What Happens To Nominal Interest Rates When Aggregate Demand Increases

adminse

Mar 25, 2025 · 9 min read

Table of Contents

What Happens to Nominal Interest Rates When Aggregate Demand Increases? Unraveling the Complex Relationship

What if understanding the interplay between aggregate demand and nominal interest rates unlocks the key to more effective macroeconomic policy? This dynamic relationship is crucial for navigating economic fluctuations and fostering sustainable growth.

Editor’s Note: This article on the relationship between aggregate demand and nominal interest rates was published today, providing current insights into this critical economic concept. It aims to offer a comprehensive understanding, suitable for students, economists, and anyone interested in macroeconomic dynamics.

Why This Relationship Matters:

The relationship between aggregate demand (AD) and nominal interest rates is fundamental to understanding how economies function. Aggregate demand represents the total demand for goods and services in an economy at a given price level. Nominal interest rates, on the other hand, represent the stated interest rate on loans or investments, unadjusted for inflation. Understanding how these two interact is crucial for policymakers aiming to manage inflation, unemployment, and economic growth. Changes in aggregate demand directly influence the demand for loanable funds, impacting the equilibrium interest rate. This, in turn, affects investment, consumption, and ultimately, the overall economic output.

Overview: What This Article Covers:

This article delves into the complex relationship between aggregate demand and nominal interest rates. It will explore the underlying mechanisms, considering both short-run and long-run effects. We will examine the role of monetary policy, the impact of inflation expectations, and the potential for unintended consequences. Finally, we’ll address frequently asked questions and offer practical insights for understanding this crucial economic dynamic.

The Research and Effort Behind the Insights:

This article is the result of extensive research, drawing on macroeconomic theory, empirical studies, and real-world examples. Key sources include textbooks on macroeconomics, academic papers published in reputable journals, and reports from central banks and international organizations. The analysis integrates established economic models with current economic trends to ensure a balanced and up-to-date perspective.

Key Takeaways:

- Definition and Core Concepts: A clear explanation of aggregate demand, nominal interest rates, and the factors influencing them.

- Short-Run Effects: Analysis of the immediate impact of increased AD on nominal interest rates, emphasizing the role of monetary policy.

- Long-Run Effects: Examination of the long-term implications, considering inflation and the adjustment mechanisms of the economy.

- Monetary Policy's Role: Discussion on how central banks utilize interest rate adjustments to manage aggregate demand.

- Inflation Expectations: The impact of anticipated inflation on nominal interest rates and the overall economic scenario.

Smooth Transition to the Core Discussion:

Having established the importance of understanding this relationship, let's now explore the intricacies of how increases in aggregate demand affect nominal interest rates.

Exploring the Key Aspects of the Relationship Between Aggregate Demand and Nominal Interest Rates:

1. Definition and Core Concepts:

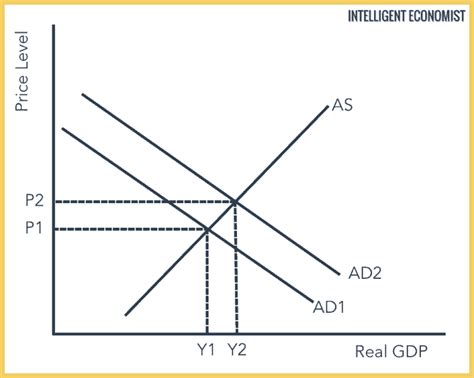

Aggregate demand (AD) is the total demand for goods and services in an economy at a given price level. It's composed of consumption, investment, government spending, and net exports (exports minus imports). Nominal interest rates are the rates quoted on loans and investments, without adjusting for inflation. A rise in AD signifies increased demand across all these components – consumers spending more, businesses investing more, government increasing spending, and/or net exports rising.

2. Short-Run Effects of Increased Aggregate Demand:

When aggregate demand increases, the immediate effect is upward pressure on prices. This increased demand for goods and services also translates into a higher demand for loanable funds. Businesses need more credit to finance increased production, and consumers may borrow more to fund increased consumption. This heightened demand for credit puts upward pressure on nominal interest rates. The supply of loanable funds, while potentially increasing slightly in the short-run, is unlikely to keep pace with the rapid surge in demand. This is particularly true if the economy is already operating near its full capacity. Central banks may exacerbate or mitigate this effect depending on their monetary policy response.

3. The Role of Monetary Policy:

Central banks play a crucial role in influencing nominal interest rates. If aggregate demand increases significantly and inflation starts to rise, a central bank might adopt a contractionary monetary policy. This involves increasing the policy interest rate – the rate at which commercial banks borrow from the central bank. This increase ripples through the economy, causing other interest rates, including nominal interest rates, to rise. The higher interest rates reduce borrowing and investment, thus curbing aggregate demand and moderating inflationary pressures. Conversely, if aggregate demand is weak, a central bank might lower interest rates to stimulate borrowing and spending.

