How Long Can You Make Minimum Payment On Credit Card

adminse

Apr 06, 2025 · 7 min read

Table of Contents

How Long Can You Make Minimum Payments on a Credit Card? The Truth About Minimum Payments and Their Long-Term Impact

How long can you realistically survive only making minimum credit card payments, before facing severe financial consequences?

The answer is: It's rarely a sustainable strategy, and the longer you rely on minimum payments, the more it will cost you in the long run.

Editor’s Note: This article on the long-term implications of minimum credit card payments was published today, providing up-to-date information and insights for managing credit card debt effectively. Understanding the true cost of minimum payments is crucial for maintaining healthy finances.

Why Minimum Payments Matter: The Hidden Costs of Convenience

Many credit card holders find the allure of minimum payments tempting. It seems like a manageable way to keep your account in good standing while gradually paying down your balance. However, the reality is far more complex and potentially damaging. The convenience of minimum payments often masks a significant hidden cost: exorbitant interest charges and a prolonged repayment period. This impacts your credit score, financial well-being, and overall financial freedom. Understanding the intricacies of interest calculations, compounding effects, and the long-term impact on creditworthiness is crucial for making informed financial decisions. This article will illuminate the underlying mechanics of minimum payments and provide actionable strategies for navigating credit card debt effectively.

Overview: What This Article Covers

This article explores the complexities of relying on minimum credit card payments. We will delve into:

- The mechanics of minimum payment calculations.

- The insidious effect of compounding interest.

- The long-term implications on credit scores and financial health.

- Strategies for accelerating debt repayment.

- The crucial role of budgeting and financial planning.

- Common pitfalls to avoid when managing credit card debt.

- Resources available to help manage debt effectively.

The Research and Effort Behind the Insights

This article is the product of extensive research, drawing on data from consumer finance websites, reputable financial institutions, and expert analysis on credit card debt management. The information presented is supported by evidence and aims to provide readers with accurate and reliable guidance.

Key Takeaways:

- Minimum payments prolong debt repayment: Relying solely on minimum payments significantly extends the repayment period, leading to much higher overall costs.

- Interest compounds rapidly: Unpaid interest adds to your principal balance, creating a snowball effect that makes debt increasingly difficult to manage.

- High interest rates drain your finances: Credit card interest rates are notoriously high, making minimum payments an expensive long-term solution.

- Debt can negatively impact your credit score: Consistent minimum payments (especially if you sometimes miss them) can hurt your credit score.

- Strategic debt management is essential: Proactive strategies, such as budgeting, debt consolidation, and seeking financial advice, are vital for effectively managing credit card debt.

Smooth Transition to the Core Discussion:

Now that we understand the gravity of relying solely on minimum payments, let's delve into the specifics of how these calculations work and their consequences.

Exploring the Key Aspects of Minimum Payments

1. Definition and Core Concepts: A minimum payment is the smallest amount a credit card issuer requires you to pay each billing cycle to remain in good standing. This amount typically includes a portion of the outstanding balance (principal) and the accumulated interest. However, the proportion dedicated to principal is often quite small, leaving a substantial portion of the debt untouched.

2. Applications Across Industries: The minimum payment calculation is consistent across most credit card issuers, although the specific formula might vary slightly. They usually base this on a percentage of your outstanding balance (often 1-3%), plus any accrued interest. This standardization ensures that the concept applies equally regardless of the card provider.

3. Challenges and Solutions: The primary challenge is the slow repayment and escalating interest charges. Solutions involve creating a budget, prioritizing debt repayment, exploring debt consolidation or balance transfer options, and considering seeking professional financial advice.

4. Impact on Innovation: Ironically, the widespread use of minimum payment options fuels innovation in the financial technology sector (FinTech), including apps that aid in debt management and financial planning.

Closing Insights: Summarizing the Core Discussion

Relying solely on minimum payments is a financial trap that can lead to years, even decades, of debt. The high interest rates, compounding effect, and minimal principal reduction make it an unsustainable long-term solution.

Exploring the Connection Between Interest Rates and Minimum Payments

The relationship between interest rates and minimum payments is paramount. High interest rates, typical of credit cards, significantly impact the effectiveness of minimum payments. Even when diligently making the minimum payment each month, a large portion goes towards interest, leaving very little to reduce the principal balance. This vicious cycle keeps you in debt for a much longer period.

Key Factors to Consider:

-

Roles and Real-World Examples: Imagine a $5,000 credit card balance with a 20% APR. The minimum payment might only be around $100. The majority of this payment goes towards interest, resulting in a negligible reduction of the principal. Over time, this small reduction leads to a slow repayment, significantly increasing the total interest paid.

