How Do I Unfreeze My Credit Freeze

adminse

Apr 07, 2025 · 7 min read

Table of Contents

Unlocking Your Credit: A Comprehensive Guide to Unfreezing Your Credit Freeze

What if regaining access to your credit report was simpler than you think? A credit freeze offers robust protection, but knowing how to lift it efficiently is equally crucial.

Editor’s Note: This article provides up-to-date information on unfreezing your credit reports with the three major credit bureaus: Equifax, Experian, and TransUnion. The procedures outlined here are accurate as of the date of publication, but it’s always advisable to check the individual bureau websites for the most current instructions.

Why Unfreezing Your Credit Matters: Accessing Financial Opportunities

A credit freeze, also known as a security freeze, is a powerful tool to protect your credit information from identity theft. It prevents creditors from accessing your credit report without your explicit permission, thus significantly reducing the risk of fraudulent accounts being opened in your name. However, a freeze also prevents you from accessing your own credit, which can be problematic when you need to apply for loans, credit cards, or even rent an apartment. Understanding how to temporarily or permanently lift this freeze is essential for navigating various financial situations. This impacts your ability to secure financing for a home, car, or other significant purchases, and can even affect your ability to get a job, depending on the employer’s background check procedures.

Overview: What This Article Covers

This article provides a step-by-step guide on how to unfreeze your credit report with each of the three major credit bureaus: Equifax, Experian, and TransUnion. We'll cover the different methods for unfreezing—online, by phone, and by mail—highlighting the advantages and disadvantages of each. Additionally, we'll discuss security precautions, common challenges, and what to expect during the process. Finally, we'll explore how to re-freeze your credit after you've finished your application process.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing from official websites of Equifax, Experian, and TransUnion, as well as numerous consumer finance articles and guides. The information presented reflects current procedures and best practices for managing credit freezes and unfreezes. Every step outlined is supported by verifiable information to ensure accuracy and provide readers with reliable guidance.

Key Takeaways:

- Understanding the Process: Learn the specific steps required to unfreeze your credit with each bureau.

- Choosing the Right Method: Determine the most efficient method based on your personal preferences and circumstances.

- Security Best Practices: Understand how to protect your personal information during the unfreezing process.

- Re-freezing Your Credit: Learn how to quickly and easily re-freeze your credit once your application is complete.

Smooth Transition to the Core Discussion:

Now that we’ve established the importance of understanding how to unfreeze your credit, let’s delve into the practical steps involved with each major credit bureau.

Exploring the Key Aspects of Unfreezing Your Credit

1. Unfreezing with Equifax:

- Online: The fastest and most convenient method. Visit the Equifax website and navigate to their security freeze section. You will need to provide your Social Security number, date of birth, and other identifying information to verify your identity. Once verified, you can select to temporarily lift the freeze for a specified period or permanently remove it.

- By Phone: Call Equifax's dedicated security freeze line. You'll need to provide the same identifying information as the online method. Be prepared to answer security questions to verify your identity.

- By Mail: This is the slowest method. You'll need to download and complete the appropriate form from Equifax's website, and mail it with required documentation. Allow ample processing time for this method.

2. Unfreezing with Experian:

- Online: Similar to Equifax, Experian offers a secure online portal to manage your security freeze. After verifying your identity, you can choose to temporarily or permanently lift the freeze.

- By Phone: Contact Experian's customer service line. Be ready to provide your Social Security number, date of birth, and answer security questions.

- By Mail: Download the necessary form from Experian's website, complete it, and mail it along with the required identification. This method requires significant processing time.

3. Unfreezing with TransUnion:

- Online: TransUnion also provides an online platform to manage your credit freeze. Follow the steps to verify your identity and lift the freeze, selecting either a temporary or permanent unfreeze.

- By Phone: Contact TransUnion's customer service line dedicated to credit freezes. Be prepared to answer security questions and provide identifying information.

- By Mail: Download the appropriate form from TransUnion’s website, complete it, and mail it with necessary documentation. This method takes the longest.

Closing Insights: Summarizing the Core Discussion

Unfreezing your credit is a straightforward process, but it's essential to understand the different methods available and choose the one that best suits your needs and time constraints. The online method is generally the quickest and most convenient, while the mail-in method is the slowest. Remember to always verify the legitimacy of the website or phone number before providing any personal information.

