How To Work Out Credit Utilisation

adminse

Apr 07, 2025 · 8 min read

Table of Contents

Mastering Credit Utilization: Your Guide to a Stellar Credit Score

What if the secret to a significantly improved credit score lies in understanding just one key metric? Effective credit utilization is that powerful lever, and mastering it can dramatically boost your financial health.

Editor’s Note: This article on credit utilization was published today, providing you with the most up-to-date information and strategies to optimize your credit score. Understanding and managing your credit utilization is crucial for building and maintaining excellent credit.

Why Credit Utilization Matters:

Credit utilization is the ratio of your outstanding credit card debt to your total available credit. It's a critical factor in your credit score calculation, impacting your creditworthiness far more than many realize. Lenders view high credit utilization as a significant risk, suggesting potential overspending and difficulty managing finances. Conversely, low credit utilization signals responsible credit management, making you a more attractive borrower. This impacts not just your ability to secure loans at favorable interest rates but also your access to credit in general. It can even affect your insurance premiums and rental applications.

Overview: What This Article Covers

This article provides a comprehensive guide to credit utilization, covering its importance, calculation, optimal levels, strategies for improvement, and potential pitfalls to avoid. Readers will gain actionable insights and practical tips to maintain healthy credit utilization ratios and boost their credit scores.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing from reputable sources like Experian, Equifax, TransUnion, and the Consumer Financial Protection Bureau (CFPB). We've analyzed numerous studies on credit scoring models and incorporated best practices recommended by financial experts to provide accurate and trustworthy information.

Key Takeaways:

- Definition and Core Concepts: A thorough understanding of credit utilization and its impact on credit scores.

- Calculation and Monitoring: Learn how to calculate your credit utilization ratio and effectively monitor it.

- Optimal Utilization Rates: Discover the ideal credit utilization percentages for maximizing your credit score.

- Strategies for Improvement: Explore practical and effective methods to lower your credit utilization.

- Long-Term Strategies: Develop sustainable habits for managing credit and maintaining a healthy utilization ratio.

- Addressing High Utilization: Learn how to tackle already high credit utilization and recover your credit score.

Smooth Transition to the Core Discussion:

Now that we've established the importance of credit utilization, let's delve into the specifics. We'll explore how it's calculated, what constitutes good versus bad utilization, and most importantly, how to improve your ratio and achieve a stellar credit score.

Exploring the Key Aspects of Credit Utilization

1. Definition and Core Concepts:

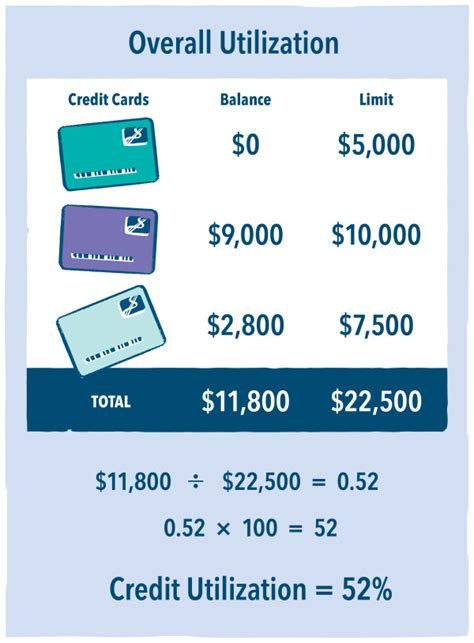

Credit utilization is expressed as a percentage. It's calculated by dividing your total outstanding credit card balances by your total available credit across all your cards. For example, if you have $1,000 in outstanding balances and a total credit limit of $5,000, your credit utilization is 20% ($1,000/$5,000 x 100%).

The core concept is simple: the lower your utilization, the better. This demonstrates responsible credit management to lenders, indicating a lower risk of default.

2. Applications Across Industries:

The impact of credit utilization extends beyond just credit scores. Landlords may check your credit report, and a high utilization rate can negatively affect your chances of securing a rental property. Similarly, insurance companies might consider your credit score when determining your premiums, potentially leading to higher costs for those with poor credit utilization. Even some employers may review credit reports during the hiring process, making a healthy credit utilization ratio important for overall financial well-being.

3. Challenges and Solutions:

One major challenge is the temptation to max out credit cards, especially during unexpected expenses or financial emergencies. This can rapidly increase utilization, negatively impacting credit scores. Another common challenge is simply forgetting to pay down balances regularly. Effective solutions include budgeting, creating a debt repayment plan, and setting up automatic payments to ensure consistent debt reduction. Regularly monitoring your credit reports and setting spending limits can also prevent high utilization.

