Dealer Market Definition Example Vs Broker Or Auction Market

adminse

Mar 25, 2025 · 9 min read

Table of Contents

Unlocking the Secrets of Dealer, Broker, Auction, and Market Maker Markets: A Deep Dive

What if the future of efficient trading hinges on understanding the nuances of different market structures? These distinct models—dealer markets, broker markets, auction markets, and market maker markets—shape how assets are bought and sold, profoundly impacting price discovery and liquidity.

Editor’s Note: This comprehensive guide to dealer, broker, auction, and market maker markets was published today, offering readers the latest insights into these crucial financial mechanisms. Understanding these market structures is essential for anyone involved in trading or investing.

Why Understanding Market Structures Matters

The way a market is structured significantly impacts its efficiency, transparency, and overall cost of trading. Different market structures cater to various asset classes and investor needs. Understanding these nuances is crucial for investors to make informed decisions, select appropriate trading strategies, and assess risk effectively. The choice of market structure can influence price discovery, liquidity, and the speed of transactions. For example, the high liquidity of a dealer market might be beneficial for frequent traders, while the price transparency of an auction market could be preferred by those seeking the best possible execution price. This knowledge empowers investors to optimize their trading strategies and achieve better outcomes.

Overview: What This Article Covers

This in-depth analysis will dissect the core functionalities of dealer markets, broker markets, auction markets, and market maker markets. We will explore their defining characteristics, compare their strengths and weaknesses, and provide real-world examples to illustrate their practical applications. The discussion will delve into the mechanics of each market type, highlighting their impact on price discovery, liquidity, and transaction costs.

The Research and Effort Behind the Insights

This article is the culmination of extensive research, drawing on academic literature, industry reports, and real-world observations from various financial markets. We have meticulously analyzed the operational aspects of each market structure, considering their historical evolution and current state. The analysis provides a clear, evidence-based understanding of the intricacies of these market types.

Key Takeaways:

- Definition and Core Concepts: A clear explanation of each market type and its fundamental principles.

- Practical Applications: Real-world examples illustrating the use of each market structure across different asset classes.

- Comparative Analysis: A detailed comparison of the advantages and disadvantages of each market type.

- Future Implications: A forward-looking perspective on the evolution and potential changes in these market structures.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding market structures, let's delve into the specifics of each market type, beginning with dealer markets.

Exploring the Key Aspects of Different Market Structures

1. Dealer Markets:

-

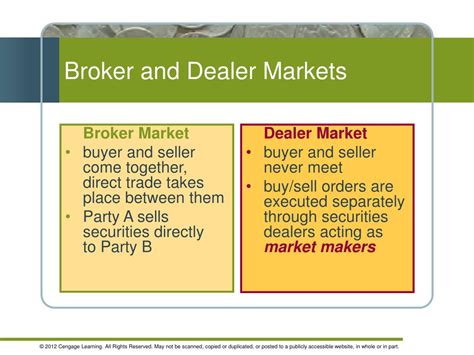

Definition and Core Concepts: In a dealer market, trading occurs directly between investors and market makers (dealers). Dealers maintain an inventory of securities and provide bid and ask prices, acting as both buyers and sellers. They profit from the spread between the bid and ask prices. There is no centralized trading venue; transactions happen over-the-counter (OTC).

-

Applications Across Industries: Dealer markets are prevalent in less liquid asset classes, such as bonds, foreign exchange (Forex), and some derivatives. The OTC nature allows for greater flexibility and customization of transactions. For instance, large bond trades often occur in dealer markets because of the ability to negotiate terms and sizes not readily available on exchanges.

-

Challenges and Solutions: A key challenge is potential price manipulation by dealers due to their control over inventory. Regulations and increased transparency aim to mitigate these risks. Another challenge is limited price transparency compared to auction markets. The use of electronic trading platforms and reporting mechanisms enhances transparency in modern dealer markets.

-

Impact on Innovation: Technological advancements, like electronic communication networks (ECNs), have improved speed and efficiency in dealer markets. These systems allow for faster price discovery and reduced transaction costs.

2. Broker Markets:

-

Definition and Core Concepts: Broker markets facilitate trading by connecting buyers and sellers but do not hold inventory. Brokers act as intermediaries, matching orders from different investors. They earn commissions for executing trades. These markets often have centralized trading venues, like stock exchanges.

-

Applications Across Industries: Broker markets are the dominant model for highly liquid assets like stocks traded on major exchanges. The centralized nature ensures transparency and efficient price discovery.

-

Challenges and Solutions: Broker markets can experience high trading volumes, potentially leading to temporary price volatility. Circuit breakers and other regulatory measures aim to prevent market crashes. Another challenge is the potential for order book manipulation, requiring strict surveillance and regulation.

-

Impact on Innovation: High-frequency trading (HFT) has significantly impacted broker markets, increasing speed and efficiency but also raising concerns about fairness and market manipulation. Regulations are constantly evolving to address these challenges.

3. Auction Markets:

-

Definition and Core Concepts: Auction markets bring together all buyers and sellers at a specific time and place (either physical or electronic) to determine the price through a bidding process. The highest bid and lowest ask are matched to clear the market.

