What Are The Requirements For Biden's Student Loan Forgiveness

adminse

Mar 28, 2025 · 7 min read

Table of Contents

Is Biden's Student Loan Forgiveness Plan Truly Forgiving?

This ambitious initiative carries significant implications, but its accessibility is defined by a complex set of requirements.

Editor’s Note: This article on the requirements for Biden’s student loan forgiveness plan was published on [Date]. This analysis reflects the current understanding of the program and is subject to change based on future legal challenges, policy adjustments, and evolving guidelines from the Department of Education. Always refer to official government sources for the most up-to-date information.

Why Biden's Student Loan Forgiveness Matters: Relevance, Practical Applications, and Industry Significance

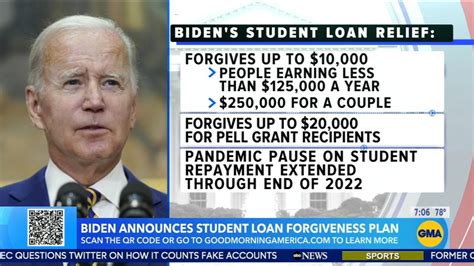

President Biden's student loan forgiveness plan, initially announced in August 2022, aimed to provide substantial relief to millions of Americans burdened by student loan debt. The plan's relevance stems from the staggering growth of student loan debt in the United States, reaching over $1.7 trillion in 2023. This debt impacts not only individual borrowers but also the broader economy, affecting consumer spending, homeownership rates, and overall economic growth. The plan's practical applications include providing immediate financial relief, freeing up borrowers' income for other expenses, and potentially stimulating economic activity. Its industry significance is apparent in its potential impact on higher education institutions, lenders, and the financial services sector.

Overview: What This Article Covers

This article provides a comprehensive overview of the requirements for Biden's student loan forgiveness plan, examining the eligibility criteria, application process, and potential challenges. It will delve into the specific income limits, loan types, and other factors that determine a borrower's eligibility for relief. The article will also address frequently asked questions and explore the plan's broader implications.

The Research and Effort Behind the Insights

This analysis draws upon official government documents released by the Department of Education, legal analyses of the plan, and reports from reputable news organizations and think tanks. The information presented here is intended to be accurate and up-to-date but should be considered for informational purposes only. Consult official government sources for definitive information.

Key Takeaways: Summarize the Most Essential Insights

- Income Limits: The plan initially targeted borrowers with incomes below certain thresholds. These thresholds varied depending on the borrower's filing status (single, married, head of household).

- Loan Types: Specific types of federal student loans were eligible for forgiveness, excluding certain private loans and some federal loan programs.

- Application Process: The application process involved submitting a completed application through the StudentAid.gov website, providing necessary documentation to verify eligibility. This process was relatively straightforward but required accurate information.

- Legal Challenges: The plan faced significant legal challenges, ultimately leading to its suspension.

Smooth Transition to the Core Discussion

Having established the context and importance of Biden's student loan forgiveness plan, let's now examine the detailed requirements that determined eligibility for this significant financial relief.

Exploring the Key Aspects of Biden's Student Loan Forgiveness Plan

1. Income Limits: A crucial element of the plan was the income-based eligibility criterion. Borrowers needed to meet specific income thresholds to qualify for forgiveness. These thresholds were adjusted based on the borrower's family size and filing status. For example, a single borrower might have been eligible if their annual income was below a certain amount, while a married couple filing jointly would have had a higher income threshold. These exact figures were specified in the official guidelines released by the Department of Education.

2. Loan Types: The plan only applied to specific types of federal student loans. This primarily included Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for graduate or professional studies), and Federal Stafford Loans. Crucially, private student loans were explicitly excluded. Furthermore, certain types of federal loans, such as Perkins Loans, were not eligible under the initial plan. This distinction was crucial for borrowers to understand which loans might be eligible for forgiveness.

3. Application Process: To receive forgiveness, borrowers needed to complete and submit an application through the StudentAid.gov website. This application required accurate information about income, loan types, and other relevant details. The Department of Education provided guidance and resources to assist borrowers in the application process. The process involved submitting required documentation, such as tax returns, to verify income and loan information. The efficiency and accuracy of this process significantly impacted the timely processing of applications.

