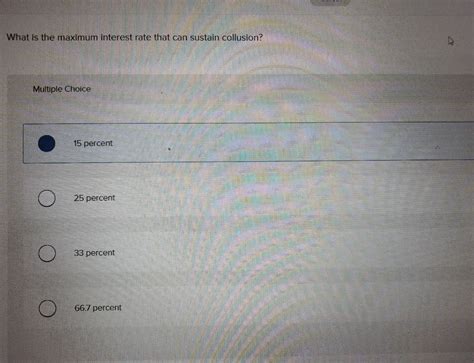

What Is The Maximum Interest Rate That Can Sustain Collusion

adminse

Mar 25, 2025 · 8 min read

Table of Contents

Unveiling the Limits: What's the Maximum Interest Rate That Can Sustain Collusion?

What if the stability of collusive agreements hinges precariously on the very interest rate they aim to manipulate? Understanding this critical threshold is paramount to effectively combating anti-competitive practices and fostering fair market dynamics.

Editor’s Note: This article on the maximum sustainable interest rate for collusion was published today, offering up-to-date analysis and insights into the complex interplay between interest rates, collusion, and market stability.

Why This Matters: Interest rates are a fundamental pillar of any economy, influencing borrowing costs, investment decisions, and overall market behavior. When collusive agreements artificially inflate interest rates, the consequences can be far-reaching, impacting consumers, businesses, and economic growth. Understanding the upper limit of interest rates compatible with collusion is crucial for regulators, economists, and businesses alike to identify and prevent anti-competitive behavior. This knowledge provides a powerful tool in maintaining fair market competition and promoting economic efficiency.

Overview: What This Article Covers

This article delves into the multifaceted challenge of determining the maximum interest rate that can sustain collusion. It explores the theoretical foundations of collusive behavior, examines the role of interest rates in influencing cartel stability, and analyzes real-world examples to illustrate the complexities involved. Readers will gain a nuanced understanding of the factors affecting the sustainability of collusive agreements under varying interest rate environments.

The Research and Effort Behind the Insights

This analysis incorporates insights from game theory, economic modeling, empirical studies of cartel behavior, and case studies of documented collusive agreements across various sectors. A structured approach has been employed, combining theoretical frameworks with real-world observations to provide practical and actionable insights. The article aims to present a comprehensive overview, supported by rigorous research and evidence-based analysis.

Key Takeaways:

- Definition and Core Concepts: A precise definition of collusion, cartel formation, and the factors influencing their stability.

- Interest Rate's Role: The mechanisms by which interest rates impact the incentives and risks associated with collusive agreements.

- The Sustainability Threshold: An exploration of the theoretical and empirical limits to interest rates under which collusion can be maintained.

- External Factors: The influence of economic conditions, regulatory scrutiny, and market structure on the sustainability of collusive agreements at different interest rate levels.

- Case Studies: Real-world examples of collusive agreements and their failure or success under specific interest rate regimes.

Smooth Transition to the Core Discussion

Having established the significance of this inquiry, let’s now delve into the core aspects of determining the maximum sustainable interest rate for collusion. We will analyze the theoretical underpinnings, the empirical evidence, and the practical implications of this complex relationship.

Exploring the Key Aspects of the Maximum Sustainable Interest Rate for Collusion

1. Definition and Core Concepts: Collusion, in its simplest form, refers to an agreement between competitors to restrict output, fix prices, or divide markets. Cartels are a prime example of collusion, where firms explicitly coordinate their actions to achieve anti-competitive outcomes. The stability of any collusive agreement hinges on several factors, including the number of firms involved, the ease of detecting cheating, the potential for punishment, and the overall market structure.

2. Interest Rate's Role in Collusion: Interest rates play a crucial role in the economics of collusion. High interest rates increase borrowing costs for firms, impacting their ability to invest, expand capacity, and withstand periods of reduced profits during a cartel’s operation. Higher rates might incentivize firms to cheat on the collusive agreement, as the opportunity cost of lost profits due to collusion becomes greater. Conversely, low interest rates might facilitate collusion by reducing the financial pressure on firms to deviate from the agreed-upon strategy.

3. The Sustainability Threshold: A Theoretical Perspective

Determining the precise maximum interest rate that sustains collusion is challenging. It's not a fixed number but rather a range influenced by several interacting variables. Game theory provides valuable insights. The stability of a cartel depends on the balance between the temptation to cheat (by producing more and gaining market share) and the risk of punishment (e.g., price wars, legal repercussions) if cheating is detected. The higher the interest rate, the greater the incentive to cheat, as the potential gains from increased output outweigh the risks of punishment, especially for firms facing financial strain.

Economic models incorporating factors like firm heterogeneity, demand elasticity, and the frequency of interaction between firms can help estimate this threshold. However, the complexity of these models often necessitates simplifying assumptions, which limits their predictive power in real-world scenarios.