-

Applications Across Industries: Auction markets are commonly used for less frequently traded assets, like treasury bills or certain commodities. They are also increasingly used for online auctions of various goods and services. The NYSE, while now primarily a dealer market in operation, historically was structured as an auction market on the trading floor.

-

Challenges and Solutions: Auction markets can be illiquid if there is a lack of buyers or sellers. Mechanisms like opening and closing auctions, or continuous auctions, are used to manage liquidity. Another challenge is the potential for collusion amongst bidders. Regulations and transparent bidding processes aim to prevent this.

-

Impact on Innovation: Electronic auction platforms have significantly expanded the reach and efficiency of auction markets. This allows for faster execution and wider participation.

4. Market Maker Markets:

-

Definition and Core Concepts: Market makers provide liquidity by quoting bid and ask prices for a given asset. They are obliged to maintain a two-sided market, buying and selling at their quoted prices, regardless of their own position. This is a form of dealer market, but with added regulatory obligations to provide continuous liquidity.

-

Applications Across Industries: Many exchanges employ market makers to provide liquidity, particularly for smaller-cap stocks or less frequently traded securities. They are a crucial component of maintaining market depth and efficiency.

-

Challenges and Solutions: Market makers face risks related to inventory management and adverse price movements. They need sophisticated risk management systems to mitigate these risks. Regulation also helps to ensure that market makers fulfill their obligations and do not engage in manipulative practices.

-

Impact on Innovation: Technological advancements in algorithmic trading and high-frequency trading have significantly impacted market making strategies. Sophisticated algorithms are used to optimize pricing and risk management.

Closing Insights: Summarizing the Core Discussion

The choice of market structure is crucial in determining the efficiency and cost-effectiveness of trading. Dealer markets offer flexibility for less liquid assets, broker markets dominate highly liquid exchanges, auction markets provide price transparency for certain asset classes, and market makers are essential for maintaining liquidity across different securities. Each model has its advantages and disadvantages, impacting price discovery, liquidity, and transaction costs. The ongoing evolution of technology and regulation continues to shape the dynamics of these market structures.

Exploring the Connection Between Regulation and Market Structure

The relationship between regulation and market structure is symbiotic. Regulation impacts the design and operation of markets, while the market structure itself influences the need for and type of regulation.

Key Factors to Consider:

-

Roles and Real-World Examples: Regulations like those from the Securities and Exchange Commission (SEC) in the US and the Financial Conduct Authority (FCA) in the UK shape how dealer markets operate, mandating transparency and preventing manipulation. The establishment of centralized exchanges often stems from regulatory efforts aimed at improving market transparency and protecting investors.

-

Risks and Mitigations: The lack of regulation can lead to market manipulation and instability, particularly in OTC dealer markets. Regulations address these risks by mandating reporting requirements, establishing circuit breakers, and enforcing anti-manipulation rules.

-

Impact and Implications: Stronger regulations increase market transparency and protect investors, but they can also increase trading costs and potentially stifle innovation. Finding the right balance between regulation and market efficiency is an ongoing challenge.

Conclusion: Reinforcing the Connection

The interplay between regulation and market structure is fundamental to market integrity and efficiency. Appropriate regulatory frameworks help to mitigate risks, promote transparency, and ensure fair trading practices across various market structures. This contributes to the overall stability and health of financial markets.

Further Analysis: Examining Market Fragmentation in Greater Detail

Market fragmentation, the dispersion of trading across multiple venues, is a key trend impacting all the discussed market structures. This fragmentation poses challenges for both investors and regulators. It can lead to reduced liquidity in certain venues, increased transaction costs, and potential for regulatory arbitrage.

FAQ Section: Answering Common Questions About Market Structures

-

What is the difference between a dealer and a broker? A dealer trades for its own account, providing liquidity, while a broker acts as an intermediary, matching buyers and sellers.

-

How is price discovery affected by different market structures? Auction markets generally offer the most transparent price discovery, while dealer markets can have less transparent pricing due to the spread.

-

What are the risks associated with each market type? Dealer markets carry the risk of manipulation by dealers, broker markets can experience volatility, and auction markets can suffer from liquidity issues.

-

What is the future of these market structures? The increasing use of technology and electronic trading is likely to continue impacting all these market structures, leading to greater efficiency and potentially increased competition.

Practical Tips: Maximizing the Benefits of Understanding Market Structures

-

Understand the Basics: Start by clearly differentiating between dealer, broker, auction, and market maker markets and their core functionalities.

-

Identify Practical Applications: Analyze which market structure is most suitable for specific assets or investment strategies.

-

Assess Risks: Evaluate the potential risks associated with each market type and implement appropriate risk management strategies.

-

Stay Updated: Keep abreast of regulatory changes and technological advancements impacting these market structures.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding the nuances of dealer, broker, auction, and market maker markets is essential for anyone participating in financial markets. Each structure plays a distinct role, offering various advantages and disadvantages based on the underlying asset, liquidity, and regulatory environment. By appreciating the strengths and weaknesses of each model, investors and traders can make more informed decisions, optimize their strategies, and navigate the complexities of modern financial markets more effectively. The ongoing evolution of technology and regulation will continue to reshape these market structures, highlighting the importance of ongoing learning and adaptation.

Latest Posts

Related Post

Thank you for visiting our website which covers about Dealer Market Definition Example Vs Broker Or Auction Market . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.