Current Account Surplus Definition And Countries That Have It

adminse

Mar 25, 2025 · 9 min read

Table of Contents

Decoding the Current Account Surplus: A Deep Dive into Definition and Leading Nations

What if a nation's economic health is profoundly impacted by its ability to consistently export more than it imports? This seemingly simple concept, a current account surplus, holds immense power in shaping global trade dynamics and national economic strategies.

Editor’s Note: This article on current account surpluses provides a comprehensive overview of the topic, exploring its definition, significance, contributing factors, and prominent examples from around the globe. Updated with the latest economic data, it aims to provide readers with a clear and insightful understanding of this crucial macroeconomic indicator.

Why Current Account Surpluses Matter: Relevance, Practical Applications, and Global Significance

A current account surplus represents a nation's net export of goods, services, and investment income. It signifies that a country is exporting more than it is importing, resulting in a positive balance of payments. This seemingly simple statistic holds profound implications for a nation's economy, impacting its exchange rates, investment flows, and overall economic stability. Understanding current account surpluses is crucial for investors, policymakers, and anyone seeking a deeper understanding of global economic trends. The data helps predict potential trade wars, currency fluctuations, and shifts in global economic power.

Overview: What This Article Covers

This article delves into the intricacies of current account surpluses. We will define the concept precisely, exploring its components and how they contribute to the overall balance. We will then analyze several countries known for maintaining consistent current account surpluses, examining the factors contributing to their success. Finally, we will discuss potential challenges and risks associated with large and persistent surpluses, providing a balanced and nuanced perspective on this critical economic indicator.

The Research and Effort Behind the Insights

This comprehensive analysis draws upon data from the International Monetary Fund (IMF), the World Bank, and national statistical agencies. The information presented reflects the most current available data, ensuring accuracy and providing readers with up-to-date insights. Numerous academic studies and reports on international trade and macroeconomics have been consulted to support the claims and interpretations presented within this article.

Key Takeaways:

- Definition and Core Concepts: A clear explanation of current account surpluses and their constituent parts.

- Countries with Surpluses: A detailed examination of nations consistently exhibiting surpluses and the reasons behind them.

- Drivers of Surpluses: An in-depth analysis of the economic, political, and social factors contributing to current account surpluses.

- Challenges and Implications: A discussion of the potential downsides and risks associated with maintaining a large and sustained current account surplus.

Smooth Transition to the Core Discussion

Having established the significance of understanding current account surpluses, let's delve into a detailed examination of the concept, its components, and the countries that consistently exhibit this economic phenomenon.

Exploring the Key Aspects of Current Account Surpluses

Definition and Core Concepts:

The current account is a component of a country's balance of payments, recording the flow of goods, services, and income between that country and the rest of the world. It comprises four main components:

-

Balance of Trade (Goods): This represents the difference between the value of a country's exports and imports of goods (merchandise). A positive balance indicates more exports than imports.

-

Balance of Services: This reflects the difference between the value of exported and imported services, including tourism, transportation, and financial services.

-

Primary Income: This includes investment income (e.g., returns on foreign investments) and compensation of employees (e.g., salaries paid to citizens working abroad).

-

Secondary Income: This encompasses current transfers, such as foreign aid and remittances.

A current account surplus occurs when the sum of these four components results in a positive value, indicating that a country's total receipts from abroad exceed its total payments to other countries.

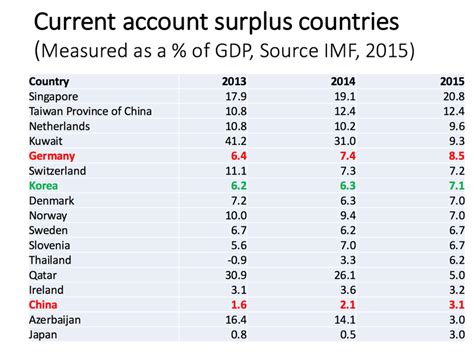

Countries with Consistent Current Account Surpluses:

Several countries are known for consistently maintaining significant current account surpluses. These include, but are not limited to:

-

Germany: Germany’s surplus often stems from its strong manufacturing sector and exports of high-value manufactured goods, such as automobiles and machinery. However, this surplus has been a subject of debate within the EU, raising concerns about imbalances within the Eurozone.

-

Japan: Japan's current account surplus is largely attributable to its substantial export-oriented economy and relatively high savings rate. The country's technological prowess and efficiency in manufacturing contribute significantly to its export competitiveness.

-

China: China's massive surplus, once a major feature of the global economy, has been shrinking in recent years. Its surplus is historically linked to its export-led growth strategy, low labor costs, and massive foreign investment in its manufacturing sector. The shift towards domestic consumption is impacting this surplus.

-

Singapore: Singapore's sustained surplus is linked to its highly developed service sector, efficient port infrastructure, and strategic location as a global trade hub. Its sophisticated financial sector also contributes significantly to its primary income receipts.