4. External Factors Influencing Collusion's Sustainability:

Several external factors can influence the maximum sustainable interest rate for collusion. These include:

- Economic Conditions: During periods of economic recession or uncertainty, firms may be more inclined to collude to protect their market share and profitability. This might allow for collusion at higher interest rates than during boom times.

- Regulatory Scrutiny: Stricter antitrust enforcement and higher penalties for collusive behavior decrease the likelihood of successful collusion, regardless of interest rate levels.

- Market Structure: The concentration of the market (the number and size of firms) greatly affects collusion. Highly concentrated markets with a few dominant players are more susceptible to collusion, potentially tolerating higher interest rates than fragmented markets with many small players.

- Technological Advancements: Technological innovations can impact collusion. Improved monitoring technologies may enhance the detection of cheating, making collusion harder to sustain, regardless of interest rates.

5. Case Studies: Real-World Evidence

Analyzing historical instances of collusion provides valuable insights into the relationship between interest rates and cartel stability. For example, the OPEC oil cartel's behavior across various periods with different interest rate environments would be informative. Similarly, analyzing the stability of cartels in other industries, like cement or chemical production, under varying macroeconomic conditions, can shed light on the practical limitations of collusion under different interest rate scenarios. The success or failure of these cartels, considering concurrent interest rates, would offer empirical evidence supporting or challenging theoretical predictions.

Exploring the Connection Between Risk Aversion and the Maximum Sustainable Interest Rate for Collusion

The degree of risk aversion among firms significantly influences the maximum sustainable interest rate for collusion. Risk-averse firms are more reluctant to deviate from a collusive agreement, even when presented with a profitable opportunity to cheat, fearing the potential consequences. This suggests that higher levels of risk aversion might allow for collusion to persist at higher interest rates than in markets dominated by less risk-averse firms.

Key Factors to Consider:

- Roles and Real-World Examples: Firms with higher debt levels or facing financial difficulties are likely to be more risk-averse and thus more willing to collude to ensure survival, potentially supporting collusion at higher interest rate levels.

- Risks and Mitigations: The risk of detection and punishment plays a critical role. Stronger antitrust enforcement significantly reduces the viability of collusion, irrespective of interest rates.

- Impact and Implications: A higher maximum sustainable interest rate for collusion could lead to prolonged periods of artificially inflated prices and reduced economic efficiency.

Conclusion: Reinforcing the Connection

The interplay between risk aversion and the maximum sustainable interest rate for collusion underscores the complexity of this issue. While a higher level of risk aversion among participants might increase the tolerance for higher interest rates within a cartel, the presence of other factors like regulatory scrutiny and economic uncertainty will invariably influence the practical limits of collusion.

Further Analysis: Examining Market Transparency in Greater Detail

Market transparency, or the extent to which information about prices, quantities, and firm behavior is available to competitors, plays a crucial role in the sustainability of collusive agreements. In markets with high transparency, cheating is easier to detect, making collusion less sustainable. This reduces the maximum sustainable interest rate for collusion because the higher the interest rate, the greater the incentive to cheat, and higher transparency increases the probability of detection.

FAQ Section: Answering Common Questions About the Maximum Sustainable Interest Rate for Collusion

Q: Is there a single, universally applicable maximum interest rate that sustains collusion?

A: No. The maximum sustainable interest rate for collusion is not a fixed number but rather a range influenced by numerous factors, including market structure, regulatory environment, firm-specific characteristics, and prevailing economic conditions.

Q: How can regulators use this information to combat collusion?

A: By understanding the factors influencing the sustainability of collusive agreements at different interest rates, regulators can better target their enforcement efforts. For example, during periods of high interest rates, they might increase monitoring and investigation efforts to deter potential collusion.

Q: What are the broader economic implications of collusion at high interest rates?

A: Collusion at high interest rates can lead to reduced consumer welfare due to higher prices, stifle innovation due to reduced competition, and hamper overall economic growth.

Practical Tips: Maximizing the Effectiveness of Anti-Collusion Strategies

- Enhance Market Transparency: Promote the free flow of information about prices and market conditions to increase the likelihood of detecting cheating.

- Strengthen Antitrust Enforcement: Implement stricter penalties for collusive behavior to deter firms from engaging in anti-competitive practices.

- Promote Competition: Encourage the entry of new firms into the market to reduce market concentration and make collusion more difficult.

Final Conclusion: Wrapping Up with Lasting Insights

Determining the maximum interest rate that sustains collusion remains a challenging but crucial endeavor. While no single answer exists, understanding the interplay of factors like risk aversion, market transparency, and regulatory environment is vital for effectively combating anti-competitive practices and fostering a more efficient and equitable marketplace. By employing a combination of theoretical modeling, empirical analysis, and effective regulatory strategies, policymakers and economists can better address this multifaceted problem and safeguard the interests of consumers and the wider economy.

Latest Posts

Related Post

Thank you for visiting our website which covers about What Is The Maximum Interest Rate That Can Sustain Collusion . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.