What Does The Quick Ratio Measure In Financial Analysis

adminse

Apr 04, 2025 · 8 min read

Table of Contents

Decoding the Quick Ratio: A Deep Dive into Liquidity Assessment

What if a company's true liquidity isn't reflected by its current ratio? The quick ratio offers a more stringent, and often more revealing, assessment of a company's short-term debt-paying ability.

Editor’s Note: This article on the quick ratio provides a comprehensive understanding of this crucial financial metric, updated with the latest insights and practical applications. It's designed to equip financial analysts, investors, and business owners with the knowledge needed to interpret and utilize this vital indicator of financial health.

Why the Quick Ratio Matters: Relevance, Practical Applications, and Industry Significance

The current ratio, a widely used liquidity measure, compares current assets to current liabilities. However, it includes inventory, which can be illiquid and difficult to convert quickly into cash. This is where the quick ratio, also known as the acid-test ratio, steps in. It provides a more conservative view of a company's short-term liquidity by excluding inventory and prepaid expenses from current assets. This matters because it gives a clearer picture of a company's ability to meet its immediate obligations using readily available assets. The quick ratio is particularly critical for businesses with high inventory levels, volatile sales, or those operating in industries with rapidly changing market conditions. Lenders, investors, and creditors heavily rely on this ratio to assess creditworthiness and investment risk. A strong quick ratio often translates to lower borrowing costs and increased investor confidence.

Overview: What This Article Covers

This article will comprehensively examine the quick ratio, starting with its definition and calculation. We'll explore its significance in financial analysis, delve into its strengths and limitations, and provide practical examples of its application across diverse industries. Furthermore, we'll analyze its relationship to other financial ratios and discuss how to interpret its results effectively. The article concludes with a FAQ section and actionable tips for using the quick ratio in financial decision-making.

The Research and Effort Behind the Insights

This article draws upon extensive research from reputable financial sources, including academic journals, industry reports, and financial textbooks. The analysis presented is data-driven, relying on established financial principles and real-world examples to illustrate the practical application of the quick ratio. The structured approach ensures clarity, accuracy, and provides actionable insights for readers.

Key Takeaways:

- Definition and Core Concepts: A precise understanding of the quick ratio's definition, components, and formula.

- Practical Applications: Real-world examples of how the quick ratio is used in various industries and by different stakeholders.

- Strengths and Limitations: A balanced perspective on the ratio’s advantages and shortcomings.

- Interpreting the Ratio: Guidance on how to analyze quick ratio results effectively and in context.

- Relationship to Other Ratios: Understanding the quick ratio's connection to other liquidity and solvency measures.

Smooth Transition to the Core Discussion:

Now that we've established the importance of the quick ratio, let's delve into its core aspects. We'll begin by defining the ratio and exploring its components before examining its practical applications and limitations.

Exploring the Key Aspects of the Quick Ratio

Definition and Core Concepts:

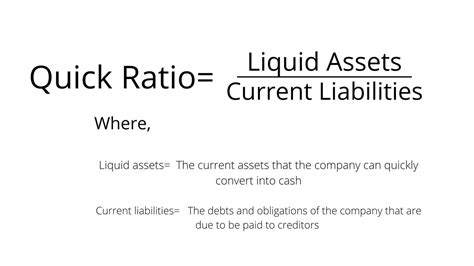

The quick ratio measures a company's ability to pay off its current liabilities (due within one year) with its most liquid assets. Unlike the current ratio, it excludes inventory and prepaid expenses because these assets may not be easily converted into cash in the short term. The formula for the quick ratio is:

(Current Assets – Inventory – Prepaid Expenses) / Current Liabilities

- Current Assets: Assets that are expected to be converted into cash or used up within one year. Examples include cash, accounts receivable, short-term investments, and marketable securities.

- Inventory: Goods held for sale in the ordinary course of business.

- Prepaid Expenses: Expenses paid in advance, such as rent or insurance.

- Current Liabilities: Obligations due within one year, including accounts payable, short-term debt, salaries payable, and accrued expenses.

Applications Across Industries:

The quick ratio's relevance transcends specific industries. However, its interpretation and significance vary based on industry characteristics.

- Retail: Retailers often have substantial inventory, making the quick ratio a more insightful measure of liquidity than the current ratio. A low quick ratio in this sector could signal potential difficulties in meeting short-term obligations.

- Manufacturing: Manufacturers also hold significant inventory, so the quick ratio offers a more conservative view of their liquidity position. The ratio can highlight whether a company can meet its debts without relying on the sale of its products.

- Technology: Technology companies, with their often lower inventory levels, might see less of a difference between the current and quick ratios. However, the quick ratio still provides a valuable assessment of their ability to meet immediate obligations.

- Financial Services: Financial institutions tend to have higher liquidity ratios overall, but the quick ratio still helps assess their ability to handle unexpected withdrawals or financial shocks.

