How To Calculate Monthly Payment On A Loan

adminse

Apr 06, 2025 · 6 min read

Table of Contents

Decoding the Numbers: A Comprehensive Guide to Calculating Monthly Loan Payments

What if understanding your monthly loan payment was as simple as following a clear formula? Mastering this calculation empowers you to make informed financial decisions and avoid unexpected debt burdens.

Editor’s Note: This article provides a detailed, step-by-step guide on how to calculate monthly loan payments, encompassing various methods and scenarios. We've included practical examples and frequently asked questions to ensure you gain a thorough understanding of this crucial financial concept.

Why Calculating Your Monthly Loan Payment Matters:

Understanding your monthly loan payment is paramount for responsible borrowing. It allows you to budget effectively, anticipate future cash flow, and avoid potential financial distress. Whether you're considering a mortgage, auto loan, personal loan, or student loan, accurately calculating your monthly payment prevents surprises and helps you make informed decisions about your borrowing capacity. This knowledge is crucial for long-term financial planning and stability. Furthermore, understanding the components of a loan payment—principal, interest, and sometimes other fees—allows for more effective debt management.

Overview: What This Article Covers:

This comprehensive guide breaks down the calculation of monthly loan payments, covering various approaches, including the use of standard formulas, online calculators, and amortization schedules. We'll delve into the fundamental components of a loan, explore different loan types and their implications, and address common misconceptions surrounding loan calculations. By the end of this article, you'll be equipped to confidently calculate and understand your monthly loan payments.

The Research and Effort Behind the Insights:

This article draws upon established financial principles and widely accepted loan calculation methodologies. The formulas and examples provided are based on standard industry practices, ensuring accuracy and reliability. The information presented aims to provide a clear and accessible explanation, suitable for individuals with varying levels of financial literacy.

Key Takeaways:

- Understanding Loan Terminology: Defining key terms like principal, interest rate, loan term, and amortization.

- Mastering the Loan Payment Formula: Learning and applying the standard formula for calculating monthly payments.

- Exploring Different Loan Types: Examining how the calculation varies slightly across various loan types.

- Utilizing Online Calculators: Learning how to effectively use online resources for loan payment calculations.

- Interpreting Amortization Schedules: Understanding the breakdown of each monthly payment over the loan's lifespan.

- Addressing Common Pitfalls: Avoiding common mistakes in loan payment calculations and understanding potential hidden fees.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding monthly loan payments, let's dive into the specifics of how to calculate them.

Exploring the Key Aspects of Calculating Monthly Loan Payments:

1. Definition and Core Concepts:

Before delving into calculations, let's define key terms:

- Principal (P): The original amount of money borrowed.

- Interest Rate (r): The annual interest rate charged on the loan, expressed as a decimal (e.g., 6% = 0.06).

- Loan Term (n): The total number of months in the loan's repayment period.

- Monthly Payment (M): The fixed amount paid each month to repay the loan.

2. The Standard Loan Payment Formula:

The most common formula used to calculate the monthly payment on a loan is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly Payment

- P = Principal Loan Amount

- i = Monthly Interest Rate (Annual Interest Rate / 12)

- n = Number of Months (Loan Term in Years * 12)

Example:

Let's say you borrow $10,000 (P) at an annual interest rate of 5% (r), with a loan term of 3 years (n = 36 months).

-

Calculate the monthly interest rate (i): 0.05 / 12 = 0.004167

-

Substitute the values into the formula:

M = 10000 [ 0.004167 (1 + 0.004167)^36 ] / [ (1 + 0.004167)^36 – 1]

- Calculate:

M ≈ $299.70

Therefore, your monthly payment would be approximately $299.70.

3. Applications Across Industries:

This formula is applicable to various loan types, including:

- Mortgages: Loans used to purchase real estate.

- Auto Loans: Loans used to purchase vehicles.

- Personal Loans: Unsecured loans for various purposes.

- Student Loans: Loans used to finance education.

4. Challenges and Solutions:

The primary challenge lies in accurately understanding and applying the formula. Using online calculators can significantly simplify the process. Additionally, ensure you understand all associated fees (e.g., origination fees, closing costs) that might increase your overall monthly payment.

