What Is An Acceptable Credit Utilization Ratio

adminse

Apr 07, 2025 · 8 min read

Table of Contents

What's the magic number for a healthy credit utilization ratio? Unlocking the secrets to better credit scores.

Maintaining a low credit utilization ratio is paramount for a strong credit profile and access to favorable financial products.

Editor’s Note: This article on acceptable credit utilization ratios was published today, offering readers up-to-date insights and best practices for managing credit effectively. It explores the various factors impacting the ideal ratio and provides actionable steps for improvement.

Why Your Credit Utilization Ratio Matters:

Your credit utilization ratio is a crucial factor in determining your credit score. It represents the percentage of your available credit that you're currently using. Lenders closely monitor this ratio because it reflects your debt management habits and your ability to responsibly handle credit. A high utilization ratio signals to lenders that you might be overextended financially, increasing the perceived risk associated with lending you more money. Conversely, a low utilization ratio demonstrates responsible credit management, making you a more attractive borrower. This translates to better interest rates on loans, credit cards, and potentially even lower insurance premiums.

Overview: What This Article Covers:

This comprehensive guide delves into the intricacies of credit utilization ratios. We will define the ratio, explore its impact on credit scores, examine what constitutes an "acceptable" ratio, and discuss strategies for improving your score by managing your utilization effectively. We'll also look at the differences in how various credit scoring models weigh this factor and touch upon potential misconceptions surrounding credit utilization.

The Research and Effort Behind the Insights:

This article is the result of extensive research, drawing upon data from leading credit bureaus (such as Experian, Equifax, and TransUnion), analyses of credit scoring algorithms, and insights from financial experts. We've examined countless studies and reports to present a comprehensive and up-to-date understanding of credit utilization and its implications. The information provided is evidence-based and aims to equip readers with actionable knowledge.

Key Takeaways:

- Definition and Core Concepts: A clear explanation of credit utilization ratio and its calculation.

- Impact on Credit Scores: How credit utilization influences the three major credit scoring models (FICO, VantageScore).

- Acceptable Utilization Ranges: Determining what constitutes a good, fair, and poor credit utilization ratio.

- Strategies for Improvement: Practical steps to lower your credit utilization ratio and improve your credit score.

- Addressing Misconceptions: Clarifying common misunderstandings about credit utilization.

Smooth Transition to the Core Discussion:

Understanding the significance of credit utilization is the first step towards building and maintaining a healthy credit profile. Now, let's explore the key aspects of this crucial credit metric in detail.

Exploring the Key Aspects of Credit Utilization Ratio:

Definition and Core Concepts:

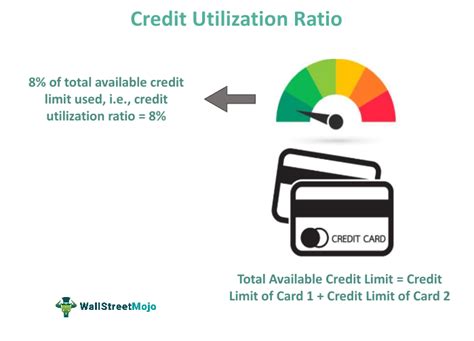

The credit utilization ratio is simply the percentage of your available credit that you are currently using. It's calculated by dividing your total credit card debt by your total credit limit. For example, if you have a total credit limit of $10,000 and owe $2,000, your credit utilization ratio is 20% ($2,000 / $10,000 = 0.20 or 20%). This calculation applies to individual cards and across all your credit accounts. While the overall ratio is most important, individual card utilization is also considered by credit scoring models.

Impact on Credit Scores:

The credit utilization ratio is one of the most significant factors influencing your credit score. Both FICO and VantageScore scoring models heavily weigh this factor. A high utilization ratio indicates a higher risk of default in the eyes of lenders, leading to a lower credit score. Conversely, a low utilization ratio reflects responsible credit management, signaling lower risk and boosting your score. The exact impact varies depending on the specific scoring model and other factors in your credit report, but the general principle remains consistent: lower utilization is better.

Acceptable Utilization Ranges:

While there's no universally agreed-upon "magic number," financial experts generally recommend keeping your credit utilization ratio below 30%. Many advise aiming for even lower, ideally under 10%. Here's a breakdown of generally accepted ranges:

- Excellent (Under 10%): This range demonstrates exceptional credit management and significantly minimizes risk for lenders.

- Good (10-29%): This is a healthy range, showing responsible credit usage.

- Fair (30-49%): This range signals potential risk to lenders and can negatively impact your credit score.

- Poor (50% and above): This indicates significant financial strain and drastically increases the perceived risk for lenders, leading to a substantial drop in your credit score.

Strategies for Improvement:

Lowering your credit utilization ratio requires proactive management of your credit accounts. Here are some effective strategies:

- Pay Down Existing Debt: The most direct approach is to reduce your outstanding balances on your credit cards. Prioritize paying down high-interest debt first.

