Current Income Definition

adminse

Mar 25, 2025 · 9 min read

Table of Contents

What if the true measure of economic well-being isn't just wealth, but the consistent flow of income? Understanding current income is crucial for policymakers, businesses, and individuals alike, offering a vital lens through which to view economic health and personal financial security.

Editor’s Note: This article on current income definition, updated today, provides a comprehensive overview of its various interpretations, applications, and implications for economic analysis and personal finance. It delves into the nuances of different measurement methods and explores the challenges associated with accurately capturing this dynamic economic indicator.

Why Current Income Matters: Relevance, Practical Applications, and Industry Significance

Current income, in its simplest form, represents the flow of money received by individuals or households during a specific period. However, its practical significance extends far beyond this basic definition. Accurate measurement of current income is fundamental to several areas:

-

Policymaking: Governments rely on current income data to design and implement effective social welfare programs, tax policies, and economic stimulus measures. Understanding income distribution helps tailor policies to address inequality and promote economic growth. Accurate data is essential for targeting benefits and ensuring fair taxation.

-

Business Decisions: Businesses utilize current income data to understand market trends, consumer spending patterns, and the overall economic climate. This informs strategic decisions related to pricing, marketing, investment, and hiring. For example, understanding disposable income helps companies predict demand for their products or services.

-

Economic Forecasting: Economists use current income data to predict future economic trends, assess the health of the economy, and monitor inflation. Changes in income levels can serve as leading indicators of economic growth or recession.

-

Personal Finance: Individuals utilize their current income to manage their personal finances, budget effectively, make investment decisions, and plan for the future. A clear picture of current income allows for informed financial planning and responsible debt management.

Overview: What This Article Covers

This article provides a detailed exploration of current income, examining its various definitions, measurement methodologies, limitations, and practical applications. We will delve into different types of income, discuss the challenges associated with accurate measurement, and explore its relevance to various stakeholders, including individuals, businesses, and governments. Readers will gain a comprehensive understanding of current income, enabling them to interpret economic data more effectively and make informed financial decisions.

The Research and Effort Behind the Insights

This article draws upon extensive research from reputable sources, including academic journals, government publications, and industry reports. Data from organizations like the Bureau of Economic Analysis (BEA), the Bureau of Labor Statistics (BLS), and the Organisation for Economic Co-operation and Development (OECD) have been utilized to support the analysis and ensure accuracy. The information presented is intended to provide a neutral and objective perspective on current income and its significance.

Key Takeaways: Summarize the Most Essential Insights

-

Definition and Core Concepts: A clear understanding of current income's various interpretations, encompassing gross income, disposable income, and other relevant measures.

-

Measurement Challenges: An examination of the difficulties involved in accurately measuring current income, considering factors like the informal economy and underreporting.

-

Applications and Interpretations: A comprehensive look at the practical applications of current income data in economic analysis, policymaking, and business decisions.

-

Impact on Individuals and Households: An exploration of how current income affects personal financial planning, budgeting, and overall economic well-being.

-

Future Trends and Implications: An analysis of the potential changes and implications for current income in the future, considering technological advancements and evolving economic landscapes.

Smooth Transition to the Core Discussion

Having established the importance of current income, let's delve into a deeper analysis of its various aspects, beginning with a comprehensive definition and its different facets.

Exploring the Key Aspects of Current Income

1. Defining Current Income: Multiple Perspectives

The term "current income" can be interpreted in various ways depending on the context and the specific application. While a layman's understanding might focus solely on wages or salary, a broader definition encompasses a wider range of income streams. Key aspects include:

-

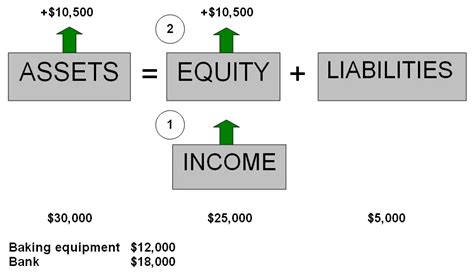

Gross Income: This is the total income received before any deductions for taxes, social security contributions, or other withholdings. It represents the total earnings from all sources.

-

Net Income (Disposable Income): This is the income remaining after all deductions have been made. It reflects the amount available for spending and saving. This is a crucial measure for understanding consumer spending power and economic activity.

-

Adjusted Gross Income (AGI): Used primarily for tax purposes, AGI is gross income less certain deductions allowed by tax law. It is a key determinant of tax liability.

-

Household Income: This encompasses the combined income of all individuals within a household, providing a broader picture of a family's financial capacity.

-

Per Capita Income: This represents the average income per person within a given geographical area (e.g., a country, state, or city). It provides a measure of average economic well-being.

2. Measurement Challenges: Accuracy and Reliability

Accurately measuring current income presents several challenges:

-

The Informal Economy: A significant portion of economic activity occurs in the informal sector, where transactions are often undocumented and unreported. This leads to underestimation of total income.