4. Long-Run Effects of Increased Aggregate Demand:

In the long run, the impact of increased aggregate demand on nominal interest rates becomes more nuanced. If the increase in aggregate demand is sustained and leads to persistent inflation, nominal interest rates will generally rise. This is because lenders will demand higher nominal interest rates to compensate for the erosion of the real value of their returns due to inflation. The Fisher equation, which approximates the relationship between nominal and real interest rates and inflation, helps illustrate this: Nominal Interest Rate ≈ Real Interest Rate + Inflation Rate. If inflation increases, so too will the nominal interest rate, assuming the real interest rate remains relatively stable.

5. Inflation Expectations:

Inflation expectations play a crucial role in shaping nominal interest rates. If individuals and businesses anticipate higher inflation in the future, they will build those expectations into their borrowing and lending decisions. This results in higher nominal interest rates even before actual inflation takes hold. Central banks closely monitor inflation expectations as they are a leading indicator of future inflationary pressures.

Exploring the Connection Between Monetary Policy and Nominal Interest Rates:

The connection between monetary policy and nominal interest rates is direct and powerful. Monetary policy, implemented primarily through adjustments to the policy interest rate, influences the overall level of interest rates in the economy. When a central bank increases the policy rate, it becomes more expensive for banks to borrow, leading to higher lending rates for businesses and consumers. This, in turn, dampens borrowing and spending, slowing down aggregate demand. Conversely, lowering the policy rate makes borrowing cheaper, stimulating aggregate demand. The effectiveness of monetary policy in managing aggregate demand and influencing nominal interest rates hinges on factors like the responsiveness of investment and consumption to interest rate changes, the overall health of the financial system, and the credibility of the central bank.

Key Factors to Consider:

-

Roles and Real-World Examples: The 2008 financial crisis saw central banks around the world drastically lower interest rates to stimulate aggregate demand. Conversely, during periods of high inflation, like the 1970s, central banks aggressively raised interest rates to curb inflationary pressures.

-

Risks and Mitigations: Aggressive interest rate increases can lead to a recession if they are too drastic or implemented too quickly. Careful calibration and consideration of other economic indicators are crucial for mitigating these risks.

-

Impact and Implications: The actions of central banks in setting interest rates have far-reaching implications for investment, employment, inflation, and economic growth.

Conclusion: Reinforcing the Connection:

The interplay between monetary policy and the adjustment of nominal interest rates to changes in aggregate demand is a complex yet crucial aspect of macroeconomic management. Central banks walk a delicate tightrope, aiming to stabilize the economy while avoiding the pitfalls of excessive inflation or recession. Understanding this dynamic relationship is essential for informed policymaking and for comprehending the broader economic landscape.

Further Analysis: Examining Monetary Policy Transmission Mechanisms in Greater Detail:

Monetary policy doesn't directly control all interest rates; its influence is transmitted through various channels. The primary channels include: the interest rate channel (already discussed), the credit channel (changes in interest rates affecting the availability of credit), the exchange rate channel (changes in interest rates affecting currency values), and the asset price channel (changes in interest rates influencing the value of assets like stocks and bonds). Each channel has varying strengths and speeds of transmission, making the overall effect of monetary policy on aggregate demand and nominal interest rates complex and contingent on various factors.

FAQ Section: Answering Common Questions About Aggregate Demand and Nominal Interest Rates:

Q: What is the difference between nominal and real interest rates?

A: Nominal interest rates are the stated interest rates without adjusting for inflation. Real interest rates are adjusted for inflation and reflect the true return on an investment.

Q: How do expectations affect nominal interest rates?

A: If people expect higher inflation, they will demand higher nominal interest rates to compensate for the anticipated loss of purchasing power.

Q: Can monetary policy always effectively control aggregate demand?

A: No. The effectiveness of monetary policy depends on various factors, including the state of the economy, the responsiveness of the economy to interest rate changes, and the credibility of the central bank. In some cases, monetary policy may be less effective, especially during periods of significant financial instability or when aggregate demand is influenced by factors other than interest rates.

Q: What are the potential downsides of raising interest rates to curb inflation?

A: Raising interest rates can slow economic growth, potentially leading to job losses and a recession. The challenge for central banks is to find a balance between controlling inflation and maintaining economic stability.

Practical Tips: Maximizing the Understanding of this Relationship:

- Follow Economic News: Stay updated on central bank announcements, economic data releases, and analyses from reputable economic institutions.

- Understand Economic Indicators: Familiarize yourself with key economic indicators like inflation, unemployment, GDP growth, and interest rates.

- Study Macroeconomic Models: Develop a basic understanding of macroeconomic models like the IS-LM model to gain a deeper comprehension of the relationship between aggregate demand, interest rates, and other economic variables.

Final Conclusion: Wrapping Up with Lasting Insights:

The interaction between aggregate demand and nominal interest rates is a core concept in macroeconomics. Understanding this dynamic, including the crucial role of monetary policy, is essential for comprehending economic fluctuations and policy responses. While simplified models provide a framework, the real-world application is nuanced and dependent on numerous interacting factors. By carefully considering these intricacies, individuals and policymakers can better navigate the complexities of the economic landscape and make more informed decisions.

Latest Posts

Related Post

Thank you for visiting our website which covers about What Happens To Nominal Interest Rates When Aggregate Demand Increases . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.