What Credit Score Do U Need For Chase Freedom Unlimited

adminse

Apr 07, 2025 · 7 min read

Table of Contents

What Credit Score Do You Need for Chase Freedom Unlimited? Unlocking the Chase Sapphire Preferred Pathway

What if securing a Chase Freedom Unlimited card unlocks access to a wider world of financial opportunities? This highly sought-after card, while seemingly accessible, hinges on a crucial factor: your credit score.

Editor’s Note: This article on the Chase Freedom Unlimited credit card application requirements, specifically concerning credit scores, was published today, [Date]. We’ve compiled information from reputable sources to provide you with the most up-to-date and accurate insights. This information is intended for educational purposes and should not be considered financial advice. Always consult with a financial professional for personalized guidance.

Why Your Credit Score Matters for Chase Freedom Unlimited

The Chase Freedom Unlimited card is a popular choice among consumers due to its straightforward rewards program and relatively low annual fee. However, securing approval for this card, like any credit card, is contingent upon several factors, with your credit score being paramount. Chase, like other major credit card issuers, utilizes credit scoring models to assess the risk associated with extending credit to applicants. A higher credit score signifies a lower risk of default, increasing your chances of approval and potentially influencing the terms offered. Understanding how your credit score impacts your eligibility for the Chase Freedom Unlimited card is vital in your application strategy. This directly affects not only your immediate credit card application but could also influence your ability to obtain other Chase products, such as the coveted Chase Sapphire Preferred® card, in the future.

Overview: What This Article Covers

This article delves into the intricacies of obtaining the Chase Freedom Unlimited card, focusing specifically on the crucial role of your credit score. We’ll explore the typical credit score ranges required, the factors that influence Chase’s approval decisions, how to improve your credit score, alternative options if you don't meet the requirements, and the broader implications for your financial future.

The Research and Effort Behind the Insights

This article is the result of extensive research, encompassing analysis of Chase's publicly available information, examination of various consumer finance websites and forums, and referencing industry reports on credit scoring and credit card approvals. We've carefully considered the nuances of credit scoring models and their impact on credit card applications. The goal is to offer readers well-supported and actionable insights, enabling them to navigate the credit card application process with confidence.

Key Takeaways:

- Credit Score Range: While Chase doesn't publicly state a minimum credit score for the Freedom Unlimited, it's generally understood that a good to excellent credit score significantly increases the likelihood of approval.

- Factors Beyond Credit Score: Income, credit history length, existing debt, and utilization rate all play significant roles.

- Improving Your Credit Score: Strategic steps can be taken to bolster your credit score before applying.

- Alternatives: Explore alternative credit cards if immediate approval for the Freedom Unlimited seems unlikely.

- Long-Term Financial Planning: Building a strong credit profile has far-reaching benefits beyond securing a single credit card.

Smooth Transition to the Core Discussion

Understanding the importance of your credit score in the Chase Freedom Unlimited application process sets the stage for a detailed examination of the key factors influencing approval. Let's now delve deeper into the specifics.

Exploring the Key Aspects of Chase Freedom Unlimited Credit Score Requirements

While Chase doesn't publish a precise minimum credit score for the Freedom Unlimited card, experience and industry analysis suggest a range for favorable consideration.

1. Definition and Core Concepts:

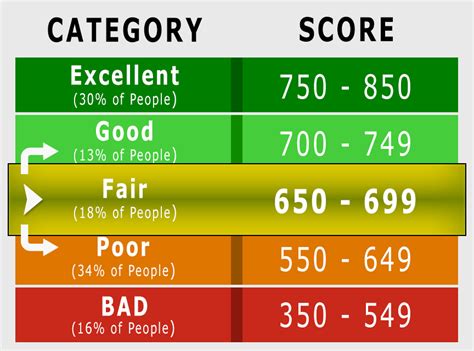

A credit score is a numerical representation of your creditworthiness, calculated using information from your credit reports. The most commonly used scoring models are FICO and VantageScore. These scores range from approximately 300 to 850, with higher scores indicating lower risk. Lenders, including Chase, use these scores to assess the likelihood of borrowers repaying their debts.

2. Applications Across Industries:

Credit scores are used extensively across industries, not just for credit card applications. They influence loan approvals (mortgages, auto loans), insurance rates, and even employment opportunities in some sectors. Understanding the importance of your credit score extends beyond simply obtaining a credit card.