Exploring the Connection Between PINs/Passwords and Unfreezing Your Credit

The relationship between your PINs/passwords and unfreezing your credit is crucial for security. Each credit bureau requires you to verify your identity before allowing you to lift the freeze. This typically involves providing a PIN or password that you created when you initially set up the freeze. Forgetting this information can significantly delay the process. It's therefore vital to store your PINs/passwords securely but accessibly—perhaps in a password manager, but never directly within your credit report files.

Key Factors to Consider:

- Roles and Real-World Examples: If you forget your PIN/password, you'll likely need to go through an extended identity verification process, potentially involving additional documentation. This can delay your application significantly.

- Risks and Mitigations: Failing to remember your PIN/password exposes you to the risk of unauthorized access to your credit report. Use strong, unique passwords and store them securely.

- Impact and Implications: A forgotten PIN/password can cause delays in securing loans, credit cards, or other financial products, potentially impacting your financial goals.

Conclusion: Reinforcing the Connection

The security measures implemented by credit bureaus emphasize the importance of protecting your personal information. While the PIN/password system adds a layer of security, it’s crucial to manage your credentials responsibly to avoid delays or potential security breaches.

Further Analysis: Examining Identity Verification in Greater Detail

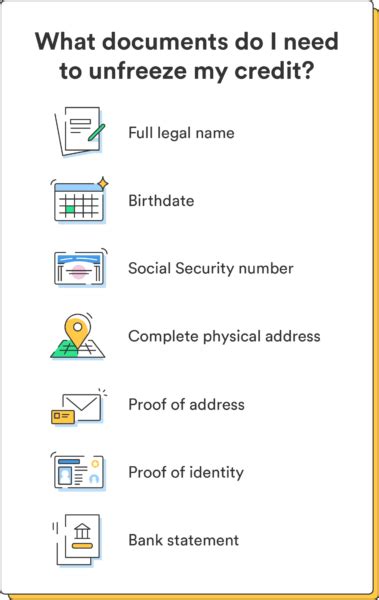

Identity verification is a fundamental aspect of unfreezing your credit. Credit bureaus employ various methods to confirm your identity, including asking for your Social Security number, date of birth, address history, and answers to security questions. The complexity of the verification process can vary based on the method chosen (online, phone, or mail) and the bureau. Failing to provide accurate information can lead to delays or rejection of your unfreeze request.

FAQ Section: Answering Common Questions About Unfreezing Your Credit

Q: How long does it take to unfreeze my credit?

A: Unfreezing your credit online is typically instantaneous. Phone and mail methods can take several days to process.

Q: What happens if I forget my PIN or password?

A: You will need to contact the credit bureau’s customer service department and go through an extended identity verification process.

Q: Can I unfreeze my credit with one bureau and leave the others frozen?

A: Yes, you can manage each freeze individually.

Q: Is there a fee to unfreeze my credit?

A: Many states have laws prohibiting fees for security freezes, but it’s best to check the individual bureau websites for any potential charges.

Practical Tips: Maximizing the Benefits of Unfreezing Your Credit

- Plan Ahead: Don’t wait until the last minute to unfreeze your credit if you have a major financial application pending.

- Choose the Fastest Method: Utilize the online method whenever possible for the quickest results.

- Keep Records: Keep a record of your PINs/passwords and the dates you unfreeze and re-freeze your credit.

- Re-freeze Promptly: After completing your financial application, immediately re-freeze your credit to maintain ongoing protection.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding how to unfreeze your credit is a crucial aspect of managing your financial well-being. By following the steps outlined in this article and implementing best security practices, you can navigate this process efficiently and safely, gaining access to financial opportunities while maintaining robust protection against identity theft. Remember that proactive credit monitoring and security measures are vital to safeguarding your financial future.

Latest Posts

Latest Posts

-

Acceptance Market Definition

Apr 30, 2025

-

Acceptable Quality Level Aql Definition And How It Works

Apr 30, 2025

-

Acceleration Principle Definition And How It Works In Economics

Apr 30, 2025

-

Accelerated Option Definition

Apr 30, 2025

-

Accelerated Bookbuild Definition How The Process Works

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about How Do I Unfreeze My Credit Freeze . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.