5. Impact on Innovation:

Technological advancements have made loan payment calculations more accessible through online calculators and sophisticated financial software. These tools improve financial literacy and empower borrowers with greater control over their debt.

Exploring the Connection Between Amortization Schedules and Loan Calculations:

An amortization schedule is a detailed table showing the breakdown of each monthly payment over the loan's life. It shows how much of each payment goes towards principal and how much goes towards interest. Understanding an amortization schedule provides a clear picture of your loan repayment progress and the evolving balance over time. Many online loan calculators generate amortization schedules alongside the monthly payment calculation.

Key Factors to Consider:

- Roles and Real-World Examples: Amortization schedules are crucial for tracking loan repayment, especially with mortgages, where the initial payments are predominantly interest.

- Risks and Mitigations: Misunderstanding an amortization schedule can lead to inaccurate budgeting or an incomplete grasp of total loan costs.

- Impact and Implications: Careful analysis of an amortization schedule allows for informed decisions about refinancing or accelerating loan repayment.

Further Analysis: Examining Amortization Schedules in Greater Detail:

Amortization schedules illustrate the decreasing proportion of interest and increasing proportion of principal paid with each subsequent payment. This is because the interest is calculated on the remaining loan balance (principal), which decreases over time.

FAQ Section: Answering Common Questions About Loan Payment Calculations:

Q: What happens if I make extra payments?

A: Extra payments reduce the principal balance, leading to lower interest charges and potentially faster loan repayment. Amortization schedules can be adjusted to reflect these extra payments.

Q: How do I find a reliable online loan calculator?

A: Reputable financial websites and banking institutions offer accurate loan calculators. Look for calculators that clearly explain their calculations and allow you to input various loan parameters.

Q: What are some common mistakes to avoid?

A: Common mistakes include incorrect input of interest rates (annual vs. monthly), miscalculation of the loan term, and neglecting associated fees.

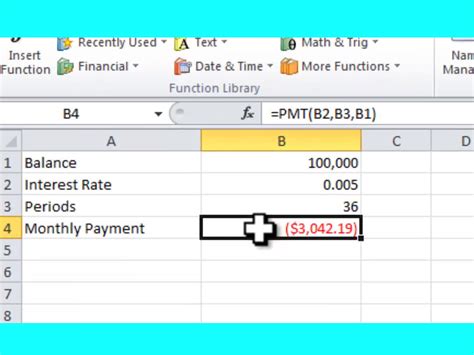

Q: Can I use a spreadsheet to calculate my monthly payment?

A: Yes, you can use spreadsheet software like Excel or Google Sheets to perform these calculations using the formula or built-in financial functions.

Practical Tips: Maximizing the Benefits of Understanding Loan Payments:

-

Always shop around for the best interest rates. Even small differences in interest rates can significantly impact your total loan cost.

-

Understand the total cost of the loan. Don’t focus solely on the monthly payment; consider the total amount you'll repay over the loan's life.

-

Use online calculators and amortization schedules. These tools provide valuable insights into your loan repayment.

-

Consider prepayment options. Explore the possibility of making extra payments to reduce your loan term and total interest paid.

-

Budget carefully. Ensure your monthly loan payment fits comfortably within your overall budget.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding how to calculate your monthly loan payment is a crucial financial skill. By mastering this calculation and utilizing available tools like online calculators and amortization schedules, you gain control over your debt and make informed borrowing decisions. This knowledge empowers you to manage your finances effectively and build a stronger financial future. Remember to always carefully review all loan terms and conditions before signing any loan agreement.

Latest Posts

Latest Posts

-

Will My Credit Score Go Up If Inquiries Fall Off

Apr 07, 2025

-

What Store Credit Cards Can You Get With A 600 Credit Score

Apr 07, 2025

-

What Kind Of Credit Card Can You Get With A 600 Credit Score

Apr 07, 2025

-

What Credit Card Can I Open With 600 Credit Score

Apr 07, 2025

-

What Credit Cards Can I Get With A 600 Fico Score

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about How To Calculate Monthly Payment On A Loan . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.