What Does The Bible Say About Money Management Pdf

adminse

Apr 06, 2025 · 8 min read

Table of Contents

What Does the Bible Say About Money Management? A Comprehensive Guide

What if our understanding of finances could be transformed by ancient wisdom? The Bible, surprisingly, offers a robust framework for responsible money management, guiding us toward financial stewardship rather than mere accumulation.

Editor’s Note: This article explores the biblical perspective on money management, drawing from various scriptures and interpretations. It aims to provide a practical and insightful guide for modern readers seeking financial wisdom grounded in faith.

Why Biblical Money Management Matters:

In today's consumer-driven world, financial anxieties are commonplace. The Bible, however, transcends mere financial advice; it offers a holistic approach to wealth, aligning our financial practices with our spiritual values. Understanding biblical principles can lead to greater contentment, reduced stress, and a more purposeful approach to managing resources. It's not about becoming wealthy, but about using what we have wisely and generously, reflecting God's character. This approach resonates with increasing numbers seeking ethical and responsible financial practices. Biblical principles address not just personal finance, but also have implications for charitable giving, business ethics, and societal justice.

Overview: What This Article Covers:

This article will delve into the core tenets of biblical money management, exploring key scriptures, interpreting their meaning in a modern context, and providing practical applications. We will examine the concepts of stewardship, contentment, generosity, avoiding debt, planning for the future, and the ethical considerations involved in business and financial dealings. We'll also address common questions and misconceptions surrounding biblical finance.

The Research and Effort Behind the Insights:

This article is the result of extensive research, drawing upon numerous biblical texts, theological commentaries, and resources on Christian financial stewardship. Interpretations are presented carefully, acknowledging diverse perspectives within Christian theology while focusing on commonly held principles. The aim is to provide a balanced and informed perspective, supporting claims with relevant scriptures and reasoned arguments.

Key Takeaways:

- Stewardship: Understanding that all possessions are ultimately God's gifts, requiring responsible management.

- Contentment: Finding satisfaction in God's provision, regardless of material wealth.

- Generosity: Practicing giving and tithing as expressions of faith and gratitude.

- Debt Avoidance: The biblical emphasis on avoiding unnecessary debt and living within one's means.

- Planning and Prudence: The importance of wise financial planning and responsible decision-making.

- Ethical Business Practices: Conducting business with integrity, honesty, and fairness.

Smooth Transition to the Core Discussion:

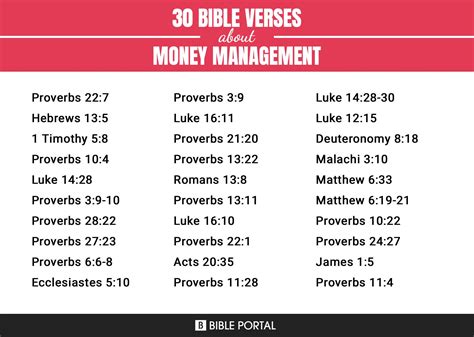

Having established the importance of biblical money management, let's explore the key scriptures and principles that guide this approach.

Exploring the Key Aspects of Biblical Money Management:

1. Stewardship: God Owns It All:

The foundational principle of biblical finance is stewardship. This concept emphasizes that all we possess—our time, talents, and resources—belong to God. We are merely stewards, entrusted with managing these gifts for His glory. Proverbs 3:9-10 states, "Honor the Lord with your wealth and with the firstfruits of all your produce; then your barns will be filled with plenty, and your vats will overflow with new wine." This verse highlights the importance of acknowledging God's ownership and recognizing our responsibility to manage resources wisely. It isn't about hoarding, but about using resources to further God's kingdom.

2. Contentment: Finding Joy in God's Provision:

The Bible repeatedly emphasizes the importance of contentment. Philippians 4:11-13 says, "I have learned to be content whatever the circumstances. I know what it is to be in need, and I know what it is to have plenty. I have learned the secret of being content in any and every situation, whether well fed or hungry, whether living in plenty or in want." This passage shows that true contentment stems from a relationship with God, not from material possessions. This doesn't mean neglecting financial planning, but it does mean prioritizing spiritual well-being over material wealth. Material possessions can be a blessing, but they should never become the source of our happiness or identity.

3. Generosity: Giving Back to God and Others:

Generosity is a core element of biblical finance. The Old Testament mandated tithing (giving 10% of income to God's work), and the New Testament encourages giving freely and generously. 2 Corinthians 9:7 states, "Each of you should give what you have decided in your heart to give, not reluctantly or under compulsion, for God loves a cheerful giver." Giving isn't merely a financial obligation, but an act of worship, expressing gratitude for God's blessings and extending compassion to those in need. This includes supporting the church, engaging in charitable work, and helping others in various ways.

