What Is A Money Market Account Vs Savings

adminse

Apr 06, 2025 · 9 min read

Table of Contents

What's the real difference between a money market account and a savings account?

Understanding these seemingly similar accounts is crucial for maximizing your financial returns.

Editor’s Note: This article comparing money market accounts (MMAs) and savings accounts was published today, providing readers with the latest information and insights to help them make informed financial decisions.

Why Money Market Accounts and Savings Accounts Matter:

In the world of personal finance, choosing the right account for your savings is paramount. While both money market accounts (MMAs) and savings accounts offer a safe place to park your cash and earn interest, understanding their nuances is key to optimizing your financial strategy. The choice between an MMA and a savings account depends heavily on your financial goals, risk tolerance, and the amount of money you intend to keep readily accessible. Choosing the right account can mean the difference between earning a slightly better return on your savings or missing out on valuable interest income.

Overview: What This Article Covers:

This article provides a comprehensive comparison of money market accounts and savings accounts, examining their features, benefits, drawbacks, and suitability for different financial situations. We will delve into interest rates, fees, accessibility, and other key factors to help you determine which account best aligns with your needs. Furthermore, we'll explore the role of each account in a diversified investment portfolio.

The Research and Effort Behind the Insights:

This article draws upon extensive research from reputable financial institutions, industry reports, and regulatory documents. The information presented is intended to be factual and unbiased, guiding readers towards making informed decisions about their savings management. We've incorporated real-world examples and case studies to illustrate the practical implications of choosing between an MMA and a savings account.

Key Takeaways:

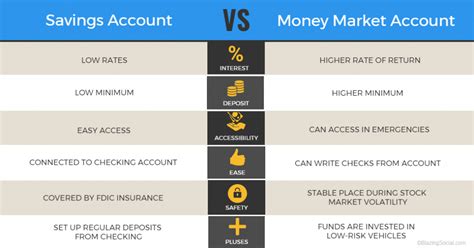

- Definition and Core Concepts: A clear understanding of the fundamental differences between MMAs and savings accounts.

- Interest Rates and Returns: A comparison of typical interest rates offered by each account type.

- Fees and Charges: An analysis of potential fees associated with both MMAs and savings accounts.

- Accessibility and Liquidity: An examination of how easily funds can be accessed from each account.

- Minimum Balance Requirements: A discussion of the minimum balance requirements often associated with MMAs.

- Investment Options: An explanation of the investment options sometimes available within MMAs.

- FDIC Insurance: A clarification on the FDIC insurance coverage provided for both account types.

- Choosing the Right Account: Guidance on selecting the most appropriate account based on individual circumstances.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding the distinctions between money market accounts and savings accounts, let's dive into a detailed comparison of their key features and characteristics.

Exploring the Key Aspects of Money Market Accounts vs. Savings Accounts:

Definition and Core Concepts:

A savings account is a basic deposit account offered by banks and credit unions, designed primarily for storing money and earning interest. These accounts typically offer lower interest rates than other accounts but provide a secure and easily accessible place to save.

A money market account (MMA) is a type of savings account that offers a higher interest rate than a regular savings account. MMAs typically require a higher minimum balance than savings accounts and may offer additional features, such as check-writing capabilities or debit card access. They are designed to provide a balance between liquidity and higher returns.

Interest Rates and Returns:

MMAs generally offer higher interest rates than savings accounts. However, these rates are not fixed and fluctuate based on market conditions. Savings account interest rates are also variable, but they tend to be lower than MMA rates. The actual interest rate offered varies depending on the financial institution and the prevailing economic conditions. It's crucial to compare rates from multiple institutions before making a decision.

Fees and Charges:

Both MMAs and savings accounts can incur fees. Savings accounts may charge monthly maintenance fees if the minimum balance is not met. MMAs may also have monthly maintenance fees, as well as fees for exceeding the number of allowed transactions or for falling below the minimum balance requirement. Always check the fee schedule of any account before opening it.

Accessibility and Liquidity:

Both MMAs and savings accounts offer relatively easy access to funds. You can typically withdraw money from either account using an ATM, debit card, or by writing checks (in the case of some MMAs). However, frequent withdrawals from an MMA might trigger fees, especially if the withdrawals drop the balance below the required minimum.

Minimum Balance Requirements:

MMAs usually have higher minimum balance requirements than savings accounts. Failing to maintain the minimum balance in an MMA can lead to penalties, including lower interest rates or monthly fees. Savings accounts typically have lower or no minimum balance requirements.

Investment Options:

Some MMAs invest a portion of the funds in short-term securities, such as Treasury bills or certificates of deposit (CDs). This investment component contributes to their higher interest rates, but also introduces a small degree of risk, although it's generally considered low. Savings accounts, on the other hand, typically do not directly invest in such securities.

FDIC Insurance:

Both MMAs and savings accounts are typically insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per insured bank, for each account ownership category. This protection guarantees that your money is safe in case of bank failure.

Choosing the Right Account:

The best choice between an MMA and a savings account depends on individual needs and financial circumstances. Consider the following factors:

- Amount of savings: If you have a smaller amount to save, a savings account might be more suitable due to lower minimum balance requirements.

