What Credit Score Do I Need To Rent A Mobile Home

adminse

Apr 07, 2025 · 8 min read

Table of Contents

What Credit Score Do I Need to Rent a Mobile Home? Unlocking Your Mobile Home Rental Dreams

What if securing your dream mobile home rental hinges on a number you may not even know? A strong credit score is often the key that unlocks the door to mobile home rentals, and understanding its significance is crucial for success.

Editor’s Note: This comprehensive guide to mobile home rental credit requirements was published today to provide up-to-date information and practical advice for prospective renters. We've researched various lending practices and industry standards to help you navigate this often-misunderstood process.

Why Your Credit Score Matters in Mobile Home Rentals:

The relevance of a good credit score extends far beyond securing a mortgage; it plays a vital role in securing a mobile home rental. Landlords, whether individual owners or large property management companies, use credit checks as a crucial tool to assess a potential tenant's financial responsibility and risk. A poor credit history can signal potential late rent payments, property damage, or other financial instability, leading to rejection. This isn't just about protecting the landlord's financial interests; it’s about ensuring a stable and positive environment for all residents within the mobile home park. The better your credit score, the more likely you are to be considered a low-risk tenant, enhancing your chances of approval.

Overview: What This Article Covers:

This article will delve into the complexities of credit scores and their impact on mobile home rentals. We'll explore what constitutes a good credit score in this context, factors influencing a landlord's decision beyond credit, common misconceptions, and actionable steps you can take to improve your chances of securing a rental. We will also analyze the potential variation in requirements across different landlords and locations.

The Research and Effort Behind the Insights:

This article is the result of extensive research, drawing on data from credit reporting agencies, industry reports on mobile home park management, and interviews with real estate professionals specializing in mobile home rentals. We have analyzed numerous online rental listings and consulted with legal experts to ensure the accuracy and relevance of the information presented.

Key Takeaways:

- Minimum Credit Score Requirements: While there's no universally mandated credit score for mobile home rentals, understanding common ranges and expectations is crucial.

- Factors Beyond Credit Score: Landlords consider various factors, including rental history, income, and employment stability.

- Improving Your Credit Score: Practical steps you can take to enhance your credit profile before applying.

- Alternative Options: Exploring strategies for securing a rental with less-than-perfect credit.

Smooth Transition to the Core Discussion:

Now that we understand the critical role of credit scores in mobile home rentals, let's dive into the specifics, examining what landlords look for and how you can improve your chances of approval.

Exploring the Key Aspects of Mobile Home Rental Credit Requirements:

1. Definition and Core Concepts:

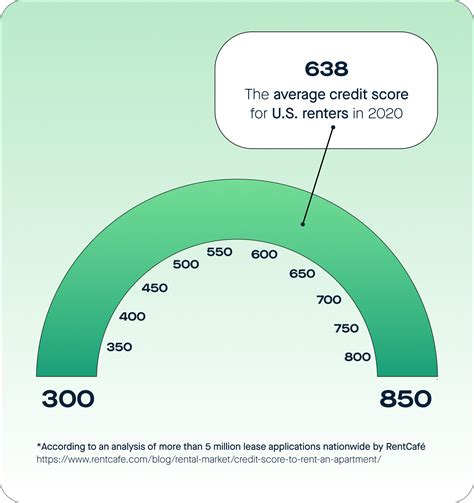

A credit score is a three-digit numerical representation of your creditworthiness, calculated based on information from your credit report. The most widely used scoring systems are FICO and VantageScore. These scores range typically from 300 to 850, with higher scores indicating better credit health. For mobile home rentals, a higher score generally translates to a greater likelihood of approval.

2. Applications Across Industries:

Credit checks are standard practice in various industries, including housing, employment, and insurance. Landlords use them to minimize risk and ensure the financial stability of their tenants. This is particularly true in mobile home parks where property maintenance and timely rent payments are crucial for the overall upkeep of the community.

3. Challenges and Solutions:

Many individuals face challenges with their credit scores, whether due to past financial difficulties or lack of credit history. Understanding these challenges and implementing strategies to improve credit is crucial for securing a mobile home rental. This includes addressing outstanding debts, correcting errors on credit reports, and establishing a positive payment history.

4. Impact on Innovation:

The increasing reliance on credit scores in various aspects of life, including renting, has led to innovations in credit reporting and financial management tools. These tools can help individuals monitor their credit, identify areas for improvement, and build a stronger credit profile.

Closing Insights: Summarizing the Core Discussion:

Securing a mobile home rental is a significant financial undertaking. A strong credit score significantly improves your chances of approval, signaling to landlords your financial responsibility and stability. While the specific credit score required varies, aiming for a score above 650 generally increases your competitiveness.

