Freezing Of Credit

adminse

Apr 07, 2025 · 8 min read

Table of Contents

Freezing Your Credit: A Comprehensive Guide to Protecting Your Identity

What if a simple action could significantly reduce your risk of identity theft and financial fraud? Freezing your credit is that powerful preventative measure, offering a robust shield against unauthorized access to your financial life.

Editor’s Note: This article on credit freezing was published today, providing you with the most up-to-date information and best practices for protecting your credit.

Why Freezing Your Credit Matters: Relevance, Practical Applications, and Industry Significance

Identity theft is a pervasive and costly crime. Millions of individuals fall victim each year, suffering financial losses, damaged credit scores, and the significant emotional distress of repairing their damaged financial lives. Freezing your credit is a proactive step that significantly mitigates this risk. It acts as a barrier, preventing new accounts from being opened in your name without your explicit authorization. This is particularly relevant in today’s digital age, where data breaches are increasingly common, exposing personal information to malicious actors. The practical application is straightforward: a frozen credit report prevents creditors from accessing your credit information, thus making it significantly harder for fraudsters to obtain loans, credit cards, or other financial products in your name. The industry significance lies in the collective effort to combat financial crime, with credit freezing becoming a widely endorsed security measure by financial institutions and consumer protection agencies.

Overview: What This Article Covers

This article provides a comprehensive overview of credit freezing, encompassing its definition, the process involved, its benefits and limitations, and answers to frequently asked questions. We'll explore the differences between freezing and placing a fraud alert, examine the impact on different credit reporting agencies, and offer actionable advice to maximize the protective benefits of credit freezing.

The Research and Effort Behind the Insights

This article draws upon extensive research, incorporating information from the three major credit bureaus (Equifax, Experian, and TransUnion), the Federal Trade Commission (FTC), and other reputable consumer protection organizations. The information presented is designed to be factual, accurate, and readily understandable to the average consumer.

Key Takeaways:

- Definition and Core Concepts: A clear understanding of credit freezing and its core mechanisms.

- Practical Applications: How credit freezing safeguards against identity theft and financial fraud.

- Challenges and Solutions: Addressing potential inconveniences and strategies for managing a frozen credit report.

- Future Implications: The evolving landscape of credit freezing and its role in future financial security.

Smooth Transition to the Core Discussion:

Now that we've established the importance of credit freezing, let's delve into the specifics. Understanding the process, benefits, and potential drawbacks will empower you to make informed decisions about protecting your financial well-being.

Exploring the Key Aspects of Freezing Your Credit

Definition and Core Concepts: Credit freezing, also known as a security freeze, is a service offered by each of the three major credit bureaus (Equifax, Experian, and TransUnion). When you freeze your credit, you essentially lock your credit report, preventing creditors and other businesses from accessing it. This prevents them from opening new accounts in your name, a key step in preventing identity theft. Importantly, a credit freeze does not affect your existing credit accounts; you can still use your existing credit cards and loans. The freeze only prevents the opening of new accounts.

Applications Across Industries: The primary application of credit freezing lies in personal financial protection. It's a valuable tool for individuals of all ages and financial situations, offering a proactive defense against identity theft. However, its usefulness extends to various industries, including banking, insurance, and even human resources. Companies often advise employees to freeze their credit as a precautionary measure following a data breach.

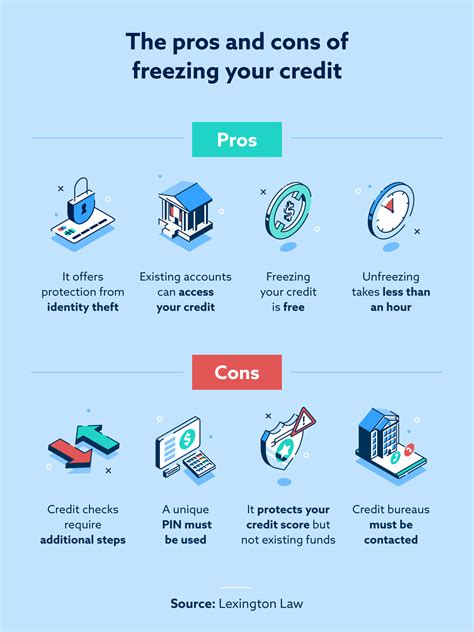

Challenges and Solutions: One of the main challenges associated with credit freezing is the potential inconvenience when applying for new credit or other financial products. To access your credit report for a legitimate application, you will need to temporarily lift the freeze, a process that usually involves an online request and a brief waiting period. However, this is a small price to pay for the significant protection it provides. The solution is planning ahead – unfreeze your credit report only when necessary, and remember to refreeze it immediately afterward.

