How Do I Cancel My Allstate Insurance

adminse

Mar 25, 2025 · 7 min read

Table of Contents

How Do I Cancel My Allstate Insurance? A Comprehensive Guide

What if navigating the process of canceling your Allstate insurance policy felt unnecessarily complicated? This detailed guide simplifies the procedure, empowering you to make informed decisions and confidently manage your insurance needs.

Editor’s Note: This article on canceling your Allstate insurance policy was published today, providing you with the most up-to-date information and procedures.

Why Canceling Your Allstate Insurance Matters:

Canceling an Allstate insurance policy, whether it's auto, home, renters, or life insurance, is a significant decision with financial and logistical implications. Understanding the process, including potential penalties and refund calculations, is crucial for a smooth transition. This is especially important given the complexities of insurance contracts and the potential for misunderstandings regarding cancellation fees or outstanding payments. Knowing your rights and obligations safeguards you against unexpected charges and ensures a clean break with your insurer.

Overview: What This Article Covers

This article provides a comprehensive guide to canceling your Allstate insurance, covering various policy types, cancellation methods, refund calculations, and frequently asked questions. You’ll learn about the steps involved, potential implications, and how to best prepare for the cancellation process. We’ll delve into different scenarios, including early cancellation, mid-term cancellation, and cancellation due to a life event, offering actionable advice and real-world examples.

The Research and Effort Behind the Insights

This article is based on extensive research, drawing on Allstate's official website, policy documents, consumer reports, and industry best practices. Information regarding cancellation policies is validated by cross-referencing multiple sources to ensure accuracy and completeness. The aim is to provide reliable and up-to-date guidance, minimizing any confusion or misinformation.

Key Takeaways:

- Understanding Your Policy: Knowing the specific terms and conditions of your Allstate policy is the first step.

- Multiple Cancellation Methods: Allstate offers several ways to cancel, including online, by phone, or via mail.

- Refund Calculation: Understanding how Allstate calculates refunds after cancellation is critical.

- Proof of Cancellation: Always obtain confirmation of cancellation to avoid future issues.

- Gap in Coverage: Be mindful of potential gaps in coverage between canceling your Allstate policy and securing new insurance.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding the cancellation process, let's explore the various methods available and the key considerations involved in canceling your Allstate insurance policy.

Exploring the Key Aspects of Canceling Allstate Insurance

1. Contacting Allstate:

The first step, regardless of the cancellation method you choose, is to confirm your policy details and the best method for cancellation with Allstate directly. You can typically find contact information (phone numbers, email addresses, and mailing addresses) on your policy documents or on the Allstate website. Reaching out allows you to verify your policy number, understand the cancellation procedures, and ascertain any potential implications before proceeding.

2. Methods of Cancellation:

Allstate offers several ways to cancel your policy:

- Online: Many Allstate customers can cancel their policies through the Allstate website's online customer portal. This usually involves logging in with your credentials and navigating to the policy management section. This method often provides immediate confirmation.

- By Phone: Calling Allstate's customer service number allows you to speak directly to a representative. This method is particularly helpful if you have questions or need clarification regarding your policy or the cancellation process.

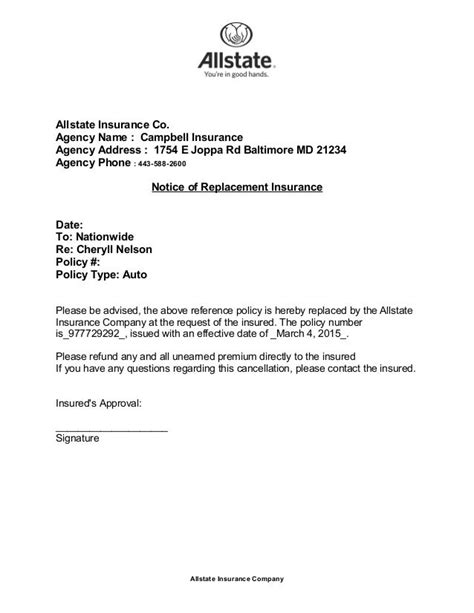

- Via Mail: Sending a written cancellation request via certified mail with return receipt requested provides a documented record of your cancellation. This method is recommended if you prefer a hard-copy record of your request and confirmation. Ensure to include your policy number, name, address, and a clear statement of your intent to cancel.

3. Understanding Your Refund:

Allstate’s refund policy is determined by the type of insurance, the remaining premium period, and the reason for cancellation. Generally, you’ll receive a pro-rated refund for any prepaid premiums that cover a period beyond the cancellation date. However, this is not always the case, especially with certain policies or if you cancel early. Always request a detailed explanation of your refund calculation to avoid any discrepancies.

