How Do Interest Rates Affect Business Investment

adminse

Mar 25, 2025 · 8 min read

Table of Contents

How Do Interest Rates Affect Business Investment? A Deep Dive into the Crucial Connection

What if the future of economic growth hinges on understanding the intricate relationship between interest rates and business investment? This powerful dynamic governs capital allocation, shaping industries and determining the overall health of economies worldwide.

Editor's Note: This comprehensive analysis of how interest rates impact business investment was published today, providing you with current insights and perspectives on this crucial economic relationship.

Why Interest Rates Matter to Business Investment:

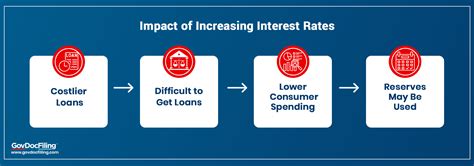

Interest rates are the bedrock of borrowing costs. They represent the price businesses pay to access capital for expansion, innovation, and operational improvements. Fluctuations in these rates, therefore, directly influence a company's willingness and ability to invest. Lower rates make borrowing cheaper, encouraging investment, while higher rates increase the cost of borrowing, potentially stifling investment activity. This seemingly simple relationship has cascading effects throughout the economy, influencing job creation, technological advancements, and overall economic growth. Understanding this dynamic is crucial for businesses making strategic investment decisions and for policymakers aiming to manage economic cycles. Terms like "cost of capital," "discount rate," and "return on investment" are frequently interwoven in this discussion, all directly influenced by the prevailing interest rate environment.

Overview: What This Article Covers:

This article provides a deep dive into the multifaceted relationship between interest rates and business investment. We will explore the fundamental mechanisms at play, examining the impact of both short-term and long-term interest rate changes. Furthermore, we will analyze various influencing factors, including the business cycle, inflation expectations, and government policies. Finally, we will delve into case studies and offer practical strategies for businesses to navigate fluctuating interest rate environments.

The Research and Effort Behind the Insights:

This article is the product of extensive research, drawing upon established economic theories, empirical studies from reputable sources like the Federal Reserve, the International Monetary Fund (IMF), and the World Bank, along with analyses from leading financial institutions and academic journals. The information presented is supported by data-driven evidence and aims to provide a comprehensive and nuanced understanding of the subject.

Key Takeaways:

- Definition and Core Concepts: A clear understanding of interest rates, their types, and their role in capital markets.

- Impact on Investment Decisions: How changes in interest rates affect a company's cost of capital and investment appraisal techniques.

- Short-Term vs. Long-Term Rates: The different implications of short-term and long-term interest rate fluctuations on investment decisions.

- Influence of Monetary Policy: The role of central banks in manipulating interest rates to stimulate or curb economic activity.

- Industry-Specific Impacts: How different industries are differentially affected by changes in interest rates.

- Strategies for Business Resilience: Practical steps businesses can take to manage risk and maximize investment returns in a volatile interest rate environment.

Smooth Transition to the Core Discussion:

Having established the significance of the interest rate-investment nexus, let's now delve into the specific mechanisms through which interest rates impact business investment decisions.

Exploring the Key Aspects of How Interest Rates Affect Business Investment:

1. The Cost of Capital:

The most direct impact of interest rates is on the cost of capital. This represents the overall cost a company incurs to finance its investments. This cost encompasses debt financing (loans, bonds), which directly reflects prevailing interest rates, and equity financing (issuing shares), which is indirectly affected by interest rates through their influence on investor expectations and risk-free returns. When interest rates rise, the cost of debt financing increases, making borrowing more expensive. This higher cost of capital reduces the attractiveness of investment projects, as the return on investment (ROI) needs to exceed the increased borrowing cost to remain profitable. Conversely, lower interest rates reduce the cost of capital, making investment projects more financially viable.

2. Investment Appraisal Techniques:

Businesses employ various techniques to evaluate the feasibility of investment projects, such as Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period. These methods rely heavily on discounting future cash flows back to their present value. The discount rate used in these calculations is often linked to the cost of capital, which, as discussed, is directly affected by interest rates. Higher interest rates lead to higher discount rates, reducing the present value of future cash flows and potentially rendering previously viable projects unprofitable. Conversely, lower rates decrease the discount rate, making future cash flows appear more valuable and increasing the likelihood of project approval.

3. Short-Term vs. Long-Term Interest Rates:

The impact of interest rate changes varies depending on the timeframe. Short-term interest rate fluctuations primarily affect working capital management and short-term investment decisions, such as inventory financing or short-term debt. Long-term rates, however, are crucial for major capital expenditures like building new factories, acquiring equipment, or undertaking large-scale research and development projects. Changes in long-term rates significantly influence the overall investment climate and have a more profound and lasting effect on economic growth.

