How To Calculate Minimum Monthly Payment On A Loan

adminse

Apr 06, 2025 · 8 min read

Table of Contents

Decoding the Minimum Monthly Payment: A Comprehensive Guide to Loan Calculations

What if understanding your minimum monthly loan payment could save you thousands over the life of a loan? Mastering this calculation empowers you to make informed financial decisions and avoid costly pitfalls.

Editor’s Note: This article on calculating minimum monthly loan payments was published today and provides up-to-date information on various calculation methods and factors to consider. It's designed to help you understand your loan payments better, regardless of your financial background.

Why Understanding Minimum Monthly Payments Matters:

Understanding your minimum monthly loan payment is crucial for several reasons. It directly impacts your monthly budget, allowing you to plan effectively and avoid default. It also influences your overall loan cost, as higher minimum payments lead to faster repayment and less interest paid over time. For potential borrowers, understanding this calculation empowers informed decisions about loan affordability and the implications of different loan terms. For existing borrowers, it's key to managing debt effectively and avoiding late payment penalties. Furthermore, understanding this calculation is essential for comparing loans from different lenders with varying interest rates and terms.

Overview: What This Article Covers:

This article provides a comprehensive guide to calculating minimum monthly loan payments, covering various loan types and methodologies. We'll explore the fundamentals of loan amortization, different calculation formulas, and the influence of interest rates and loan terms. We'll also address common scenarios, such as calculating payments for mortgages, auto loans, and personal loans. Finally, we will delve into advanced concepts and considerations for making informed financial decisions regarding your loan repayment.

The Research and Effort Behind the Insights:

This article is the result of extensive research drawing upon established financial principles, formulas, and real-world examples. Information is sourced from reputable financial institutions and academic resources to ensure accuracy and reliability. The methodologies presented are widely accepted and used in the financial industry.

Key Takeaways:

- Understanding Amortization: We will explain the core principle of loan amortization, which is the process of gradually paying down a loan over time.

- Calculating Payments: We'll cover the formula and the steps involved in calculating minimum monthly payments for various loan types.

- Factors Influencing Payments: We'll explore how interest rates, loan terms (loan length), and the principal loan amount impact the minimum monthly payment.

- Practical Applications: We'll provide real-world examples and practical applications to help you understand and use the calculation methods.

- Advanced Concepts: We’ll discuss more complex scenarios and considerations that might affect your minimum monthly payment calculation.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding minimum monthly loan payments, let's dive into the core aspects of calculating them.

Exploring the Key Aspects of Minimum Monthly Payment Calculation:

1. Understanding Loan Amortization:

Loan amortization is the process of repaying a loan through a series of scheduled payments. Each payment typically consists of two parts: interest and principal. Initially, a larger portion of the payment goes towards interest, while the principal repayment is smaller. Over time, the proportion shifts, with more of each payment going towards the principal as the loan balance decreases. This gradual reduction of the loan balance is what constitutes amortization.

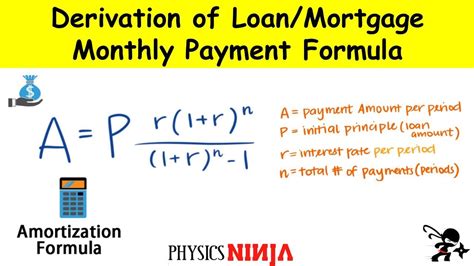

2. The Formula for Calculating Minimum Monthly Payments:

The most common formula used to calculate the minimum monthly payment on a loan is based on the following:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly Payment

- P = Principal Loan Amount (the total amount borrowed)

- i = Monthly Interest Rate (annual interest rate divided by 12)

- n = Total Number of Payments (loan term in years multiplied by 12)

3. Step-by-Step Calculation:

Let's illustrate the calculation with an example:

Suppose you borrow $10,000 (P) at an annual interest rate of 5% (annual interest rate) for a 3-year loan term (loan term).

-

Calculate the monthly interest rate (i): 5% annual interest rate / 12 months = 0.05 / 12 = 0.004167

-

Calculate the total number of payments (n): 3 years * 12 months/year = 36 months

-

Apply the formula:

M = 10000 [ 0.004167 (1 + 0.004167)^36 ] / [ (1 + 0.004167)^36 – 1]

M ≈ 299.70

Therefore, the minimum monthly payment for this loan would be approximately $299.70.

4. Factors Influencing Minimum Monthly Payments:

- Principal Loan Amount: A larger loan amount directly results in a higher minimum monthly payment.

- Interest Rate: Higher interest rates lead to increased minimum monthly payments.

