Minimum Payment Irs Installment Plan

adminse

Apr 06, 2025 · 9 min read

Table of Contents

Navigating the IRS Installment Agreement: Understanding Minimum Payments and Avoiding Penalties

What if struggling to pay your taxes didn't mean facing crippling penalties? An IRS installment agreement can offer a lifeline, but understanding the minimum payment requirements is crucial for success.

Editor’s Note: This article on IRS installment agreements and minimum payments was published today, providing up-to-date information on navigating this complex process. We’ve compiled the latest guidance to help taxpayers understand their options and avoid costly mistakes.

Why IRS Installment Agreements Matter:

Facing a significant tax debt can be overwhelming. Many taxpayers find themselves unable to pay their taxes in full, leading to anxiety about potential penalties, liens, and even wage garnishment. An IRS installment agreement (IA), also known as a payment plan, offers a structured way to pay off tax debt over time. This prevents further penalties from accruing and allows taxpayers to regain financial stability. However, understanding the minimum payment requirements is critical to avoid defaulting on the agreement and facing even more severe consequences. The agreement provides a clear path toward resolving tax debt, preserving credit, and preventing further legal action. This structured repayment method benefits both the taxpayer and the IRS by ensuring eventual collection of the tax liability.

Overview: What This Article Covers:

This comprehensive guide delves into the intricacies of IRS installment agreements, focusing specifically on minimum payment calculations and related considerations. We will explore eligibility criteria, the application process, factors influencing minimum payments, methods of payment, and strategies for successfully managing an installment agreement. The article will also address frequently asked questions and provide practical tips for navigating this process effectively.

The Research and Effort Behind the Insights:

This article is based on extensive research, drawing from official IRS publications, tax codes, and expert commentary on tax law and financial planning. We have meticulously reviewed IRS guidelines and relevant case studies to ensure accuracy and provide readers with reliable information for making informed decisions.

Key Takeaways:

- Definition and Core Concepts: A clear understanding of IRS installment agreements, eligibility requirements, and the overall process.

- Minimum Payment Calculation: A breakdown of how minimum payments are determined, including factors like total tax debt and income.

- Application Process: A step-by-step guide to applying for an installment agreement.

- Payment Methods and Monitoring: Available payment options and how to track payments and agreement status.

- Consequences of Default: Understanding the repercussions of failing to meet minimum payment obligations.

- Strategies for Success: Practical tips for managing an installment agreement and preventing default.

Smooth Transition to the Core Discussion:

Now that we’ve established the importance of understanding IRS installment agreements, let's delve into the specific details of minimum payments and the factors that influence them.

Exploring the Key Aspects of IRS Installment Agreements:

1. Definition and Core Concepts: An IRS installment agreement allows taxpayers to pay off their tax debt in monthly installments over a period of time, typically up to 72 months. To be eligible, taxpayers generally need to demonstrate a genuine inability to pay their tax liability in full and must meet certain financial requirements. The IRS assesses the taxpayer's ability to repay the debt based on factors like income, expenses, and assets.

2. Minimum Payment Calculation: The IRS doesn't have a fixed minimum payment amount. Instead, the minimum payment is calculated based on several factors:

- Total Tax Debt: This includes the unpaid tax liability, penalties, and interest.

- Taxpayer's Income: The IRS considers the taxpayer's adjusted gross income (AGI) and disposable income to determine affordability.

- Monthly Expenses: Essential living expenses, such as housing, food, and transportation, are taken into account to assess the taxpayer's remaining capacity to make payments.

- Assets: The value of assets the taxpayer possesses may influence the payment plan terms. This helps the IRS determine the potential for repayment.

- Type of Tax Debt: The type of tax debt (e.g., income tax, payroll tax) might influence the payment terms and minimum payment amount.

The IRS often uses a formula to calculate the minimum payment, ensuring the debt is repaid within a reasonable timeframe while considering the taxpayer's financial situation. It's not simply a fixed percentage of the total debt. The amount is tailored to each individual case.

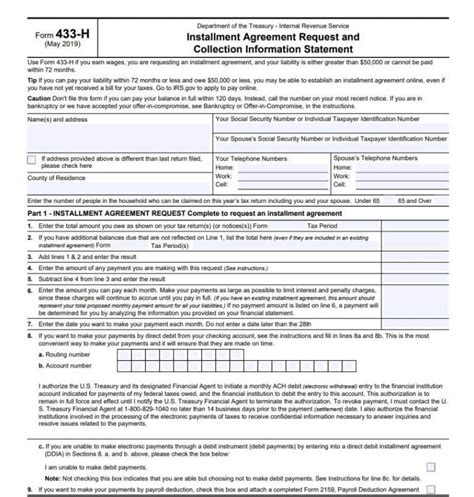

3. Application Process: Applying for an installment agreement involves:

- Gathering Necessary Documents: This includes tax returns, financial statements, bank statements, and proof of income.

- Completing Form 9465: This is the official IRS form for applying for an installment agreement.

- Submitting the Application: The application can be submitted online through the IRS website, by mail, or through a tax professional.

- IRS Review and Approval: The IRS reviews the application and determines if the taxpayer meets the eligibility requirements.

- Agreement Terms: Once approved, the IRS will outline the terms of the agreement, including the payment amount, payment schedule, and length of the agreement.

4. Payment Methods and Monitoring: Taxpayers can typically make payments through various methods, such as:

- Direct Pay: The IRS's online payment system.

- Debit Card, Credit Card, or Electronic Funds Withdrawal: These options are available through the IRS website or third-party payment processors.

