How To Calculate Minimum Payment On Line Of Credit

adminse

Apr 06, 2025 · 7 min read

Table of Contents

Unlocking the Mystery: How to Calculate Minimum Payments on a Line of Credit

What if understanding your line of credit minimum payment could save you hundreds, even thousands, of dollars in interest? Mastering this calculation is crucial for responsible credit management and financial well-being.

Editor’s Note: This article provides a comprehensive guide to calculating minimum payments on lines of credit, updated for 2024. We’ll explore various calculation methods, factors influencing minimums, and strategies for managing your debt effectively.

Why Understanding Minimum Payments Matters

A line of credit (LOC) offers flexible borrowing, but it’s crucial to understand the mechanics of minimum payments. Paying only the minimum can lead to significant long-term costs due to accumulating interest and prolonged repayment periods. Knowing how minimum payments are calculated empowers you to make informed financial decisions, potentially saving substantial sums in interest charges and avoiding late payment penalties. This understanding is relevant for various LOC types, including home equity lines of credit (HELOCs), business lines of credit, and personal lines of credit.

Overview: What This Article Covers

This article will delve into the intricacies of calculating minimum payments on lines of credit. We will examine different calculation methods employed by lenders, the factors influencing these calculations, the impact of interest capitalization, and strategies for minimizing your overall debt burden. We will also address common questions and misconceptions surrounding minimum payments.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing upon information from leading financial institutions, consumer protection agencies, and reputable financial publications. The information provided is intended to be informative and educational, but it does not constitute financial advice. Consult with a qualified financial advisor for personalized guidance.

Key Takeaways:

- Understanding the Calculation Methods: Different lenders utilize varying methods to determine minimum payments.

- Identifying Influencing Factors: Several factors, including outstanding balance, interest rate, and payment terms, impact the minimum payment.

- Recognizing the Impact of Interest Capitalization: Failing to pay more than the minimum can lead to significant interest accrual.

- Strategic Debt Management: Employing strategies to pay more than the minimum can accelerate debt repayment and save money.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding minimum payments, let's explore the key aspects of calculating them.

Exploring the Key Aspects of Minimum Payment Calculations

1. Definition and Core Concepts:

The minimum payment on a line of credit is the smallest amount a borrower is required to pay each billing cycle to remain in good standing with the lender. This payment typically covers a portion of the outstanding balance and accrued interest. Failure to make the minimum payment by the due date will result in late payment fees and potentially negative impacts on credit scores.

2. Applications Across Industries:

Minimum payment calculations are consistent across various types of lines of credit, whether it's a personal LOC, a HELOC, or a business LOC. The underlying principles remain the same, although the specific calculation methods and terms might vary slightly depending on the lender and the agreement.

3. Challenges and Solutions:

One of the significant challenges is the misconception that only paying the minimum is sufficient. This can lead to substantial long-term interest costs and prolonged repayment periods. The solution lies in understanding the calculation, budgeting for higher payments, and actively working towards paying off the debt more quickly.

4. Impact on Innovation:

Technological advancements have simplified the process of calculating and tracking minimum payments. Online banking platforms and mobile apps provide users with easy access to their statements and payment information. However, the core principles of calculating minimum payments remain unchanged.

Closing Insights: Summarizing the Core Discussion

Understanding how your line of credit minimum payment is calculated is paramount to responsible debt management. While the specific formula might differ between lenders, the fundamental principles remain the same: a portion of the outstanding balance and the accrued interest are factored into the minimum payment amount. Paying only the minimum should be seen as a last resort, as it prolongs the repayment period and significantly increases the total interest paid.

Exploring the Connection Between Interest Rates and Minimum Payments

The interest rate on your line of credit plays a crucial role in determining your minimum payment. A higher interest rate will lead to a larger interest component in your minimum payment, even if your outstanding balance remains the same. This is because more interest is accruing each billing cycle, requiring a larger payment to remain current.

