How Do I Do A Balance Transfer To My Discover Card

adminse

Mar 31, 2025 · 8 min read

Table of Contents

How Do I Do a Balance Transfer to My Discover Card? Unlocking Savings and Managing Debt

Is juggling multiple credit card debts leaving you stressed and financially strained? A strategic balance transfer can significantly reduce your interest burden and simplify your financial life.

Editor’s Note: This article on balance transfers to Discover cards was published [Date]. We've compiled up-to-date information to help you navigate the process effectively.

Why a Discover Card Balance Transfer Matters:

A balance transfer allows you to move outstanding balances from other credit cards to your Discover card, potentially saving you money on interest. High interest rates are a major debt trap, and transferring balances to a card with a promotional 0% APR period can provide crucial breathing room to pay down your debt without accumulating additional interest charges. This strategy is particularly valuable for individuals with high-interest debt on multiple cards, offering a pathway to consolidate debt and streamline repayment. Discover's balance transfer offers, while not always widely advertised, can be a powerful tool for effective debt management when strategically utilized.

Overview: What This Article Covers

This article comprehensively guides you through the process of performing a balance transfer to your Discover card. We will explore eligibility requirements, the application process, potential fees, and crucial considerations to ensure a successful and financially advantageous transfer. We will also compare Discover's balance transfer options to other cards, highlighting the benefits and drawbacks. Finally, we will address frequently asked questions and provide practical tips to maximize the benefits of a balance transfer.

The Research and Effort Behind the Insights

The information presented here is based on extensive research of Discover's official website, financial industry best practices, and analysis of numerous consumer experiences with balance transfers. We have meticulously examined terms and conditions, fees, and interest rates to provide you with the most accurate and up-to-date information available.

Key Takeaways:

- Understanding Eligibility: Discover's criteria for balance transfers will be explored.

- The Application Process: A step-by-step guide to initiating a balance transfer.

- Fees and Interest Rates: A thorough breakdown of potential costs associated with balance transfers.

- Strategic Planning: How to maximize the benefits and minimize the risks.

- Alternatives and Comparisons: Weighing Discover's offerings against competitors.

Smooth Transition to the Core Discussion:

Now that we understand the potential advantages of a Discover card balance transfer, let's delve into the specifics of how to execute this strategy effectively.

Exploring the Key Aspects of Discover Card Balance Transfers

1. Eligibility Requirements:

Before you begin the balance transfer process, it's crucial to understand Discover's eligibility criteria. These typically include:

- Good Credit Score: A higher credit score significantly improves your chances of approval for a balance transfer. Discover, like other credit card issuers, generally favors applicants with a credit score above 670.

- Account History: A positive credit history, demonstrating responsible credit card usage and timely payments, strengthens your application.

- Available Credit: You need sufficient available credit on your Discover card to accommodate the balance transfer. This available credit is the difference between your credit limit and your current outstanding balance.

- Income Verification: Discover may request documentation to verify your income, ensuring you have the capacity to manage the transferred balance.

2. The Application Process:

The application process usually involves these steps:

- Check Your Eligibility: Begin by reviewing your Discover account online or contacting customer service to determine your eligibility for a balance transfer.

- Locate the Balance Transfer Option: This option is often found within your online account management tools. Look for a section related to "balance transfers," "credit line increases," or similar terminology.

- Submit the Application: Complete the balance transfer application form, providing accurate information regarding the accounts you wish to transfer balances from. This will likely include the card number, account holder's name, and the amount you intend to transfer.

- Review and Approve: Discover will review your application and notify you of their decision. Approval may depend on your creditworthiness and available credit.

- Payment Processing: Once approved, the balance transfer will be processed, and the funds will be transferred from your existing card(s) to your Discover account.

3. Fees and Interest Rates:

Be aware of potential costs associated with balance transfers:

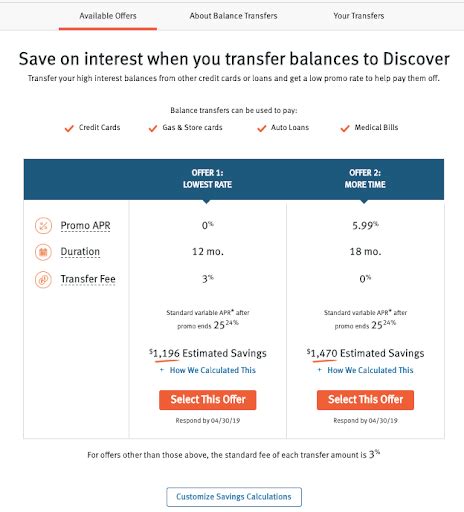

- Balance Transfer Fee: Discover often charges a percentage-based fee on the transferred amount (typically 3-5%). This fee is usually deducted from the transferred balance.