4. Impact on Innovation:

The increasing use of credit scoring models and alternative data in lending has intensified the importance of credit utilization. Lenders are constantly refining their algorithms, making efficient credit management even more critical. Understanding and optimizing credit utilization has become a key aspect of navigating the evolving financial landscape.

Closing Insights: Summarizing the Core Discussion

Credit utilization is a powerful indicator of responsible financial behavior. By consistently keeping your utilization low, you demonstrate to lenders that you can manage your finances effectively, leading to improved credit scores and increased access to favorable financial products.

Exploring the Connection Between Payment History and Credit Utilization

While credit utilization is a crucial element, it's not the only factor influencing your credit score. Payment history, the length of your credit history, and the types of credit you use also play significant roles. Let's delve into how payment history interacts with credit utilization.

Key Factors to Consider:

Roles and Real-World Examples: A consistent history of on-time payments significantly mitigates the negative impact of even moderately high credit utilization. Conversely, even a low utilization rate can be undermined by late or missed payments. Imagine two individuals: one with a 30% utilization rate but consistently on-time payments, and another with a 10% utilization rate but a history of late payments. The former might have a better credit score because on-time payments are heavily weighted.

Risks and Mitigations: The risk of a damaged credit score is higher when high utilization combines with late payments. Mitigation strategies include setting up automatic payments, using reminders, and establishing a budget to ensure timely payments. Budgeting apps and financial planning tools can be particularly helpful.

Impact and Implications: The combined effect of high utilization and late payments can significantly lower your credit score, leading to higher interest rates on loans, difficulty securing credit, and even impacting your ability to rent an apartment or obtain insurance.

Conclusion: Reinforcing the Connection

The relationship between payment history and credit utilization is synergistic. While low utilization is vital, consistent on-time payments amplify its positive impact. Addressing both aspects ensures a strong credit profile and better financial health.

Further Analysis: Examining Payment History in Greater Detail

Payment history is a crucial element of your credit score. Even a single missed payment can negatively impact your score, highlighting the importance of consistent and timely payments. This section provides a closer look at the impact of payment history. Late payments can stay on your credit report for seven years, impacting your creditworthiness for an extended period.

FAQ Section: Answering Common Questions About Credit Utilization

Q: What is the ideal credit utilization ratio?

A: Financial experts generally recommend keeping your credit utilization below 30%, with an ideal range of 10% or less.

Q: How often should I check my credit utilization?

A: Ideally, monitor your credit utilization monthly, or at least quarterly, to stay on top of your spending and ensure it aligns with your financial goals.

Q: What should I do if my credit utilization is too high?

A: Prioritize paying down your highest-interest debts first. Consider transferring balances to a lower-interest card (if feasible) and create a realistic budget to control spending and reduce debt.

Q: Does closing credit cards improve credit utilization?

A: Closing credit cards can sometimes hurt your credit score, especially if it reduces your total available credit significantly. It's often better to keep cards open, even if you don't use them frequently, and maintain a low balance on them.

Q: My credit score dropped even though my utilization is low. Why?

A: Your credit score is impacted by numerous factors. While low credit utilization is crucial, other elements, like payment history, length of credit history, and types of credit used, also play significant roles.

Practical Tips: Maximizing the Benefits of Credit Utilization Management

- Understand the Basics: Grasp the definition, calculation, and significance of credit utilization.

- Monitor Regularly: Track your credit utilization consistently using online banking tools, credit reports, or budgeting apps.

- Set Realistic Goals: Establish a target credit utilization percentage (ideally below 30%) and develop a plan to achieve it.

- Pay Down Debt Strategically: Focus on paying down high-interest debt first to minimize interest charges and improve utilization.

- Avoid Opening Multiple Cards Simultaneously: This can temporarily lower your available credit and increase your utilization.

- Maintain a Balanced Portfolio: Diversify your credit mix by having a variety of credit accounts (credit cards, loans, etc.).

- Use Credit Cards Responsibly: Only spend what you can afford to pay back in full each month.

- Check Your Credit Report Regularly: Monitor for any errors or discrepancies that could affect your score.

Final Conclusion: Wrapping Up with Lasting Insights

Effectively managing credit utilization is a cornerstone of building and maintaining excellent credit. By understanding its impact, consistently monitoring your ratios, and adopting responsible spending habits, you can significantly improve your credit score, opening doors to better financial opportunities. Remember, responsible credit management is an ongoing process that requires consistent attention and effort. The rewards, however, are well worth the investment in your financial future.

Latest Posts

Latest Posts

-

Absolute Pollution Exclusion Definition

Apr 30, 2025

-

Absolute Physical Life Definition

Apr 30, 2025

-

Absolute Advantage Definition Benefits And Example

Apr 30, 2025

-

What Is Absenteeism Definition Causes And Costs For Business

Apr 30, 2025

-

Absentee Landlord Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about How To Work Out Credit Utilisation . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.