Key Factors to Consider:

-

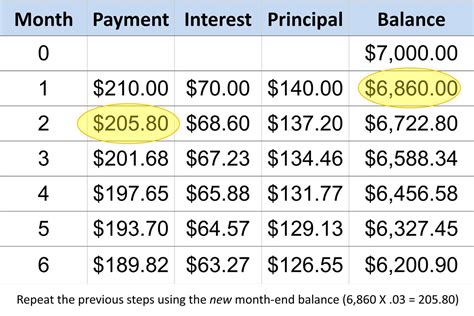

Roles and Real-World Examples: Let’s say you have a $10,000 balance on a line of credit with a 10% annual interest rate. If the interest is calculated monthly, a significant portion of your minimum payment will go towards interest, leaving a smaller amount applied to the principal. Conversely, a lower interest rate would result in a smaller interest component and a larger portion of the payment applied towards reducing the principal.

-

Risks and Mitigations: Failing to understand the impact of interest rates can lead to significant overspending on interest. The mitigation strategy involves negotiating for a lower interest rate if possible, making larger-than-minimum payments, and paying off the debt as quickly as possible to minimize the overall interest paid.

-

Impact and Implications: The interest rate directly impacts the affordability and overall cost of your line of credit. A high interest rate makes the debt more expensive and can significantly hinder your ability to pay it off in a timely manner.

Conclusion: Reinforcing the Connection

The relationship between interest rates and minimum payments is undeniably strong. A higher interest rate translates to a larger minimum payment and increased overall cost. By understanding this connection, borrowers can make informed decisions, negotiate better terms, and adopt strategies to minimize their long-term borrowing costs.

Further Analysis: Examining Interest Capitalization in Greater Detail

Interest capitalization is a critical aspect to consider. This is the process where accrued but unpaid interest is added to the principal balance of your loan. This increases the principal balance, leading to higher minimum payments and increased overall interest charges in the future. It's a vicious cycle that can significantly inflate your total debt.

FAQ Section: Answering Common Questions About Minimum Payments on Lines of Credit

-

What is a line of credit? A line of credit is a revolving credit account that allows you to borrow money up to a pre-approved limit. You can borrow and repay as needed, up to the limit.

-

How is the minimum payment calculated? The exact method varies between lenders, but generally, it includes a portion of the outstanding balance and the accrued interest.

-

What happens if I only pay the minimum payment? You'll accumulate interest and prolong your repayment period, leading to significantly higher overall costs.

-

Can I negotiate my minimum payment? While it's uncommon, it's possible to discuss payment options with your lender, especially if you're facing financial hardship.

-

What are the consequences of missing a minimum payment? Late fees, negative impact on credit score, and potential account closure.

Practical Tips: Maximizing the Benefits of Understanding Minimum Payments

-

Understand your statement thoroughly: Review your statement carefully to understand how your minimum payment is calculated and the breakdown of principal and interest.

-

Budget for more than the minimum payment: Aim to pay more than the minimum to accelerate debt repayment and reduce overall interest costs.

-

Explore debt consolidation options: If you're struggling to manage multiple debts, consider consolidating them into a single loan with a lower interest rate.

-

Contact your lender for assistance: If you're facing financial difficulty, contact your lender to discuss payment options and avoid delinquency.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding how to calculate minimum payments on a line of credit is a fundamental aspect of responsible financial management. While the specific calculations might differ, the core principles remain consistent: higher interest rates lead to higher minimum payments, and paying only the minimum prolongs repayment and increases the total cost. By adopting proactive strategies and making informed decisions, you can effectively manage your line of credit and avoid the pitfalls of accumulating debt. Remember, responsible borrowing and diligent repayment are crucial for maintaining a strong financial foundation.

Latest Posts

Latest Posts

-

What Does Your Credit Score Need To Be For Chase Sapphire Reserve

Apr 07, 2025

-

What Credit Score Do You Need To Get A Chase Sapphire Reserve Card

Apr 07, 2025

-

What Credit Bureau Does Chase Sapphire Reserve Use

Apr 07, 2025

-

What Credit Score Do You Need To Get Chase Sapphire Reserve

Apr 07, 2025

-

What Credit Score Do You Need To Get Approved For Chase Sapphire Reserve

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about How To Calculate Minimum Payment On Line Of Credit . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.