What Is The Difference Between Installment Loans Vs Revolving Credit

adminse

Apr 07, 2025 · 8 min read

Table of Contents

Installment Loans vs. Revolving Credit: Understanding the Key Differences

What if your financial well-being depended on understanding the nuances between installment loans and revolving credit? Choosing the right type of credit can significantly impact your financial health, and knowing the difference is crucial for responsible borrowing.

Editor’s Note: This article on installment loans versus revolving credit was published today, offering readers up-to-date insights into these crucial financial tools. Understanding the differences between these credit options is essential for making informed financial decisions.

Why Understanding Installment Loans and Revolving Credit Matters:

The ability to access credit is a cornerstone of modern financial life, enabling purchases from homes to appliances. However, navigating the diverse landscape of credit products can be daunting. Installment loans and revolving credit represent two fundamentally different approaches to borrowing, each with its own advantages and disadvantages. Understanding these differences is crucial for making responsible borrowing decisions, managing debt effectively, and achieving long-term financial stability. The implications extend to credit scores, interest rates, and overall financial well-being.

Overview: What This Article Covers:

This article delves into the core aspects of installment loans and revolving credit, providing a comprehensive comparison. Readers will gain actionable insights into how these credit products function, their respective pros and cons, and which option might be best suited for their individual circumstances. The article will explore practical examples and address common questions to provide a clear and complete understanding.

The Research and Effort Behind the Insights:

This article is the result of extensive research, drawing upon information from reputable financial institutions, consumer protection agencies, and academic studies on consumer credit. The analysis presented is grounded in data-driven research and aims to provide readers with accurate and trustworthy information to make informed decisions.

Key Takeaways:

- Definition and Core Concepts: A clear definition of installment loans and revolving credit, outlining their fundamental characteristics.

- Practical Applications: Examples of how each credit type is used in real-world scenarios.

- Interest Rates and Fees: A comparison of the typical interest rates and fees associated with each type of credit.

- Credit Score Impact: How utilizing installment loans and revolving credit can affect your credit score.

- Advantages and Disadvantages: A balanced assessment of the pros and cons of each credit type.

- Choosing the Right Option: Guidance on determining which type of credit is most suitable for specific financial needs.

Smooth Transition to the Core Discussion:

Having established the importance of understanding installment loans and revolving credit, let's now explore the key characteristics and differences between these two prevalent forms of credit.

Exploring the Key Aspects of Installment Loans and Revolving Credit:

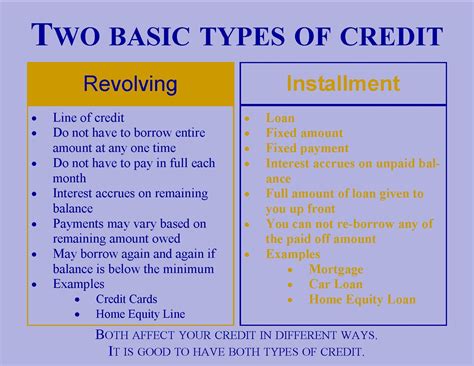

1. Installment Loans:

Installment loans involve borrowing a fixed sum of money upfront, which is then repaid over a specified period through a series of scheduled payments. Each payment remains the same throughout the loan term, typically consisting of both principal and interest. The loan agreement clearly outlines the total amount borrowed, the interest rate, the repayment schedule, and any associated fees.

Examples: Auto loans, mortgages, personal loans, student loans, and some types of medical loans are all examples of installment loans.

Advantages of Installment Loans:

- Predictable Payments: Consistent monthly payments make budgeting easier.

- Fixed Interest Rate: The interest rate is typically fixed for the duration of the loan, eliminating the risk of fluctuating interest costs.

- Improved Credit Score (with responsible use): On-time payments demonstrate responsible credit management, potentially leading to a higher credit score.

Disadvantages of Installment Loans:

- Longer Repayment Periods: Longer repayment terms can mean paying significantly more in interest over the life of the loan.

- Difficulty in Early Repayment: Some installment loans charge prepayment penalties if you pay off the loan early.

- Limited Flexibility: Once the loan agreement is signed, changing the repayment terms can be challenging.

2. Revolving Credit:

Revolving credit is a type of credit that provides a pre-approved credit limit. Borrowers can withdraw funds up to their credit limit, repay the balance, and then borrow again. The interest is calculated on the outstanding balance, not the total credit limit.

Examples: Credit cards, lines of credit, and home equity lines of credit (HELOCs) are common examples of revolving credit.

Advantages of Revolving Credit:

- Flexibility: Provides access to funds as needed, offering greater flexibility than installment loans.

- Building Credit: Responsible use of revolving credit, with consistent on-time payments and low balances, can contribute to a positive credit history.

- Rewards Programs: Many credit cards offer rewards programs, such as cashback or points, for purchases.

Disadvantages of Revolving Credit:

- High Interest Rates: Revolving credit typically carries higher interest rates than installment loans.

