What Is Bps In Interest Rates

adminse

Mar 25, 2025 · 8 min read

Table of Contents

Decoding BPS in Interest Rates: A Comprehensive Guide

What if understanding basis points (BPS) unlocked a deeper understanding of financial markets and investment strategies? Mastering this seemingly simple concept is crucial for navigating the complexities of interest rate fluctuations and their impact on various financial instruments.

Editor’s Note: This article provides a comprehensive explanation of basis points (BPS) in interest rates, updated with current market context. It's designed for both novice and experienced investors seeking a clearer grasp of this fundamental financial term.

Why Basis Points (BPS) Matter:

Basis points, or BPS, are a fundamental unit of measurement in finance, especially when discussing changes in interest rates. While seemingly minor, understanding BPS is critical for several reasons:

- Precision in Communication: Using BPS eliminates ambiguity when discussing small changes in interest rates. Saying a rate increased by 0.25% is less precise than saying it increased by 25 BPS. This precision is especially crucial in bond trading and other interest-rate sensitive markets.

- Accurate Calculations: Many financial calculations, such as the impact of rate changes on bond prices or loan payments, require the precise measurement that BPS provides.

- Risk Management: Understanding BPS fluctuations allows investors and financial institutions to better assess and manage interest rate risk. A seemingly small change in BPS can have a substantial cumulative impact over time.

- Investment Strategy: Sophisticated investment strategies often rely on anticipating small shifts in interest rates, making an understanding of BPS essential. For example, bond traders closely monitor BPS changes to adjust their portfolios based on yield curve movements.

Overview: What This Article Covers:

This article will thoroughly explore the concept of basis points, including its definition, practical applications, and significance in various financial contexts. We'll examine how BPS are calculated, used in different financial instruments, and the impact of BPS changes on investment strategies. Furthermore, we'll delve into the relationship between BPS and other financial metrics, and explore frequently asked questions regarding its use.

The Research and Effort Behind the Insights:

This article draws upon established financial principles, widely accepted industry practices, and numerous sources on financial analysis and interest rate modeling. The information provided aims to be accurate, reliable, and relevant to the current financial landscape. Every claim is supported by established financial concepts and widely-used methodologies.

Key Takeaways:

- Definition and Core Concepts: A clear and concise explanation of basis points (BPS).

- Practical Applications: How BPS are used in various financial contexts (e.g., bonds, mortgages, loans).

- Calculations and Conversions: Understanding how to calculate and convert between percentages and BPS.

- Impact on Investment Strategies: How BPS movements affect investment decisions.

- Challenges and Considerations: Potential pitfalls and limitations when using BPS.

Smooth Transition to the Core Discussion:

Now that we've established the importance of BPS, let's delve into a detailed exploration of this critical concept.

Exploring the Key Aspects of Basis Points (BPS):

Definition and Core Concepts:

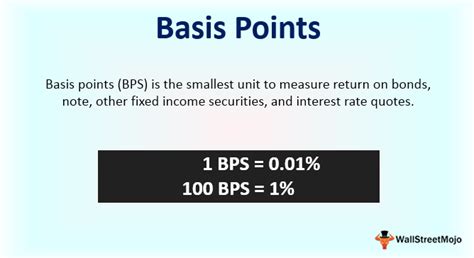

A basis point (BPS) is one-hundredth of one percentage point. Mathematically, 1 BPS = 0.01%. This seemingly small unit is critical for expressing precise changes in interest rates. For instance, if an interest rate increases from 5% to 5.25%, it's said to have increased by 25 BPS.

Applications Across Industries:

BPS are extensively used across various financial industries, including:

- Fixed Income Markets: Bond yields, changes in coupon rates, and yield spreads are all commonly expressed in BPS. A bond's yield can change by several BPS in response to market conditions.

- Mortgage Lending: Changes in mortgage rates are often expressed in BPS, allowing borrowers and lenders to accurately assess the impact of rate fluctuations on monthly payments and overall cost.

- Corporate Finance: Companies use BPS to analyze changes in borrowing costs, measure the impact of interest rate changes on their debt servicing, and assess the financial health of their investments.

- Derivatives Trading: Interest rate derivatives, like interest rate swaps and futures contracts, utilize BPS to express price changes and measure changes in value.

- Central Banking: Central banks use BPS when announcing changes to their benchmark interest rates, influencing short-term borrowing costs across the financial system.

Calculations and Conversions:

Converting between percentages and BPS is straightforward:

- Percentage to BPS: Multiply the percentage change by 100. For example, a 0.5% change is equal to 50 BPS (0.5% * 100 = 50 BPS).

- BPS to Percentage: Divide the number of BPS by 100. For example, 75 BPS is equal to 0.75% (75 BPS / 100 = 0.75%).

Impact on Investment Strategies:

Understanding BPS is crucial for various investment strategies:

- Bond Portfolio Management: Investors closely monitor BPS changes in bond yields to manage their portfolio risk and maximize returns. Rising yields typically lead to falling bond prices and vice versa.

