What Is The Difference Between A Credit Score And A Credit Rating Quizlet

adminse

Apr 07, 2025 · 8 min read

Table of Contents

Decoding the Difference: Credit Score vs. Credit Rating

What's the real difference between a credit score and a credit rating, and why should you care? Understanding this distinction is crucial for navigating the financial world and securing favorable loan terms.

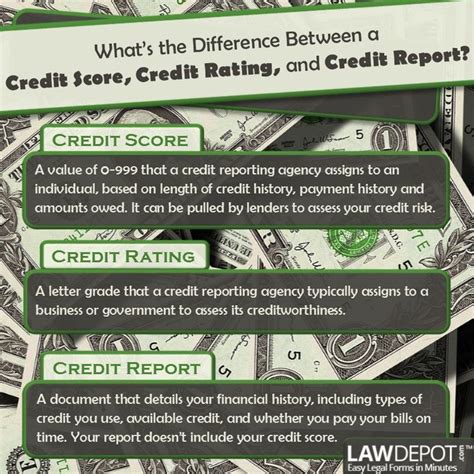

A credit score is a single number summarizing your creditworthiness, while a credit rating is a more in-depth assessment of your credit risk, used primarily by lenders and investors.

Editor’s Note: This article on the differences between credit scores and credit ratings was published today, providing readers with up-to-date information on this important financial topic. This comprehensive guide will help you understand these concepts, clarifying the nuances and implications for your financial health.

Why Understanding Credit Scores and Ratings Matters

Credit scores and ratings are cornerstones of the financial system. They profoundly impact your ability to access credit, secure favorable interest rates, and even obtain certain types of insurance. A strong credit score opens doors to better financial opportunities, while a weak one can lead to higher interest rates, loan denials, and increased costs. Similarly, a favorable credit rating is essential for corporations seeking funding. Understanding the difference between these two crucial assessments empowers you to make informed decisions and manage your finances effectively.

Overview: What This Article Covers

This article delves into the core aspects of credit scores and credit ratings, exploring their definitions, calculation methods, uses, and significance for individuals and businesses. Readers will gain a clear understanding of the key differences, learn how these assessments are used, and discover strategies to improve their credit profiles.

The Research and Effort Behind the Insights

This article is the result of extensive research, incorporating information from reputable sources such as the Fair Isaac Corporation (FICO), major credit bureaus (Experian, Equifax, TransUnion), and financial industry publications. Data-driven analysis and clear explanations ensure readers receive accurate and trustworthy information to make informed financial decisions.

Key Takeaways:

- Definition and Core Concepts: A clear distinction between credit scores and credit ratings, including their respective purposes and methodologies.

- Calculation Methods: An explanation of the factors influencing both credit scores and credit ratings.

- Uses and Applications: How credit scores and ratings are used by lenders, insurers, and employers.

- Improving Creditworthiness: Strategies for enhancing both credit scores and creditworthiness factors impacting credit ratings.

- The Interplay of Scores and Ratings: How credit scores can influence the overall credit rating process for individuals and businesses.

Smooth Transition to the Core Discussion:

Now that we understand the importance of distinguishing between credit scores and credit ratings, let's delve into a detailed examination of each concept, exploring their intricacies and applications.

Exploring the Key Aspects of Credit Scores and Credit Ratings

1. Credit Scores: The Numerical Representation of Creditworthiness

A credit score is a three-digit number that summarizes an individual's creditworthiness. It's a snapshot of your credit history, reflecting how likely you are to repay your debts. The most common credit scoring models in the United States are FICO scores, developed by the Fair Isaac Corporation. These scores typically range from 300 to 850, with higher scores indicating better creditworthiness.

Factors Affecting Credit Scores:

- Payment History (35%): This is the most significant factor. On-time payments demonstrate responsibility, while late or missed payments negatively impact your score.

- Amounts Owed (30%): The amount of debt you owe relative to your available credit (credit utilization ratio) is crucial. High credit utilization suggests a higher risk of default.

- Length of Credit History (15%): A longer credit history, showing consistent responsible credit management over time, generally results in a better score.

- New Credit (10%): Frequently applying for new credit can negatively affect your score, as it signals increased risk to lenders.

- Credit Mix (10%): Having a variety of credit accounts (credit cards, loans, etc.) demonstrates responsible credit management, but this is the least impactful factor.

2. Credit Ratings: The In-Depth Assessment of Credit Risk

Credit ratings are assessments of the creditworthiness of borrowers, usually corporations or governments, by specialized credit rating agencies like Moody's, Standard & Poor's (S&P), and Fitch. Unlike credit scores, which are numerical, credit ratings are alphanumeric, indicating different levels of risk. A higher rating suggests a lower risk of default. For example, AAA is the highest rating, representing the lowest risk, while lower ratings, like C or D, indicate significantly higher risk.

Factors Affecting Credit Ratings:

Credit rating agencies use a complex methodology to assess creditworthiness, considering various factors, including:

- Financial Strength: This encompasses the borrower's profitability, liquidity, and leverage ratios.

