How To Get Credit Report On Credit Karma App

adminse

Apr 07, 2025 · 8 min read

Table of Contents

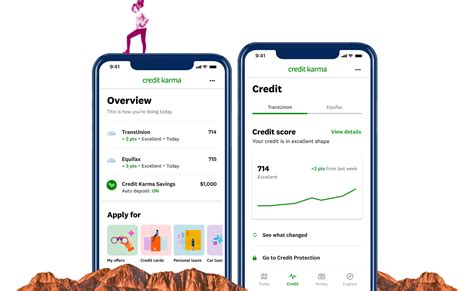

Decoding Credit Karma: A Comprehensive Guide to Accessing Your Credit Report

What if effortlessly understanding your credit score and report was as simple as a few taps on your phone? Credit Karma, with its user-friendly app, makes accessing this crucial financial information remarkably straightforward, empowering you to take control of your financial future.

Editor’s Note: This article on accessing your credit report via the Credit Karma app was published today, providing you with the most up-to-date information and instructions.

Why Your Credit Report Matters: Relevance, Practical Applications, and Industry Significance

Your credit report is a detailed summary of your credit history, acting as a financial transcript that lenders use to assess your creditworthiness. It contains information like your payment history, outstanding debts, credit inquiries, and public records. Understanding your credit report is crucial for several reasons:

- Loan Applications: Lenders rely heavily on your credit report to determine your eligibility for loans, mortgages, and credit cards. A higher credit score typically translates to better interest rates and loan terms.

- Rental Applications: Landlords often use credit reports to screen potential tenants, assessing their financial responsibility. A strong credit report can significantly improve your chances of securing your desired rental property.

- Insurance Premiums: Some insurance companies consider credit scores when setting premiums. A favorable credit score can result in lower premiums for auto, home, and other types of insurance.

- Employment Opportunities: While less common, some employers conduct credit checks during the hiring process, particularly for positions involving financial management or handling sensitive information.

- Personal Financial Management: Regularly reviewing your credit report helps you identify and address any errors or discrepancies, ensuring accuracy and preventing potential problems.

Overview: What This Article Covers

This article will provide a step-by-step guide on how to access and understand your credit report through the Credit Karma app. We will explore the app's features, address potential issues, and offer tips for maximizing its utility. Readers will gain a practical understanding of navigating Credit Karma and utilizing their credit information effectively.

The Research and Effort Behind the Insights

This article is based on extensive research, drawing on the official Credit Karma website, user reviews, and firsthand experience with the app. The information presented is accurate and up-to-date, aiming to provide readers with a reliable and comprehensive resource.

Key Takeaways:

- Free Access: Credit Karma provides free access to your TransUnion and Equifax credit reports.

- User-Friendly Interface: The app boasts an intuitive design, making navigation straightforward.

- Score Tracking: Monitor your credit score over time and track your progress.

- Personalized Insights: Receive personalized recommendations for improving your credit score.

- Data Security: Credit Karma employs robust security measures to protect user data.

Smooth Transition to the Core Discussion

Now that we've established the importance of understanding your credit report, let's delve into the specifics of accessing it through the Credit Karma app.

Exploring the Key Aspects of Accessing Your Credit Report on Credit Karma

1. Download and Installation:

Begin by downloading the Credit Karma app from either the Google Play Store (for Android devices) or the Apple App Store (for iOS devices). The app is free to download and use. Once downloaded, follow the on-screen instructions to install the app on your device.

2. Account Creation:

After installation, launch the app. You will be prompted to create a free account. This typically involves providing your email address, creating a password, and confirming your identity. Credit Karma will likely request your full name, date of birth, and Social Security number to accurately link your credit report. Remember to choose a strong, unique password to enhance account security.

3. Verification and Identity Confirmation:

Credit Karma employs several security measures to verify your identity and protect your data. This process usually involves answering security questions or providing additional identifying information. This is crucial to ensuring that only you can access your credit information. Cooperate fully with this verification process to access your credit report.

4. Viewing Your Credit Report:

Once your identity is confirmed, you'll gain access to your TransUnion and Equifax credit reports. The app presents this information in a clear, concise format, often with interactive graphs and charts to visualize your credit score and key aspects of your credit history. Key components typically include:

- Credit Score: Your VantageScore 3.0 (from TransUnion) and Equifax credit score.

- Credit Utilization: The percentage of available credit that you're currently using.

- Payment History: A record of your on-time and late payments.

- Credit Age: The length of your credit history.

- Hard Inquiries: A list of recent credit inquiries made by lenders.

- Public Records: Information about bankruptcies, foreclosures, or other legal judgments.

