If I Have A 1000 Credit Limit How Much Should I Spend

adminse

Apr 07, 2025 · 7 min read

Table of Contents

A $1000 Credit Limit: How Much Should You Spend? Unlocking Financial Freedom

What if responsible credit card use is the key to building a strong financial future? Mastering your spending habits within a $1000 credit limit can significantly impact your credit score and financial well-being.

Editor’s Note: This article on managing a $1000 credit limit was published today. It provides up-to-date advice on responsible credit card usage and building a positive credit history.

Why a $1000 Credit Limit Matters: Relevance, Practical Applications, and Industry Significance

A $1000 credit limit, while seemingly small, represents a valuable tool for building credit and managing finances. For many, it’s a starting point—a stepping stone towards higher limits and greater financial flexibility. Understanding how to utilize this limit responsibly is crucial for establishing a positive credit history, avoiding debt traps, and achieving long-term financial goals. This knowledge is especially relevant for young adults, individuals rebuilding credit, or anyone seeking to improve their financial literacy. The principles discussed here are applicable to any credit limit, but focusing on a $1000 limit offers a tangible, easily understood example for practical application.

Overview: What This Article Covers

This article explores the complexities of managing a $1000 credit limit. We'll delve into calculating your spending capacity, the importance of credit utilization, strategies for responsible spending, and the potential consequences of overspending. Readers will gain actionable insights and strategies to build a strong credit history while staying financially secure.

The Research and Effort Behind the Insights

This article draws upon extensive research from reputable sources, including financial literacy websites, credit reporting agencies’ guidelines, and expert advice from financial professionals. Data-driven analysis of credit utilization ratios and their impact on credit scores informs the recommendations provided. The aim is to present accurate and trustworthy information to empower readers with informed decision-making.

Key Takeaways:

- Understanding Credit Utilization: The critical role of keeping your credit utilization low (ideally below 30%) in maintaining a healthy credit score.

- Budgeting and Tracking Expenses: The importance of creating a realistic budget and diligently tracking spending to avoid exceeding your limit.

- Prioritizing Payments: Strategies for consistently paying your credit card balance on time and in full to avoid interest charges.

- Emergency Fund vs. Credit Card: The benefits of establishing an emergency fund before relying heavily on credit.

- Long-Term Credit Building: How responsible credit card use contributes to a positive credit history and improved financial opportunities.

Smooth Transition to the Core Discussion:

Now that we understand the importance of responsible credit card management, let's explore the specifics of navigating a $1000 credit limit effectively.

Exploring the Key Aspects of Managing a $1000 Credit Limit

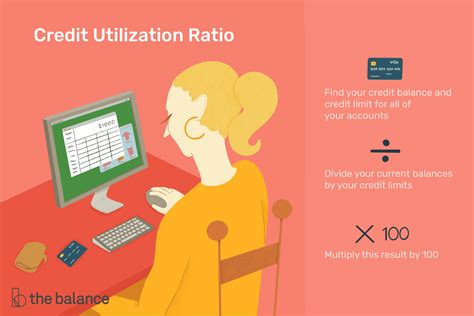

1. Defining Credit Utilization and its Impact:

Credit utilization is the percentage of your available credit that you’re currently using. For a $1000 limit, if you have a $300 balance, your utilization is 30%. Credit bureaus view high utilization (generally above 30%) negatively, as it signals potential financial instability. Aim for a utilization rate consistently below 30%, and ideally closer to 10%, to showcase responsible credit management. With a $1000 limit, this means keeping your balance below $300, preferably below $100.

2. Budgeting and Tracking Expenses:

Before you even swipe your card, create a detailed budget. List your essential expenses (rent, utilities, groceries) and non-essential expenses (entertainment, dining out). Track every purchase meticulously, either manually in a spreadsheet or using budgeting apps. This awareness is critical for staying within your $1000 limit and avoiding accumulating debt.

3. Prioritizing Payments and Avoiding Interest:

Paying your credit card balance in full each month is paramount. This prevents accruing interest, which can quickly spiral your debt out of control. With a $1000 limit, even a small interest rate can lead to significant extra costs over time. Prioritize credit card payment over other expenses to maintain a zero balance each month.