4. Proof of Cancellation:

Upon canceling your policy, request confirmation from Allstate in writing. This confirmation should include the cancellation date, the refund amount (if applicable), and any outstanding balances. This serves as crucial documentation should any disputes or issues arise later. For mailed cancellations, the return receipt provides proof of delivery. For online cancellations, a confirmation email is usually provided.

5. Potential Gaps in Coverage:

One critical consideration is the potential gap in your insurance coverage. Ensure that you have secured alternative insurance coverage before canceling your Allstate policy, especially if the cancellation is not immediate. A gap in coverage can leave you vulnerable in the event of an accident or incident.

Exploring the Connection Between Reason for Cancellation and Cancellation Procedure

The reason for canceling your Allstate insurance significantly impacts the procedure and potential consequences.

Roles and Real-World Examples:

- Moving: If you're moving to a new state or location not covered by your current Allstate policy, you’ll need to inform them of your new address and request a policy change or cancellation.

- Switching Insurers: Many consumers cancel Allstate to switch to a different insurance company offering lower premiums or better coverage. In this case, obtaining quotes from other insurers before canceling Allstate is advisable.

- Policy Changes: If Allstate substantially changes your policy terms or increases premiums unacceptably, you might choose to cancel. Documenting these changes is vital when contacting Allstate.

- Financial Hardship: If you're facing financial difficulties, canceling your policy might seem like a solution. However, carefully weigh this decision, considering the potential risks of being uninsured.

Risks and Mitigations:

- Cancellation Fees: Some policies may involve early cancellation fees. Understanding these fees beforehand is crucial.

- Lapses in Coverage: As mentioned earlier, ensure you have secured alternative insurance before canceling your policy to avoid gaps in coverage.

- Unpaid Balances: Settle any outstanding payments before canceling to avoid further complications.

Impact and Implications:

The impact of canceling your Allstate policy varies depending on your specific circumstances. It might lead to financial savings, finding a more suitable insurer, or resolving unsatisfactory service. However, it’s crucial to carefully weigh the pros and cons and manage the transition effectively.

Conclusion: Reinforcing the Connection

The reason for canceling and the chosen cancellation method significantly impact the overall process. Careful planning and clear communication with Allstate minimize complications and ensure a smooth transition.

Further Analysis: Examining Refund Calculations in Greater Detail

Allstate's refund calculation differs based on policy type and cancellation date. Generally, a pro-rated refund is offered for the unearned premium portion. For instance, if you cancel halfway through your six-month policy period, you will typically receive a refund for the remaining three months. However, specific policy terms should be consulted for accurate refund calculations.

FAQ Section: Answering Common Questions About Canceling Allstate Insurance

-

Q: How long does it take to process a cancellation request?

- A: Processing time varies depending on the cancellation method. Online cancellations may be immediate, while mail-in requests might take a few business days. Contact Allstate directly for an estimate.

-

Q: What if I have an outstanding payment?

- A: You must settle any outstanding payments before your policy can be fully canceled. Contact Allstate to arrange payment.

-

Q: Can I cancel my policy mid-term?

- A: Yes, you can cancel mid-term, but you might incur early cancellation fees, depending on your policy terms.

-

Q: What happens if I don't cancel my policy and I move?

- A: Your insurance coverage might become invalid if you fail to notify Allstate about your move. This can have significant legal and financial implications.

-

Q: What is the best way to cancel my Allstate insurance?

- A: The best method depends on your preference and circumstances. Online cancellation is often convenient, while contacting them by phone or mail might be preferable for specific situations.

Practical Tips: Maximizing the Benefits of the Cancellation Process

- Gather your Policy Documents: Locate your policy number, coverage details, and payment information.

- Contact Allstate: Confirm the cancellation procedure and any potential fees.

- Request Confirmation: Get written confirmation of your cancellation to avoid future issues.

- Secure New Insurance (if applicable): Avoid coverage gaps by finding a new insurer before canceling.

- Understand your Refund: Inquire about the refund calculation and timeframe.

Final Conclusion: Wrapping Up with Lasting Insights

Canceling Allstate insurance requires careful planning and awareness of the various methods and implications. By understanding your policy, utilizing the appropriate cancellation method, and securing necessary documentation, you can navigate this process efficiently and confidently. Remember to prioritize avoiding coverage gaps and obtaining confirmation of cancellation to protect yourself against future complications. Proactive communication with Allstate is crucial throughout the entire process.

Latest Posts

Latest Posts

-

Who Acquired Caliber Home Loans

Mar 31, 2025

-

Who Owns Caliber Home Loans

Mar 31, 2025

-

Who Bought Caliber Home Loans

Mar 31, 2025

-

How Do I Do A Balance Transfer On My Chase Credit Card

Mar 31, 2025

-

How Do I Do A Balance Transfer To My Discover Card

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about How Do I Cancel My Allstate Insurance . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.