- Debt Levels: The amount of debt relative to assets and earnings is a critical factor. High debt levels indicate greater risk.

- Management Quality: The competence and experience of the management team are assessed.

- Industry Conditions: The overall health and outlook of the borrower's industry play a role.

- Economic Conditions: Macroeconomic factors, such as interest rates and economic growth, also influence credit ratings.

3. Key Differences Summarized:

| Feature | Credit Score | Credit Rating |

|---|---|---|

| Purpose | Assess individual creditworthiness | Assess credit risk of borrowers (individuals, businesses, governments) |

| Provider | Credit bureaus (e.g., Experian, Equifax, TransUnion) | Credit rating agencies (e.g., Moody's, S&P, Fitch) |

| Format | Numerical (e.g., 300-850) | Alphanumeric (e.g., AAA, AA, A, BBB, etc.) |

| Users | Lenders, insurers, employers | Lenders, investors, regulators |

| Scope | Primarily individual credit history | Broader financial assessment, including financial statements |

Exploring the Connection Between Credit Utilization and Credit Scores

Credit utilization, the percentage of available credit used, is a significant factor influencing credit scores. A high credit utilization ratio (e.g., using 80% or more of available credit) signals to lenders that you may be overextended financially, increasing the perceived risk of default. Conversely, keeping credit utilization low (e.g., below 30%) demonstrates responsible credit management and positively impacts your credit score.

Key Factors to Consider:

- Roles and Real-World Examples: A high credit utilization ratio can significantly lower a credit score, making it difficult to obtain loans at favorable interest rates. Conversely, maintaining low credit utilization can enhance credit scores and access to better financing opportunities.

- Risks and Mitigations: Ignoring credit utilization can lead to a lower credit score, impacting access to credit and interest rates. Regularly monitoring credit utilization and paying down debt can help mitigate this risk.

- Impact and Implications: The impact of credit utilization on credit scores is substantial, affecting not just borrowing costs but also eligibility for loans, credit cards, and even insurance.

Conclusion: Reinforcing the Connection

The relationship between credit utilization and credit scores underscores the importance of responsible credit management. By monitoring credit utilization and keeping it low, individuals can significantly improve their credit scores and access better financial opportunities.

Further Analysis: Examining Credit Reporting Agencies in Greater Detail

Credit reporting agencies (CRAs) play a pivotal role in collecting and compiling credit information, forming the foundation of both credit scores and ratings. Experian, Equifax, and TransUnion are the three major CRAs in the United States. They gather information from lenders, and this data is used to create credit reports, which lenders utilize to assess creditworthiness. Understanding how CRAs operate is crucial for effectively managing your credit profile.

FAQ Section: Answering Common Questions About Credit Scores and Ratings

-

What is a credit score? A credit score is a three-digit number that summarizes your creditworthiness based on your credit history.

-

What is a credit rating? A credit rating is an alphanumeric assessment of the creditworthiness of a borrower (individual, business, or government), usually provided by credit rating agencies.

-

How are credit scores calculated? Credit scores are calculated using a variety of factors, primarily payment history, amounts owed, length of credit history, new credit, and credit mix.

-

How are credit ratings determined? Credit ratings are determined through a more complex process, evaluating financial strength, debt levels, management quality, industry conditions, and economic conditions.

-

Can I improve my credit score? Yes, by paying bills on time, keeping credit utilization low, maintaining a long credit history, and avoiding excessive new credit applications.

-

Can a credit rating be improved? Yes, by improving financial strength, reducing debt levels, demonstrating effective management, and operating in a stable industry.

Practical Tips: Maximizing the Benefits of Understanding Credit Scores and Ratings

-

Obtain your credit reports: Regularly check your credit reports from all three major CRAs for errors or inaccuracies.

-

Monitor your credit scores: Track your credit scores to identify potential problems early on.

-

Maintain low credit utilization: Keep your credit utilization below 30% to improve your credit score.

-

Pay your bills on time: Consistent on-time payments are crucial for a good credit score and credit rating.

-

Manage debt effectively: Keep your debt levels manageable to avoid negatively impacting your credit score and rating.

-

Understand the factors influencing your credit profile: Educate yourself on the elements impacting both credit scores and ratings.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding the difference between credit scores and credit ratings is crucial for financial success. Credit scores provide a concise summary of individual creditworthiness, while credit ratings offer a broader assessment of credit risk for borrowers of all sizes. By actively managing your credit profile and understanding the factors influencing both credit scores and ratings, you can significantly improve your financial prospects. The information presented here empowers individuals and businesses to make informed decisions, securing favorable financial terms and building a strong credit foundation for the future.

Latest Posts

Latest Posts

-

Additional Death Benefit Definition

Apr 30, 2025

-

Additional Child Tax Credit Actc Definition And Who Qualifies

Apr 30, 2025

-

Adding To A Loser Definition And Example

Apr 30, 2025

-

What Is An Addendum Definition How It Works And Examples

Apr 30, 2025

-

Add On Interest Definition Formula Cost Vs Simple Interest

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about What Is The Difference Between A Credit Score And A Credit Rating Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.