-

Underreporting: Individuals may underreport income to avoid taxes or for other reasons, leading to inaccurate data.

-

Data Collection Methods: Different data collection methods (surveys, administrative data) have their own limitations, potentially leading to discrepancies in reported income levels.

-

Changing Economic Landscape: The increasing prevalence of gig work, remote work, and the digital economy makes it challenging to capture income from non-traditional sources accurately.

3. Applications Across Industries and Sectors

The applications of current income data are vast:

-

Macroeconomics: It's a key indicator in macroeconomic models to predict economic growth, inflation, and unemployment.

-

Social Welfare Programs: Used to determine eligibility for various social benefits and programs, including unemployment benefits, food stamps, and housing assistance.

-

Taxation: The foundation for calculating tax liabilities for individuals and businesses.

-

Market Research: Used to understand consumer spending habits, purchasing power, and market demand.

-

Financial Planning: Essential for individuals and families to create budgets, manage expenses, and plan for future financial goals (retirement, education).

4. Impact on Innovation and Economic Growth

Current income significantly impacts innovation and economic growth. Higher levels of disposable income generally lead to increased consumer spending, which fuels economic activity. Furthermore, a more equitable distribution of income can foster a more stable and prosperous economy, supporting innovation by allowing individuals to invest in education and entrepreneurship.

Closing Insights: Summarizing the Core Discussion

Current income, in its various forms, serves as a critical indicator of economic health and individual well-being. While challenges exist in accurately measuring it, the data provides invaluable insights for policymakers, businesses, and individuals alike. Understanding its nuances is essential for making informed decisions and promoting sustainable economic growth.

Exploring the Connection Between Income Inequality and Current Income

Income inequality, the uneven distribution of income among individuals or households, is intricately linked to current income. While measures of current income provide an overview of total income levels, they don't necessarily reveal the extent of inequality. A high average current income can mask significant disparities in wealth distribution.

Key Factors to Consider:

-

Roles and Real-World Examples: High income inequality can lead to social unrest, decreased economic mobility, and slower economic growth. Countries with high levels of income inequality often see a larger gap between the wealthiest and poorest segments of the population, impacting societal stability and opportunities.

-

Risks and Mitigations: Policies aimed at reducing income inequality, such as progressive taxation, social safety nets, and investments in education and job training, can help mitigate the negative impacts of income disparity.

-

Impact and Implications: Income inequality can create a less dynamic and less efficient economy by limiting opportunities for a large portion of the population. This can lead to slower innovation, reduced productivity, and even political instability.

Conclusion: Reinforcing the Connection

The relationship between income inequality and current income highlights the need for a holistic understanding of economic well-being. While current income provides crucial data, policymakers and researchers must consider the distribution of income to accurately gauge the economic health of a society and design effective policies.

Further Analysis: Examining Income Inequality in Greater Detail

Analyzing income inequality requires looking beyond simple averages and exploring various metrics such as the Gini coefficient (a measure of income inequality), the Palma ratio (comparing the top 10% to the bottom 40%), and quantile ratios (comparing income shares across different income groups). These provide a more nuanced picture of income distribution than simply focusing on average current income.

FAQ Section: Answering Common Questions About Current Income

Q: What is the difference between gross and net income?

A: Gross income is the total income earned before any deductions, while net income (or disposable income) is the income remaining after deductions for taxes, social security contributions, and other withholdings.

Q: How is current income used in economic forecasting?

A: Changes in current income levels can serve as leading indicators of economic growth or recession. Economists use this data, along with other factors, to create economic forecasts.

Q: How does current income impact personal financial planning?

A: Current income is fundamental to personal financial planning. It determines how much money is available for spending, saving, and investing, influencing budgeting, debt management, and long-term financial goals.

Q: What are some of the challenges in measuring current income accurately?

A: Challenges include the informal economy, underreporting of income, and the difficulties of capturing income from rapidly evolving economic sectors like the gig economy.

Practical Tips: Maximizing the Benefits of Understanding Current Income

-

Track Your Income: Keep a detailed record of all income streams to understand your financial picture clearly.

-

Create a Budget: Based on your current income, create a realistic budget to manage expenses effectively.

-

Plan for the Future: Use your current income as a foundation for long-term financial planning, including retirement and education savings.

-

Stay Informed: Keep abreast of economic trends and policy changes that could affect your income and financial situation.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding current income is crucial for navigating the complexities of personal finance and the broader economic landscape. By recognizing its different facets, appreciating the challenges in its measurement, and utilizing its insights effectively, individuals, businesses, and policymakers can foster economic stability, promote sustainable growth, and enhance individual well-being. The accurate measurement and interpretation of current income remain essential for a clear picture of economic health and future prosperity.

Latest Posts

Related Post

Thank you for visiting our website which covers about Current Income Definition . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.