- Check or Money Order: Payments can be mailed to the designated IRS address.

It's vital to monitor payment status regularly to ensure payments are processed correctly and the agreement remains current. The IRS provides online tools and account access for tracking payments and agreement status.

5. Consequences of Default: Failing to make minimum payments according to the agreement's terms can lead to severe consequences, such as:

- Termination of the Agreement: The IRS can terminate the agreement, and the full outstanding balance becomes immediately due.

- Additional Penalties and Interest: Further penalties and interest will accrue on the unpaid balance, substantially increasing the total debt.

- Lien on Assets: The IRS may place a lien on the taxpayer's assets, impacting credit rating and potentially leading to asset seizure.

- Wage Garnishment or Bank Levy: The IRS can garnish wages or levy bank accounts to collect the outstanding debt.

6. Strategies for Success: To successfully manage an installment agreement and avoid default, taxpayers should:

- Maintain Accurate Records: Keep detailed records of all payments and communication with the IRS.

- Budget Carefully: Create a realistic budget that accounts for the monthly payment and other essential expenses.

- Communicate Proactively: Contact the IRS immediately if facing unforeseen financial difficulties that prevent timely payments. They may be willing to work with you to modify the agreement terms.

- Seek Professional Help: Consider consulting with a tax professional or financial advisor for guidance and support in navigating the process.

Exploring the Connection Between Penalties and Interest and Minimum Payments:

Penalties and interest significantly impact the minimum payment calculation within an installment agreement. Understanding this connection is crucial for accurate budgeting and successful agreement completion. The IRS charges penalties for late payment and interest on the outstanding balance. These additions increase the total tax debt, directly affecting the minimum monthly payment amount. The higher the penalty and interest, the higher the minimum payment required.

Key Factors to Consider:

-

Roles and Real-World Examples: Taxpayers facing significant penalties and interest due to prior tax delinquencies will see a substantially increased minimum payment compared to someone with a smaller tax debt and fewer penalties. For example, a taxpayer with a $10,000 tax liability and $2,000 in penalties and interest will have a much higher minimum payment than a taxpayer with the same initial liability but no penalties or interest.

-

Risks and Mitigations: Failing to account for penalty and interest increases in the monthly budget is a significant risk. Mitigation involves accurately calculating the total debt inclusive of penalties and interest, building a realistic budget, and proactively communicating with the IRS if challenges arise.

-

Impact and Implications: Ignoring penalties and interest can lead to a much longer repayment period and significantly increased total cost. It can also increase the likelihood of defaulting on the agreement and facing severe repercussions.

Conclusion: Reinforcing the Connection:

The interplay between penalties, interest, and minimum payments highlights the importance of addressing tax debt promptly and proactively. Failing to account for these factors can lead to significant financial hardship. Accurate calculation and careful budgeting are key to successful installment agreement management.

Further Analysis: Examining Penalties and Interest in Greater Detail:

The IRS's penalty and interest calculations are complex. Penalties can vary based on the type of tax, the reason for non-payment, and the length of the delinquency. Interest is typically calculated daily on the unpaid balance, compounding over time. Understanding these intricacies is crucial for accurate financial planning and successful negotiation of an installment agreement.

FAQ Section: Answering Common Questions About IRS Installment Agreements:

-

What is an IRS installment agreement? An IRS installment agreement (IA) is a formal agreement with the IRS allowing taxpayers to pay their tax debt in monthly installments over a set period.

-

Am I eligible for an installment agreement? Eligibility depends on various factors, including the total amount owed, ability to pay, and compliance history. Generally, you must not have a history of willful disregard of tax laws.

-

How long can an installment agreement last? Typically, installment agreements can last up to 72 months.

-

What happens if I miss a payment? Missing payments can lead to the termination of your agreement, additional penalties, and further collection actions.

-

How do I apply for an installment agreement? You apply using IRS Form 9465, which can be submitted online, by mail, or through a tax professional.

Practical Tips: Maximizing the Benefits of an IRS Installment Agreement:

-

Act Quickly: Don't delay applying for an installment agreement once you realize you cannot pay your taxes in full. The longer you wait, the more interest and penalties accrue.

-

Be Honest and Accurate: Provide the IRS with complete and accurate financial information to avoid delays and potential issues.

-

Budget Effectively: Create a realistic budget that includes your monthly installment payment and other essential expenses.

-

Maintain Communication: Stay in contact with the IRS and promptly address any changes in your financial situation.

-

Seek Professional Assistance: Consult with a tax professional if needed to ensure you understand your options and navigate the process correctly.

Final Conclusion: Wrapping Up with Lasting Insights:

Navigating the IRS installment agreement process requires a clear understanding of minimum payment calculations and the factors that influence them. By carefully considering these factors, taxpayers can successfully manage their tax debt, avoid default, and regain financial stability. Proactive planning, accurate financial reporting, and open communication with the IRS are key elements for success. Remember, seeking professional guidance can be invaluable in navigating this complex process and securing the best possible outcome.

Latest Posts

Latest Posts

-

How Long After Paying Off Student Loans Does It Affect Credit Score

Apr 07, 2025

-

Does Paying Off Student Loans Hurt Your Credit Score

Apr 07, 2025

-

Does Not Paying Back Student Loans Affect Credit Score

Apr 07, 2025

-

Does Paying Off Student Loans Hurt Credit Score

Apr 07, 2025

-

How Good Is A 610 Credit Score

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about Minimum Payment Irs Installment Plan . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.