What Is The Minimum Payment On A $500 Credit Card Balance

adminse

Apr 04, 2025 · 7 min read

Table of Contents

Decoding the Minimum Payment on a $500 Credit Card Balance: A Comprehensive Guide

What if navigating your credit card debt felt less daunting and more manageable? Understanding the minimum payment on a $500 balance is the first step toward responsible credit card management.

Editor’s Note: This article provides up-to-date information on calculating and understanding minimum credit card payments. The information is for educational purposes and doesn't constitute financial advice. Consult with a financial advisor for personalized guidance.

Why Understanding Minimum Payments Matters:

Ignoring or misunderstanding minimum payments on credit cards can lead to significant financial problems. A seemingly small $500 balance can balloon into a substantial debt burden if not managed effectively. Understanding the minimum payment calculation, its implications, and the potential long-term costs is crucial for responsible credit card usage and maintaining a healthy financial standing. This knowledge empowers individuals to make informed decisions about their debt and avoid the pitfalls of high-interest charges and damaged credit scores.

Overview: What This Article Covers:

This article comprehensively explores the concept of minimum credit card payments, specifically focusing on a $500 balance. It will delve into how minimum payments are calculated, the implications of only making minimum payments, strategies for paying down debt faster, and the importance of understanding your credit card agreement. We'll also explore factors affecting minimum payment calculations and offer practical tips for responsible credit card management.

The Research and Effort Behind the Insights:

This article draws upon extensive research from reputable sources including credit card company websites, financial literacy organizations, and consumer protection agencies. The information provided is based on widely accepted industry practices and legal frameworks surrounding credit card agreements. The aim is to present clear, concise, and accurate information to help readers make informed decisions about their credit card debt.

Key Takeaways:

- Minimum Payment Calculation: Understanding the formula and factors that determine your minimum payment.

- Consequences of Minimum Payments: The long-term impact of only paying the minimum, including interest accrual and debt growth.

- Accelerated Debt Repayment: Strategies for paying off your debt faster and saving money on interest.

- Credit Card Agreements: The importance of reviewing your credit card agreement to understand your terms and conditions.

- Practical Tips: Actionable advice for responsible credit card usage and debt management.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding minimum payments, let's delve into the specifics of calculating and managing a $500 credit card balance.

Exploring the Key Aspects of Minimum Payments on a $500 Balance:

1. Definition and Core Concepts:

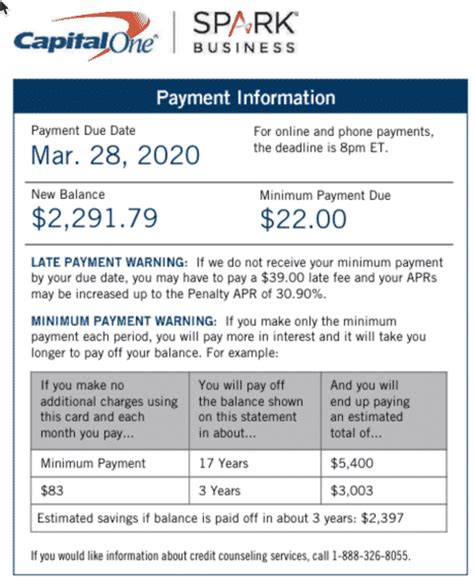

The minimum payment on a credit card is the smallest amount a cardholder is required to pay each month to remain in good standing with the credit card issuer. This amount is typically a percentage of your outstanding balance (often between 1% and 3%), but it can also include a fixed minimum dollar amount, whichever is greater. For example, if your minimum payment is 2% of your $500 balance, it would be $10. However, many issuers set a minimum payment floor – say $25. In this case, even though 2% of $500 is only $10, your minimum payment would be $25. This is explicitly stated in your credit card agreement.

2. Applications Across Industries:

While the core concept of minimum payment remains consistent across most credit card issuers, there might be slight variations in how the minimum payment is calculated or presented. It is always advisable to check your credit card statement or your online account for precise details specific to your card.

3. Challenges and Solutions:

The primary challenge associated with only making minimum payments is the exponential growth of debt due to high-interest rates. The solution is to pay more than the minimum whenever possible. Even an extra $20 or $30 per month can significantly reduce the total interest paid and shorten the repayment period.