-

Risks and Mitigations: The primary risk is prolonged debt and mounting interest charges. Mitigating this involves actively paying more than the minimum payment, exploring debt consolidation or balance transfer options to reduce interest rates, and improving personal financial management practices.

-

Impact and Implications: Ignoring the impact of high interest rates on minimum payments can lead to severe financial distress. This can affect credit scores, hinder major financial goals (like buying a home or investing), and cause significant stress.

Conclusion: Reinforcing the Connection

The interplay between high interest rates and minimum payments underscores the importance of proactive debt management. Understanding this connection empowers individuals to make informed choices and avoid the pitfalls of long-term minimum payment reliance.

Further Analysis: Examining Compounding Interest in Greater Detail

Compounding interest is the silent killer of minimum payment strategies. It's the interest charged not only on the original principal but also on the accumulated interest. This exponential growth makes debt increasingly difficult to manage over time. Let's illustrate with an example: a $10,000 balance with a 18% APR. Even with consistent minimum payments, the interest continues to accrue, potentially doubling or tripling the total repayment amount over several years. This highlights the crucial need for a strategic approach beyond minimum payments.

FAQ Section: Answering Common Questions About Minimum Payments

Q: What is the average minimum payment on a credit card?

A: The average minimum payment is usually calculated as a percentage of your outstanding balance (often 1-3%), plus any accrued interest. However, this can vary significantly depending on the card issuer and your credit history.

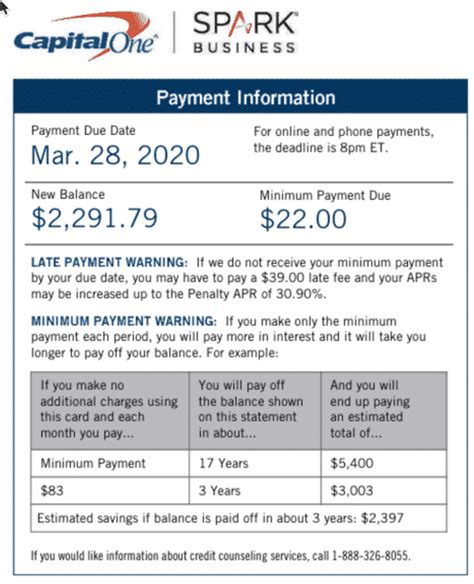

Q: How long will it take to pay off a credit card using only minimum payments?

A: This depends entirely on your balance, interest rate, and the minimum payment amount. It can take many years, even decades, to pay off a credit card using only minimum payments.

Q: Will making minimum payments affect my credit score?

A: Consistently making only minimum payments might not directly harm your credit score initially. However, it can negatively impact your credit utilization ratio (the percentage of your available credit you're using), which is a crucial component of your credit score. Furthermore, if you ever miss a minimum payment, it will severely damage your credit.

Q: What happens if I can't make the minimum payment?

A: Missing a minimum payment results in late fees, increased interest charges, and a negative impact on your credit score. It also puts you at risk of default, which has serious financial consequences.

Practical Tips: Maximizing the Benefits of Strategic Repayment

- Understand the Basics: Calculate your total interest paid over time using only minimum payments to truly understand the cost.

- Create a Budget: Track your income and expenses to identify areas where you can cut back and allocate more money towards debt repayment.

- Prioritize Debt Repayment: Develop a plan to pay down your credit card debt faster, potentially using the debt avalanche or debt snowball methods.

- Explore Debt Consolidation: Consider consolidating your credit card debt into a lower-interest loan, simplifying payments and reducing overall costs.

- Seek Professional Advice: If struggling with debt, seek advice from a credit counselor or financial advisor.

Final Conclusion: Wrapping Up with Lasting Insights

While minimum payments offer temporary relief, they are rarely a viable long-term strategy for managing credit card debt. The hidden costs of interest, extended repayment periods, and potential negative impacts on credit scores significantly outweigh the convenience. Proactive debt management, including budgeting, strategic repayment plans, and exploring debt consolidation options, is crucial for achieving financial freedom and avoiding the pitfalls of relying solely on minimum payments. Take control of your finances today – your future self will thank you.

Latest Posts

Latest Posts

-

How Do You Improve Your Credit Score Without A Credit Card

Apr 07, 2025

-

How To Boost My Credit Score Without A Credit Card

Apr 07, 2025

-

How To Build Your Credit Score With A Credit Card

Apr 07, 2025

-

How Do You Build Your Credit Score Without A Credit Card

Apr 07, 2025

-

How To Boost Your Credit Score Without A Credit Card

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about How Long Can You Make Minimum Payment On Credit Card . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.