How To Calculate Your Credit Utilization Percentage

adminse

Apr 07, 2025 · 8 min read

Table of Contents

Decoding Your Credit Score: Mastering Credit Utilization Percentage

What if the key to a higher credit score lies in a simple percentage? Understanding and managing your credit utilization ratio is crucial for financial health and achieving credit excellence.

Editor’s Note: This comprehensive guide to calculating and managing your credit utilization percentage was published today, providing readers with up-to-date information and actionable strategies for improving their credit scores.

Why Credit Utilization Matters: Relevance, Practical Applications, and Industry Significance

Credit utilization, simply put, is the ratio of your outstanding credit card debt to your total available credit. It's a critical factor influencing your credit score, often outweighing other factors like payment history. Lenders view a high credit utilization ratio as a sign of potential financial instability, increasing the perceived risk of loan default. Conversely, a low credit utilization ratio signals responsible credit management, improving your creditworthiness and potentially leading to better interest rates on loans and credit cards. This impacts not only your ability to secure loans but also your overall financial well-being. The significance extends beyond individual finances; understanding credit utilization is crucial for businesses managing credit lines and individuals striving for financial freedom.

Overview: What This Article Covers

This article provides a step-by-step guide to calculating your credit utilization percentage across multiple credit cards. It explores the optimal utilization rate, delves into the impact of different credit card types, discusses strategies for lowering your utilization, and answers frequently asked questions. You'll gain actionable insights backed by research and practical examples.

The Research and Effort Behind the Insights

This article draws upon data from reputable credit reporting agencies, financial experts, and extensive research on credit scoring models. The information presented is designed to be accurate, up-to-date, and easily understandable, empowering you to take control of your credit health.

Key Takeaways:

- Definition of Credit Utilization: A clear explanation of the concept and its importance.

- Calculation Methods: Step-by-step instructions for calculating your credit utilization for single and multiple credit cards.

- Ideal Credit Utilization Range: Understanding the optimal percentage for a healthy credit score.

- Strategies for Reducing Credit Utilization: Practical tips and advice to lower your ratio effectively.

- Impact of Different Credit Card Types: How different credit cards influence your overall utilization.

- Long-Term Implications: The long-term benefits of maintaining a low credit utilization percentage.

Smooth Transition to the Core Discussion:

Now that we've established the importance of credit utilization, let's dive into the practical aspects of calculating and managing it effectively. Understanding this metric is the first step towards building a strong credit profile.

Exploring the Key Aspects of Credit Utilization Percentage

1. Definition and Core Concepts:

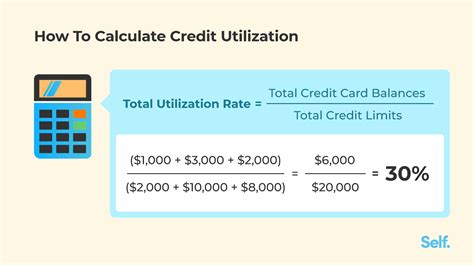

Credit utilization is expressed as a percentage: (Total Credit Card Debt / Total Available Credit) * 100. Total credit card debt represents the sum of your outstanding balances across all your credit cards. Total available credit is the sum of your credit limits on all your credit cards. For example, if you have $1,000 in outstanding debt and a total credit limit of $5,000, your credit utilization is (1000/5000) * 100 = 20%.

2. Calculating Credit Utilization for Single and Multiple Credit Cards:

- Single Credit Card: This is straightforward. Divide your current balance by your credit limit and multiply by 100.

- Multiple Credit Cards: Add up the outstanding balances on all your credit cards to get your total credit card debt. Add up the credit limits on all your credit cards to get your total available credit. Then, divide your total credit card debt by your total available credit and multiply by 100.

Example:

Let's say you have three credit cards:

- Card 1: Balance = $500, Credit Limit = $2,000

- Card 2: Balance = $800, Credit Limit = $3,000

- Card 3: Balance = $200, Credit Limit = $1,000

Total Credit Card Debt = $500 + $800 + $200 = $1,500 Total Available Credit = $2,000 + $3,000 + $1,000 = $6,000 Credit Utilization = ($1,500 / $6,000) * 100 = 25%

3. Ideal Credit Utilization Range:

While the ideal credit utilization rate is generally considered to be below 30%, aiming for under 10% is even better. Keeping your credit utilization consistently low demonstrates responsible credit management and can significantly contribute to a higher credit score. Credit scoring models don't have a universally agreed-upon percentage, but keeping it below 30% is a widely accepted best practice.

