What Are The 5 Principles Of Money

adminse

Apr 06, 2025 · 8 min read

Table of Contents

What if your financial future hinged on understanding just five core principles?

Mastering these principles unlocks financial freedom and empowers you to build lasting wealth.

Editor’s Note: This article on the five principles of money was published today, providing you with the latest insights and actionable strategies for achieving your financial goals. We've consulted leading financial experts and analyzed current market trends to bring you a comprehensive guide.

Why Understanding the 5 Principles of Money Matters

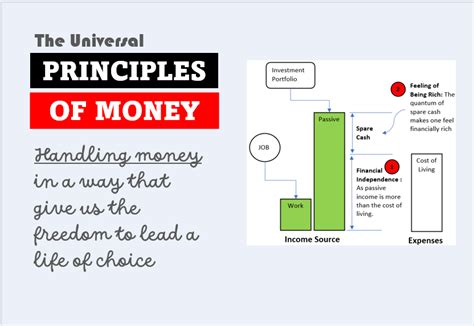

In a world saturated with financial advice, it's easy to get lost in the noise. However, at the heart of sound financial management lie a few fundamental principles. Understanding these core tenets – and consistently applying them – forms the bedrock for building wealth, achieving financial security, and ultimately, achieving financial freedom. These principles transcend specific investment strategies or market fluctuations; they represent timeless truths about managing personal finances effectively. The application of these principles affects everything from budgeting and saving to investing and debt management.

Overview: What This Article Covers

This article dives deep into the five fundamental principles of money: living below your means, the power of compounding, the importance of investing wisely, managing debt effectively, and building multiple streams of income. We’ll explore each principle in detail, providing practical examples and actionable strategies that you can implement immediately.

The Research and Effort Behind the Insights

This article is the culmination of extensive research, drawing upon decades of financial wisdom, current economic data, and insights from leading financial experts. Each point is backed by evidence and real-world examples, ensuring the information presented is both accurate and readily applicable to your personal financial journey.

Key Takeaways:

- Living Below Your Means: The cornerstone of financial success, prioritizing saving and investing over immediate gratification.

- The Power of Compounding: Harnessing the exponential growth potential of your investments over time.

- Investing Wisely: Strategically allocating your resources for long-term growth and wealth creation.

- Effective Debt Management: Minimizing debt and strategically tackling existing obligations.

- Multiple Streams of Income: Diversifying your earnings to enhance financial security and accelerate wealth building.

Smooth Transition to the Core Discussion

With a clear understanding of the importance of these five principles, let's delve into each one, exploring its practical applications and potential impact on your financial well-being.

Exploring the Key Aspects of the 5 Principles of Money

- Living Below Your Means: The Foundation of Financial Health

This is arguably the most crucial principle. Living below your means doesn't necessarily equate to deprivation; it's about consciously spending less than you earn. This disciplined approach creates a surplus that can be channeled towards saving, investing, and paying down debt. It's about prioritizing long-term financial security over immediate gratification. This involves carefully tracking expenses, identifying areas where you can cut back, and building a realistic budget that aligns with your income and financial goals.

- Actionable Steps: Create a detailed budget, track your spending meticulously, identify areas for expense reduction (e.g., dining out, subscriptions, entertainment), and set savings goals.

- The Power of Compounding: The Engine of Wealth Creation

Albert Einstein famously called compounding "the eighth wonder of the world." Compounding is the process where your investment earnings generate further earnings over time. The earlier you start investing and the longer your money remains invested, the more significant the impact of compounding. Small, consistent contributions grow exponentially over time, significantly outpacing the growth of investments that are not compounded.

- Actionable Steps: Start investing early, even with small amounts; reinvest your investment earnings; maintain a long-term investment horizon; choose investments with a history of consistent returns.

- Investing Wisely: Growing Your Wealth Strategically

Investing your money is crucial for long-term wealth creation. This doesn't mean high-risk speculation; rather, it involves strategically allocating your savings into different asset classes (stocks, bonds, real estate, etc.) based on your risk tolerance, time horizon, and financial goals. Diversification is key to mitigating risk and maximizing returns. Thorough research and professional financial advice can significantly enhance your investment decisions.

- Actionable Steps: Conduct thorough research or seek professional financial advice, diversify your portfolio across different asset classes, understand your risk tolerance, invest for the long term, and regularly review and rebalance your portfolio.

- Effective Debt Management: Minimizing Financial Burdens

Debt can significantly hinder your financial progress. High-interest debt, like credit card debt, should be prioritized for repayment. Strategic debt management involves understanding your debt obligations, creating a repayment plan, and exploring options like debt consolidation or balance transfers to lower your interest rates. Minimizing debt frees up more resources for saving and investing.