- Interest Rates: While Discover may offer a promotional 0% APR period for a limited time, understand that the standard interest rate will apply after the promotional period ends. Ensure you understand this rate and create a repayment plan to pay off the balance before the promotional period expires.

- Late Payment Fees: Late payments can incur significant penalties, so prioritize timely payments.

4. Strategic Planning for Success:

- Calculate Total Costs: Factor in all fees and interest rates to determine the overall cost of the balance transfer.

- Create a Repayment Plan: Develop a detailed budget and repayment schedule to pay off the transferred balance before the promotional 0% APR period concludes. Consider debt snowball or avalanche methods to optimize repayment.

- Monitor Your Account: Regularly monitor your Discover account to track payments and ensure you stay on track with your repayment plan.

5. Alternatives and Comparisons:

Before deciding on a Discover balance transfer, compare offers from other credit card companies. Some may offer lower fees, longer 0% APR periods, or more favorable terms. Consider factors such as credit score requirements, fees, APRs, and available credit limits when comparing offers.

Exploring the Connection Between Credit Utilization and Discover Card Balance Transfers

Credit utilization refers to the percentage of your available credit that you are currently using. A high credit utilization ratio (above 30%) can negatively impact your credit score. A balance transfer, when managed properly, can actually help reduce credit utilization on your other cards, potentially boosting your credit score over time.

Key Factors to Consider:

- Roles and Real-World Examples: Reducing credit utilization on high-interest cards through a balance transfer can improve credit scores, leading to better interest rates in the future. For example, if you have a card with $5,000 debt and a $6,000 limit (83% utilization), transferring $5,000 to Discover could reduce this to 0% utilization, improving your score.

- Risks and Mitigations: Failing to repay the balance before the 0% APR period ends will result in accruing high interest charges, negating the benefits of the transfer. Careful budgeting and a defined repayment plan are crucial to mitigate this risk.

- Impact and Implications: A successful balance transfer can lead to lower overall debt, improved credit scores, and reduced financial stress. However, improper planning can exacerbate debt problems.

Conclusion: Reinforcing the Connection

The connection between credit utilization and successful balance transfers is undeniable. A strategic balance transfer to a Discover card can significantly improve credit health, but only when coupled with responsible financial planning and disciplined repayment.

Further Analysis: Examining APRs in Greater Detail

Annual Percentage Rate (APR) is the annual interest rate charged on outstanding balances. Lower APRs translate to lower interest costs. Carefully comparing APRs across different credit cards is crucial when choosing a balance transfer card. Discover's APRs vary depending on creditworthiness, so pre-qualifying for a balance transfer offer can provide a clearer picture of the potential interest charges.

FAQ Section: Answering Common Questions About Discover Card Balance Transfers

- Q: What happens if I don't pay off the balance before the 0% APR period expires? A: You will start accruing interest at the standard APR, which can significantly increase your debt.

- Q: Can I transfer balances from any credit card? A: Discover may have restrictions on the types of cards from which balances can be transferred. Review their terms and conditions for specifics.

- Q: How long does it take for the balance transfer to be processed? A: The processing time varies, but typically ranges from a few days to several weeks.

- Q: What if my balance transfer application is denied? A: Reasons for denial might include poor credit score, insufficient available credit, or inconsistencies in the application information. Review your credit report and address any negative factors before reapplying.

Practical Tips: Maximizing the Benefits of a Discover Card Balance Transfer

- Compare Offers: Shop around and compare balance transfer offers from various credit card companies.

- Budget Carefully: Create a realistic budget that allows for timely repayment.

- Automate Payments: Set up automatic payments to avoid late fees.

- Track Progress: Monitor your account regularly to ensure you remain on track.

- Understand the Fine Print: Read all terms and conditions before accepting a balance transfer offer.

Final Conclusion: Wrapping Up with Lasting Insights

A Discover card balance transfer can be a powerful tool for managing debt and saving money on interest, but it requires careful planning and execution. By understanding eligibility requirements, fees, and interest rates, and by creating a disciplined repayment plan, you can leverage a balance transfer to significantly improve your financial situation. Remember, a balance transfer is a tool; its effectiveness depends entirely on responsible financial management.

Latest Posts

Latest Posts

-

How Do You Add Cash Savings To Retirement Planning

Apr 29, 2025

-

Risk Based Mortgage Pricing Definition

Apr 29, 2025

-

Risk Based Haircut Definition

Apr 29, 2025

-

What Is The Best Retirement Planning Software

Apr 29, 2025

-

What Should I Consider For Life Expectancy In Retirement Planning

Apr 29, 2025

Related Post

Thank you for visiting our website which covers about How Do I Do A Balance Transfer To My Discover Card . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.