The market for personal finance apps is large and growing, presenting a significant opportunity for innovation and entrepreneurship. Remember that continuous improvement, based on user feedback and market trends, is essential for long-term success.

Latest Posts

Latest Posts

-

Is 1500 Credit Limit Good

Apr 07, 2025

-

1500 Credit Limit How Much To Use

Apr 07, 2025

-

Credit Limit Of 15000

Apr 07, 2025

-

How Much Of A Credit Card Limit Should I Use

Apr 07, 2025

-

If My Credit Card Limit Is 1500 How Much Should I Spend

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about How To Create A Personal Finance App . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.