- Interest Rate Swaps: Corporations and financial institutions use interest rate swaps to hedge against interest rate risk. Understanding BPS helps in accurately pricing and managing these swaps.

- Fixed-Income Arbitrage: Sophisticated investors attempt to profit from small discrepancies in bond yields, often measured in BPS.

- Macroeconomic Forecasting: Economists analyze BPS changes in interest rates to understand monetary policy implications and forecast economic activity.

Challenges and Considerations:

While BPS offer precision, there are some considerations:

- Context is Crucial: The significance of a BPS change depends heavily on the context. A 10 BPS change in a 1% interest rate is significantly different from a 10 BPS change in a 10% interest rate.

- Cumulative Effect: Small changes in BPS can accumulate over time, producing a substantial overall impact.

Exploring the Connection Between Yield Curves and Basis Points:

The yield curve, a graphical representation of interest rates across different maturities, is profoundly influenced by BPS movements. Changes in the slope and shape of the yield curve often reflect shifts in investor expectations about future interest rates and economic growth. A steepening yield curve (where longer-term rates rise faster than short-term rates) might indicate higher future interest rate expectations, often measured in BPS increments announced by central banks. Conversely, a flattening yield curve could suggest a slowdown in economic growth or a potential shift in monetary policy, impacting the BPS spread between different maturity bonds.

Key Factors to Consider:

- Roles and Real-World Examples: Changes in the yield curve, reflected in BPS differentials across maturities, inform decisions about bond portfolio duration and interest rate hedging strategies. For instance, if the yield curve steepens by 25 BPS across the 2-year and 10-year treasury notes, investors might shorten the duration of their bond portfolios to mitigate potential losses from rising interest rates.

- Risks and Mitigations: Misinterpreting BPS movements in the yield curve can lead to significant investment losses. Sophisticated risk management techniques are necessary to account for uncertainties in the yield curve's shape and shifts in BPS across maturities. Diversification and hedging strategies are commonly used to mitigate these risks.

- Impact and Implications: Yield curve shifts expressed in BPS have broader macroeconomic implications. They influence borrowing costs for businesses and consumers, shaping investment decisions and overall economic activity. Understanding these relationships helps anticipate potential economic cycles and adjust investment strategies accordingly.

Conclusion: Reinforcing the Connection:

The interplay between yield curves and BPS underscores the importance of precise interest rate analysis. By carefully monitoring BPS movements within the yield curve, investors and financial institutions can make informed decisions, manage risks effectively, and navigate the dynamic financial landscape.

Further Analysis: Examining Monetary Policy and BPS in Greater Detail:

Central banks play a crucial role in influencing interest rates and, consequently, BPS movements. Changes in a central bank's benchmark interest rate, often expressed in BPS, directly impact short-term borrowing costs and have ripple effects throughout the financial system. For example, a 25 BPS increase in the federal funds rate by the Federal Reserve (Fed) signals a tightening of monetary policy, influencing borrowing costs for banks and eventually consumers and businesses. This impacts various financial markets, including bond yields and exchange rates, creating further BPS adjustments across various financial instruments.

FAQ Section: Answering Common Questions About BPS:

- What is a basis point (BPS)? A basis point is one-hundredth of a percentage point (0.01%).

- Why are BPS used in finance? BPS provide a precise way to express small changes in interest rates and other financial metrics.

- How do I convert a percentage to BPS? Multiply the percentage by 100.

- How do I convert BPS to a percentage? Divide the BPS by 100.

- What is the significance of BPS in bond trading? BPS changes directly impact bond prices and yields. Small shifts can lead to substantial gains or losses, especially for long-term bonds.

- How do central bank announcements influence BPS? Central bank announcements about interest rate changes, typically in BPS increments, immediately impact market expectations and lead to adjustments in various interest rates and financial instruments.

Practical Tips: Maximizing the Benefits of Understanding BPS:

- Master the Conversion: Practice converting percentages to BPS and vice versa to build fluency.

- Contextualize Changes: Always consider the magnitude of the BPS change relative to the base interest rate.

- Monitor Market Trends: Stay informed about interest rate movements and central bank announcements to anticipate BPS changes.

- Utilize Financial Tools: Employ financial calculators and software to accurately calculate the impact of BPS changes on investment portfolios.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding basis points is not just a technical detail; it's a fundamental skill for anyone navigating the complexities of the financial world. By mastering the concept of BPS and its application across various financial instruments and markets, investors, businesses, and policymakers can gain a deeper understanding of interest rate dynamics and make more informed decisions. The precision offered by BPS is crucial for effective risk management, strategic investment, and navigating the ever-changing landscape of financial markets. Ignoring the significance of BPS can lead to miscalculations, inaccurate assessments, and potentially costly errors in financial decision-making.

Latest Posts

Related Post

Thank you for visiting our website which covers about What Is Bps In Interest Rates . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.