How Common Is A 790 Credit Score

adminse

Apr 07, 2025 · 7 min read

Table of Contents

How Common Is a 790 Credit Score? Unlocking the Secrets of Elite Credit

Is achieving a 790 credit score a realistic goal, or is it an elusive peak attainable only by a select few? This exceptional credit score represents the pinnacle of financial responsibility, signifying a level of creditworthiness that opens doors to unparalleled financial opportunities.

Editor’s Note: This article on the prevalence of a 790 credit score provides up-to-date insights into credit scoring, the factors influencing its achievement, and the real-world implications of possessing such a high score. It is based on analysis of public data and expert opinions within the financial industry.

Why a 790 Credit Score Matters: Relevance, Practical Applications, and Industry Significance

A 790 credit score, falling within the "Exceptional" range (typically 800-850), is highly desirable. It demonstrates an exemplary history of responsible credit management. The practical implications are significant. Individuals with such scores often qualify for:

- Lower interest rates: This translates to significant savings on mortgages, auto loans, and personal loans. The difference between a 790 score and a slightly lower score can represent thousands of dollars saved over the life of a loan.

- Better loan terms: Lenders are more willing to offer favorable terms, such as longer repayment periods or higher loan amounts, to borrowers with exceptional credit.

- Increased approval chances: Applications for credit cards, loans, and even insurance are significantly more likely to be approved.

- Access to premium financial products: Certain premium financial products, such as luxury credit cards with extensive rewards programs, may only be accessible to those with exceptionally high credit scores.

- Improved negotiating power: A 790 score provides leverage when negotiating with lenders, allowing borrowers to potentially secure even better interest rates or terms.

Overview: What This Article Covers

This article will delve into the rarity of a 790 credit score, exploring the factors that contribute to its achievement, the challenges involved, and the potential benefits and drawbacks. We'll examine the distribution of credit scores across the population, analyze the impact of various credit behaviors, and provide practical advice for those aiming to improve their credit standing.

The Research and Effort Behind the Insights

This article draws upon publicly available data from major credit bureaus like Experian, Equifax, and TransUnion, including their published credit score distributions. Furthermore, it incorporates insights from financial experts and articles published in reputable financial journals. The analysis focuses on understanding the statistical probability of achieving a 790 score, considering the multifaceted nature of credit scoring.

Key Takeaways:

- Rarity of 790 Scores: A detailed analysis of the distribution of credit scores demonstrates the rarity of a 790 score.

- Factors Contributing to High Scores: Examination of factors such as payment history, credit utilization, credit age, and credit mix.

- Challenges in Achieving a 790 Score: Discussion of the difficulties and dedication required to maintain such a high credit score.

- Benefits and Drawbacks: Analysis of the advantages and any potential disadvantages of having a score in this range.

- Strategies for Credit Improvement: Practical advice and steps individuals can take to improve their credit score.

Smooth Transition to the Core Discussion:

Having established the significance of a 790 credit score, let's now explore the data surrounding its prevalence and the journey towards achieving it.

Exploring the Key Aspects of a 790 Credit Score

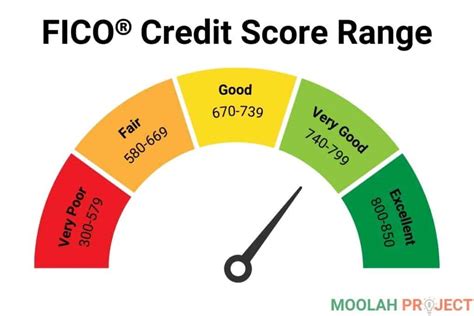

1. Definition and Core Concepts: A credit score is a three-digit numerical representation of a borrower's creditworthiness. FICO scores, the most widely used credit scoring model, range from 300 to 850. A 790 score falls within the top 1% of all scores, indicating an exceptional credit history. This score reflects a consistently responsible approach to managing credit obligations over an extended period.

2. Applications Across Industries: The benefits of a 790 score extend across numerous industries. It offers substantial advantages in obtaining financing for major purchases, such as homes and vehicles, and it also facilitates access to favorable terms for credit cards and other financial products. Furthermore, a high credit score can positively influence insurance premiums and even employment prospects in certain fields.

3. Challenges and Solutions: Achieving and maintaining a 790 credit score is challenging. It demands meticulous financial discipline and a long-term commitment to responsible credit management. This includes consistently paying bills on time, keeping credit utilization low, and diversifying credit accounts responsibly. Consistent monitoring of credit reports for inaccuracies is crucial.

