What Credit Score Do I Need To Finance A Mobile Home

adminse

Apr 07, 2025 · 7 min read

Table of Contents

What Credit Score Do You Need to Finance a Mobile Home?

Securing a mobile home loan requires careful planning and understanding of the financing process. Your credit score is a pivotal factor.

Editor’s Note: This article on securing mobile home financing and the required credit scores was published today, offering readers up-to-date information and insights into the process.

Why Your Credit Score Matters for Mobile Home Financing

The purchase of a mobile home, often referred to as a manufactured home, is a significant financial undertaking. Unlike traditional mortgages for site-built homes, financing a mobile home often involves different lending institutions and slightly different criteria. However, the importance of a good credit score remains paramount. Lenders use your credit score as a primary indicator of your creditworthiness and risk assessment. A higher credit score signifies a lower risk to the lender, potentially leading to more favorable loan terms, including lower interest rates and potentially higher loan amounts. Conversely, a lower credit score can result in higher interest rates, a smaller loan amount, or even loan denial.

Overview: What This Article Covers

This article delves into the intricacies of mobile home financing, specifically addressing the crucial role of your credit score. We'll explore the typical credit score requirements, factors influencing loan approval, strategies for improving your credit, and alternative financing options. Readers will gain actionable insights to navigate the mobile home financing process effectively.

The Research and Effort Behind the Insights

This article is based on extensive research, drawing from various reputable sources including financial institutions specializing in mobile home loans, consumer credit reporting agencies, and financial literacy websites. Data from these sources has been meticulously analyzed to provide a comprehensive and accurate overview of credit score requirements for mobile home financing.

Key Takeaways:

- Credit Score Ranges and Loan Approval: Understanding the typical credit score ranges lenders prefer for mobile home loans.

- Factors Beyond Credit Score: Exploring other crucial factors that influence loan approval beyond your credit score.

- Improving Your Credit Score: Practical strategies to improve your credit score before applying for a mobile home loan.

- Alternative Financing Options: Exploring options available to individuals with less-than-perfect credit scores.

Smooth Transition to the Core Discussion

Now that we understand the critical role of credit scores in mobile home financing, let's delve into the specifics of credit score ranges, influencing factors, and strategies for securing a loan.

Exploring the Key Aspects of Mobile Home Financing and Credit Scores

Definition and Core Concepts: A mobile home loan is a type of secured loan used to purchase a manufactured home. The home itself serves as collateral for the loan. The lender assesses your creditworthiness to determine the risk involved in lending you the money. Your credit score, a three-digit number generated by credit bureaus (Equifax, Experian, and TransUnion), plays a crucial role in this assessment. A higher credit score generally reflects responsible borrowing behavior, reducing the perceived risk for the lender.

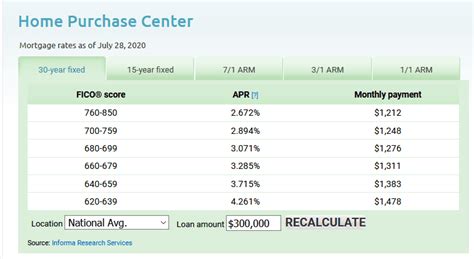

Credit Score Ranges and Loan Approval: While there's no universally fixed credit score requirement, most lenders prefer applicants with credit scores of 660 or higher for favorable loan terms. Scores below 620 are considered subprime and may lead to higher interest rates, stricter lending criteria, or loan denial. Lenders typically categorize credit scores as follows:

- Excellent (750-850): Likely to receive the best interest rates and loan terms.

- Good (700-749): High chances of approval with favorable terms.

- Fair (660-699): Approval is possible but may come with higher interest rates.

- Poor (Below 660): Approval is less likely, and obtaining financing may be challenging. Alternative financing options may be necessary.

Applications Across Industries: The principles of credit score evaluation for mobile home loans are similar to other types of consumer loans, such as auto loans and personal loans. Lenders in all these sectors assess the risk of loan default using similar credit scoring models.

Challenges and Solutions: Obtaining a mobile home loan with a poor credit score can be challenging. However, strategies exist to improve your credit score and increase your chances of approval:

- Dispute Credit Report Errors: Review your credit reports carefully for any errors and dispute them with the respective credit bureaus.

