Why Does The Credit Card Company Set The Minimum Payment So Low At Only 3 Of Your Balance

adminse

Apr 06, 2025 · 7 min read

Table of Contents

Why Does the Credit Card Company Set the Minimum Payment So Low? Uncovering the Strategy Behind the Minimum

Why are credit card minimum payments so deceptively low? Is this a benevolent gesture or a carefully calculated strategy?

The seemingly small minimum payment is a powerful tool, silently driving up debt and profits for credit card companies.

Editor’s Note: This article on credit card minimum payments was published [Date]. We aim to provide clear, unbiased information to help consumers understand the financial implications of credit card debt.

Why Minimum Payments Matter: A Silent Debt Trap

Many consumers view the low minimum payment on their credit card statements as a helpful feature, allowing them to manage their finances more flexibly. However, this perception often masks the reality of how these seemingly small payments contribute to significantly higher overall interest costs and prolonged debt. Understanding the mechanics and implications of minimum payments is crucial for responsible credit card management and avoiding the pitfalls of long-term debt. The strategy behind low minimum payments is a significant factor in the profitability of the credit card industry, and consumers need to be aware of this to make informed financial decisions. It impacts credit scores, financial well-being, and long-term financial stability.

What This Article Covers

This article delves into the reasons behind the low minimum payment amounts set by credit card companies. It explores the financial implications for consumers, the strategic advantages for the companies, and offers practical strategies for managing credit card debt effectively. We will examine the mathematical intricacies, regulatory factors, and ethical considerations surrounding this controversial practice.

The Research and Effort Behind the Insights

This article draws upon extensive research, including analyses of credit card agreements, reports from consumer protection agencies, academic studies on consumer debt, and insights from financial experts. The information presented is supported by credible sources and aims to provide an objective and comprehensive understanding of the topic.

Key Takeaways:

- The mathematics of minimum payments: Understanding the compounding effect of interest on even small outstanding balances.

- The strategic benefits for credit card companies: Profit maximization through interest accumulation and extended repayment periods.

- The legal and regulatory context: Examining the rules and regulations governing minimum payment calculations.

- Consumer protection and advocacy: Highlighting resources and strategies for managing credit card debt effectively.

- Long-term financial implications: The impact of prolonged debt on credit scores, financial health, and overall well-being.

Smooth Transition to the Core Discussion

Now that we've established the importance of understanding minimum payments, let's delve into the specifics of why credit card companies set them so low.

Exploring the Key Aspects of Minimum Payments

1. The Mathematics of Minimum Payments and Compound Interest:

The primary reason minimum payments are so low is the insidious power of compound interest. Compound interest means interest is calculated not only on the principal balance but also on the accumulated interest itself. Let's illustrate with an example:

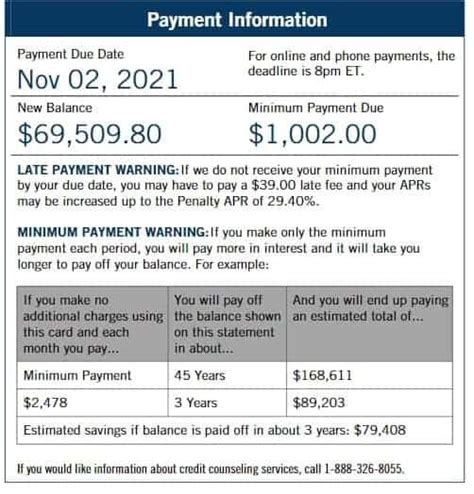

Imagine a $10,000 credit card balance with a 18% annual interest rate (APR). A minimum payment of 3% would be $300. After making this payment, the remaining balance is $9700. However, the interest accrues on the $9700, not the original $10,000. This means that a significant portion of each subsequent minimum payment goes towards paying interest, leaving only a small amount to reduce the principal. This cycle continues, often resulting in years of payments with minimal reduction in the principal balance.

2. Strategic Advantages for Credit Card Companies:

Low minimum payments are a highly profitable strategy for credit card companies. They create a prolonged revenue stream through sustained interest payments. The longer a consumer takes to pay off their debt, the more interest the company earns. This extended repayment period maximizes profitability, even if the individual payments seem small. This is a core component of their business model.

