How High Should Credit Utilization Be

adminse

Apr 07, 2025 · 8 min read

Table of Contents

How High Should Your Credit Utilization Be? Unlocking the Secrets to a Healthy Credit Score

What if the seemingly small detail of your credit utilization ratio holds the key to unlocking a significantly higher credit score? Mastering this crucial aspect of credit management can dramatically improve your financial health and open doors to better loan terms and interest rates.

Editor’s Note: This article on credit utilization was published today, offering readers the most up-to-date insights and strategies for managing their credit effectively.

Why Credit Utilization Matters: More Than Just a Number

Credit utilization is the percentage of your total available credit you're currently using. It's a critical factor in your credit score calculation, impacting your overall creditworthiness more than many realize. Lenders view a high credit utilization ratio as a sign of potential financial instability, making them hesitant to offer favorable loan terms. Conversely, a low utilization ratio signals responsible credit management, increasing your chances of approval for loans with better interest rates and higher credit limits. Understanding and effectively managing credit utilization is crucial for building and maintaining a strong credit profile.

Overview: What This Article Covers

This article delves into the intricacies of credit utilization, explaining its importance, ideal ranges, and strategies for improvement. Readers will learn how to calculate their utilization, understand its impact on credit scores, and discover actionable steps to optimize this key factor for better financial health. We'll also explore the nuances of different credit card types and their effect on overall utilization.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing upon insights from leading credit bureaus (like Experian, Equifax, and TransUnion), financial experts, and numerous case studies analyzing the impact of credit utilization on credit scores. The information provided is based on established credit scoring models and industry best practices.

Key Takeaways:

- Definition and Core Concepts: A thorough explanation of credit utilization and its role in credit scoring.

- Ideal Utilization Ranges: Identifying the optimal percentage to maintain for a healthy credit score.

- Strategies for Improvement: Actionable steps to reduce credit utilization and improve creditworthiness.

- The Impact of Different Credit Card Types: Understanding how various cards affect overall utilization.

- Addressing High Utilization: Methods for lowering high utilization quickly and effectively.

- Maintaining a Healthy Utilization: Long-term strategies for keeping utilization low and stable.

Smooth Transition to the Core Discussion:

Now that we understand the significance of credit utilization, let's explore its core aspects in more detail, providing practical strategies and insightful analysis.

Exploring the Key Aspects of Credit Utilization

1. Definition and Core Concepts:

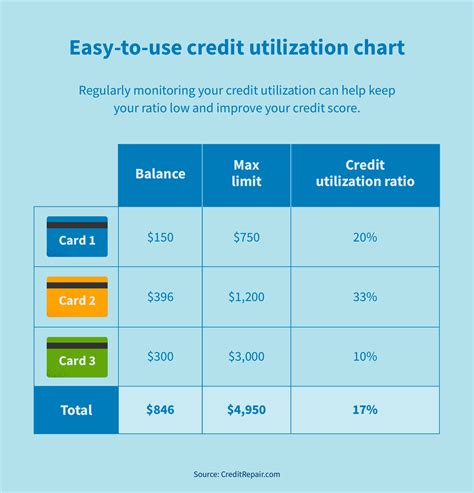

Credit utilization is simply the ratio of your outstanding credit balance to your total available credit. It's calculated as:

(Total Credit Card Balances) / (Total Available Credit) * 100%

For example, if you have a total available credit of $10,000 and an outstanding balance of $2,000, your credit utilization is 20%.

2. Ideal Utilization Ranges:

While the exact impact of credit utilization varies slightly depending on the specific credit scoring model used, the general consensus among financial experts is that keeping your credit utilization below 30% is crucial for maintaining a healthy credit score. Ideally, aiming for under 10% is even better, as this demonstrates exceptional credit management. Scores tend to be negatively impacted when utilization exceeds 30%, and the impact intensifies significantly above 50% or 70%.

3. Strategies for Improvement:

- Pay Down Balances: The most direct method is to consistently pay down your credit card balances. Even small, regular payments can make a noticeable difference over time.

- Increase Available Credit: Consider requesting a credit limit increase on your existing cards. This will lower your utilization ratio without changing your debt. However, only do this if you can manage your spending responsibly.

- Consolidate Debt: If you have multiple high-interest debts, consolidating them into a single loan with a lower interest rate can help you pay down balances faster and reduce your overall utilization.

- Avoid Opening Multiple New Accounts: Opening several new credit cards in a short period can temporarily lower your average credit age and negatively impact your credit score. Focus on managing your existing accounts effectively.

- Monitor Regularly: Keep a close eye on your credit reports and scores to track your progress and identify potential areas for improvement.