- Pay Bills on Time: Consistent on-time payments are crucial for building a positive credit history.

- Reduce Credit Utilization: Keep your credit card balances low to improve your credit utilization ratio.

- Maintain Old Credit Accounts: Closing old credit accounts can negatively impact your credit score.

- Consider Credit Counseling: Professional credit counseling can provide personalized advice and strategies for improving your credit.

Impact on Innovation: The increasing use of sophisticated credit scoring models and alternative data sources is leading to a more nuanced approach to credit risk assessment. This is impacting how lenders evaluate borrowers, particularly those with limited credit history or less-than-perfect scores. For instance, lenders may consider rent payments or utility bill payments as indicators of creditworthiness.

Closing Insights: Summarizing the Core Discussion

Your credit score significantly impacts your ability to secure a mobile home loan. While a higher credit score (660 or above) increases your chances of approval and favorable terms, individuals with lower scores still have options. Proactive credit management and exploring alternative financing are crucial steps in the process.

Exploring the Connection Between Debt-to-Income Ratio and Mobile Home Financing

The debt-to-income (DTI) ratio, representing the percentage of your gross monthly income dedicated to debt payments, is another crucial factor lenders consider. A high DTI ratio indicates a greater financial burden, increasing the risk of loan default. Even with a good credit score, a high DTI ratio can hinder your loan approval.

Key Factors to Consider:

- Roles and Real-World Examples: A borrower with a 700 credit score but a DTI ratio of 50% may be viewed as riskier than someone with a 680 credit score and a DTI of 30%. Lenders will likely offer less favorable terms or deny the loan in the former case.

- Risks and Mitigations: To mitigate high DTI risks, borrowers can try reducing existing debts, increasing their income, or providing additional collateral.

- Impact and Implications: A high DTI can significantly impact your eligibility for a mobile home loan, leading to loan denial or less favorable terms.

Conclusion: Reinforcing the Connection

The debt-to-income ratio complements your credit score in the lender’s risk assessment. Managing both your credit score and DTI is crucial for successful mobile home financing.

Further Analysis: Examining Down Payment and Loan-to-Value Ratio in Greater Detail

The down payment and the loan-to-value (LTV) ratio also play a crucial role. A larger down payment reduces the loan amount, mitigating the lender’s risk, potentially leading to more favorable terms. The LTV ratio is the loan amount divided by the home's appraised value. A lower LTV ratio (e.g., 80% or less) typically makes it easier to secure financing, even with a slightly lower credit score.

FAQ Section: Answering Common Questions About Mobile Home Financing

- What is the minimum credit score needed to finance a mobile home? While there's no strict minimum, lenders generally prefer scores above 660. Lower scores may require alternative financing or more stringent conditions.

- How does my credit history affect my interest rate? A better credit history translates to lower interest rates, significantly impacting the overall cost of the loan.

- Can I get a mobile home loan with bad credit? While more challenging, options exist including loans with higher interest rates, larger down payments, or government-backed programs for low-income individuals.

- What documents do I need to apply for a mobile home loan? You’ll need proof of income, employment history, credit report, and the sales contract for the mobile home.

Practical Tips: Maximizing the Benefits of Mobile Home Financing

- Check your credit report: Address any errors or inaccuracies before applying.

- Improve your credit score: Work to raise your score before seeking financing.

- Shop around for lenders: Compare interest rates and terms from multiple lenders.

- Consider a larger down payment: This lowers your LTV ratio and improves your chances of approval.

Final Conclusion: Wrapping Up with Lasting Insights

Securing mobile home financing requires a strategic approach. Understanding the importance of your credit score, DTI ratio, down payment, and LTV ratio is essential. By actively managing your credit and financial situation, you can significantly enhance your chances of obtaining favorable loan terms and successfully financing your mobile home. Remember, proactive planning and careful preparation are key to navigating this process effectively.

Latest Posts

Latest Posts

-

Advance Refunding Definition

Apr 30, 2025

-

Advance Premium Fund Definition

Apr 30, 2025

-

Advance Premium Definition

Apr 30, 2025

-

Advance Funded Pension Plan Definition

Apr 30, 2025

-

Advance Commitment Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about What Credit Score Do I Need To Finance A Mobile Home . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.