- Access to funds: If you need frequent access to your funds, a savings account is often more flexible, as there are fewer restrictions on withdrawals.

- Risk tolerance: While both accounts are generally considered low-risk, MMAs carry a slightly higher degree of market risk due to their investment component.

- Interest rate: If earning a higher interest rate is a priority, an MMA might be the better choice, assuming you can meet the minimum balance requirement.

Exploring the Connection Between Interest Rates and Money Market Accounts vs. Savings Accounts:

Interest rates are a crucial factor in deciding between MMAs and savings accounts. The relationship is straightforward: MMAs generally offer higher interest rates than savings accounts. This difference arises because MMAs often invest a portion of their funds in short-term, interest-bearing securities. This investment strategy allows them to generate higher returns, which are then passed on to account holders in the form of higher interest rates. However, this also means that MMA interest rates are more susceptible to fluctuations in the market compared to savings accounts.

Key Factors to Consider:

- Market Conditions: Changes in the overall economic climate and interest rate environment directly impact the interest rates offered on both MMAs and savings accounts. When interest rates are high, both types of accounts tend to offer higher returns. Conversely, during periods of low interest rates, returns on both will likely be lower.

- Competition Among Financial Institutions: The level of competition among banks and credit unions also influences interest rates. Higher competition often translates into better rates for consumers. It's advisable to compare interest rates offered by several financial institutions before selecting an account.

- Minimum Balance Requirements: While MMAs typically offer better interest rates, they often require higher minimum balances. Meeting these requirements ensures that you receive the advertised interest rate. Failing to maintain the minimum balance might result in a reduction of the interest earned.

- Account Fees: The impact of fees on overall returns should not be overlooked. While an MMA might offer a higher interest rate, it might also have higher maintenance fees, which could offset the interest earned, especially with lower balances.

Conclusion: Reinforcing the Connection:

The relationship between interest rates and the choice between MMAs and savings accounts is fundamental. The higher interest rates offered by MMAs make them attractive to those with larger balances and a lower need for frequent access to funds. However, one must carefully weigh these higher returns against the higher minimum balance requirements and potential fees.

Further Analysis: Examining Interest Rate Fluctuations in Greater Detail:

Interest rate fluctuations are an inherent characteristic of both MMAs and savings accounts. These fluctuations are mainly influenced by the actions of the Federal Reserve, the central bank of the United States. The Fed's monetary policy decisions, such as changes in the federal funds rate, significantly impact the overall interest rate environment. This, in turn, affects the interest rates offered on deposit accounts like MMAs and savings accounts. Additionally, global economic factors, inflation rates, and market sentiment can also influence these fluctuations. Understanding these broader economic trends can help individuals anticipate potential changes in interest rates and adjust their savings strategies accordingly.

FAQ Section: Answering Common Questions About Money Market Accounts vs. Savings Accounts:

What is the main difference between a money market account and a savings account?

The primary difference lies in the interest rate and minimum balance requirements. MMAs generally offer higher interest rates but often require higher minimum balances. Savings accounts typically have lower or no minimum balance requirements, but offer lower interest rates.

Can I write checks from a money market account?

Some MMAs allow check writing, but not all. Check the terms and conditions of the specific account you are considering. Savings accounts typically do not offer check writing services.

Which account is better for short-term savings goals?

For short-term goals where easy access to funds is crucial, a savings account is often more suitable. For slightly longer-term savings where maximizing interest is prioritized, an MMA might be more appropriate, provided the minimum balance can be consistently maintained.

Are both money market accounts and savings accounts FDIC insured?

Yes, both are typically FDIC insured up to $250,000 per depositor, per insured bank, for each account ownership category.

Practical Tips: Maximizing the Benefits of Money Market Accounts and Savings Accounts:

Understand the nuances of each account type: Before opening an account, carefully review the terms and conditions, including interest rates, fees, minimum balance requirements, and transaction limits.

Compare rates across institutions: Shop around and compare rates and fees from multiple banks and credit unions before making a decision.

Set realistic goals: Determine your savings goals and choose the account that best aligns with your needs and timeline.

Maintain minimum balances: If choosing an MMA, make sure you can consistently meet the minimum balance requirement to avoid fees and maximize interest earnings.

Diversify your savings: Consider using a combination of both MMAs and savings accounts to optimize your overall savings strategy.

Final Conclusion: Wrapping Up with Lasting Insights:

Choosing between a money market account and a savings account is a crucial decision for anyone looking to manage their finances effectively. By understanding their key differences – interest rates, minimum balance requirements, fees, and accessibility – individuals can make informed choices that align with their specific financial goals and risk tolerance. Ultimately, the best account depends on individual circumstances. However, armed with the knowledge presented in this article, individuals can make confident decisions to optimize their savings and maximize their financial returns.

Latest Posts

Latest Posts

-

What Is The Highest Credit Limit For Capital One Gold Mastercard

Apr 06, 2025

-

What Is The Highest Credit Limit You Can Get On A Credit Card

Apr 06, 2025

-

Cara Mengatur Money Management

Apr 06, 2025

-

Cara Kerja Fund Manager

Apr 06, 2025

-

Cara Money Management

Apr 06, 2025

Related Post

Thank you for visiting our website which covers about What Is A Money Market Account Vs Savings . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.