How To Get Credit Score On Credit Karma

adminse

Apr 07, 2025 · 7 min read

Table of Contents

How to Get Your Credit Score on Credit Karma: A Comprehensive Guide

Is it really free, and what's the catch?

Credit Karma offers a valuable service, providing users with free access to their credit scores and reports. This empowers individuals to better understand and manage their financial health.

Editor’s Note: This article on obtaining your credit score through Credit Karma was published today and provides up-to-date information on the process and associated services. It's designed to help you navigate the platform and understand how to maximize its benefits.

Why Your Credit Score Matters:

Your credit score is a crucial three-digit number that reflects your creditworthiness. Lenders use it to assess the risk associated with lending you money. A higher credit score typically translates to better interest rates on loans, credit cards, and mortgages, saving you substantial money over time. It also influences your ability to secure rental properties, insurance rates, and even employment opportunities in some cases. Understanding and improving your credit score is essential for achieving your financial goals. Knowing your score is the first step.

Overview: What This Article Covers:

This article provides a step-by-step guide on how to obtain your credit score on Credit Karma, addressing frequently asked questions, exploring the limitations, and offering tips for maximizing the platform's benefits. We will explore the process of registration, accessing your scores, interpreting the information provided, and understanding the nuances of the Credit Karma service.

The Research and Effort Behind the Insights:

This article is based on extensive research, including direct experience using the Credit Karma platform, analysis of their terms of service, and review of numerous online resources and user testimonials. The information provided is intended to be accurate and up-to-date, but readers are always encouraged to consult Credit Karma's official website for the most current information.

Key Takeaways:

- Free Access: Credit Karma provides free access to your VantageScore 3.0 and TransUnion credit scores.

- Regular Updates: Your scores are typically updated weekly.

- Credit Reports: You receive access to your TransUnion credit report, providing detailed information about your credit history.

- Personalized Insights: The platform offers personalized recommendations for improving your credit score.

- Limitations: Credit Karma primarily uses VantageScore 3.0 and TransUnion data. It doesn't provide all the information you might find on a full credit report from all three major bureaus (Equifax, Experian, and TransUnion).

Smooth Transition to the Core Discussion:

Now that we understand the importance of a credit score and Credit Karma's role, let's delve into the specifics of how to get your score and make the most of this free resource.

Exploring the Key Aspects of Obtaining Your Credit Score on Credit Karma:

1. Registration and Account Creation:

The first step is creating a free account on the Credit Karma website or mobile app. You will need to provide some basic personal information, including your name, date of birth, address, and Social Security number. Credit Karma uses this information to securely access your credit data from TransUnion. Remember to always be cautious about sharing your personal information online and only use official websites.

2. Verification and Data Retrieval:

Once you submit your information, Credit Karma will verify your identity using a soft credit pull. This type of inquiry doesn't affect your credit score. After verification, Credit Karma will access your TransUnion credit report and calculate your VantageScore 3.0. This usually happens within minutes.

3. Accessing Your Credit Score and Report:

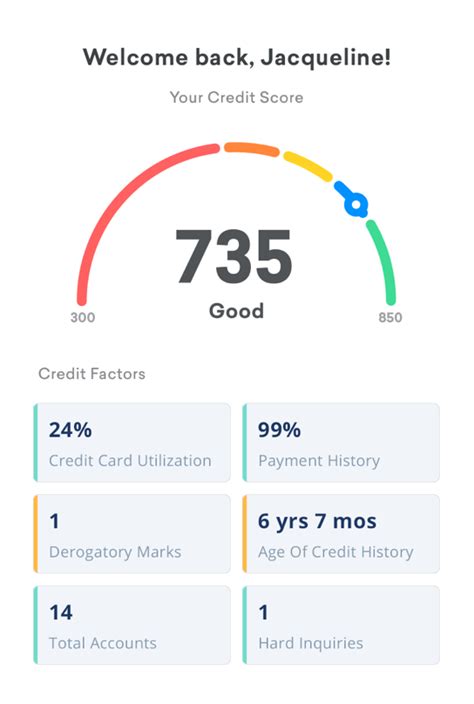

Once your account is set up and your data is retrieved, you can immediately access your TransUnion credit score and report through your Credit Karma dashboard. The platform presents this information clearly and concisely, providing an overview of your score and key factors influencing it.

4. Understanding Your Credit Report:

Your credit report contains a wealth of information about your credit history. You'll find details on:

- Accounts: This section lists all your open and closed credit accounts (credit cards, loans, mortgages). It includes account details like credit limits, balances, payment history, and account opening dates.

- Inquiries: This section shows recent credit inquiries, indicating when lenders have requested your credit report. Too many inquiries can negatively impact your score.