Impact on Innovation: Credit freezing represents a significant innovation in consumer protection, providing an easily accessible and effective tool for combating identity theft. As technology evolves and new forms of fraud emerge, the importance of credit freezing is likely to grow. This highlights the ongoing need for responsible financial practices and robust security measures in the digital age.

Closing Insights: Summarizing the Core Discussion

Credit freezing is a powerful tool in the fight against identity theft. It's a proactive measure that significantly reduces the risk of fraudulent activity by preventing unauthorized access to your credit report. While it requires a small amount of planning and foresight, the peace of mind it offers far outweighs the minor inconvenience.

Exploring the Connection Between Security Awareness and Credit Freezing

The relationship between security awareness and credit freezing is inextricable. Security awareness encompasses understanding the risks associated with identity theft, taking preventative measures, and being vigilant about suspicious activity. Credit freezing forms a crucial component of this security awareness, providing a robust preventative measure against one of the most significant threats to financial security.

Roles and Real-World Examples: Security awareness plays a vital role in understanding the need for credit freezing. Individuals who are well-versed in security best practices are more likely to recognize the importance of credit freezing and proactively implement it. For instance, an individual who has recently experienced a data breach involving their personal information would understand the increased risk and would likely freeze their credit to minimize further potential damage.

Risks and Mitigations: One potential risk is forgetting to unfreeze your credit when applying for legitimate financial products. The mitigation strategy is to create reminders or incorporate the unfreezing process into a checklist for any major financial application.

Impact and Implications: The broader impact of security awareness coupled with credit freezing extends beyond individual protection. A more security-conscious population reduces the overall prevalence of identity theft, impacting the entire financial ecosystem.

Conclusion: Reinforcing the Connection

The synergy between security awareness and credit freezing highlights the importance of a multi-faceted approach to financial security. By understanding the risks and proactively implementing measures like credit freezing, individuals can significantly enhance their protection against identity theft and maintain greater control over their financial well-being.

Further Analysis: Examining Security Best Practices in Greater Detail

Beyond credit freezing, various security best practices contribute to a comprehensive approach to identity theft prevention. These include using strong, unique passwords for online accounts, regularly monitoring credit reports, being wary of phishing scams, and shredding documents containing sensitive personal information. These practices reinforce the protective shield provided by credit freezing.

FAQ Section: Answering Common Questions About Credit Freezing

What is credit freezing? Credit freezing, also known as a security freeze, prevents creditors from accessing your credit report without your explicit authorization.

How do I freeze my credit? You can freeze your credit reports individually with each of the three major credit bureaus: Equifax, Experian, and TransUnion. Each bureau has its own website and process for initiating a freeze.

Is there a cost to freeze my credit? While some states offer free credit freezes, others may charge a small fee. Check each bureau's website for specific pricing.

How long does it take to freeze my credit? The freezing process is typically quick and can be completed online in minutes. However, allow some time for the process to fully register on their systems.

How do I unfreeze my credit? Unfreezing your credit typically involves an online request, often requiring a PIN or password you create during the freezing process. There might be a short waiting period before the freeze is lifted.

Can I freeze my credit if I have existing accounts? Yes, freezing your credit will not affect your existing accounts. It only prevents new accounts from being opened.

How long does a credit freeze last? A credit freeze remains in place until you decide to lift it.

What happens if I lose my PIN or password? Each bureau has procedures for recovering lost access credentials; check their websites for details.

Practical Tips: Maximizing the Benefits of Credit Freezing

- Freeze Your Credit with All Three Bureaus: Protect yourself comprehensively by freezing with Equifax, Experian, and TransUnion.

- Keep Your PINs and Passwords Secure: Protect your access credentials carefully.

- Unfreeze Only When Necessary: Temporarily lift the freeze only when applying for legitimate credit or other financial services.

- Refreeze Immediately Afterward: Once your application is processed, immediately refreeze your credit report.

- Regularly Review Your Credit Reports: Check your credit reports periodically for any unauthorized activity.

Final Conclusion: Wrapping Up with Lasting Insights

Credit freezing represents a powerful and proactive measure in the fight against identity theft. By combining credit freezing with other strong security practices and a heightened awareness of potential threats, individuals can significantly minimize their risk and protect their financial future. The small effort required to implement a credit freeze far outweighs the potential devastation of becoming a victim of identity theft. Taking control of your credit security is a vital step in safeguarding your financial well-being.

Latest Posts

Latest Posts

-

Adjustable Rate Preferred Stock Arps Definition

Apr 30, 2025

-

Adjustable Premium Definition

Apr 30, 2025

-

Adjustable Life Insurance Definition Pros Cons Vs Universal

Apr 30, 2025

-

What Is Adjudication Definition How It Works Types And Example

Apr 30, 2025

-

Adhesion Contract Definition History And Enforceability

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about Freezing Of Credit . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.