Challenges and Solutions:

While the quick ratio is a valuable tool, it has limitations:

- Subjectivity in Asset Classification: The categorization of assets as current or non-current can involve some judgment, leading to potential inconsistencies in calculations across different companies.

- Ignoring Long-Term Liquidity: The quick ratio focuses solely on short-term liquidity and doesn't consider a company's long-term solvency.

- Industry Variations: Interpreting the quick ratio requires considering industry benchmarks and the specific circumstances of the company. A ratio that's considered acceptable in one industry might be concerning in another.

Impact on Innovation:

While not directly impacting innovation, a strong quick ratio enhances a company's financial flexibility, allowing for greater investment in research and development, expansion, and technological advancements. Financial stability is a cornerstone of innovation.

Closing Insights: Summarizing the Core Discussion

The quick ratio provides a more stringent evaluation of a company's short-term liquidity than the current ratio by excluding less liquid assets. It's a crucial metric for assessing a company's ability to meet its immediate financial obligations, and its interpretation should always consider industry benchmarks and the specific context of the business.

Exploring the Connection Between Working Capital and the Quick Ratio

Working capital, the difference between current assets and current liabilities, is closely related to the quick ratio. A healthy working capital position generally supports a higher quick ratio. However, a high working capital balance doesn't guarantee a strong quick ratio if a significant portion of the current assets are tied up in illiquid inventory or prepaid expenses.

Key Factors to Consider:

- Roles and Real-World Examples: Companies with robust working capital management often demonstrate higher quick ratios. Conversely, businesses experiencing working capital shortfalls often show lower quick ratios, potentially indicating financial distress.

- Risks and Mitigations: Low working capital can increase the risk of liquidity problems, negatively affecting the quick ratio. Strategies such as improved inventory management, efficient accounts receivable collection, and better cash flow forecasting can help mitigate these risks.

- Impact and Implications: The impact of insufficient working capital on the quick ratio can be significant, potentially leading to difficulties in meeting debt obligations, hindering growth opportunities, and even leading to bankruptcy.

Conclusion: Reinforcing the Connection

The connection between working capital and the quick ratio highlights the importance of effective working capital management in maintaining a strong liquidity position. A healthy working capital balance, combined with efficient management of current assets, contributes to a higher quick ratio, signifying better short-term financial health.

Further Analysis: Examining Working Capital in Greater Detail

Working capital management involves optimizing the levels of current assets and liabilities to ensure efficient operations and sufficient liquidity. Techniques such as just-in-time inventory management, aggressive accounts receivable collection, and effective cash flow forecasting are crucial for maximizing working capital and supporting a healthy quick ratio.

FAQ Section: Answering Common Questions About the Quick Ratio

Q: What is a good quick ratio?

A: There's no universally "good" quick ratio. The acceptable range varies significantly across industries. However, a quick ratio of 1.0 or higher is generally considered favorable, indicating sufficient liquid assets to cover current liabilities. It's crucial to compare a company's quick ratio to its industry peers and historical trends.

Q: How does the quick ratio differ from the current ratio?

A: The current ratio includes all current assets, while the quick ratio excludes inventory and prepaid expenses. This makes the quick ratio a more conservative measure of short-term liquidity.

Q: Can a company have a high quick ratio but still face financial difficulties?

A: Yes. While a high quick ratio suggests good short-term liquidity, it doesn't guarantee long-term solvency. Other factors, such as profitability, debt levels, and overall business strategy, must also be considered.

Practical Tips: Maximizing the Benefits of the Quick Ratio Analysis

- Understand the Basics: Thoroughly grasp the definition, components, and calculation of the quick ratio.

- Compare to Industry Benchmarks: Analyze the quick ratio in the context of industry averages and competitors' performance.

- Analyze Trends Over Time: Track the quick ratio over several periods to identify any concerning trends or improvements.

- Consider Other Financial Ratios: Use the quick ratio in conjunction with other financial metrics, such as the current ratio, debt-to-equity ratio, and profitability ratios, for a more comprehensive assessment.

Final Conclusion: Wrapping Up with Lasting Insights

The quick ratio serves as a powerful tool in financial analysis, offering a more conservative assessment of short-term liquidity than the current ratio. By understanding its calculation, interpretation, and limitations, financial analysts, investors, and business owners can gain valuable insights into a company's financial health and make informed decisions. Its consistent monitoring and careful interpretation, coupled with an understanding of its relationship to other financial metrics and industry context, are vital for effective financial management.

Latest Posts

Latest Posts

-

How Long Do Collections Stay On Your Credit Report After Paid

Apr 07, 2025

-

How Long Does Collection Stay On Credit Report After Paid In Canada

Apr 07, 2025

-

How Long Do Collections Stay On Credit Report After Paid

Apr 07, 2025

-

How To Add Tradelines To Your Personal Credit

Apr 07, 2025

-

About Tradeline And Boost Your Credit

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about What Does The Quick Ratio Measure In Financial Analysis . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.