Exploring the Connection Between Rental History and Mobile Home Rental Approval:

Rental history is intrinsically linked to mobile home rental approval. It provides a tangible record of your past tenancy, including your payment history, respect for property, and adherence to lease agreements. A consistent and positive rental history can significantly offset a less-than-perfect credit score, demonstrating to landlords your reliability as a tenant.

Key Factors to Consider:

- Roles and Real-World Examples: A prospective tenant with a 620 credit score but five years of consistent on-time rent payments is significantly more attractive to a landlord than someone with a 700 credit score and a history of late payments or evictions.

- Risks and Mitigations: A poor rental history increases the risk of late payments, property damage, or other tenancy-related issues. Landlords mitigate this risk by prioritizing applicants with positive rental histories. Prospective tenants can mitigate this risk by addressing past rental issues and providing documentation of improvements.

- Impact and Implications: A strong rental history can outweigh a slightly lower credit score, highlighting the importance of maintaining a positive track record.

Conclusion: Reinforcing the Connection:

The interplay between rental history and credit score in mobile home rental approval is crucial. Landlords consider both factors holistically, seeking a balanced profile that indicates financial responsibility and tenancy reliability. Building a strong rental history through consistent on-time payments and respectful tenancy is vital, potentially compensating for minor credit imperfections.

Further Analysis: Examining Income and Employment Stability in Greater Detail:

Income and employment stability are equally significant factors considered by landlords when evaluating potential tenants. Consistent income demonstrates the capacity to pay rent reliably, reducing the risk of delinquency. Stable employment signifies a long-term financial commitment, reassuring landlords of your ability to meet your financial obligations.

Income Verification: Landlords typically require proof of income through pay stubs, tax returns, or employment verification letters. This ensures that the income claimed is legitimate and sufficient to cover rental expenses. A consistent income stream, even if modest, strengthens an application.

Employment History: A stable work history, even if involving several employers, indicates financial responsibility and long-term planning. Frequent job changes may raise concerns, although explanations for such changes can often alleviate these concerns.

Debt-to-Income Ratio: This ratio compares your total monthly debt payments to your gross monthly income. A lower debt-to-income ratio (DTI) shows that a significant portion of your income isn't already allocated to debt repayment, increasing your capacity to cover rent and other expenses.

FAQ Section: Answering Common Questions About Mobile Home Rental Credit Requirements:

Q: What is the minimum credit score I need to rent a mobile home?

A: There's no universal minimum. However, a credit score above 650 is generally preferred, although some landlords may consider applicants with lower scores depending on other factors like rental history and income.

Q: What if I have a low credit score?

A: A low credit score doesn't automatically disqualify you. Highlighting a strong rental history, stable income, and co-signer might improve your chances. Consider working on improving your credit score before applying.

Q: What documents do I need to provide for a mobile home rental application?

A: Landlords typically require proof of income, identification, rental history verification, and authorization for a credit check.

Q: Can a co-signer help me secure a rental with poor credit?

A: Yes, a co-signer with good credit can significantly improve your chances of approval. The co-signer assumes joint responsibility for the lease agreement.

Q: How long does the credit check process take?

A: The credit check itself is usually quick, but processing the application can take several days to a week.

Practical Tips: Maximizing the Benefits of a Strong Credit Profile:

- Check Your Credit Report: Review your credit report for inaccuracies and address any negative items promptly.

- Pay Bills on Time: Consistent on-time payments are crucial for building a positive credit history.

- Reduce Debt: Lowering your debt-to-income ratio improves your financial standing.

- Establish a Credit History: If you lack a credit history, consider obtaining a secured credit card or becoming an authorized user on someone else's account.

Final Conclusion: Wrapping Up with Lasting Insights:

Securing a mobile home rental involves more than just finding the right property; it involves demonstrating financial responsibility and reliability to the landlord. While a strong credit score is highly beneficial, it's not the sole determining factor. By presenting a comprehensive picture of your financial stability and positive rental history, you significantly increase your chances of securing your dream mobile home rental. Remember, proactive credit management and responsible financial behavior are key to a successful application.

Latest Posts

Latest Posts

-

Advance Refunding Definition

Apr 30, 2025

-

Advance Premium Fund Definition

Apr 30, 2025

-

Advance Premium Definition

Apr 30, 2025

-

Advance Funded Pension Plan Definition

Apr 30, 2025

-

Advance Commitment Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about What Credit Score Do I Need To Rent A Mobile Home . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.