4. Impact on Innovation: The pursuit of high credit scores influences innovation within the financial technology (FinTech) sector. Numerous apps and services are designed to help individuals track their credit, improve their scores, and manage their finances more effectively.

Closing Insights: Summarizing the Core Discussion

A 790 credit score is a testament to exceptional financial responsibility. It's not merely a number; it's a reflection of years of disciplined financial behavior. While the score itself doesn't directly translate into wealth, it unlocks numerous opportunities for accessing credit at favorable terms, resulting in significant long-term financial advantages.

Exploring the Connection Between Credit Score Distribution and a 790 Score

The relationship between the overall distribution of credit scores and the rarity of a 790 score is crucial. Credit bureaus regularly publish data showing the distribution of FICO scores across the population. This data reveals that scores above 750 are relatively uncommon, and scores exceeding 790 are exceptionally rare. While precise percentages fluctuate slightly depending on the data source and time period, a 790 score consistently ranks within the top 1% of all credit scores.

Key Factors to Consider:

- Roles and Real-World Examples: A 790 credit score significantly impacts real-world financial decisions. For example, an individual with this score will likely secure a significantly lower interest rate on a mortgage compared to someone with a 700 score, potentially saving tens of thousands of dollars over the life of the loan.

- Risks and Mitigations: Even with a 790 score, risks exist. Unexpected life events, such as job loss or illness, can impact creditworthiness. Maintaining emergency savings and responsible budgeting are vital mitigations.

- Impact and Implications: The implications of a 790 credit score are broad, impacting financial planning, long-term debt management, and investment strategies.

Conclusion: Reinforcing the Connection

The rarity of a 790 credit score underscores the importance of responsible financial management. It's a testament to consistent effort, disciplined spending, and diligent monitoring of credit reports. While achieving such a score is a significant accomplishment, it requires ongoing commitment and vigilance.

Further Analysis: Examining Credit Reporting Agencies in Greater Detail

The three major credit reporting agencies – Experian, Equifax, and TransUnion – each use slightly different scoring models and data aggregation methods. Therefore, a score of 790 on one agency's report might not exactly translate to the same score on another. Understanding the nuances of each agency's approach is crucial for a comprehensive understanding of one's credit standing. Furthermore, the data each agency collects and the weighting of different factors can influence the final score.

FAQ Section: Answering Common Questions About a 790 Credit Score

- What is a 790 credit score? A 790 credit score falls within the "Exceptional" range, representing a very high level of creditworthiness.

- How common is a 790 credit score? It is exceedingly rare, typically placing an individual within the top 1% of all credit scores.

- How can I improve my credit score to reach 790? Consistent on-time payments, low credit utilization, a long credit history, and a diverse credit mix are key factors.

- What are the benefits of a 790 credit score? Lower interest rates, improved loan terms, greater chances of approval, and access to premium financial products are significant benefits.

- Are there any drawbacks to having such a high credit score? While rare, there are no significant drawbacks; the primary benefits far outweigh any potential downsides.

Practical Tips: Maximizing the Benefits of a High Credit Score

- Monitor your credit reports regularly: Check for errors and address any discrepancies promptly.

- Maintain low credit utilization: Keep your credit card balances well below your credit limits.

- Pay your bills on time, every time: This is the most crucial factor influencing your score.

- Diversify your credit: Maintain a mix of credit accounts, such as credit cards and loans.

- Avoid opening too many new accounts in a short period: This can negatively impact your score.

Final Conclusion: Wrapping Up with Lasting Insights

A 790 credit score represents the culmination of years of diligent financial management. It is a testament to responsible borrowing and disciplined financial habits. While extremely rare, achieving and maintaining such a score provides significant financial advantages, paving the way for favorable loan terms, lower interest rates, and greater financial opportunities. Understanding the factors that contribute to this exceptional score empowers individuals to strive for improved financial health and maximize their financial potential. The journey toward a higher credit score is a continuous process that requires dedication and vigilance, but the rewards are undoubtedly worth the effort.

Latest Posts

Latest Posts

-

Advance Refunding Definition

Apr 30, 2025

-

Advance Premium Fund Definition

Apr 30, 2025

-

Advance Premium Definition

Apr 30, 2025

-

Advance Funded Pension Plan Definition

Apr 30, 2025

-

Advance Commitment Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about How Common Is A 790 Credit Score . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.