How To Teach My Child About Money

adminse

Apr 06, 2025 · 7 min read

Table of Contents

How to Teach Your Child About Money: A Comprehensive Guide

What if financial literacy could be the most valuable gift you give your child? Mastering money management is crucial for their future success and well-being.

Editor’s Note: This article on teaching children about money was published today and offers practical, up-to-date strategies for parents and guardians to instill healthy financial habits in their kids. We’ve incorporated insights from financial experts and child development specialists to ensure accuracy and relevance.

Why Teaching Your Child About Money Matters:

In a world increasingly driven by financial decisions, equipping children with sound money management skills is no longer a luxury but a necessity. Financial literacy empowers them to make informed choices, avoid debt, achieve financial independence, and build a secure future. Early education in this area fosters responsible spending habits, saving strategies, and a deeper understanding of the value of money. This knowledge extends beyond personal finance; it fosters crucial life skills like planning, decision-making, and goal-setting.

Overview: What This Article Covers:

This comprehensive guide delves into the art of teaching children about money at various age levels. We will explore age-appropriate strategies, practical techniques, and real-world applications, helping you build a strong foundation of financial literacy for your child. We will cover topics from introducing the concept of money to more complex concepts like budgeting and investing.

The Research and Effort Behind the Insights:

This article is the result of extensive research, incorporating insights from leading financial educators, child psychologists, and behavioral economists. We’ve reviewed numerous studies on financial literacy development in children and drawn upon best practices to create this actionable guide. Our goal is to provide parents and guardians with evidence-based strategies they can implement effectively.

Key Takeaways:

- Age-Appropriate Introduction: Understanding the developmental stages of your child is crucial for tailoring your approach.

- Hands-On Learning: Practical experiences, such as allowances and chores, are invaluable.

- Open Communication: Creating a safe space for dialogue about money is essential.

- Long-Term Perspective: Instilling the importance of saving and investing from a young age sets the stage for future success.

- Real-World Applications: Connecting financial concepts to everyday life enhances comprehension.

Smooth Transition to the Core Discussion:

With a clear understanding of the importance of early financial education, let's delve into the practical strategies and techniques for teaching your child about money at different ages.

Exploring the Key Aspects of Teaching Children About Money:

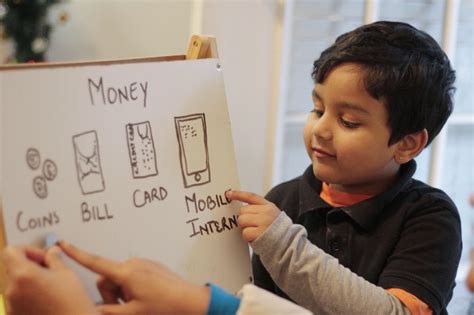

1. Early Childhood (Ages 3-5): Introducing the Concept of Money:

At this stage, the focus is on introducing the basic concepts of money. Use play money to demonstrate the idea of buying and selling. Let them participate in simple shopping scenarios, like choosing items at a pretend store. Emphasize the connection between work (e.g., helping with chores) and receiving rewards. Don't focus on numerical values yet; instead, focus on the concept of exchange.

2. Elementary School (Ages 6-12): Understanding Value and Saving:

This is the time to introduce the value of money, the difference between needs and wants, and the importance of saving. Start with a simple piggy bank and establish a regular allowance linked to small chores. Teach them about delayed gratification by encouraging them to save for a specific goal (a toy, a book, etc.). Play money games and utilize age-appropriate budgeting apps to enhance understanding.

3. Middle School (Ages 13-15): Budgeting, Earning, and Spending:

Now it’s time to move beyond basic saving. Introduce the concept of budgeting, demonstrating how to allocate money for different needs and wants. Encourage them to earn money through part-time jobs or extra chores. Help them create a simple budget, tracking their income and expenses. Discuss different payment methods, the importance of saving for long-term goals (like college), and the dangers of debt.

4. High School (Ages 16-18): Investing, Banking, and Financial Responsibility:

At this stage, your teen can start learning about more complex financial concepts, such as investing, banking, credit cards, and taxes. Open a savings account for them and discuss the benefits of compound interest. Introduce the concept of investing in a simple and age-appropriate manner, such as through educational accounts or mutual funds. Discuss the responsible use of credit cards, highlighting the importance of avoiding debt. Teach them about taxes and their responsibilities as a future taxpayer.