4. The Role of an Emergency Fund:

Before relying on your credit card for emergencies, build an emergency fund. This is a savings account holding 3-6 months’ worth of living expenses. An emergency fund provides a financial safety net, reducing the need to resort to credit cards for unexpected costs like car repairs or medical bills. Using your credit card for emergencies should be a last resort, after exhausting your emergency fund.

5. Long-Term Credit Building Strategies:

Responsible credit card use is foundational for building a strong credit history. Consistent, on-time payments and low credit utilization demonstrate responsible financial behavior, positively impacting your credit score. This score opens doors to better interest rates on loans, mortgages, and even insurance. A $1000 credit limit, managed effectively, is a solid starting point for establishing this positive history.

Exploring the Connection Between Emergency Savings and a $1000 Credit Limit

The relationship between emergency savings and a $1000 credit limit is crucial. An emergency fund acts as a buffer, reducing reliance on credit. Using your credit card for unexpected expenses can rapidly increase your credit utilization, negatively affecting your credit score. A well-funded emergency fund helps to maintain low credit utilization, even during unforeseen financial challenges.

Key Factors to Consider:

- Roles and Real-World Examples: A young adult starting their credit journey might use their $1000 limit for essential purchases, paying it off monthly. An individual rebuilding credit may use it sparingly, prioritizing low utilization and timely payments.

- Risks and Mitigations: Overspending and exceeding the $1000 limit lead to high interest charges and damage to your credit score. Mitigation involves meticulous budgeting, expense tracking, and disciplined repayment.

- Impact and Implications: Responsible use builds credit, while irresponsible use can lead to debt, impacting your credit score and future financial opportunities.

Conclusion: Reinforcing the Connection

The interplay between emergency savings and a $1000 credit limit underscores the importance of responsible financial management. By prioritizing saving and disciplined spending, individuals can leverage a small credit limit to build a positive credit history without falling into debt.

Further Analysis: Examining Budgeting Techniques in Greater Detail

Effective budgeting is paramount for managing a $1000 credit limit. Techniques like the 50/30/20 rule (50% needs, 30% wants, 20% savings/debt repayment) can help allocate funds effectively. Detailed expense tracking, using budgeting apps or spreadsheets, provides crucial insights into spending patterns, allowing for adjustments and better financial control.

FAQ Section: Answering Common Questions About Managing a $1000 Credit Limit

- What is the best way to use a $1000 credit limit? Use it for planned purchases, paying the balance in full each month and maintaining low credit utilization.

- Can I build credit with a $1000 limit? Absolutely! Responsible use, including timely payments and low utilization, will positively impact your credit score.

- What happens if I exceed my $1000 limit? You may incur over-limit fees, and your credit score may be negatively affected.

- How often should I check my credit report? At least once a year to monitor your credit score and identify any errors.

Practical Tips: Maximizing the Benefits of a $1000 Credit Limit

- Set a realistic budget: List all income and expenses, allocating funds for necessities and prioritizing debt repayment.

- Track expenses diligently: Use budgeting apps or spreadsheets to monitor spending patterns and stay within your limit.

- Pay your balance in full each month: Avoid interest charges and maintain a healthy credit utilization rate.

- Automate payments: Set up automatic payments to ensure on-time payments and avoid late fees.

- Review your credit report regularly: Monitor your credit score and identify any potential issues.

Final Conclusion: Wrapping Up with Lasting Insights

A $1000 credit limit, though seemingly small, presents a significant opportunity for financial growth. By understanding credit utilization, budgeting effectively, and prioritizing timely payments, individuals can use this limit to build a positive credit history and achieve long-term financial success. Responsible credit card management is not just about avoiding debt; it's about building a foundation for a secure and prosperous financial future. Remember, financial discipline and mindful spending are the keys to unlocking the full potential of your credit.

Latest Posts

Latest Posts

-

Actionable Definition

Apr 30, 2025

-

Across The Board Definition

Apr 30, 2025

-

Acquittance Definition

Apr 30, 2025

-

Acquisition Indigestion Definition

Apr 30, 2025

-

Acquisition Financing Definition How It Works Types

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about If I Have A 1000 Credit Limit How Much Should I Spend . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.