What Are Some Money Management Skills

adminse

Apr 06, 2025 · 7 min read

Table of Contents

Mastering Your Finances: Essential Money Management Skills for a Secure Future

What if financial freedom isn't just a dream, but a skill you can learn and master? Effective money management isn't about restricting yourself; it's about empowering yourself to achieve your financial goals.

Editor's Note: This article provides a comprehensive guide to essential money management skills, published today to offer readers the most up-to-date and practical advice for navigating the complexities of personal finance.

Why Money Management Matters:

In today's economic landscape, strong money management skills are no longer a luxury—they're a necessity. Whether you're aiming to buy a home, fund your education, secure a comfortable retirement, or simply reduce financial stress, understanding and implementing effective money management strategies is crucial. The ability to control your finances empowers you to make informed decisions, pursue your aspirations, and build a secure financial future. From budgeting and saving to investing and debt management, these skills are fundamental to achieving long-term financial well-being.

Overview: What This Article Covers:

This article provides a detailed exploration of key money management skills, covering budgeting techniques, saving strategies, debt management approaches, investing basics, and the importance of financial planning. Readers will gain actionable insights, backed by practical examples and expert advice, to improve their financial literacy and build a stronger financial foundation.

The Research and Effort Behind the Insights:

This comprehensive guide is the culmination of extensive research, drawing upon reputable financial sources, expert opinions, and real-world case studies. The information presented is designed to be accurate, reliable, and easily applicable to diverse financial situations.

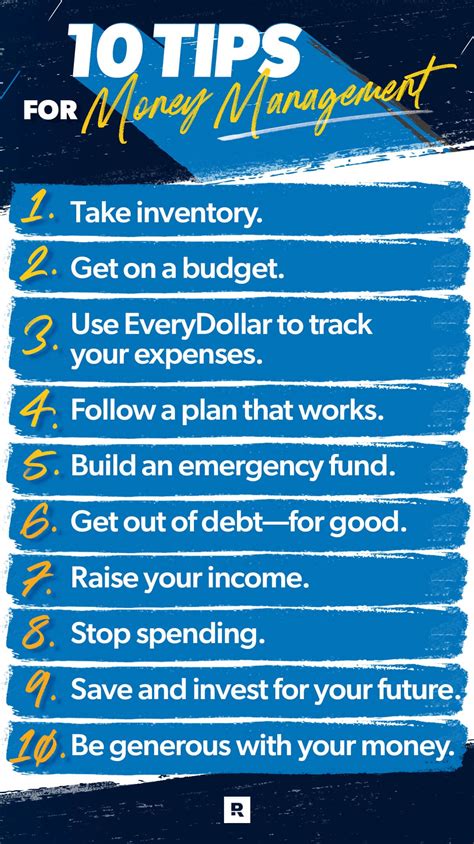

Key Takeaways:

- Budgeting Basics: Understanding income, expenses, and creating a realistic budget.

- Saving Strategies: Developing effective saving plans for short-term and long-term goals.

- Debt Management: Strategies for reducing and eliminating debt effectively.

- Investing Fundamentals: A beginner's guide to different investment options.

- Financial Planning: The importance of setting financial goals and creating a plan to achieve them.

Smooth Transition to the Core Discussion:

With a clear understanding of why strong money management is essential, let's delve into the core components of effective financial control, exploring practical strategies and proven techniques.

Exploring the Key Aspects of Money Management:

1. Budgeting: The Foundation of Financial Control:

Budgeting is the cornerstone of successful money management. It involves tracking your income and expenses to understand where your money goes and identify areas for improvement. There are various budgeting methods, including:

- 50/30/20 Rule: Allocate 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-Based Budgeting: Assign every dollar of your income to a specific category, ensuring expenses equal income.

- Envelope System: Allocate cash to different spending categories in physical envelopes.

Regardless of the method chosen, the key is consistency. Regularly track your spending, compare it to your budget, and adjust as needed. Using budgeting apps or spreadsheets can simplify the process.

2. Saving: Building a Financial Safety Net:

Saving is crucial for both short-term and long-term financial security. Short-term savings might cover unexpected expenses (emergency fund), while long-term savings contribute to larger goals like retirement or a down payment on a house.

- Emergency Fund: Aim for 3-6 months' worth of living expenses in a readily accessible account.

- Savings Goals: Define specific savings goals (e.g., down payment, vacation), setting realistic timelines and contribution amounts.

- High-Yield Savings Accounts: Maximize your savings growth by choosing accounts with competitive interest rates.

- Automated Savings: Set up automatic transfers from your checking account to your savings account to build savings consistently.

3. Debt Management: Strategies for Reducing Financial Burden:

High levels of debt can significantly hinder your financial progress. Effective debt management strategies include:

- Debt Snowball: Prioritize paying off smaller debts first to build momentum and motivation.

- Debt Avalanche: Focus on paying off debts with the highest interest rates first to minimize overall interest paid.