- Loan Term: Longer loan terms (e.g., a 30-year mortgage versus a 15-year mortgage) result in lower minimum monthly payments but significantly higher total interest paid over the life of the loan. Conversely, shorter loan terms result in higher monthly payments but lower overall interest paid.

5. Applications Across Industries:

The formula and principles discussed apply to various loan types:

- Mortgages: Used to finance the purchase of a home. These loans usually have longer terms (15-30 years).

- Auto Loans: Finance the purchase of a vehicle. These generally have shorter terms (3-7 years).

- Personal Loans: Used for various personal expenses, with terms varying depending on the lender and purpose of the loan.

- Student Loans: Finance higher education costs. Repayment schedules vary depending on the loan type and repayment plan.

6. Impact on Innovation:

The availability of online loan calculators has significantly simplified the process of calculating minimum monthly payments, making it easier for consumers to compare loans and make informed decisions. Furthermore, advancements in financial technology are continuously improving the accuracy and accessibility of loan payment calculations.

Exploring the Connection Between Interest Rates and Minimum Monthly Payments:

The relationship between interest rates and minimum monthly payments is directly proportional. A higher interest rate increases the cost of borrowing, leading to a larger minimum monthly payment. Conversely, a lower interest rate decreases the cost of borrowing and thus reduces the minimum monthly payment. This relationship is central to understanding the overall cost of a loan.

Key Factors to Consider:

-

Roles and Real-World Examples: A borrower with a higher interest rate on a car loan will have a higher monthly payment than a borrower with a lower interest rate, even if both borrow the same amount for the same loan term.

-

Risks and Mitigations: High interest rates pose a risk of financial strain if borrowers don't budget adequately. Mitigation strategies include securing a loan with a lower interest rate or opting for a longer loan term (though this increases total interest paid).

-

Impact and Implications: Interest rate fluctuations directly impact affordability and the overall cost of borrowing, affecting borrowers' financial planning and long-term financial health.

Conclusion: Reinforcing the Connection:

The strong correlation between interest rates and minimum monthly payments underscores the importance of comparing loan offers carefully. Understanding this relationship empowers borrowers to make informed decisions that align with their financial capabilities and long-term goals.

Further Analysis: Examining Interest Rate Fluctuations in Greater Detail:

Interest rates are influenced by various macroeconomic factors, including inflation, central bank policies, and market conditions. Fluctuations in these factors can lead to changes in interest rates, directly impacting minimum monthly payments.

FAQ Section: Answering Common Questions About Minimum Monthly Payment Calculations:

Q: What is the minimum monthly payment?

A: The minimum monthly payment is the lowest amount you are required to pay on a loan each month to avoid default. It's calculated based on the loan amount, interest rate, and loan term.

Q: What happens if I pay more than the minimum monthly payment?

A: Paying more than the minimum reduces the principal balance quicker, leading to less interest paid over the life of the loan and potentially saving you money.

Q: What if I miss a minimum monthly payment?

A: Missing a payment can result in late fees, negatively impact your credit score, and potentially lead to loan default.

Q: Where can I find a loan calculator to help me with these calculations?

A: Many online financial websites and institutions offer free loan calculators that can simplify the process. Simply search for "loan calculator" on the internet.

Practical Tips: Maximizing the Benefits of Understanding Minimum Monthly Payments:

-

Shop around for loans: Compare interest rates and terms from multiple lenders before committing to a loan.

-

Use a loan calculator: Utilize online calculators to estimate minimum monthly payments and explore different loan scenarios.

-

Budget carefully: Ensure your monthly budget can comfortably accommodate the minimum monthly payment and other financial obligations.

-

Consider extra payments: Explore the possibility of making extra payments to reduce the loan term and minimize overall interest paid.

-

Monitor your loan account: Regularly review your loan statements to ensure accuracy and track your payment progress.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding how to calculate the minimum monthly payment on a loan is a fundamental aspect of responsible borrowing. By grasping the concepts discussed in this article, and by leveraging the readily available tools and resources, you can effectively manage your debt, avoid costly mistakes, and make informed financial decisions. The power of understanding this seemingly simple calculation can significantly impact your financial well-being.

Latest Posts

Latest Posts

-

What Credit Score Do You Need To Get Chase Sapphire Reserve

Apr 07, 2025

-

What Credit Score Do You Need To Get Approved For Chase Sapphire Reserve

Apr 07, 2025

-

What Credit Score Does Chase Sapphire Reserve Use

Apr 07, 2025

-

What Credit Score You Need For Chase Sapphire Reserve

Apr 07, 2025

-

What Kind Of Credit Score Do You Need For Chase Sapphire Reserve

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about How To Calculate Minimum Monthly Payment On A Loan . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.