Closing Insights: Summarizing the Core Discussion:

Teaching your child about money is a continuous process, requiring patience, consistency, and open communication. By adapting your approach to their age and developmental stage, you can lay a strong foundation for their future financial success. Remember that fostering responsible financial habits early on is invaluable, offering more than just monetary benefits; it instills crucial life skills that will serve them well throughout their lives.

Exploring the Connection Between Chores and Allowance and Teaching Children About Money:

Connecting chores to an allowance is a powerful way to instill the value of work and the concept of earning money. It teaches them that money doesn't magically appear but is earned through effort and responsibility. This direct connection between work and reward reinforces the concept of delayed gratification and the importance of planning and budgeting.

Key Factors to Consider:

- Roles: The allowance acts as a reward for completing chores, teaching responsibility and the value of earning money. Chores contribute to the household's functioning, teaching teamwork and contribution to the family.

- Real-World Examples: A child might earn an allowance for setting the table, doing laundry, or cleaning their room. This connects the abstract concept of money to concrete actions.

- Risks and Mitigations: An allowance system needs clearly defined expectations and consequences for not completing chores. It's crucial to avoid using the allowance as a punishment.

- Impact and Implications: A well-structured chore and allowance system instills valuable life skills – responsibility, work ethic, and financial management – setting a strong foundation for future financial success.

Conclusion: Reinforcing the Connection:

The connection between chores and allowance is not just about money; it’s about fostering a sense of responsibility, contribution, and understanding the value of hard work. This carefully crafted system offers invaluable lessons that extend far beyond basic financial literacy.

Further Analysis: Examining the Role of Budgeting in Greater Detail:

Budgeting is a crucial life skill that should be taught progressively. Start with a simple visual budget at a younger age, perhaps using jars labeled “Saving,” “Spending,” and “Giving.” As they grow older, introduce spreadsheets or budgeting apps that allow for more detailed tracking of income and expenses. Teach them to categorize expenses, differentiate between needs and wants, and allocate funds accordingly. Encourage them to set financial goals, both short-term and long-term, and create a plan to achieve them.

FAQ Section: Answering Common Questions About Teaching Children About Money:

- What is the best age to start teaching my child about money? The earlier, the better. Even toddlers can begin to understand the concept of exchange.

- How much allowance should I give my child? The amount depends on your family's financial situation and your child's age and responsibilities. Start small and increase the allowance as they take on more responsibilities.

- What if my child spends their allowance immediately? This is a learning opportunity. Help them understand the importance of saving for future goals. Encourage them to track their spending and reflect on their choices.

- Should I teach my child about investing? Yes, but start with age-appropriate concepts and resources. Consider educational accounts or age-appropriate investment options.

- How can I make learning about money fun and engaging? Use games, apps, and real-life scenarios to make learning enjoyable. Involve them in family financial discussions, adapting the complexity to their understanding.

Practical Tips: Maximizing the Benefits of Financial Education:

- Lead by Example: Children learn by observing. Demonstrate responsible financial behaviors in your own life.

- Make it Relevant: Connect financial concepts to their everyday experiences.

- Be Patient and Consistent: Teaching financial literacy takes time and effort.

- Encourage Questions: Create a safe space for open communication.

- Celebrate Successes: Acknowledge and reward their efforts and accomplishments.

Final Conclusion: Wrapping Up with Lasting Insights:

Teaching your child about money is an investment in their future. By equipping them with the knowledge and skills to manage their finances responsibly, you’re giving them a valuable gift that will empower them to achieve financial independence and build a secure future. It's not just about money; it's about building character, fostering responsibility, and empowering them to navigate the complexities of the financial world with confidence.

Latest Posts

Latest Posts

-

What Kind Of Credit Score Do You Need For Sheffield Financial

Apr 07, 2025

-

What Credit Score Do You Need For Sheffield Financial

Apr 07, 2025

-

What Does Credit Card Statement Date Mean

Apr 07, 2025

-

Statement Date Of Credit Card Means

Apr 07, 2025

-

When Is The Statement Closing Date On A Credit Card

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about How To Teach My Child About Money . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.