4. Strategies for Reducing Credit Utilization:

- Pay Down Balances: The most direct way is to pay down your outstanding balances as much as possible. Focus on the cards with the highest utilization rates first.

- Increase Credit Limits: Request a credit limit increase from your credit card issuer. However, only do this if you can responsibly manage a higher limit and won't increase your spending.

- Close Unused Cards: If you have unused credit cards, consider closing them. This will reduce your total available credit, and if you have no outstanding balance on them, it won't impact your utilization. However, closing cards can potentially lower your average credit age, so weigh the pros and cons carefully.

- Strategic Spending: Avoid maxing out your credit cards. Be mindful of your spending habits and try to keep your balances well below your limits.

- Debt Consolidation: Consolidating your high-interest debt onto a lower-interest loan can help you pay down balances faster.

5. Impact of Different Credit Card Types:

Credit utilization is calculated across all your credit accounts, including store cards, secured credit cards, and unsecured credit cards. The impact on your credit score is cumulative. Using a mix of different cards can help diversify your credit profile but doesn't change the core principle of keeping utilization low.

6. Long-Term Implications:

Maintaining a low credit utilization ratio has long-term benefits, including:

- Higher Credit Score: A lower utilization rate contributes significantly to a higher credit score.

- Better Interest Rates: A good credit score qualifies you for better interest rates on loans, credit cards, and other financial products.

- Increased Borrowing Power: Lenders are more likely to approve your loan applications and offer you higher credit limits.

- Improved Financial Health: Responsible credit management promotes better financial discipline and reduces the risk of debt accumulation.

Exploring the Connection Between Payment History and Credit Utilization

While credit utilization is a significant factor, payment history remains paramount in determining your credit score. Consistent on-time payments demonstrate financial responsibility, mitigating the negative impact of even a moderately high utilization rate. Conversely, even a low utilization rate won't compensate for consistently missed payments.

Key Factors to Consider:

- Roles and Real-World Examples: A consistent on-time payment history shows reliability, even if utilization is slightly higher. Conversely, a perfect utilization rate but a history of missed payments severely damages credit. Consider individuals with similar utilization but differing payment histories – the one with a better payment record will likely have a higher score.

- Risks and Mitigations: The risk of high utilization is a negative impact on your credit score. Mitigation involves paying down balances and managing spending effectively.

- Impact and Implications: The long-term impact of poor payment history combined with high utilization is severely reduced borrowing power and higher interest rates.

Conclusion: Reinforcing the Connection:

The relationship between payment history and credit utilization is synergistic. Both contribute to a healthy credit score, but neglecting either can significantly harm your creditworthiness. Prioritizing both responsible spending and on-time payments is key to long-term financial success.

Further Analysis: Examining Payment History in Greater Detail:

Payment history is recorded as the number of times you've paid your credit cards on time or late. Even a single missed payment can negatively affect your credit score for several years. The impact is particularly severe for recurring late payments or defaults. Consistent on-time payments, even with a slightly higher utilization rate, demonstrate reliability and financial stability to lenders.

FAQ Section: Answering Common Questions About Credit Utilization

- What is credit utilization? Credit utilization is the ratio of your outstanding credit card debt to your total available credit.

- How is credit utilization calculated? It's calculated by dividing your total credit card debt by your total available credit and multiplying by 100.

- What is the ideal credit utilization percentage? Aim for under 30%, with under 10% being ideal.

- How can I lower my credit utilization? Pay down balances, increase credit limits (responsibly), close unused cards, and manage spending.

- Does credit utilization affect my credit score? Yes, it's a major factor.

- What happens if I have high credit utilization? It can lower your credit score, increase interest rates, and make it harder to get loans approved.

Practical Tips: Maximizing the Benefits of Credit Utilization Management

- Track Your Spending: Use budgeting apps or spreadsheets to monitor your spending and avoid exceeding your credit limits.

- Set Payment Reminders: Set up automatic payments or reminders to ensure you pay your bills on time.

- Review Your Credit Reports Regularly: Check your credit reports for errors and monitor your credit utilization.

- Communicate with Credit Card Issuers: If you're struggling to manage your debt, communicate with your credit card issuers to explore options like payment plans.

Final Conclusion: Wrapping Up with Lasting Insights

Mastering credit utilization is a cornerstone of responsible financial management. By understanding how it’s calculated, maintaining a low utilization rate, and combining this with a positive payment history, you can significantly improve your credit score, unlock better financial opportunities, and achieve long-term financial well-being. Take control of your finances today and reap the rewards of responsible credit management.

Latest Posts

Related Post

Thank you for visiting our website which covers about How To Calculate Your Credit Utilization Percentage . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.