How To Study Financial Management

adminse

Apr 06, 2025 · 7 min read

Table of Contents

Mastering the Art of Financial Management: A Comprehensive Guide to Effective Study

What if your future financial success hinges on a deep understanding of financial management? This crucial skillset empowers individuals and organizations to make informed decisions, optimize resources, and achieve long-term prosperity.

Editor’s Note: This comprehensive guide to studying financial management was published today, providing you with the most up-to-date strategies and insights to excel in this critical field.

Why Financial Management Matters:

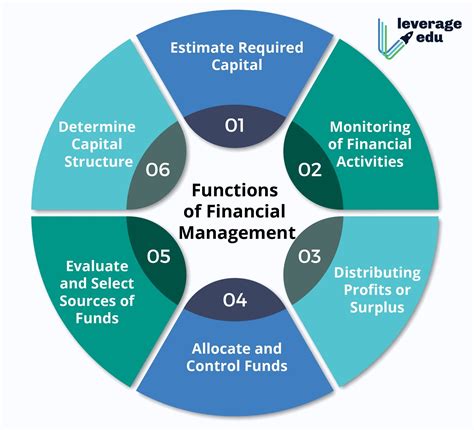

Financial management is not just about balancing a checkbook; it's a multifaceted discipline encompassing planning, organizing, directing, and controlling financial resources to achieve organizational goals. Its relevance spans personal finance, corporate strategies, and even governmental policy. Understanding financial management principles is crucial for:

- Personal Wealth Creation: Making informed investment decisions, managing debt effectively, and planning for retirement requires a solid grasp of financial concepts.

- Business Success: Profitability, growth, and long-term sustainability depend on effective financial planning, budgeting, and resource allocation.

- Investment Analysis: Evaluating investment opportunities, understanding risk and return, and making data-driven choices are fundamental aspects of financial management.

- Career Advancement: Professionals with strong financial management skills are highly sought after across various industries.

Overview: What This Article Covers

This article provides a structured approach to studying financial management, covering foundational concepts, practical application, common challenges, and future trends. You will gain actionable insights, practical tips, and a roadmap for successful learning.

The Research and Effort Behind the Insights:

This guide is the result of extensive research, drawing upon established financial textbooks, reputable online resources, and insights from experienced financial professionals. Every concept is explained clearly and supported by relevant examples to ensure a comprehensive and accurate understanding.

Key Takeaways:

- Foundational Concepts: A solid grasp of core financial principles, including accounting, finance, and economics.

- Practical Application: Learning to apply theoretical knowledge to real-world scenarios through case studies and problem-solving.

- Analytical Skills: Developing strong analytical skills for interpreting financial statements, forecasting, and making informed decisions.

- Software Proficiency: Familiarity with financial modeling software such as Excel and specialized financial software.

Smooth Transition to the Core Discussion:

Having established the importance of financial management, let's delve into a practical, step-by-step approach to effective study.

Exploring the Key Aspects of Financial Management Study:

1. Building a Strong Foundation:

Before tackling advanced concepts, it's vital to establish a solid foundation in fundamental principles. This includes:

- Accounting: Understanding the basics of accounting—balance sheets, income statements, cash flow statements—is crucial. Mastering these financial statements is the cornerstone of financial analysis. Focus on learning how to interpret and analyze these statements, not just prepare them.

- Finance: Explore core finance concepts like time value of money, risk and return, capital budgeting, and cost of capital. These form the bedrock of making informed financial decisions.

- Economics: A basic understanding of macro and microeconomics will provide context for broader financial trends and market forces. Understanding supply and demand, inflation, and interest rates is essential for understanding the economic landscape affecting financial decisions.

Resources: Utilize textbooks like "Financial Accounting" by Libby, Libby, and Short, "Corporate Finance" by Brealey, Myers, and Allen, and introductory economics textbooks. Online resources like Investopedia and Khan Academy offer valuable supplemental material.

2. Mastering Financial Statement Analysis:

Financial statement analysis is the art of extracting meaningful insights from a company's financial statements. This involves:

- Ratio Analysis: Calculate and interpret various financial ratios (liquidity, profitability, solvency, efficiency) to assess a company's financial health.

- Trend Analysis: Analyze financial data over time to identify trends and patterns.

- Comparative Analysis: Compare a company's financial performance to its industry peers.

Practical Application: Practice analyzing real-world financial statements. Many publicly traded companies make their financial statements available online (e.g., through the SEC's EDGAR database).

3. Developing Financial Modeling Skills:

Proficiency in financial modeling is essential for forecasting, budgeting, and evaluating investment opportunities.

- Spreadsheet Software: Master the use of spreadsheet software (primarily Microsoft Excel) for creating financial models. Learn functions like NPV, IRR, and scenario analysis.

- Financial Modeling Techniques: Understand techniques such as discounted cash flow (DCF) analysis, sensitivity analysis, and Monte Carlo simulation.

Resources: Online courses and tutorials on financial modeling are readily available, catering to different skill levels.