- Debt Consolidation: Combine multiple debts into a single loan with a lower interest rate.

- Negotiating with Creditors: Explore options for reducing interest rates or monthly payments. (Seek professional advice if needed).

4. Investing: Building Wealth Over Time:

Investing allows your money to grow over time, potentially outpacing inflation and generating long-term wealth. Several investment options are available, each with different levels of risk and return:

- Stocks: Ownership shares in publicly traded companies. Higher risk, higher potential return.

- Bonds: Loans to governments or corporations. Lower risk, lower potential return.

- Mutual Funds: Diversified portfolios of stocks and/or bonds. Moderate risk, moderate potential return.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, but traded on stock exchanges.

- Real Estate: Investing in properties for rental income or appreciation.

5. Financial Planning: A Roadmap to Your Financial Future:

Financial planning involves setting long-term financial goals and creating a roadmap to achieve them. This includes:

- Defining Financial Goals: Identify short-term and long-term goals (e.g., retirement, education, homeownership).

- Creating a Financial Plan: Develop a strategy to achieve your goals, considering your income, expenses, savings, and investment plans.

- Regular Review and Adjustments: Your financial plan should be a living document, regularly reviewed and adjusted as your circumstances change.

- Seeking Professional Advice: Consider consulting a financial advisor for personalized guidance.

Exploring the Connection Between Budgeting and Long-Term Financial Success:

The connection between effective budgeting and long-term financial success is undeniable. Budgeting provides the framework for achieving financial goals. By tracking income and expenses, individuals can identify areas where they can reduce spending and increase savings. This disciplined approach allows for strategic allocation of funds towards investments, debt reduction, and achieving long-term financial aspirations. Without a clear understanding of cash flow, long-term financial planning becomes significantly more challenging.

Key Factors to Consider:

- Roles and Real-World Examples: Many successful individuals attribute their financial stability to consistent budgeting and disciplined saving habits. Warren Buffett, known for his frugal lifestyle, demonstrates the power of long-term financial planning.

- Risks and Mitigations: Failure to budget can lead to overspending, debt accumulation, and missed financial opportunities. Regularly reviewing and adjusting your budget mitigates these risks.

- Impact and Implications: Effective budgeting enables informed decision-making, reducing financial stress and increasing the likelihood of achieving long-term financial goals.

Conclusion: Reinforcing the Connection:

The relationship between budgeting and long-term financial success is inextricably linked. Budgeting is the foundation upon which successful financial planning is built. By understanding and consistently applying budgeting principles, individuals can gain control of their finances, reduce debt, increase savings, and pave the way for a secure and prosperous future.

Further Analysis: Examining Saving Strategies in Greater Detail:

Saving strategies extend beyond simply depositing money into an account. Effective saving involves goal setting, selecting appropriate savings vehicles, and maintaining consistent contributions. Strategies like the "snowball" method for saving (similar to the debt snowball method, but for savings) or creating separate savings accounts for different goals allow for focused saving and clearer tracking of progress. Understanding the difference between interest-bearing accounts and non-interest-bearing accounts is also vital for maximizing savings growth.

FAQ Section: Answering Common Questions About Money Management:

Q: What is the best budgeting method?

A: There's no single "best" method. The ideal approach depends on individual preferences, financial situation, and goals. Experiment with different methods to find what works best for you.

Q: How much should I save each month?

A: A good starting point is to save at least 20% of your after-tax income. However, this percentage can vary depending on your goals and financial situation.

Q: What should I do if I'm overwhelmed by debt?

A: Seek professional financial advice. A credit counselor can help you develop a debt management plan and negotiate with creditors.

Q: How can I start investing?

A: Start by educating yourself about different investment options and risk tolerance. Consider consulting a financial advisor to develop a personalized investment plan.

Practical Tips: Maximizing the Benefits of Money Management:

- Track your spending: Use a budgeting app or spreadsheet to monitor your income and expenses.

- Create a realistic budget: Don't set unrealistic goals; start small and gradually increase your savings and investment contributions.

- Automate your savings: Set up automatic transfers to your savings and investment accounts.

- Pay yourself first: Allocate a portion of your income to savings before paying other expenses.

- Review your budget regularly: Adjust your budget as needed to reflect changes in income or expenses.

Final Conclusion: Wrapping Up with Lasting Insights:

Mastering your finances is a journey, not a destination. By consistently implementing the money management skills outlined in this article, individuals can build a strong financial foundation, reduce stress, and achieve their financial aspirations. Remember, effective money management isn't about deprivation; it's about empowerment—empowering yourself to create the financial future you desire.

Latest Posts

Latest Posts

-

What Is A Companys Credit Profile

Apr 08, 2025

-

What Is A Thick Credit Profile

Apr 08, 2025

-

What Is A Consumer Credit Profile

Apr 08, 2025

-

What Is A Credit Risk Profile

Apr 08, 2025

-

What Is A Thin Credit Profile

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about What Are Some Money Management Skills . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.