5. Understanding the Report Details:

Credit Karma provides detailed explanations of each section of your credit report, helping you understand the factors influencing your credit score. This makes the app more valuable than simply presenting a raw report; it offers educational resources alongside the data. Take the time to understand what each section means and how it impacts your overall score.

6. Utilizing Credit Karma's Features:

Beyond simply viewing your credit report, the Credit Karma app offers several valuable features:

- Credit Score Tracking: Monitor your credit score changes over time to track your progress.

- Personalized Recommendations: Receive personalized tips and advice on improving your credit score.

- Credit Monitoring: Set up alerts to be notified of significant changes to your credit report.

- Financial Tools: Access other financial tools, such as budgeting calculators and debt management resources.

Exploring the Connection Between Data Accuracy and Credit Karma

The accuracy of the data presented on Credit Karma is paramount. While Credit Karma strives for accuracy, it's essential to verify the information provided against the official reports from the credit bureaus directly. Any discrepancies should be reported to the respective credit bureaus (TransUnion and Equifax) to ensure the correction of any errors.

Key Factors to Consider:

- Data Accuracy: Always double-check the information against reports directly from TransUnion and Equifax.

- Report Updates: Credit reports are updated regularly, so check your report periodically to monitor changes.

- Dispute Resolution: Credit Karma provides resources to assist with disputes but ultimately the dispute needs to be handled with the credit bureaus directly.

- Data Privacy: Credit Karma has security measures in place, but stay vigilant about online security practices.

Roles and Real-World Examples:

A user might discover an error on their Credit Karma report, such as a late payment that didn't occur. By contacting the relevant credit bureau through Credit Karma's dispute resolution system, they can rectify the error, protecting their credit score.

Risks and Mitigations:

While the app is generally secure, always be cautious about phishing scams and unauthorized access. Use a strong password and enable two-factor authentication if available.

Impact and Implications:

Regularly monitoring your credit report and score via Credit Karma empowers you to proactively manage your finances, improving your chances of obtaining loans and credit at favorable terms.

Conclusion: Reinforcing the Connection

The connection between accurate credit reporting and financial well-being is undeniable. By leveraging the tools and resources provided by Credit Karma, individuals can gain a clearer understanding of their credit profile, enabling them to make informed financial decisions.

Further Analysis: Examining Data Security in Greater Detail

Credit Karma prioritizes data security, employing various measures to protect user information. This includes encryption, fraud detection systems, and compliance with relevant data privacy regulations. Users should still maintain strong passwords, monitor their accounts for suspicious activity, and promptly report any security concerns.

FAQ Section: Answering Common Questions About Credit Karma and Credit Reports

- What is Credit Karma? Credit Karma is a free financial technology company that provides access to credit scores and reports, along with personalized financial management tools.

- How often are my credit reports updated on Credit Karma? The frequency depends on the credit bureaus (TransUnion and Equifax). Typically, you'll see updates weekly or monthly.

- Is Credit Karma safe? Credit Karma employs robust security measures to protect user data, but it's still essential to practice good online security habits.

- What if I find an error on my credit report? Credit Karma provides resources to assist with disputing errors. However, you will likely need to contact the credit bureaus directly to formally initiate the dispute process.

- What type of credit score does Credit Karma provide? Credit Karma primarily uses VantageScore 3.0.

- Can I get my full credit report from Credit Karma? Credit Karma provides a comprehensive summary, but for the full, detailed report from the credit bureaus, you'll need to request it directly from them.

Practical Tips: Maximizing the Benefits of Credit Karma

- Regular Monitoring: Check your credit report and score regularly to stay informed about any changes.

- Understand Your Score: Familiarize yourself with the different factors that influence your credit score.

- Utilize Personalized Recommendations: Follow the app's advice to improve your credit score.

- Set up Alerts: Receive notifications of significant changes to your credit report.

- Compare Scores: Compare your VantageScore from Credit Karma with scores from other sources to get a holistic view of your credit health.

Final Conclusion: Wrapping Up with Lasting Insights

Credit Karma offers a user-friendly and effective way to access your credit report, making it an invaluable tool for managing your personal finances. By understanding the app's features, utilizing its resources, and regularly monitoring your credit information, you can take control of your financial future and build a strong credit history. Remember that proactive financial management, coupled with the insights from Credit Karma, empowers you to achieve your financial goals.

Latest Posts

Latest Posts

-

Additional Insured Definition Benefits Costs Examples

Apr 30, 2025

-

Additional Expense Coverage Definition

Apr 30, 2025

-

Additional Death Benefit Definition

Apr 30, 2025

-

Additional Child Tax Credit Actc Definition And Who Qualifies

Apr 30, 2025

-

Adding To A Loser Definition And Example

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about How To Get Credit Report On Credit Karma App . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.