- Public Records: This section notes any bankruptcies, judgments, or liens filed against you.

- Payment History: This is a critical section, as it demonstrates your ability to repay debts on time. Late or missed payments are major factors negatively affecting your score.

5. Utilizing Credit Karma's Features:

Credit Karma offers several additional features beyond just providing your credit score:

- Credit Score Simulator: This tool allows you to see how hypothetical changes to your credit behavior might affect your score. This is a valuable tool for planning and making informed decisions.

- Personalized Recommendations: Credit Karma provides tailored advice and recommendations based on your credit report, helping you identify areas for improvement.

- Identity Monitoring: Some Credit Karma services include identity monitoring features, alerting you to potential identity theft or fraud.

- Financial Tools: The platform offers additional financial tools, such as budgeting assistance and savings trackers.

Closing Insights: Summarizing the Core Discussion:

Obtaining your credit score through Credit Karma is a straightforward process, providing free and easy access to valuable information. By understanding your credit report and utilizing the platform's features, you can gain significant insights into your financial health and take steps to improve your credit score.

Exploring the Connection Between Credit Monitoring and Credit Karma:

Credit Karma's core service revolves around credit monitoring. This involves regularly tracking and analyzing your credit data to provide you with up-to-date information on your score and report. This constant monitoring is crucial because it allows you to identify potential issues early on, such as fraudulent activity or errors in your report. Promptly addressing these issues can prevent more significant problems in the future.

Key Factors to Consider:

- Data Sources: Credit Karma primarily uses TransUnion data, and its credit score is VantageScore 3.0. Keep in mind that other lenders may use different scoring models (like FICO scores from Experian and Equifax) resulting in a slightly different score.

- Accuracy: While Credit Karma strives for accuracy, errors can occur. Always review your credit report carefully for any inaccuracies and dispute them with TransUnion directly if necessary.

- Marketing: Credit Karma is a free service, and they generate revenue through advertising and partnerships with financial institutions. You may see advertisements for credit cards or other financial products.

- Security: Credit Karma employs security measures to protect your information, but it's always vital to practice good online security habits.

Further Analysis: Examining VantageScore 3.0 in Greater Detail:

VantageScore 3.0 is a credit scoring model used by Credit Karma. While similar to the more widely known FICO score, there are some differences. Understanding these differences can help you interpret your Credit Karma score accurately. VantageScore typically emphasizes payment history and credit utilization, placing less weight on the length of credit history compared to FICO.

FAQ Section: Answering Common Questions About Credit Karma:

Q: Is Credit Karma completely free?

A: Yes, the basic credit score and report access is free. However, some additional features, such as advanced identity monitoring, may require a subscription.

Q: How often does my score update?

A: Your score is typically updated weekly.

Q: What if I find an error on my credit report?

A: You should dispute the error directly with TransUnion, the credit bureau that provided the data to Credit Karma. Credit Karma can provide guidance on how to do this.

Q: Does Credit Karma affect my credit score?

A: Accessing your credit score through Credit Karma uses a "soft inquiry" which does not affect your credit score.

Q: Can I use Credit Karma to monitor my Equifax and Experian scores?

A: While Credit Karma mainly focuses on TransUnion data, they may offer tools or insights related to Equifax and Experian in their other services.

Practical Tips: Maximizing the Benefits of Credit Karma:

- Check Regularly: Log in regularly to monitor your credit score and report for any changes or potential problems.

- Understand Your Score: Familiarize yourself with the factors influencing your score and identify areas for improvement.

- Use the Simulator: Experiment with the Credit Score Simulator to see how different actions may affect your score.

- Follow Recommendations: Credit Karma provides personalized recommendations; act on these suggestions to improve your credit health.

- Check for Errors: Review your report regularly and dispute any errors you find.

Final Conclusion: Wrapping Up with Lasting Insights:

Credit Karma offers a valuable service by providing free access to your credit score and report, empowering you to better manage your financial well-being. By understanding how to utilize the platform, interpreting your credit data, and proactively addressing any issues, you can significantly improve your financial health and achieve your financial goals. Remember, consistent monitoring and informed decision-making are key to building and maintaining a strong credit score.

Latest Posts

Latest Posts

-

Acceptance Market Definition

Apr 30, 2025

-

Acceptable Quality Level Aql Definition And How It Works

Apr 30, 2025

-

Acceleration Principle Definition And How It Works In Economics

Apr 30, 2025

-

Accelerated Option Definition

Apr 30, 2025

-

Accelerated Bookbuild Definition How The Process Works

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about How To Get Credit Score On Credit Karma . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.