3. The Role of Regulation and Consumer Protection:

While regulations exist to protect consumers, they don't always prevent the impact of low minimum payments. Laws mandate disclosure of APRs and minimum payment calculations, but the inherent design of minimum payments often leads consumers into long-term debt cycles. The complexities of interest calculations can be easily misunderstood by many consumers, making them vulnerable to this system.

4. The Psychological Impact of Minimum Payments:

The low minimum payment can create a false sense of security for consumers. The affordability of the minimum payment can lull borrowers into a sense of manageable debt, delaying the urgency to pay off the balance more aggressively. This procrastination directly benefits the credit card companies, extending the period of interest accrual.

5. The Impact on Credit Scores:

High credit utilization (the percentage of available credit used) negatively impacts credit scores. Even if consumers make minimum payments diligently, maintaining a high balance can severely damage their credit ratings, impacting future borrowing opportunities, interest rates, and even employment prospects.

Closing Insights: The Systemic Nature of Low Minimum Payments

The persistently low minimum payment on credit cards is not a mistake; it is a deliberate strategy. It's designed to maximize revenue for credit card companies by extending the repayment period and increasing the overall interest paid.

Exploring the Connection Between APR and Minimum Payments

The connection between the Annual Percentage Rate (APR) and the minimum payment is paramount. A higher APR, coupled with a low minimum payment, accelerates the compounding interest effect, making it significantly harder to pay off the debt. Let's explore this further.

Key Factors to Consider:

Roles and Real-World Examples: A consumer with a high APR and a low minimum payment might find themselves paying mostly interest for years, barely chipping away at the principal. This is common in credit card debt cycles.

Risks and Mitigations: The primary risk is long-term debt, potentially leading to financial hardship. Mitigation strategies involve increasing payments, transferring balances to lower-APR cards, or seeking debt consolidation options.

Impact and Implications: Prolonged reliance on minimum payments significantly impacts credit scores, making future borrowing more expensive and challenging.

Conclusion: The Intertwined Fate of APR and Minimum Payments

The interplay between high APRs and low minimum payments creates a potent recipe for prolonged debt. Understanding this dynamic is crucial for responsible credit card use.

Further Analysis: A Deeper Dive into Compound Interest

Compound interest is the silent killer in credit card debt. It exponentially increases the cost of borrowing, making even small balances difficult to manage over time. Understanding the formula and its effects is vital for navigating the financial realities of credit card debt.

FAQ Section: Addressing Common Questions

What is the average minimum payment percentage on credit cards? While it varies, 3% is a common minimum payment percentage, but it can range from 1% to 5%.

Can I negotiate a lower minimum payment with my credit card company? It's unlikely, but you could try contacting customer service. However, remember that this may not change the overall interest cost.

What happens if I only pay the minimum payment? You'll likely pay significantly more in interest, prolonging debt repayment and potentially damaging your credit score.

What are some better strategies for managing credit card debt? Consider debt consolidation, balance transfers, and creating a budget to make larger-than-minimum payments.

Practical Tips: Maximizing the Benefits of Paying More Than the Minimum

-

Understand the Compound Interest Impact: Use online calculators to visualize how much extra you'll pay in interest by only paying the minimum.

-

Prioritize Debt Reduction: Make extra payments whenever possible, even small amounts beyond the minimum, to reduce principal quicker.

-

Budget Effectively: Create a realistic budget to allocate funds towards your credit card debt repayment.

Final Conclusion: Taking Control of Your Credit Card Debt

The low minimum payment set by credit card companies is a calculated strategy that maximizes their profit. However, understanding the mechanics behind it empowers consumers to make informed decisions about their finances. By actively paying more than the minimum, actively budgeting, and exploring other debt management strategies, individuals can break free from the trap of perpetual debt and achieve better financial health. Knowledge is power, and armed with this knowledge, you can take control of your financial future.

Latest Posts

Latest Posts

-

What Credit Score Does Honda Use Reddit

Apr 07, 2025

-

What Credit Bureau Does Sheffield Financial Use

Apr 07, 2025

-

What Kind Of Credit Score Do You Need For Sheffield Financial

Apr 07, 2025

-

What Credit Score Do You Need For Sheffield Financial

Apr 07, 2025

-

What Does Credit Card Statement Date Mean

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about Why Does The Credit Card Company Set The Minimum Payment So Low At Only 3 Of Your Balance . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.