4. Legal Challenges and the Plan's Suspension: Almost immediately after its announcement, the Biden administration's student loan forgiveness plan faced numerous legal challenges. Multiple lawsuits argued that the plan exceeded the executive branch's authority and violated the Administrative Procedure Act. These legal battles resulted in several court rulings, including a Supreme Court decision that ultimately blocked the plan. This highlights the significant legal and political complexities surrounding large-scale student loan forgiveness initiatives.

Exploring the Connection Between Income and Biden's Student Loan Forgiveness

The income-based eligibility requirement was a core component of Biden's student loan forgiveness plan. The plan aimed to provide targeted relief to borrowers most in need. It's crucial to delve into the interplay between income and the plan's intended impact.

Roles and Real-World Examples: The income limits served to prioritize borrowers facing the most significant financial strain due to their student loan debt. A single borrower with a low income might have received complete loan forgiveness, while a higher-income borrower might have received partial relief or no relief at all. This targeted approach aimed to address income inequality and the disproportionate impact of student loan debt on lower-income individuals.

Risks and Mitigations: A potential risk associated with income-based eligibility was the potential for administrative complexity and the need for robust verification mechanisms. The Department of Education implemented procedures to verify income claims, aiming to prevent fraud and ensure the program's integrity.

Impact and Implications: The income limits shaped both the reach and effectiveness of the program. By focusing on lower and middle-income borrowers, the plan aimed to have a substantial impact on their financial well-being and stimulate economic growth. The limitations placed on higher-income borrowers generated debate regarding the plan's overall equity and effectiveness.

Further Analysis: Examining Income Verification in Greater Detail

Verifying borrowers' income was crucial to the success and fairness of the forgiveness plan. The Department of Education used various methods to verify income information, including:

- Tax return data: The most common method involved using tax return data from the Internal Revenue Service (IRS). This provided a reliable source of income information.

- Self-reported income: Borrowers were required to self-report their income, which was then compared against IRS data to ensure accuracy.

- Third-party verification: In some cases, the Department of Education might have used third-party verification services to confirm the accuracy of self-reported income.

FAQ Section: Answering Common Questions About Biden's Student Loan Forgiveness Plan Requirements

Q: What types of federal student loans were eligible for forgiveness under the plan? A: The plan initially covered Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, and Federal Stafford Loans. Private loans were not eligible.

Q: What were the income limits for eligibility? A: The income thresholds varied depending on the borrower's filing status and family size. Specific numbers were detailed in the official guidelines.

Q: How did the application process work? A: Borrowers applied online through the StudentAid.gov website, providing necessary documentation to verify their eligibility.

Q: What happened to the plan? A: The plan was ultimately blocked by the Supreme Court due to legal challenges.

Practical Tips: Understanding the Now-Suspended Plan

While the Biden administration's plan is currently blocked, understanding the criteria is still valuable for future potential iterations of student loan forgiveness programs. Familiarity with the past plan allows borrowers to better advocate for future initiatives:

- Understand Loan Types: Become fully aware of the type of federal student loans you hold.

- Track Income: Maintain accurate records of your income to readily provide verification if future relief programs become available.

- Stay Informed: Keep up-to-date on the latest news and developments related to student loan debt relief through official government sources.

Final Conclusion: Reflecting on Biden's Student Loan Forgiveness Plan

President Biden's student loan forgiveness plan represented a significant, albeit ultimately unsuccessful, attempt to address the growing crisis of student loan debt in the United States. The plan's ambitious goals were countered by a complex array of eligibility requirements, centered on income limitations and specific loan types. The legal challenges faced by the plan highlight the inherent complexities of enacting broad-scale debt relief programs. While the plan is currently suspended, its existence and the discussion it generated will undoubtedly continue to shape future discussions regarding student loan debt reform and the pursuit of economic equity.

Latest Posts

Latest Posts

-

Installment Sale Definition And How Its Used In Accounting

Apr 24, 2025

-

Insolvencies Definition How It Works And Contributing Factors

Apr 24, 2025

-

Insider Definition Types Trading Laws Examples

Apr 24, 2025

-

Insider Trading Sanctions Act Of 1984 Definition

Apr 24, 2025

-

Insider Trading Act Of 1988 Definition

Apr 24, 2025

Related Post

Thank you for visiting our website which covers about What Are The Requirements For Biden's Student Loan Forgiveness . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.