3. Challenges and Solutions:

Many consumers face challenges with their credit scores, such as late payments, high credit utilization, or a limited credit history. Addressing these issues proactively is crucial for improving creditworthiness. Solutions often involve developing better budgeting practices, paying down debt, and strategically managing credit card usage.

4. Impact on Innovation:

The ongoing evolution of credit scoring models reflects the industry's continuous efforts to refine risk assessment methodologies. This reflects an ongoing innovation in how financial institutions evaluate creditworthiness.

Exploring the Connection Between Credit History Length and Chase Freedom Unlimited

The length of your credit history is another significant factor considered by Chase. A longer credit history demonstrates a proven track record of responsible credit management. Even with an excellent credit score, a short credit history may raise concerns for Chase, potentially leading to a less favorable outcome or a higher interest rate.

Key Factors to Consider:

-

Roles and Real-World Examples: A longer credit history, even with some minor blemishes, might be viewed more favorably than a shorter history with a perfect score. For example, an individual with a 750 score and a 10-year credit history is likely to have a higher approval chance than someone with the same score and only a 1-year history.

-

Risks and Mitigations: A short credit history presents a risk to the lender as there's limited data to assess long-term credit behavior. Mitigating this risk involves building a solid credit history over time through responsible credit card usage and other forms of credit.

-

Impact and Implications: The length of your credit history directly impacts the terms you receive on credit cards. A longer history typically leads to better interest rates and more favorable credit limits.

Conclusion: Reinforcing the Connection

The interplay between credit history length and credit score is crucial in Chase Freedom Unlimited applications. While a high credit score is essential, a longer history provides a more complete picture of your creditworthiness, increasing your chances of approval and potentially securing more advantageous terms.

Further Analysis: Examining Credit Utilization in Greater Detail

Credit utilization refers to the percentage of your available credit you're currently using. Keeping your credit utilization low (ideally under 30%) is vital for a good credit score. High credit utilization signals to lenders that you may be overextended financially, increasing the perceived risk.

FAQ Section: Answering Common Questions About Chase Freedom Unlimited

Q: What is the minimum credit score I need for Chase Freedom Unlimited?

A: Chase doesn't publicly disclose a minimum credit score. However, a good to excellent credit score (generally above 670) significantly improves your chances of approval.

Q: What if I have a lower credit score?

A: If you have a lower credit score, consider improving it before applying. Alternatively, explore secured credit cards or cards with more lenient approval criteria.

Q: How long does it take to get approved for the Chase Freedom Unlimited?

A: The approval process typically takes a few minutes to a few days, depending on the verification process.

Q: What happens if I'm denied?

A: If denied, review the reasons provided and work on improving your creditworthiness. You can reapply after some time, demonstrating positive changes in your credit profile.

Practical Tips: Maximizing the Benefits of a Strong Credit Score

- Check your credit report regularly: Identify and correct any errors that may be affecting your score.

- Pay your bills on time: Consistent on-time payments are crucial for a positive credit history.

- Keep your credit utilization low: Avoid maxing out your credit cards.

- Apply for new credit sparingly: Numerous applications in a short period can negatively impact your score.

- Diversify your credit mix: Having a variety of credit accounts (credit cards, loans) can be beneficial.

Final Conclusion: Wrapping Up with Lasting Insights

Securing the Chase Freedom Unlimited card is significantly influenced by your credit score and credit history length. While there isn't a publicly stated minimum credit score, a good to excellent score coupled with a responsible credit history significantly increases your chances of approval. By understanding the factors that impact your creditworthiness and taking proactive steps to improve it, you can enhance your prospects of not only securing this card but also unlocking future financial opportunities, including access to more premium Chase products like the Chase Sapphire Preferred. Remember, building a strong credit profile is a long-term investment with far-reaching benefits.

Latest Posts

Latest Posts

-

Accounts Payable Turnover Ratio Definition Formula Examples

Apr 30, 2025

-

Accounting Standards Executive Committee Acsec Definition

Apr 30, 2025

-

Accounting Research Bulletins Arbs Definition

Apr 30, 2025

-

Accounting Ratio Definition And Different Types

Apr 30, 2025

-

Accounting Rate Of Return Arr Definition How To Calculate And Example

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about What Credit Score Do U Need For Chase Freedom Unlimited . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.