-

Switzerland: Switzerland's surplus is propelled by its strong manufacturing sector, expertise in high-value-added goods, and a stable political and economic environment attracting significant foreign investment.

Drivers of Surpluses:

Several factors contribute to the emergence and persistence of current account surpluses:

-

High Export Competitiveness: Countries with strong manufacturing bases, technological innovation, and cost-effective production processes often enjoy higher export volumes, boosting their trade balances.

-

High Savings Rates: Nations with high national savings rates typically have lower domestic consumption, leading to a greater proportion of output available for export.

-

Government Policies: Export promotion policies, tax incentives for exporters, and investments in infrastructure can all contribute to increased export competitiveness.

-

Exchange Rates: A relatively undervalued currency can make a country's exports more competitive on the global market, contributing to a trade surplus.

-

Global Demand: High global demand for a country's goods and services can lead to increased exports, resulting in a current account surplus.

Challenges and Implications of Large and Persistent Surpluses:

While a current account surplus might appear positive, large and persistent surpluses can pose challenges:

-

Global Imbalances: Persistent surpluses in some countries often imply corresponding deficits in others, creating global economic imbalances that can lead to financial instability.

-

Exchange Rate Appreciation: A sustained surplus can cause the domestic currency to appreciate, making a country's exports more expensive and reducing its export competitiveness.

-

Protectionist Pressures: Large surpluses can attract criticism and protectionist measures from trading partners, leading to trade disputes and retaliatory tariffs.

-

Domestic Investment: A high savings rate associated with surpluses may not translate into sufficient domestic investment, hindering long-term economic growth.

-

Dependence on Exports: An over-reliance on exports can make an economy vulnerable to external shocks, such as a global recession or decline in demand for its exports.

Exploring the Connection Between National Savings and Current Account Surpluses

A strong correlation exists between high national savings rates and current account surpluses. Countries with high savings rates tend to have lower levels of domestic consumption, leaving a larger portion of their output available for export. This surplus of production over domestic consumption contributes directly to the current account surplus.

Key Factors to Consider:

-

Roles and Real-World Examples: Countries like China and Japan historically demonstrate the impact of high savings on current account surpluses. Their export-oriented strategies, fueled by high savings, contributed significantly to their surpluses for extended periods.

-

Risks and Mitigations: The risk lies in over-dependence on exports, creating vulnerability to external economic shocks. Diversification of the economy, fostering domestic consumption, and strategic investment in non-export sectors are crucial mitigations.

-

Impact and Implications: High savings rates, while contributing to surpluses, might stifle domestic demand and limit investment in innovation and human capital, hindering long-term sustainable growth.

Conclusion: Reinforcing the Connection

The relationship between national savings and current account surpluses is undeniable. While high savings can fuel export-led growth and contribute to surpluses, it is essential to manage this connection carefully. Policies encouraging balanced economic growth, investment in domestic sectors, and strategic management of exchange rates are crucial for mitigating the risks and reaping the benefits of high national savings.

Further Analysis: Examining Global Demand in Greater Detail

Global demand plays a critical role in shaping current account balances. High global demand for a nation's exports can lead to a surge in exports, boosting the trade balance and contributing to a surplus. However, a sudden decline in global demand can quickly reverse this effect, potentially turning a surplus into a deficit.

FAQ Section: Answering Common Questions About Current Account Surpluses

Q: What is a current account surplus?

A: A current account surplus occurs when a country's exports of goods, services, and income exceed its imports. It's a positive balance in its balance of payments.

Q: What are the main components of the current account?

A: The main components are the balance of trade in goods, balance of trade in services, primary income, and secondary income.

Q: Why do some countries consistently have current account surpluses?

A: High export competitiveness, high savings rates, government policies, exchange rates, and global demand all contribute.

Q: Are current account surpluses always good for an economy?

A: Not necessarily. While they can reflect economic strength, large and persistent surpluses can also lead to global imbalances, currency appreciation, and protectionist pressures.

Q: How can a country reduce a large current account surplus?

A: Strategies include boosting domestic demand, promoting imports, and allowing the currency to appreciate.

Practical Tips: Maximizing the Benefits of a Current Account Surplus (for countries with surpluses):

- Invest in domestic infrastructure: This enhances productivity and competitiveness in the long run.

- Promote technological innovation: This strengthens export competitiveness and reduces reliance on low-cost labor.

- Diversify the economy: This reduces vulnerability to shocks in specific export sectors.

- Enhance domestic consumption: This boosts internal demand and reduces reliance on external demand.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding current account surpluses is crucial for navigating the complexities of the global economy. While they can reflect positive economic conditions, large and persistent surpluses pose potential risks. Careful management of macroeconomic policies, coupled with a balanced approach to economic diversification, is essential for countries to leverage the benefits and mitigate the downsides of a current account surplus. The interplay between national savings, global demand, and government policies ultimately shapes a nation's current account balance and its broader economic health.

Latest Posts

Related Post

Thank you for visiting our website which covers about Current Account Surplus Definition And Countries That Have It . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.