4. Impact on Innovation (in Debt Management):

The rise of budgeting apps and debt management tools demonstrates innovation in helping consumers manage their credit card debt more effectively. These tools often provide personalized repayment plans and insights into the long-term cost of only making minimum payments.

Closing Insights: Summarizing the Core Discussion:

Understanding the mechanics of minimum payments is crucial for responsible credit card management. While the minimum payment might seem like a small, manageable amount, consistently paying only the minimum can lead to a rapid accumulation of interest and prolonged debt. This can negatively impact your credit score, limit your financial flexibility, and lead to significant long-term financial burdens.

Exploring the Connection Between Interest Rates and Minimum Payments:

The relationship between interest rates and minimum payments is profound. Higher interest rates mean more of your minimum payment goes towards interest, leaving less to reduce your principal balance. This creates a vicious cycle, where the debt becomes harder to pay off over time.

Key Factors to Consider:

- Roles and Real-World Examples: A high interest rate of, say, 20% on a $500 balance means a substantial portion of your minimum payment will cover interest, even if you pay $25. This leaves a smaller amount to reduce the actual debt, leading to a longer repayment period.

- Risks and Mitigations: The biggest risk is paying significantly more in interest than you do on the principal debt. Mitigation involves increasing your monthly payment above the minimum amount to reduce the principal balance faster and minimize interest charges.

- Impact and Implications: The long-term implication of only making minimum payments is a much larger total repayment amount. This can affect your budget, financial planning, and even your credit score.

Conclusion: Reinforcing the Connection:

The connection between interest rates and minimum payments is critical in understanding the true cost of credit card debt. By acknowledging this relationship, consumers can make informed decisions about their repayment strategy and avoid the long-term financial implications of only making minimum payments.

Further Analysis: Examining Interest Rates in Greater Detail:

Interest rates on credit cards are typically variable and depend on several factors, including the borrower's credit score, the card's terms and conditions, and the prevailing market rates. Understanding these factors is crucial in negotiating better interest rates or choosing a card with a lower rate.

FAQ Section: Answering Common Questions About Minimum Payments:

-

What is the typical minimum payment percentage? While it varies by issuer, it is typically between 1% and 3% of the outstanding balance, but it may also include a minimum dollar amount.

-

What happens if I only make minimum payments? Your debt will take much longer to repay, and you’ll pay significantly more in interest over time.

-

Can I negotiate a lower minimum payment? Generally, credit card companies are not obligated to lower your minimum payment, but contacting customer service to discuss your financial situation might reveal options.

-

How can I pay off my credit card debt faster? Increase your monthly payments, consider a balance transfer to a card with a lower interest rate, or explore debt consolidation options.

-

Will paying more than the minimum affect my credit score? Paying more than the minimum won't negatively impact your credit score; in fact, it can improve it by showing responsible debt management.

Practical Tips: Maximizing the Benefits of Responsible Credit Card Management:

- Budgeting: Create a realistic budget to track your income and expenses and identify areas where you can save money to allocate more towards debt repayment.

- Debt Snowball/Avalanche: Prioritize high-interest debts first (avalanche) or start with the smallest debt to build momentum (snowball).

- Emergency Fund: Build an emergency fund to prevent relying on your credit card for unexpected expenses.

- Credit Monitoring: Monitor your credit report regularly to ensure accuracy and detect any fraudulent activity.

- Financial Counseling: Consider seeking guidance from a non-profit credit counseling agency for personalized debt management strategies.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding the minimum payment on a $500 (or any) credit card balance is crucial for managing your finances effectively. While it may seem like a small amount, consistently paying only the minimum can lead to a significant financial burden over time. By understanding the calculations, implications, and available strategies, you can take control of your debt, minimize interest charges, and achieve financial freedom. Responsible credit card management is key to building a strong financial future.

Latest Posts

Latest Posts

-

What Is The Minimum Payment From Social Security

Apr 05, 2025

-

Minimum Payment On Target Redcard

Apr 05, 2025

-

What Does The Minimum Payment On A Credit Card Cover

Apr 05, 2025

-

What Is The Minimum Credit Score For A Target Credit Card

Apr 05, 2025

-

Minimum Oslo

Apr 05, 2025

Related Post

Thank you for visiting our website which covers about What Is The Minimum Payment On A $500 Credit Card Balance . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.