4. Influence of Monetary Policy:

Central banks, like the Federal Reserve in the US or the European Central Bank (ECB), play a vital role in influencing interest rates through monetary policy. By adjusting the policy interest rate (often the federal funds rate or the main refinancing operations rate), central banks can manipulate borrowing costs across the economy. Lowering interest rates stimulates investment by reducing the cost of capital and encouraging borrowing. This expansionary monetary policy aims to boost economic growth. Conversely, raising interest rates aims to curb inflation by making borrowing more expensive and thus reducing investment and overall economic activity. This contractionary policy aims to cool down an overheating economy.

5. Industry-Specific Impacts:

The sensitivity of different industries to interest rate changes varies considerably. Industries with high capital intensity, such as manufacturing, construction, and utilities, are generally more susceptible to interest rate fluctuations. These industries require significant upfront investment, making them particularly sensitive to changes in borrowing costs. Conversely, industries with lower capital intensity, such as services, may be less affected by interest rate changes.

Closing Insights: Summarizing the Core Discussion:

Interest rates are a powerful lever influencing business investment decisions. Understanding the relationship between the cost of capital, investment appraisal techniques, and monetary policy is crucial for both businesses and policymakers. The impact of interest rate changes varies depending on the timeframe, the industry, and other macroeconomic factors.

Exploring the Connection Between Inflation and Business Investment:

Inflation significantly impacts business investment decisions, creating a complex interplay with interest rates. High inflation erodes the purchasing power of money, making future cash flows less valuable. This necessitates a higher discount rate in investment appraisal, potentially discouraging investment. Moreover, high inflation can lead to uncertainty about future costs and prices, further dampening investment sentiment. Central banks often respond to high inflation by raising interest rates, creating a double-whammy effect that discourages investment. Conversely, low and stable inflation can foster a more predictable investment climate, encouraging businesses to commit to long-term projects.

Key Factors to Consider:

- Roles and Real-World Examples: High inflation in the 1970s led to significantly reduced investment in many developed economies. The subsequent tightening of monetary policy further exacerbated the situation.

- Risks and Mitigations: Businesses can hedge against inflation risk through various strategies, including inflation-indexed bonds and contracts that adjust for price increases.

- Impact and Implications: Persistent high inflation can lead to long-term underinvestment, hindering economic growth and productivity gains.

Conclusion: Reinforcing the Connection:

The relationship between inflation and business investment, mediated through interest rates, highlights the complexities of macroeconomic management. Central banks must carefully balance the need to control inflation with the need to avoid stifling investment. Businesses, in turn, must develop strategies to mitigate the risks associated with inflation and interest rate volatility.

Further Analysis: Examining Government Policies in Greater Detail:

Government policies significantly influence the investment climate. Fiscal policies, such as tax incentives for investment or government spending on infrastructure, can either complement or counteract the effects of monetary policy on investment. Regulatory policies, including environmental regulations or labor laws, also impact business investment decisions. The overall regulatory environment can create uncertainty and discourage investment if it's perceived as unstable or unpredictable.

FAQ Section: Answering Common Questions About Interest Rates and Business Investment:

-

What is the most significant impact of interest rates on business investment? The most significant impact is on the cost of capital, directly influencing the financial viability of investment projects.

-

How do businesses mitigate the risk of interest rate volatility? Businesses can use hedging strategies, diversify funding sources, and build financial flexibility to mitigate risk.

-

What role do central banks play in managing interest rates and investment? Central banks use monetary policy to adjust interest rates to stimulate or curb economic activity and manage inflation, thus influencing investment levels.

-

How do different industries respond to interest rate changes? Industries with high capital intensity tend to be more sensitive to interest rate changes compared to those with lower capital intensity.

Practical Tips: Maximizing the Benefits of Understanding Interest Rates:

-

Monitor Interest Rate Trends: Stay informed about prevailing interest rates and anticipated changes.

-

Conduct Thorough Investment Appraisal: Carefully evaluate investment projects considering the current and projected cost of capital.

-

Develop Flexible Financial Plans: Maintain financial flexibility to adapt to changing interest rate environments.

-

Explore Hedging Strategies: Consider implementing hedging strategies to mitigate the risk of interest rate fluctuations.

-

Diversify Funding Sources: Don't rely solely on debt financing; explore alternative funding options.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding the intricate relationship between interest rates and business investment is paramount for sustained economic growth and corporate success. By carefully monitoring interest rate trends, adapting investment strategies, and managing financial risk, businesses can navigate the complexities of this dynamic relationship and maximize their investment returns. The interplay between monetary policy, fiscal policy, and the inherent risks associated with inflation further underlines the need for a comprehensive and nuanced approach to investment decision-making in today’s dynamic global economy.

Latest Posts

Related Post

Thank you for visiting our website which covers about How Do Interest Rates Affect Business Investment . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.