4. Debt Avoidance: Living Within One's Means:

Proverbs 22:7 warns, "The rich rule over the poor, and the borrower is slave to the lender." The Bible generally discourages excessive debt, advocating for living within one's means. While there may be legitimate reasons for debt (e.g., a mortgage for a home), unnecessary debt can lead to financial stress, hinder spiritual growth, and compromise long-term financial well-being. Careful budgeting, responsible spending, and prioritizing needs over wants are crucial in avoiding debt traps.

5. Planning and Prudence: Wise Financial Decision-Making:

Proverbs 21:5 says, "The plans of the diligent lead surely to plenty, but those of everyone who is hasty, surely to poverty." This highlights the importance of thoughtful financial planning. While spontaneous purchases may seem appealing, responsible financial management includes creating a budget, saving for the future, investing wisely, and making informed decisions about spending and debt. Planning doesn't stifle spontaneity but provides a framework for responsible use of resources.

6. Ethical Business Practices: Honesty and Integrity:

The Bible emphasizes ethical conduct in all aspects of life, including business. Proverbs 11:1 states, "Dishonest scales are an abomination to the Lord, but a just weight is his delight." This principle applies to all financial transactions, encouraging fairness, honesty, and integrity in business dealings. Avoid exploiting others, engaging in deceptive practices, or prioritizing profit over ethical considerations. Biblical business practices focus on building trust, treating others fairly, and acting with transparency.

Exploring the Connection Between Planning and Biblical Money Management:

Planning plays a vital role in aligning personal finances with biblical principles. Without planning, it's difficult to effectively manage resources, avoid debt, give generously, and invest wisely. The lack of planning can lead to impulsive spending, financial instability, and a failure to fulfill stewardship responsibilities.

Key Factors to Consider:

- Roles: Planning helps individuals fulfill their roles as stewards of God's resources. It allows them to make intentional choices about spending, saving, and giving.

- Real-World Examples: Successful businesses, families, and individuals demonstrate how planning empowers them to achieve financial goals aligned with biblical values. A family budget, for instance, allows for systematic tithing and saving.

- Risks and Mitigations: The risk of poor financial management is mitigated by meticulous planning, enabling individuals to anticipate and avoid financial crises.

- Impact and Implications: Effective planning leads to long-term financial security, reduces stress, allows for generous giving, and fosters a greater sense of peace and contentment.

Conclusion: Reinforcing the Connection:

The connection between planning and biblical money management is undeniable. Planning provides the practical framework for implementing biblical principles, helping us to live out our faith in the area of finances.

Further Analysis: Examining Generosity in Greater Detail:

Generosity, often overlooked in the modern context, is not merely a suggestion but a core tenet of biblical finance. It reflects God's character, who is lavish in his giving. Generosity extends beyond tithing; it includes acts of kindness, support for missions, and providing for the needs of others. This generosity should be a joyful expression of gratitude, not a begrudging obligation.

FAQ Section:

Q: What is tithing, and is it still relevant today?

A: Tithing is the practice of giving 10% of one's income to the church or a religious organization. While the Old Testament mandated tithing under the Mosaic Law, many Christians continue the practice today as an act of worship and generosity. The emphasis is less on the percentage and more on the spirit of giving.

Q: How can I budget effectively according to biblical principles?

A: Start by tracking your income and expenses. Then, allocate funds for necessities, savings, tithing, and other expenses. Prioritize needs over wants and avoid unnecessary debt. Many resources are available online to help with budgeting, including Christian-focused financial planning tools.

Q: What does the Bible say about investing?

A: The Bible doesn't provide specific investment advice, but it emphasizes wisdom and prudence in financial decision-making. Avoid risky investments that could jeopardize financial stability and prioritize ethical investments that align with one's values.

Q: How do I reconcile biblical principles with managing debt in modern society?

A: While the Bible discourages unnecessary debt, it recognizes that circumstances may necessitate borrowing (e.g., a mortgage). The key is responsible debt management, careful planning, and paying off debt as quickly as possible while maintaining ethical and responsible financial conduct.

Practical Tips:

- Pray for guidance: Seek God's wisdom in financial decisions.

- Create a budget: Track income and expenses to manage funds effectively.

- Give generously: Practice tithing and charitable giving.

- Avoid unnecessary debt: Live within your means.

- Plan for the future: Save and invest wisely.

Final Conclusion:

The Bible's teachings on money management offer a timeless and transformative perspective on finance. It's not a set of rigid rules but a holistic approach that aligns our financial practices with our spiritual values. By embracing the principles of stewardship, contentment, generosity, debt avoidance, and ethical conduct, we can find financial freedom, reduce stress, and live a life of purpose and abundance—not necessarily material abundance, but an abundance that comes from a deeper connection with God and a commitment to living a life that reflects His character. The journey of biblical money management is a lifelong pursuit of aligning our financial lives with our faith, seeking wisdom and guidance from God along the way.

Latest Posts

Related Post

Thank you for visiting our website which covers about What Does The Bible Say About Money Management Pdf . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.