- Increase Your Credit Limits: If you have a good credit history, consider requesting a credit limit increase from your credit card issuer. This will lower your utilization ratio without reducing your debt. However, be mindful of only applying for increases when needed and not overusing the increased credit.

- Open New Credit Accounts: Opening a new credit card with a higher limit can also lower your overall utilization ratio. This should only be done strategically and with accounts you can manage responsibly. Avoid applying for too many cards in a short period, as this can negatively impact your credit score.

- Monitor Your Spending: Track your spending habits closely to avoid exceeding your credit limits. Budget carefully and prioritize paying down your balances promptly.

- Pay More Than the Minimum: Always pay more than the minimum payment on your credit cards. Paying extra reduces your balance faster, improving your utilization ratio.

- Consider Debt Consolidation: If you're struggling with high levels of debt, consider debt consolidation options such as a balance transfer or a personal loan to simplify your repayment process and potentially reduce interest rates.

Addressing Misconceptions:

Several misconceptions surround credit utilization:

-

Closing Unused Cards: While it might seem logical, closing unused credit cards can actually harm your credit score. It reduces your available credit, increasing your utilization ratio, even if you have zero balance on that card. It also lowers your average age of credit, which is another credit scoring factor.

-

Only the Highest Utilization Matters: Your overall utilization ratio is the most impactful factor, but individual card utilization matters. Keeping utilization low on all cards is better than just focusing on lowering the total utilization percentage.

-

Short-Term Spikes are Ignored: While a temporary increase in utilization might not severely damage your score, consistently high utilization is harmful.

Exploring the Connection Between Payment History and Credit Utilization:

Payment history is another crucial component of credit scores, closely intertwined with credit utilization. Consistent on-time payments, even with a higher utilization ratio, will mitigate some of the negative impact. However, consistently high utilization coupled with missed payments can severely damage your credit score. This relationship underscores the importance of responsible financial behavior.

Key Factors to Consider:

-

Roles and Real-World Examples: A person with a high credit utilization ratio and a history of missed payments is a higher risk to lenders compared to someone with high utilization but a perfect payment history. A mortgage lender might still approve a loan even with a slightly higher utilization if the applicant has a stellar payment history and a stable income.

-

Risks and Mitigations: High credit utilization significantly increases the risk of default, while mitigating this risk requires proactive debt management, and increasing your available credit responsibly.

-

Impact and Implications: Consistently high credit utilization can make it difficult to obtain new credit, loans, or even rent an apartment. It can also lead to higher interest rates, impacting the cost of borrowing.

Conclusion: Reinforcing the Connection:

The relationship between payment history and credit utilization highlights the synergistic effect of responsible financial behavior on credit scores. Maintaining both a low utilization ratio and a flawless payment history is the most effective strategy for building a strong credit profile.

Further Analysis: Examining Payment History in Greater Detail:

Payment history is a crucial element in credit scoring models. Even minor delays in payments can negatively impact your credit score. The length of your credit history is also important; a longer history of on-time payments generally leads to a better score. Late payments can remain on your credit report for up to seven years.

FAQ Section: Answering Common Questions About Credit Utilization Ratio:

Q: What is the ideal credit utilization ratio?

A: While there's no single ideal number, aiming for under 10% is generally recommended. Staying below 30% is considered good practice.

Q: How does credit utilization affect my interest rates?

A: A high credit utilization ratio indicates higher risk to lenders, leading to higher interest rates on loans and credit cards.

Q: Can I improve my credit utilization ratio quickly?

A: Yes, by paying down debt, increasing credit limits (responsibly), and making on-time payments.

Practical Tips: Maximizing the Benefits of a Low Credit Utilization Ratio:

- Track your spending: Regularly monitor your credit card spending to avoid exceeding your limits.

- Automate payments: Set up automatic payments to ensure on-time payments and avoid late fees.

- Pay more than the minimum: Always pay more than the minimum payment to reduce your balance faster.

- Review your credit reports: Check your credit reports regularly for errors and to monitor your credit utilization.

Final Conclusion: Wrapping Up with Lasting Insights:

Maintaining a low credit utilization ratio is a cornerstone of excellent credit management. By understanding its impact on your credit score and implementing the strategies discussed, you can significantly improve your financial health and access better financial products. Remember, responsible credit management is a continuous process that requires vigilance and proactive planning. Prioritize responsible spending, timely payments, and consistent monitoring of your credit utilization to build and maintain a strong credit profile.

Latest Posts

Latest Posts

-

Advance Refunding Definition

Apr 30, 2025

-

Advance Premium Fund Definition

Apr 30, 2025

-

Advance Premium Definition

Apr 30, 2025

-

Advance Funded Pension Plan Definition

Apr 30, 2025

-

Advance Commitment Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about What Is An Acceptable Credit Utilization Ratio . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.