4. The Impact of Different Credit Card Types:

Different types of credit cards can influence your overall credit utilization differently. For example, secured credit cards generally have lower credit limits, meaning a small balance can result in a high utilization rate. Conversely, credit cards with higher credit limits allow for a larger balance before significantly impacting your utilization. Understanding these differences is crucial for managing your overall credit profile.

5. Addressing High Utilization:

If you already have a high credit utilization ratio, take immediate action. Prioritize paying down your highest-interest debts first. Consider using balance transfer cards to lower your interest rates and make payments more manageable. Contact your creditors to discuss options for managing your debt if you're struggling.

6. Maintaining a Healthy Utilization:

Maintaining a low credit utilization requires ongoing diligence. Create a budget and stick to it. Automate payments to ensure you consistently make at least the minimum payment on all your accounts. Regularly review your credit report for inaccuracies and potential issues.

Closing Insights: The Power of Responsible Credit Management

Credit utilization is not just a number; it’s a reflection of your financial responsibility. By understanding its impact and implementing the strategies outlined above, you can significantly improve your credit score, access better loan terms, and build a strong financial foundation for the future.

Exploring the Connection Between Credit History Length and Credit Utilization

The relationship between credit history length and credit utilization is complex yet crucial. A longer credit history generally leads to a higher credit score, but a high utilization ratio can negate the benefits of a long history. Lenders view a long history of responsible credit management, reflected in low utilization, as a strong indicator of creditworthiness. Conversely, even a long credit history marred by consistently high utilization can hurt your credit score significantly.

Key Factors to Consider:

- Roles and Real-World Examples: A person with a 10-year credit history and consistently low utilization will likely have a much better credit score than someone with a similar history but high utilization. Even with a long credit history, persistently high utilization suggests potential financial instability.

- Risks and Mitigations: Maintaining high utilization, even with a long credit history, increases the risk of loan denials, higher interest rates, and damage to your creditworthiness. The mitigation lies in actively paying down debt and keeping utilization low.

- Impact and Implications: The interplay between credit history and utilization significantly impacts your overall creditworthiness, influencing your ability to secure loans, mortgages, and other financial products. Consistent low utilization builds creditworthiness over time, regardless of credit history length.

Conclusion: Reinforcing the Long-Term Value of Low Utilization

The interplay between credit history length and credit utilization underscores the importance of consistent, responsible credit management. While a long history is beneficial, it's only as effective as the credit management habits behind it. A long history paired with low utilization strengthens creditworthiness, while high utilization diminishes the positive impact of length.

Further Analysis: Examining Payment History in Detail

Payment history is another critical factor influencing your credit score. While credit utilization represents the amount of credit used, payment history reflects the consistency of repayments. A history of on-time payments, even with moderate utilization, can positively offset the negative impact of a higher utilization rate. However, consistently late or missed payments will severely damage your credit score, regardless of your utilization rate.

FAQ Section: Answering Common Questions About Credit Utilization

Q: What is the single most important factor influencing my credit score?

A: While several factors contribute, payment history is generally considered the most significant. However, credit utilization is a close second and often overlooked.

Q: Can I improve my credit utilization overnight?

A: While you can't instantly change your credit utilization, making significant payments can quickly reduce it.

Q: How often should I check my credit report?

A: It's recommended to check your credit report from all three major bureaus (Equifax, Experian, and TransUnion) at least annually. This allows you to identify any errors and track your progress.

Q: What should I do if I have a high credit utilization ratio?

A: Create a budget, prioritize paying down your balances, and consider strategies like debt consolidation or balance transfers.

Practical Tips: Maximizing the Benefits of Low Credit Utilization

- Track Your Spending: Use budgeting apps or spreadsheets to monitor spending and ensure you stay within your limits.

- Set Payment Reminders: Automate payments or set reminders to ensure timely payments.

- Review Your Credit Reports Regularly: Monitor your utilization and address any inconsistencies.

- Use Multiple Credit Cards Wisely: Utilize multiple cards to distribute spending and avoid exceeding limits on any single card.

- Avoid Cash Advances: Cash advances typically carry high fees and interest rates, negatively impacting utilization.

Final Conclusion: A Path to Financial Freedom

Maintaining a low credit utilization ratio is not just about achieving a high credit score; it’s about establishing sound financial habits that lead to long-term financial stability. By understanding the importance of credit utilization and diligently implementing the strategies discussed in this article, you can pave the way for a brighter financial future. Remember, responsible credit management is a journey, not a destination, and consistently low utilization is a cornerstone of financial success.

Latest Posts

Latest Posts

-

Advance Refunding Definition

Apr 30, 2025

-

Advance Premium Fund Definition

Apr 30, 2025

-

Advance Premium Definition

Apr 30, 2025

-

Advance Funded Pension Plan Definition

Apr 30, 2025

-

Advance Commitment Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about How High Should Credit Utilization Be . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.