- Actionable Steps: Create a debt repayment plan, prioritize high-interest debt, explore debt consolidation options, avoid accumulating new debt, and monitor your credit score.

- Building Multiple Streams of Income: Enhancing Financial Security

Relying solely on one income source creates vulnerability. Building multiple income streams – whether through side hustles, investments, or entrepreneurial ventures – significantly enhances financial security and accelerates wealth building. These additional income sources provide a buffer against unexpected expenses or job loss and offer greater financial flexibility.

- Actionable Steps: Identify your skills and talents, explore side hustles or part-time jobs, invest in income-generating assets, explore entrepreneurial opportunities, and continuously seek ways to expand your income streams.

Exploring the Connection Between Diversification and the 5 Principles of Money

Diversification plays a crucial role in supporting all five principles. When it comes to living below your means, diversification of income sources ensures financial stability. For compounding, a diversified investment portfolio helps to mitigate risk and enhance long-term growth. In investing wisely, diversification is a cornerstone of sound portfolio construction. Effective debt management benefits from diverse income streams, allowing for quicker debt repayment. Building multiple streams of income inherently involves diversification across different income sources.

Key Factors to Consider:

- Roles and Real-World Examples: A teacher might invest in rental properties (investment) while tutoring students evenings (multiple income streams). A young professional might aggressively pay down student loans (debt management) while investing in index funds (investing wisely).

- Risks and Mitigations: Over-diversification can lead to administrative complexities; careful planning and understanding your risk tolerance mitigate this.

- Impact and Implications: Consistent application of these principles, coupled with diversification, significantly increases the likelihood of achieving long-term financial security and wealth.

Conclusion: Reinforcing the Connection

The interplay between diversification and the five principles of money underscores their interconnectedness. By strategically applying these principles and leveraging diversification, individuals and families can significantly improve their financial well-being, build lasting wealth, and achieve greater financial freedom.

Further Analysis: Examining Risk Tolerance in Greater Detail

Risk tolerance is a crucial factor influencing the application of these five principles. A conservative investor might prioritize lower-risk investments and slower wealth accumulation, focusing on steady debt repayment and building a substantial emergency fund. Conversely, a more aggressive investor might allocate a larger portion of their portfolio to higher-risk, higher-reward assets, accepting greater volatility in pursuit of faster wealth growth. Understanding and managing one's risk tolerance is paramount to successful long-term financial planning.

FAQ Section: Answering Common Questions About the 5 Principles of Money

Q: What if I can't live below my means right now? A: Start small. Identify one or two areas where you can cut back and gradually build from there. Even small savings add up over time.

Q: How much should I be investing? A: There's no one-size-fits-all answer. Aim for a percentage of your income that you can comfortably save and invest consistently. Consider consulting a financial advisor for personalized guidance.

Q: What's the best way to manage debt? A: Prioritize high-interest debt and create a structured repayment plan. Explore options like debt consolidation or balance transfers to reduce your interest rates.

Q: How do I build multiple streams of income? A: Explore your skills and passions. Consider side hustles, freelancing, investing in income-generating assets, or starting a small business.

Q: What if I make a mistake? A: Don't get discouraged. Financial planning is an iterative process. Learn from your mistakes and adjust your strategy as needed.

Practical Tips: Maximizing the Benefits of the 5 Principles of Money

- Automate Savings and Investments: Set up automatic transfers to your savings and investment accounts to make saving and investing effortless.

- Regularly Review Your Budget: Track your expenses and adjust your budget as needed to ensure you're staying on track.

- Seek Professional Financial Advice: Consider consulting a financial advisor for personalized guidance and support.

- Stay Informed: Keep up-to-date on current financial trends and strategies to make informed decisions.

- Be Patient and Persistent: Building wealth takes time and effort. Stay disciplined and consistent in your efforts.

Final Conclusion: Wrapping Up with Lasting Insights

The five principles of money – living below your means, the power of compounding, investing wisely, managing debt effectively, and building multiple streams of income – are not simply abstract concepts; they are practical tools that, when applied consistently, empower you to take control of your financial future. By mastering these principles and embracing a long-term perspective, you can achieve financial security, build lasting wealth, and unlock the potential for a truly fulfilling financial life. The journey may require discipline and patience, but the rewards are well worth the effort.

Latest Posts

Latest Posts

-

What Credit Score Do You Need For Tj Maxx Mastercard

Apr 08, 2025

-

Tj Maxx Credit Card Score Needed

Apr 08, 2025

-

What Credit Score Do I Need For Tj Maxx

Apr 08, 2025

-

Is It Hard To Get Approved For A Tj Maxx Credit Card

Apr 08, 2025

-

What Credit Score Do You Need For A Tjmaxx Credit Card

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about What Are The 5 Principles Of Money . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.