- Variable Interest Rates: Interest rates on revolving credit can fluctuate, leading to unpredictable repayment costs.

- Potential for Overspending: The ease of access to funds can lead to overspending and debt accumulation if not managed carefully.

Exploring the Connection Between Interest Rates and Installment Loans vs. Revolving Credit:

The interest rates associated with installment loans and revolving credit are significantly different. Installment loans typically have lower interest rates, especially for secured loans like mortgages and auto loans. This is because lenders consider the asset (house or car) as collateral, reducing their risk. Conversely, revolving credit, particularly unsecured credit cards, often comes with higher interest rates to compensate for the greater risk of default. The interest rate offered will depend on your creditworthiness, the type of credit, and the lender's policies.

Key Factors to Consider:

- Credit Score Influence: A higher credit score typically qualifies you for lower interest rates on both installment loans and revolving credit.

- Loan Amount: The amount you borrow influences the interest rate. Larger loans might command higher rates.

- Loan Term: The length of the loan term (for installment loans) directly impacts the total interest paid. Longer terms mean higher total interest.

- Fees and Charges: Pay close attention to any associated fees, such as annual fees (for credit cards) or origination fees (for some installment loans).

Roles and Real-World Examples:

A homeowner might secure a fixed-rate mortgage (installment loan) to finance a house purchase, while a business owner uses a line of credit (revolving credit) to manage cash flow fluctuations. An individual might use a personal loan (installment loan) for debt consolidation or a credit card (revolving credit) for everyday purchases.

Risks and Mitigations:

The risk with installment loans lies in the potential for accumulating substantial interest over the loan term, especially with longer repayment schedules. The risk with revolving credit is overspending and accruing high-interest debt due to the ease of access to funds. Mitigating these risks involves careful budgeting, responsible spending habits, and a clear understanding of the terms and conditions of the credit agreement.

Impact and Implications:

Responsible use of both installment loans and revolving credit can positively impact your credit score, leading to better access to credit in the future. However, misuse can result in high debt levels, negatively impacting your creditworthiness and financial health.

Conclusion: Reinforcing the Connection:

The choice between installment loans and revolving credit depends entirely on your individual financial needs and circumstances. Understanding the fundamental differences—fixed versus variable payments, interest rates, and repayment flexibility—is key to making informed decisions. Careful consideration of your financial goals and risk tolerance is crucial for selecting the appropriate type of credit and utilizing it responsibly.

Further Analysis: Examining Credit Score Impact in Greater Detail:

Your credit score plays a pivotal role in determining the interest rates you qualify for with both installment loans and revolving credit. A higher credit score generally results in lower interest rates, saving you money over the life of the loan or credit agreement. Maintaining a good credit score involves responsible credit management, including on-time payments, low credit utilization ratios (for revolving credit), and a diverse credit mix.

FAQ Section: Answering Common Questions About Installment Loans and Revolving Credit:

Q: What is the best type of credit for me?

A: The best type of credit depends on your specific financial needs and circumstances. If you need a fixed amount of money for a specific purpose, an installment loan may be suitable. If you need access to funds as needed, revolving credit might be a better choice.

Q: How can I improve my chances of getting approved for a loan or credit card?

A: Maintaining a good credit score, having a stable income, and providing accurate information to lenders will significantly improve your chances of approval.

Q: What happens if I miss a payment on an installment loan or revolving credit?

A: Missing payments can severely damage your credit score, leading to higher interest rates and potential collection actions.

Q: Can I pay off an installment loan early?

A: You can often pay off an installment loan early, but some loans have prepayment penalties. Review your loan agreement to understand any associated fees.

Practical Tips: Maximizing the Benefits of Installment Loans and Revolving Credit:

- Compare Offers: Shop around and compare interest rates and fees from different lenders before committing to a loan or credit card.

- Budget Carefully: Create a realistic budget to ensure you can comfortably afford your monthly payments.

- Pay On Time: Make all payments on time to avoid late fees and damage to your credit score.

- Keep Balances Low: Maintain low credit utilization ratios for revolving credit to avoid high interest charges and improve your credit score.

- Read the Fine Print: Carefully review all loan agreements and credit card terms and conditions before signing.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding the differences between installment loans and revolving credit is paramount for effective personal finance management. By carefully weighing the advantages and disadvantages of each, and by practicing responsible credit management, individuals can harness the power of credit to achieve their financial goals while mitigating potential risks. The key takeaway is responsible borrowing, informed decision-making, and a proactive approach to managing debt.

Latest Posts

Latest Posts

-

Advance Refunding Definition

Apr 30, 2025

-

Advance Premium Fund Definition

Apr 30, 2025

-

Advance Premium Definition

Apr 30, 2025

-

Advance Funded Pension Plan Definition

Apr 30, 2025

-

Advance Commitment Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about What Is The Difference Between Installment Loans Vs Revolving Credit . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.