4. Understanding Capital Budgeting and Investment Appraisal:

Capital budgeting involves evaluating and selecting long-term investments. This requires:

- Net Present Value (NPV): Learning to calculate and interpret NPV is crucial for determining the profitability of long-term projects.

- Internal Rate of Return (IRR): Understanding IRR helps compare the profitability of different investment opportunities.

- Payback Period: Analyzing the time it takes for an investment to recoup its initial cost.

Practical Application: Work through case studies that involve evaluating different investment projects using various capital budgeting techniques.

5. Exploring Corporate Finance and Valuation:

Corporate finance focuses on the financial decisions made by corporations to maximize shareholder value. Key areas include:

- Capital Structure: Understanding the optimal mix of debt and equity financing.

- Dividend Policy: Analyzing how companies decide on dividend payouts.

- Mergers and Acquisitions: Learning the financial aspects of mergers and acquisitions.

- Valuation: Mastering different valuation techniques (e.g., discounted cash flow, comparable company analysis) to determine the fair value of a company or asset.

Resources: Advanced corporate finance textbooks and case studies provide in-depth exploration of these concepts.

6. Engaging with Real-World Applications:

To truly master financial management, it's crucial to apply your knowledge to real-world scenarios.

- Case Studies: Analyze case studies of successful and unsuccessful financial decisions.

- Simulations: Participate in financial simulations that replicate real-world challenges.

- Internships: Gain practical experience through internships in finance or related fields.

Closing Insights: Summarizing the Core Discussion

Effective study of financial management is a journey requiring dedication, consistent effort, and a structured approach. By building a strong foundation, mastering analytical skills, and engaging with real-world applications, aspiring financial professionals can acquire the knowledge and expertise needed to excel in this dynamic field.

Exploring the Connection Between Practical Experience and Financial Management Study:

Practical experience is the keystone that bridges theoretical knowledge and real-world application in financial management. Without practical experience, the theoretical knowledge remains abstract and less impactful.

Key Factors to Consider:

- Roles and Real-World Examples: Internships in finance, investment banking, or accounting offer invaluable practical experience. Working on real financial models, analyzing real company data, and contributing to actual financial decisions solidify theoretical understanding.

- Risks and Mitigations: The risk of making incorrect decisions during internships or early career roles exists. However, these experiences offer invaluable learning opportunities. Mentorship and supervision can mitigate these risks.

- Impact and Implications: Practical experience significantly enhances job prospects, improves decision-making skills, and fosters a deeper understanding of the intricacies of financial management in real-world contexts.

Conclusion: Reinforcing the Connection:

The interplay between practical experience and theoretical knowledge is synergistic. Practical application enhances theoretical understanding, making learning more meaningful and effective. By actively seeking opportunities for practical experience, aspiring financial professionals can significantly enhance their capabilities and career trajectory.

Further Analysis: Examining Practical Experience in Greater Detail:

Beyond internships, volunteer work, personal investment projects, and even participating in case competitions can provide practical experience. These diverse avenues expose individuals to different facets of financial management, building a well-rounded skillset. Analyzing personal finances also serves as valuable practical training in budgeting, investing, and debt management.

FAQ Section: Answering Common Questions About Studying Financial Management:

-

Q: What is the best way to learn financial modeling?

- A: A combination of online courses, textbooks, and hands-on practice using real data is highly effective. Start with the basics and gradually progress to more complex models.

-

Q: How important is accounting knowledge for financial management?

- A: Accounting is fundamental. Without a strong understanding of financial statements, you cannot effectively analyze a company's financial health.

-

Q: What software should I learn for financial management?

- A: Microsoft Excel is essential. Familiarity with specialized financial software (like Bloomberg Terminal) is beneficial but not always necessary at the beginning.

Practical Tips: Maximizing the Benefits of Your Financial Management Studies:

- Structured Learning: Create a structured study plan covering all key topics, allocating sufficient time for each.

- Active Recall: Use active recall techniques (like flashcards and practice questions) to solidify your understanding.

- Seek Mentorship: Connect with experienced financial professionals for guidance and advice.

- Continuous Learning: The field of finance is constantly evolving; stay updated on current trends and developments.

Final Conclusion: Wrapping Up with Lasting Insights

Mastering financial management requires a dedicated and structured approach, combining theoretical knowledge with practical application. By following the strategies outlined in this guide, you can effectively learn financial management, opening doors to exciting career opportunities and empowering you to make sound financial decisions throughout your life. The journey may be challenging, but the rewards—both personal and professional—are substantial.

Latest Posts

Latest Posts

-

What Does Credit Use Mean

Apr 08, 2025

-

What Does Credit Usage Mean

Apr 08, 2025

-

Why Can T I Add A Credit Card To Cash App

Apr 08, 2025

-

Why Can T I Make A Payment On My Credit Card

Apr 08, 2025

-

Why Can T I Get A Cash Advance On My Credit Card

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about How To Study Financial Management . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.